Seagate: Fiscal 4Q21 Financial Results

Seagate: Fiscal 4Q21 Financial Results

Excellent quarter with sales up 20% Y/Y surpassing $3 billion, highest figure since 6 years

This is a Press Release edited by StorageNewsletter.com on July 22, 2021 at 1:33 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 2,517 | 3,013 | 10,509 | 10,681 |

| Growth | 20% | 2% | ||

| Net income (loss) | 166 | 482 | 1,004 | 1,314 |

Seagate Technology Holdings plc reported financial results for its fourth quarter and fiscal year ended July 2, 2021.

“Seagate delivered very strong June quarter results achieving the highest revenue in the last 6 years and the highest non-GAAP EPS in 9 years, which capped a fiscal 2021 in which we outperformed our expectations,” said Dave Mosley, CEO. “Demand for data is rapidly accelerating in the cloud and at the edge, driving secular growth for mass capacity storage. Seagate’s industry-leading product portfolio for mass data infrastructure places the company in an outstanding position to capitalize on robust demand trends, generate solid and increasing free cash flow and achieve our long-term financial objectives.”

The company generated $478 million in cash flow from operations and $354 million in free cash flow during the fiscal fourth quarter 2021. For FY21, it generated $1.6 billion in cash flow from operations and $1.1 billion in free cash flow. It maintained a healthy balance sheet and during 4FQ21, it paid cash dividends of $154 million and repurchased 2.6 million ordinary shares for $228 million. For FY21, it paid cash dividends of $649 million and used $2.0 billion to repurchase 33.6 million ordinary shares, or 13% of the outstanding shares. Additionally, it raised $1.0 billion of debt and ended the fiscal year with cash and cash equivalents of $1.2 billion. There were 227 million ordinary shares issued and outstanding as of the end of the fiscal year.

Quarterly Cash Dividend

The board of directors declared a quarterly cash dividend of $0.67 per share, which will be payable on October 6, 2021 to shareholders of record as of the close of business on September 22, 2021. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

The company is providing the following guidance for 1FQ22:

• Revenue of $3.1 billion, plus or min $150 million

• Non-GAAP diluted EPS of $2.20, plus or min$0.15

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.15 per share.

Comments

2CQ21 is supposed to be an excellent quarter for the HDD industry. Consequently its leader, Seagate, records good financial results for its corresponding fiscal period, 4FQ21.

Revenue surpasses $3 billion for the first time in 6 years, and non-GAAP EPS of $2.00 was up +35% Q/Q, the highest level in 9 years.

The most recent 3-month period is the fourth consecutive quarter of record HDD capacity shipments at 152.3EB (see table below).

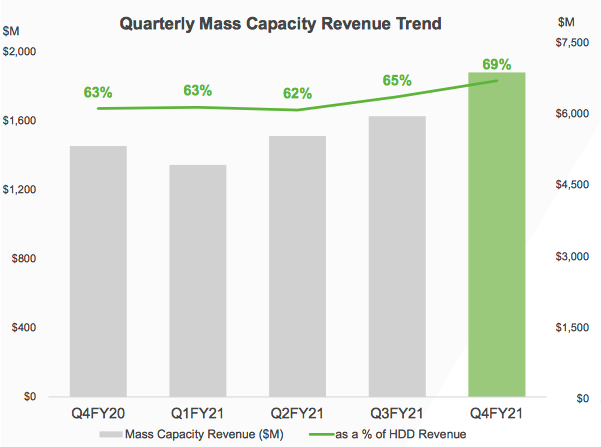

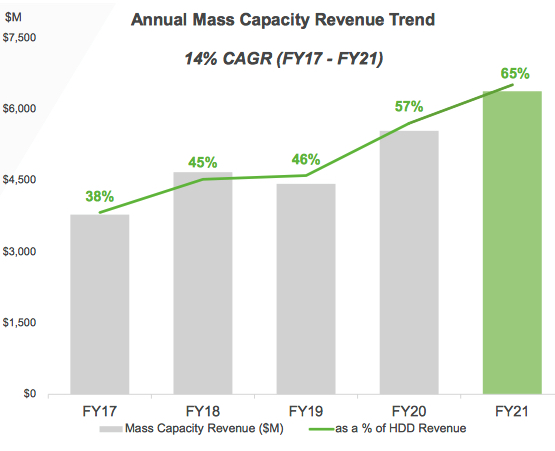

For this quarter, revenue from mass capacity storage markets increased 29% Y/Y and represented 69% of 4FQ21 HDD revenue. It was up 15% Y/Y and represented 65% of annual HDD revenue.

Mass capacity shipments reached 123EB.

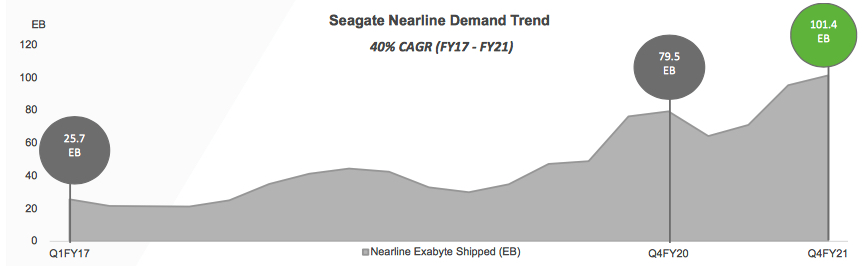

Nearline shipments were up Q/Q and Y/Y from record level in each of the comparable quarters.

For mass capacity storage:

• Strong, broad-based demand for nearline; grew cloud and enterprise sales for third consecutive quarter

• Healthy and steady cloud data center demand for the last 18 months

• Stronger than anticipated VIA recovery, due in part to tighter supply conditions

• 20TB PMR units to ship in second half of 2021

Mass capacity trends

Legacy Markets

• Pace of decline is moderating

• Revenue of $854 million compared with $864 million in both the prior quarter and the prior year period. Exabyte shipments remained relatively flat Q/Q at roughly 29EB

• Demand for mission critical and consumer drives partially offset anticipated decline in PC

CEO Dave Mosley comments on Chia cryptocurrency: "Storage center block chains such as those used by Filecoin for decentralized storage applications, or Chia cryptocurrency which is considered an environmentally friendly alternative to other block chains that utilize energy-intensive computational power to validate transactions, have significant interest. During the June quarter, we saw a meaningful increase in HDD demand due in part to the initial build-out of the Chia net space, which is comprised of both new and repurposed HDDs. By our estimation, new Chia demand represented at most a mid-single digit percentage of total industry exabyte shipments during the quarter, primarily into the distribution channel. This incremental demand served to tighten HDD supply dynamics in an increasingly robust demand environment. While the future growth outlook in this space remains unclear, we are excited by the potential applications associated with innovations in decentralized file storage."

Revenue by products in $ million

| 3FQ21 | 4FQ21 |

Q/Q Growth | % of total revenue in 4FQ21 |

|

| HDDs | 2,493 | 2,737 | 10% | 91% |

| Enterprise data solutions, SSD and others |

238 | 276 | 16% | 9% |

The company expects revenue of $3.1 billion 1FQ22, plus or minus $150 million, or between -2% and +8%.

HDDs from 2FQ15 to 4FQ21

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 | 114.0 | 4,400 |

| 2F21 |

$81 | 129.2 | 4,300 |

| 3F21 | $91 | 139.6 | 5,100 |

| 4F21 |

$97 |

152.3 |

5,400 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter