Memory Market Fortunes Turn After Disappointing 2020

NAND revenue to approach $70 billion in 2021, far surpassing previous 2018 record of $59.6 billion

This is a Press Release edited by StorageNewsletter.com on June 29, 2021 at 2:33 pmThe economic fallout from the global Covid-19 pandemic has meant mixed fortunes for memory technologies as the world juggles new working practices with fluctuating inventory and supply levels.

In a year of false starts, changing end-user demands and global economic uncertainty, the memory industry has seen mixed fortunes. There have been gains and disappointments as the market comes to terms with new realities and new trajectories.

The market research and strategy consulting company, Yole Développement investigates the memory business with the identification of disruptive memory technologies and the analysis of the strategy of the leading memory companies.

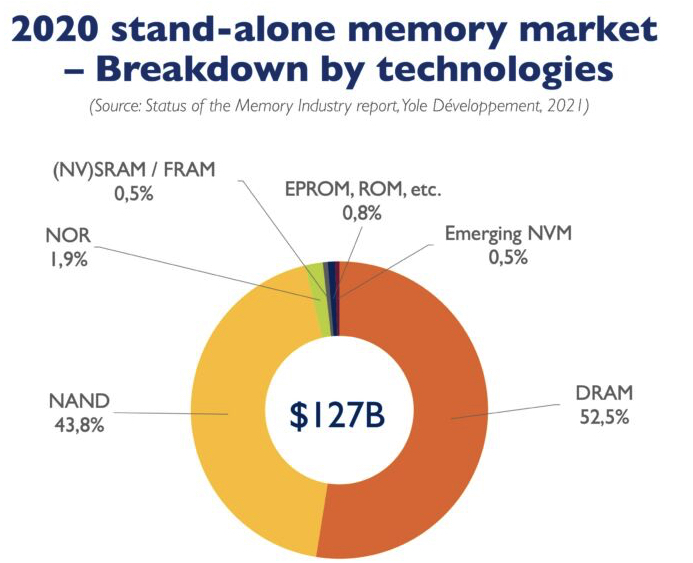

NAND and DRAM are ubiquitous technologies, together accounting for 96% of the overall stand-alone memory market. The remaining 4% consists of a broad spectrum of technologies that fit the requirements of different end-systems and markets. NOR flash is the third-largest market (~$2.4 billion in 2020), fuelled by numerous applications including industry and security, consumer, and automotive electronics, as well as telecom infrastructure. Emerging non-volatile memory (NVM) – including PCM, MRAM, ReRAM – are gaining significant momentum but will remain less than 3% of the total stand-alone memory market into 2026.

DRAM market: let the good times roll – multi-year recovery underway

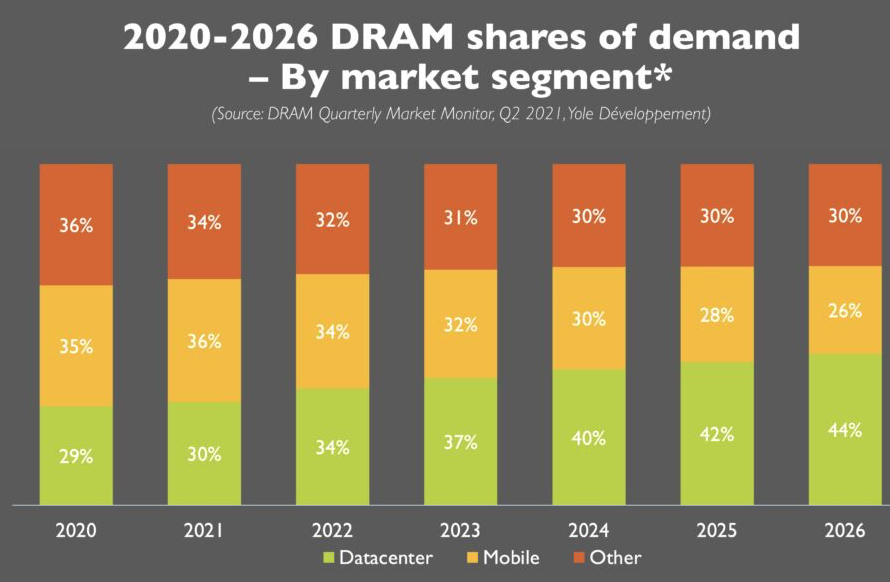

There were setbacks to the anticipated recovery of the DRAM market in 2020 due to a combination of factors. In addition to increasing tensions around trade between the US and China, the worldwide Covid-19 pandemic took its toll. Initially, the move to working from home, and concerns around the supply chain, both as a direct result of the pandemic, led to an increase in demand for DRAM in the first half of 2020. The primary beneficiaries of this were the datacenter and notebook PC sectors, as companies and education moved to at-home working.

In 2H20, however, demand fell away. Weak demand, coupled with OEMs using up their inventories meant that DRAM prices fell in 3Q20 and 4Q20.

The outlook for DRAM looks bright in 2021, however. Market conditions have already improved. PC demand continues to be robust as working from home is still in place for companies and institutions around the world. The strong demand for datacenters has meant that prices have returned to their previous levels. Now, inventories have normalized although there has been constrained supply for certain products.

DRAM is also benefitting from an increase in mobile demand, as consumers are looking once more to buy smartphones. In addition, the ongoing deployment of 5G is likely to boost demand throughout the rest of this year.

The only segment which has not rebounded is traditional enterprise OEM DRAM. Here, there is outstanding inventory, which coupled with a general economic malaise as a result of the pandemic, has resulted in weak demand.

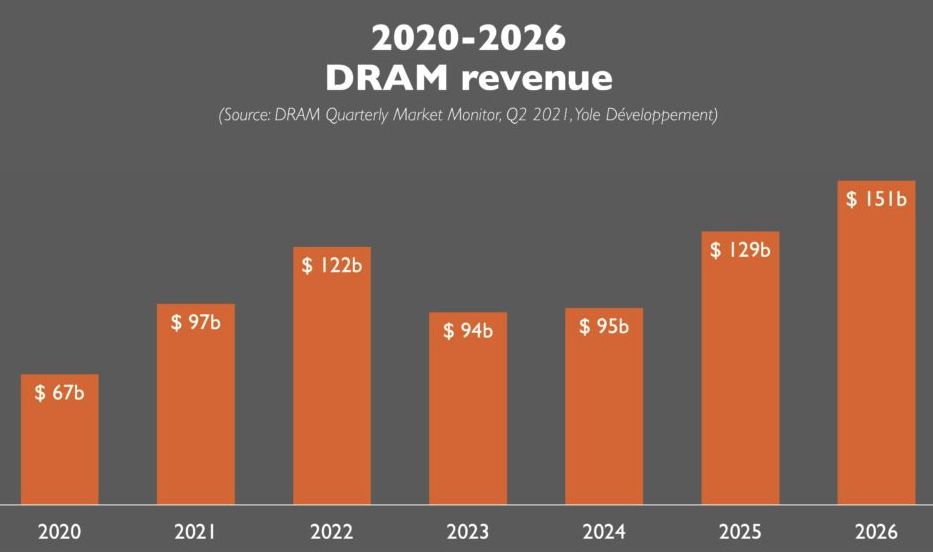

Looking further ahead, the outlook for the DRAM market is more positive. Underinvestment in manufacturing capabilities over the last 2 years is being addressed with Capex which is expected to increase by ~20% in 2021. Micron is ramping up 1anm production while Samsung and Hynix are both focusing on 1znm this year. Demand is expected to be strong over the next 12-24 months with revenues forecast to exceed $97 billion this year and to rise again to $122 billion in 2022. Bit growth is forecast to be ~21% in 2021 and to continue to grow in 2022.

NAND market: delayed recovery finally underway after sluggish 2020 …

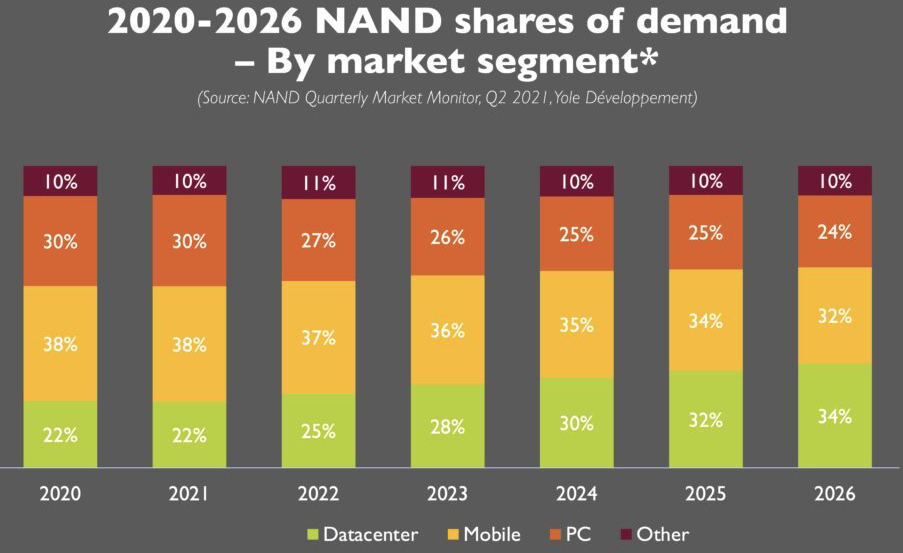

Like DRAM, NAND also suffered as a result of Covid-19 and US-China trade tensions. The recovery expected in 2020 did not materialize, although the move to working-from-home/ learning-from-home coupled with concerns over supply chain disruption, saw an increase in demand for the first half of 2020.

Like DRAM, this was focused on datacenters and notebook PCs and was followed by a fall in demand in 2H20. ASPs fell in 3H20 due to a decrease in demand and because OEMs were using up existing inventory.

Similar factors to those in the DRAM market contribute to a more positive outlook for the NAND market in 2021. Robust demand for notebook PCs and gaming has strengthened the client SSD segment in particular. There has also been strong demand for datacenter products which means prices have rebounded as inventory levels normalize once more. There is, however, constrained supply for certain products.

As with DRAM, the NAND segment is expected to benefit from the increased demand for mobile, with increased smartphone demand after a period of consumer inactivity and continuing 5G deployment. All of these factors are expected to boost demand for NAND for the rest of 2021.

Supply chain uncertainty from semiconductor controllers and other NAND sub-components has applied pressure for higher ASPs. Samsung’s manufacturing facility in Austin, TX, USA, which manufactures the NAND controllers for its SSDs was shutdown recently and the ensuing disruption highlighted the uncertainty around the supply chain. The facility’s shutdown is expected to accelerate the NAND pricing recovery, particularly for PC SSD and mobile markets, where the effects of controller shortages have been most pronounced.

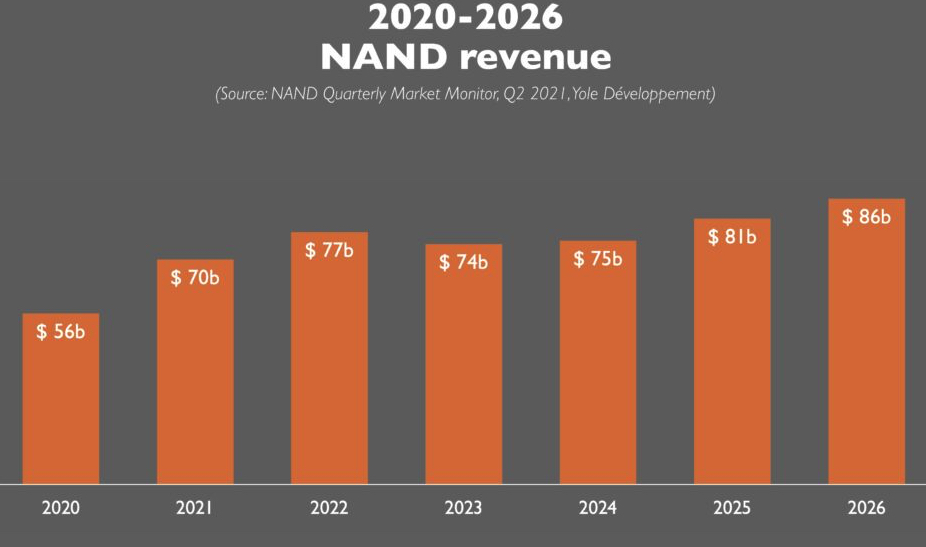

Blended NAND pricing is expected to rise in 2Q21 – vs. prior expectations of price increases starting in 2H21 – and is poised to remain strong through the remainder of 2021. Price increases, in combination with expected 2021-bit growth of 36% is forecasted to result in NAND revenue approaching $70 billion in 2021, far surpassing the previous record of $59.6 billion set in 2018.

To support the deployment of >100-layer 3D NAND processes, new shell builds, and the YMTC ramp up, Capex is expected to increase 16% in 2021. At the same time, bit growth is expected to increase this year to meet renewed demand. While QLC NAND demand remains low, it is gaining traction in the consumer/client PC SSD market.

Status of emerging NVM market segment

Both stand-alone and embedded NVM remain as emerging sectors. Stand-alone NVM includes PCM, 3D XPoint, MRAM. Yole expects the stand-alone NVM market to increase from 2020’s ~$595 billion to ~$3.3 billion in 2026, in its Emerging Non-Volatile Memory report, 2021 edition. This forecast assumes that Intel will be able to ramp up 3D XPoint manufacturing capacity early next year to meet the demand for low-latency storage for enterprise and client SCM drives. It will also rely on demand for persistent memory, which retains data during an outage, in the form of NVDIMM.

Of these stand-alone technologies, PCM is expected to dominate because Intel is combining its 3D XPoint products – particularly NVDIMMs – with its server CPUs. MRAM and ReRAM are expected to have a combined market share of ~23% in 2026.

The embedded emerging NVM market is taking off driven by MCUs and the growing IoT business, as well as by memory buffers for ASIC products, such as AI accelerators, display drivers, security ICs and CMOS image sensors for new and emerging applications.

There are several technologies in the embedded NVM market. The most popular is eMRAM, with activity in developing low power products. Yole forecasts the eMRAM market to be worth ~$1.7 billion in 2026, or ~76% of the emerging embedded NVM market. Products based on eMRAM technology were introduced in 2020, for example Sony’s GPS chips in Huawei’s smart watches.

Elsewhere, there has been rapid progress in MRAM development as IDM/foundries and equipment suppliers address its technical challenges.

In March 2021, Micron has announced that it will no longer develop its 3D XPoint technology but will increase investment in products using the Compute Express Link (CXL). The company said that there is “insufficient market validation to justify the high levels of investments required to successfully commercialize 3D XPoint at scale.” Micron was the sole supplier of 3D XPoint to Intel but Intel’s Optane business has not taken off as expected.

Micron hopes to sell its Lehi fab which is dedicated to 3D XPoint production by the end of 2021, rather than convert it to 3D NAND production. The current semiconductor shortage will improve the valuation of the fab, and save Micron ~$400 million per year in underutilization charges.

Meanwhile, Intel will continue to promote and disseminate its Optane Persistent Memory to datacenter customers but if they are still reluctant to adopt it, it cannot be discounted that Intel could quit the Optane business.

By the end of the 3D XPoint supply agreement, Intel needs to start manufacturing 3D XPoint independently. Will they be able to ramp up production in their New Mexico fab?

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter