WW SSD Controller not Niche Market

333 million units shipped in 2020

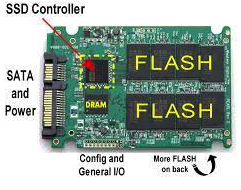

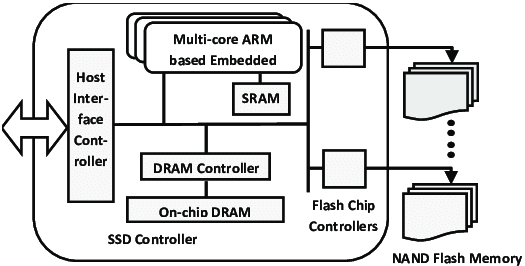

By Jean Jacques Maleval | June 30, 2021 at 2:33 pmA controller for solid-state disk is a piece of hardware bridging the NAND memory chips to the host computer. It is an embedded processor that executes firmware-level code and is one of the most important factors of SSD performance, according to Wikipedia.

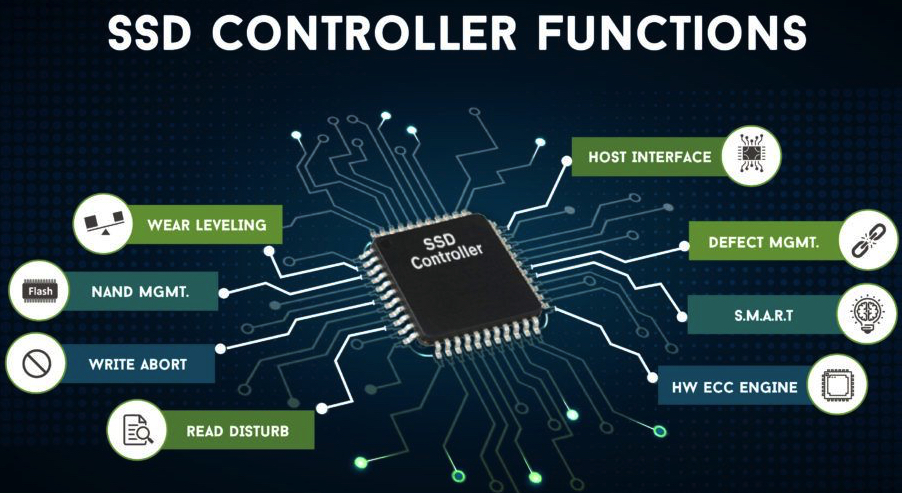

Some of the functions performed by the controller include:

• Bad block mapping

• Read and write caching

• Encryption

• Crypto-shredding

• ECC

• Garbage collection

• Read scrubbing and read disturb management

• Wear leveling

• Managing the interfaces being SATA, mSATA, SAS, FC, eMMC, U.2, USB and now more popular NVMe over PCIe

• For MLC, QLC, SLC, TLC, and,

• For different forms factors (2.5-inch, M.2, etc)

It’s relatively easy to get the global figures of this market for one reason: there is a controller in each SSD and then the number of controllers corresponds directly to the number of SSDs.

Trendfocus calculates that 332.6 million SSDs were shipped in 2020 growing 20.6% Y/Y, and 2021-2025 CAGR of 3.8%. Consequently, the same figures can be apply to SSD controllers and then not being a niche market.

We found a market research SSD Controller Market Expected to Reach $19.04 Billion at 14.60% CAGR, a report by Market Research Future dated June 21, 2021.

Most of these controllers are designed by SSD makers, the biggest ones being Samsung (25.6% market share), WDC (19.6%), SK hynix (11.2%), Kingston (8.9%), Micron (7.5%) and Intel 5.3%), representing a total of nearly 80%, which means the independent manufacturers represent a small market even if we have counted around 200 SSD makers in the world.

Who are these independant makers? Leaders here are Phison Electronics (revenue of $1.642 billion in 2020) and Marvell, with other ones like Microchip Technology, Silicon Motion, JMicron, Realtek, CNEX Labs, InnoGrit, TenaFe, PetaIO, Yeestor Microelectronics, Sage Microelectronics, LSI/Sandforce acquired by Avago acquired by Seagate.

Michael Wu, GM and president of Phison Technology Inc. (USA), comments: “While it may seemlike the majority of the client SSD share is dominated by the NAND makers and also big flash product manufacturing brands, the market share of the third party controllers is quite significant. We have seen a trend by SSD makers for consumer and client OEMs move towards outsourcing to third party controller houses, such as Phison because of time to market speed.”

The market is in good health as there is currently a worldwide shortage, particularly for PC and mobile markets, and consequently a price increase of SSD controllers (and consequently SSDs), especially with recent shutdown of Samsung’s NAND controller manufacturing facility in Austin, TX.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter