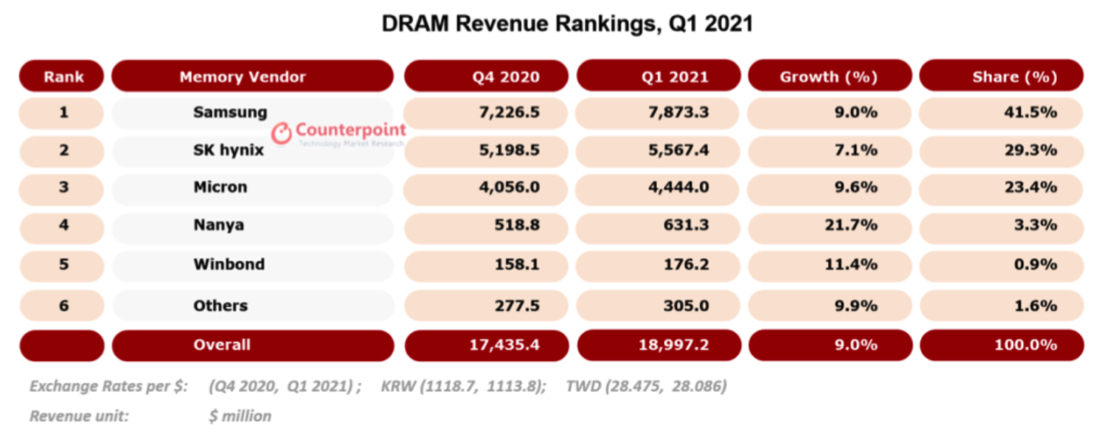

Mobile Demand Raises DRAM Revenue to $19 Billion in 1Q21

Up 30% Y/Y and 9% Q/Q

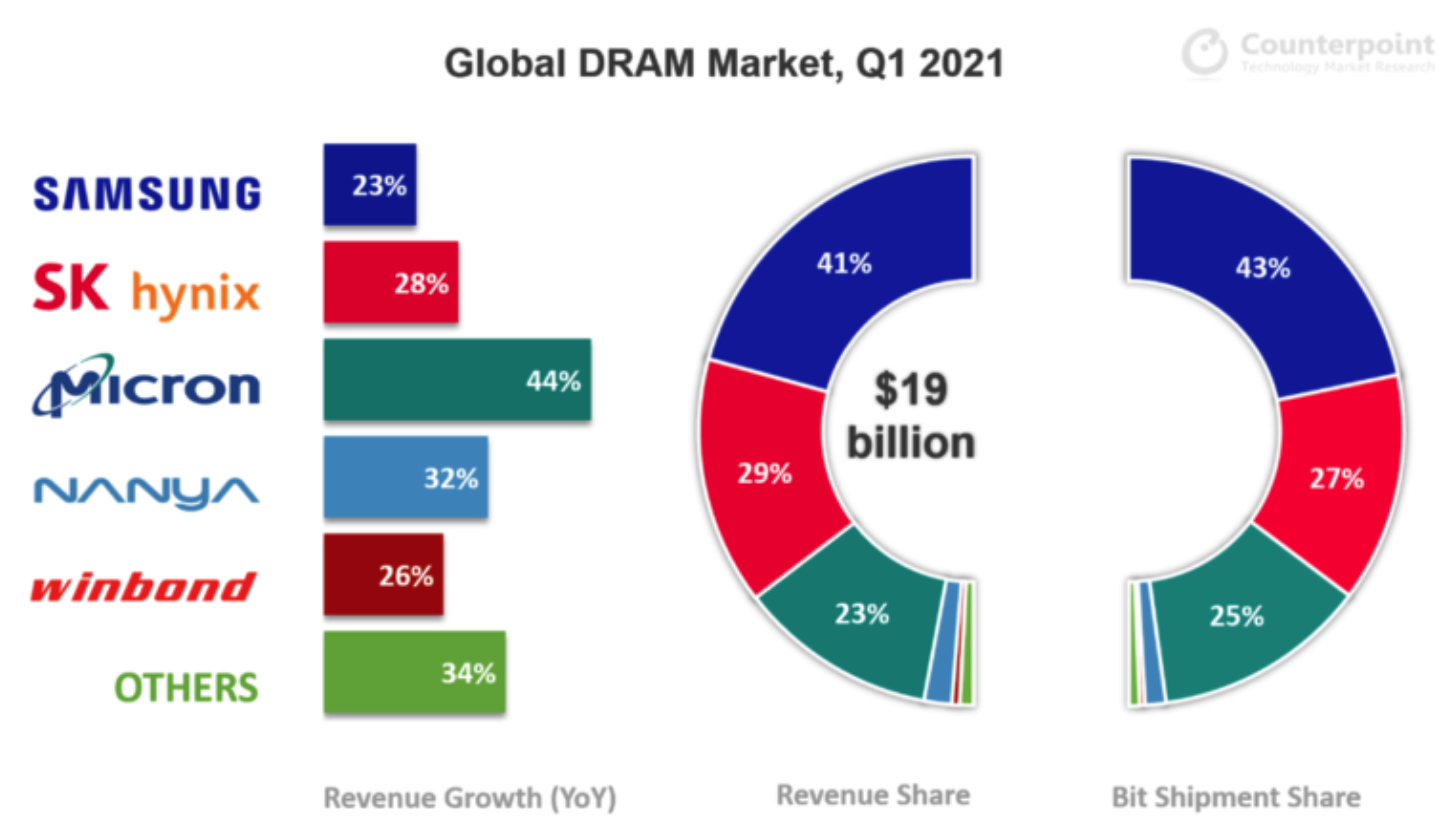

This is a Press Release edited by StorageNewsletter.com on July 2, 2021 at 2:33 pmGlobal DRAM revenues rose to $19 billion in 1Q21, increasing by a solid 30% Y/Y and 9% Q/Q, according to Counterpoint Technology Market Research.

Distance education and work from home (WFH) continued propelling a substantial demand for smartphone and laptop DRAM, resulting in a 6% growth in bit shipment and a 3% rise in ASP over the previous quarter.

Associate director Brady Wang said the Chinese handset makers stepped up their smartphone shipments in 1Q21, intending to gain shares from the beleaguered Huawei.

In addition, the high-density LPDDR4x memory prices softened in 2H20, increasing smartphone DRAM content and making 6GB the minimum standard for mid- to high-end smartphones since 2021.

As a result, the average DRAM capacity in smartphones clocked at 5.3GB in 1Q21, rising impressively by around 21% Y/Y and 7% Q/Q. Similarly, servers experienced recovery in demand, and the adoption of a new data-center CPU bumped up server content per box. Therefore, the server segment’s DRAM demand rose as well.

According to Wang, DRAM is already an oligopolistic market with an Herfindahl-Hirschman Index (HHI) of 3,138. A significant capacity expansion by any player will soon turn around market status and reduce the overall profitability. Therefore, this year, all 3 major players will spend most of their resources in migrating to advanced nodes, a process that is bound to reduce production capacity. In addition, transportation and component shortage concerns will force device vendors to place orders earlier than usual. When coupled with the growing demand for PCs, games and servers, these factors signal the possibility of the DRAM market turning to a shortage this year. The smartphone market is recovering at present, but its cost sensitivity means that a DRAM price spike may put the brakes on smartphone DRAM content growth.

Competitive landscape

The DRAM industry is dominated by 3 major players that collectively account for about 95% of the market’s bit shipments and revenue.

Samsung Electronics

With $7.9 billion in revenue, it led the DRAM market in 1Q21. The South Korean semiconductor giant continued commanding over two-fifths of the DRAM market revenue, overshadowing its nearest competitor by over 41%. Samsung’s DRAM bit shipment growth came from actively responding to the (i) 5G-related surge in smartphone demand, (ii) rising server demands for data centers and (iii) rise of home entertainment culture that increased memory content in TVs and STBs to support 4K UHD content and streaming.

Research Associate Siddharth Bhatla sees 1Znm or 15nm as Samsung’s most advanced mass-produced DRAM node from the technology perspective. The company’s plans include beginning mass production of 14nm node in 2H21. Samsung aims to differentiate its DRAM offerings using multi-layer EUV on its 14nm node, building upon the single-layer EUV in its current 15nm node.

SK hynix

Ranking second, it accounted for over 29% of the DRAM industry’s 1Q21 revenues. Surpassing Micron by over 25%, its revenues rose by over 28% Y/Y in that period, in line with the industry’s overall growth. In addition, the company’s bit shipments rose 4% Q/Q, thanks to its ability to actively cater to the surging demand for mobile and PC memory. By the year-end, SK hynix aims to (i) ramp up the production of its 1Z nm DRAM and (ii) complete development and begin mass production of its 1cx-EUV node.

Micron Technology

It achieved a 44% Y/Y jump in its DRAM revenue in 1Q21, continuing to grow fastest among the big 3 since the preceding 2 quarters. It was the first among the big 3 to begin mass production of 1cx DRAM, accounting for one-fourth of the industry’s DRAM revenue. However, its 1cx node is based on DUV, an older technology that may face severe cost competition once the EUV-based 1cx DRAMs reach the mass market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter