Cloud Infrastructure Spending Maintained Strong Growth in 1Q21

+12.5% Y/Y to $15.1 billion with highest growth for Lenovo, Huawei, and HPE

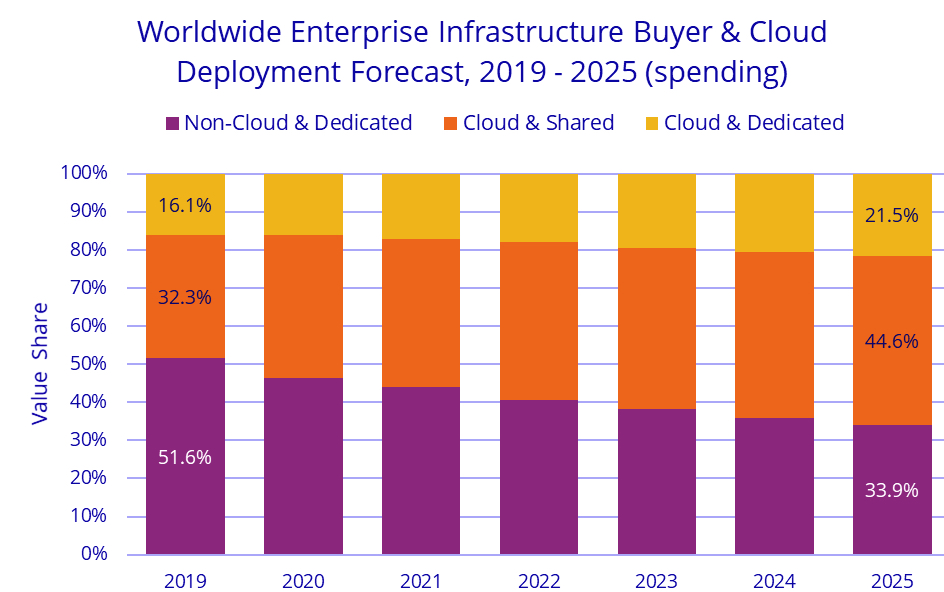

This is a Press Release edited by StorageNewsletter.com on July 6, 2021 at 2:32 pmAccording to the International Data Corporation‘s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud infrastructure, including dedicated and shared environments, increased 12.5% Y/Y in 1Q21 to $15.1 billion. Investments in non-cloud infrastructure increased yearly 6.3% in 1Q21 to $13.5 billion.

As the market and the world slowly begins to emerge from the Covid-19 pandemic, sectors of the economy that had suffered the most revenue loss are returning to growth. A lasting impact on IT infrastructure will be an increased reliance on cloud platforms for delivering commercial, educational, and social applications, as well as an intensified focus among organizations on BC and risk management, helping to drive digital transformation initiatives and increase usage of as-a-service delivery models.

Spending on shared cloud infrastructure increased 11.6% Y/Y in 1Q21, reaching $10.3 billion. It is expected that shared cloud infrastructure spending to surpass non-cloud infrastructure spending in the near future.

Spending on dedicated cloud infrastructure increased 14.7% Y/Y in 1Q21 to $4.8 billion with 45.5% of this amount deployed on customer premises. IDC expects that cloud environments will continue to outpace non-cloud throughout its forecast.

With healthy first quarter results and the overall infrastructure market beginning to recover from the pandemic, IDC is forecasting cloud infrastructure spending to grow 12.9% to $74.6 billion for 2021, while non-cloud infrastructure is expected to grow 2.7% to $58.5 billion after 2 years of declines. Shared cloud infrastructure is expected to grow by 12.2% Y/Y to $51.8 billion for the full year. Spending on dedicated cloud infrastructure is expected to grow 14.7% to $22.7 billion for the full year.

As part of the new Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, IDC tracks various categories of service providers and how much compute and storage infrastructure these service providers purchase, including both cloud and non-cloud infrastructure. The service provider categories IDC follows are: cloud service providers, digital service providers, communications service providers, and MSPs. In 1Q21, service providers as a group spent $15.5 billion on compute and storage infrastructure, growing 12.5% Y/Y, and accounting for 54.0% of total compute and storage infrastructure spending. IDC expects compute and storage spending by service providers to reach $74.7 billion for 2021, growing at 11.1% Y/Y.

Spending on cloud infrastructure increased across most regions in 1Q21, with the highest annual growth rates in Canada (40.3%), China (35.0%), and AsiaPac excluding Japan and China (28.8%). Western Europe grew 10.8%, USA grew 4.5%, and Japan declined 1.1%. The smaller regions had mixed results and collectively grew 0.1%.

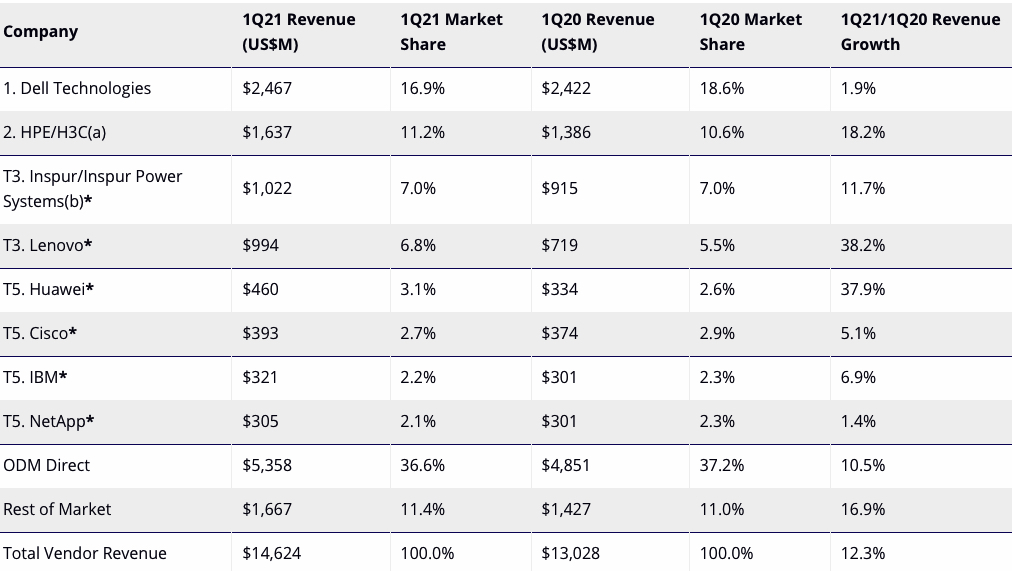

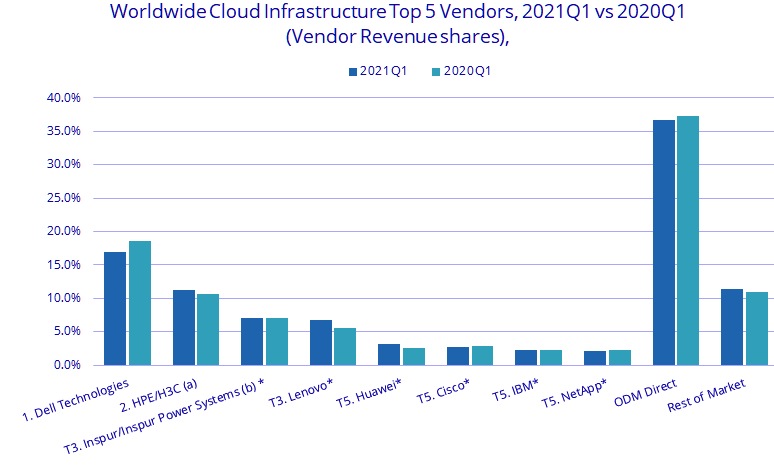

At the vendor level, all major vendors grew their cloud infrastructure revenue in 1Q21, with the highest growth rates belonging to Lenovo (38.2%) and Huawei (37.9%). Huawei, Lenovo, and HPE/H3C(a) each grew their market share compared to results from the prior year’s first quarter.

Top Companies, WW Cloud Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 1Q21

(revenue in $million)

Notes:

* IDC declares a statistical tie in the WW cloud IT infrastructure market when there is a difference of 1% or less in the vendor revenue shares among two or more vendors.

a. Due to the existing joint venture between HPE and H3C, IDC is reporting external market share on a global level for HPE and H3C as “HPE/H3C” starting from 2Q16. Per the JV agreement, Tsinghua Holdings subsidiary, Unisplendour Corporation, through a wholly-owned affiliate, purchased a 51% stake in H3C and HPE has a 49% ownership stake in the new company.

b. Inspur revenues include revenues and server units for Inspur Power Systems. Inspur is reported as a separate company with revenues including Inspur OEM systems and Inspur Power Systems locally developed and branded systems revenue. Per the JV agreement, Inspur Power Commercial System Co., Ltd., has total registered capital of RMB1 billion, with Inspur investing RMB 510 million for a 51% equity stake, and IBM investing RMB490 million for the remaining 49% equity stake.

Long-term, IDC expects spending on compute and storage cloud infrastructure to have a CAGR of 11.3% over the 2021-2025 forecast period, reaching $112.9 billion in 2025 and accounting for 66.1% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 67.5% of this amount, growing at a 10.5% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 13.1%. Spending on non-cloud infrastructure will rebound slightly in 2021 but will flatten out at a CAGR of 0.3%, reaching $57.9 billion in 2025. Spending by service providers on compute and storage infrastructure is expected to grow at a 10.1% CAGR, reaching $108.8 billion in 2025.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce. Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter