Commvault: Fiscal 1Q22 Financial Results

Commvault: Fiscal 1Q22 Financial Results

Software and products revenue up 7% Y/Y

This is a Press Release edited by StorageNewsletter.com on July 28, 2021 at 2:03 pm| (in $ million) | 1Q21 | 1Q22 | Growth |

| Revenue |

173.0 | 183.4 | 6% |

| Net income (loss) | 2.3 | 13.9 |

Commvault Systems, Inc. announced its financial results for the first quarter ended June 30, 2021.

“We are pleased that the momentum from the prior fiscal year continued into our first quarter,” said Sanjay Mirchandani, president and CEO. “We remain confident that our transformation has put us in position to thrive in a post-pandemic world and achieve the financial targets laid out in January.”

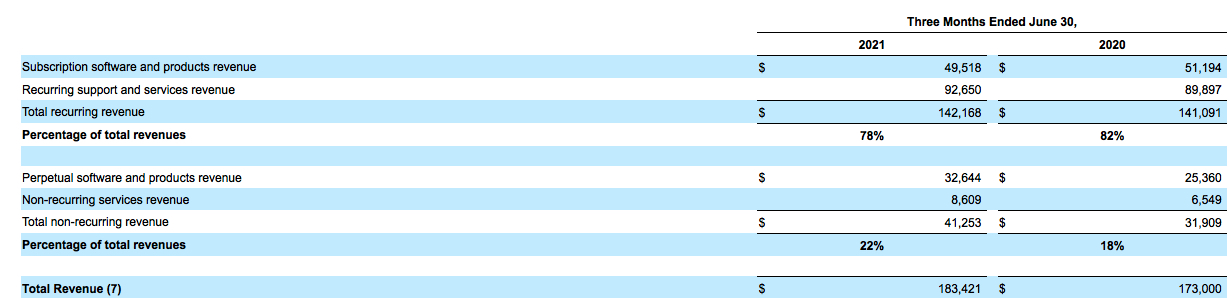

Total revenues for 1FQ22 were $183.4 million, an increase of 6% Y/Y. Total recurring revenue was $142.2 million, representing 78% of total revenue.

Annualized recurring revenue (ARR), which is the annualized value of all active Commvault recurring revenue streams at the end of the reporting period, was $532.8 million as of June 30, 2021, up 13% from June 30, 2020.

Software and products revenue was $82.2 million, a yearly increase of 7%. This increase in was driven by a 23% increase in revenue from portfolio deals (deals less than $0.1 million in software and products revenue).

Larger deal revenue (deals with greater than $0.1 million and software and products revenue) represented 69% of our software and products revenue in 1FQ22. The number of larger deal revenue transactions increased 34% Y/Y to 185 deals for the period. The average dollar amount of larger deal revenue transactions was approximately $305,000.

Services revenue in the quarter was $101.3 million, an increase of 5% year over year.

On a GAAP basis, income from operations (EBIT) was $15.5 million for the first quarter compared to $6.7 million in the prior year. Non-GAAP EBIT was $41.0 million in the quarter compared to $32.5 million in the prior year.

Operating cash flow totaled $37.2 million for 1FQ22 compared to $15.3 million in 1FQ21. Total cash and short-term investments were $359.1 million as of June 30, 2021 compared to $397.2 million as of March 31, 2021.

During 1FQ22, the company repurchased 1,249,200 shares of its common stock totaling $90.0 million at an average price of approximately $72.08 per share.

Comments

$183.4 million revenue for the quarter is up 6% Y/Y but down 4% Y/Y, and a little more than expected ($181 million). $13.9 million is a record profit since at least 1FQ18 as far as we note this figure, and probably much more!

Click to enlarge

Software and products revenue increased 7% Y/Y to $82 million. In 1FQ22, software-only growth without hardware would have been 11% Y/Y. Revenue from software transactions over $100,000 increased yearly 2% and represented 69% of software revenue. The volume of these transactions increased 34% Y/Y, and the average deal size was $305,000.

1FQ22 services revenue increased 5% Y/Y to $101 million.

The company saw continued improvement in software deals under $100,000. Revenue from these transactions grew 23% Y/Y, led by the Americas and EMEA.

For the more recent 3-month period, the firm recorded over 300 new customers. Over 50% of those customers are net new, and more than half are using another Commvault solution. 1/4 of them are choosing more than one Metallic offering. The number of enterprise customers with greater than $100,000 in Metallic ARR nearly doubled this past quarter.

The firm ended the quarter with $359 million in cash and continue to have no debt on the balance sheet.

Outlook for 2FQ22

$83 million of software revenue is expected. This would imply Y/Y software growth of 14%. On a software-only basis, $83 million of revenue would be approximately 20% yearly growth. Total revenue of $184.5 million is expected, or a tiny 1% increase Q/Q. Similar to last fiscal year, the company expects the 2FQ22 software subscription renewal opportunity to be several million dollars less than 1FQ22. For FY22, Commvault estimates a renewal opportunity of $80 million with about 60% of this being in the second half of the year. Looking further out, it expects subscription renewals will continue to be a revenue tailwind for the next several years.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 | 173.0 | 7% |

2.3 |

| 2Q21 | 171.1 | 2% | (41.2) |

| 3FQ21 | 188.0 | 7% | 1.7 |

| 4FQ21 | 191.3 | 16% | 6.3 |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 (estimations) |

184.5 | 1% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter