SK hynix: Fiscal 1Q21 Financial Results

SK hynix: Fiscal 1Q21 Financial Results

NAND flash bit shipment growing by 21% Q/Q

This is a Press Release edited by StorageNewsletter.com on April 29, 2021 at 2:33 pm| (in KRM or won billion) | 1Q20 | 1Q21 | Growth |

| Revenue |

7,199 | 8,494 | 18% |

| Net income (loss) | 649 | 993 | 53% |

SK hynix Inc. announced financial results for its first quarter 2021 ended on March 31, 2021.

The consolidated revenue of 1FQ21 was 8.494 trillion won while the operating profit amounted to 1.324 trillion won, and the net income 993 billion won. Operating margin for the quarter was 16% and net margin was 12%.

The company made better results both Q/Q and Y/Y in 1FQ21 as the semiconductor market conditions improved earlier this year. Although the first quarter is usually off-season of the semiconductor industry, the company said that the market conditions improved as demand for memory products for PCs and mobiles increased. In addition, cost competitiveness has increased as yields of major products have improved. Through this, the revenue and the operating profit increased by 7% and 37%, respectively, compared to the previous quarter.

For DRAM, the company responded to market condition, and focused on mobiles, PCs, and graphics for sales. As a result, the DRAM bit shipment increased by 4% Q/Q.

For NAND flash, the sales increase of high-density products for mobile devices led to NAND flash bit shipment growth by 21% Q/Q.

SK hynix is optimistic about the market conditions after this quarter. It expects the inventory of customers to decrease quickly as current stronger-than-expected demand growth in the broader IT market continues. Demand for DRAM is likely to continue to grow, while the NAND flash market demand is also expected to grow.

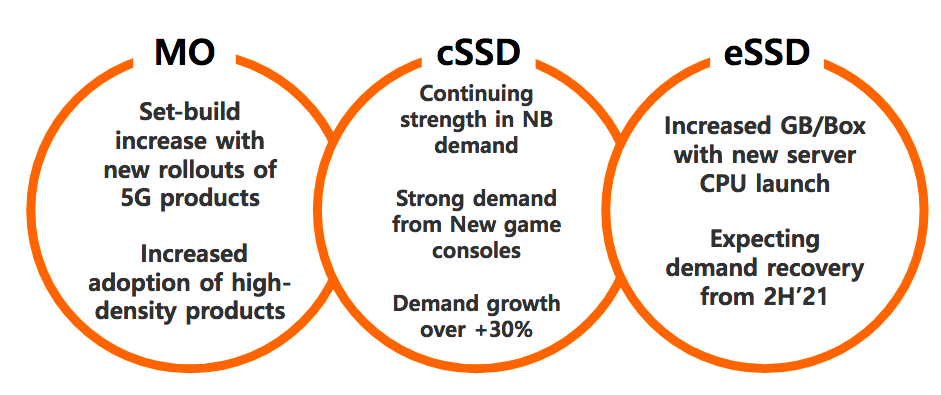

For DRAM, the firm plans to supply high-capacity Multi Chip Package (MCP) based on 12GB DRAM products from the second quarter. In addition, it has decided to increase the production volume of 1Znm DRAM. It also announced that it will finish developing the 1Anm technology using EUV equipment within this year and begin mass production of the product as well.

For NAND flash, it will increase the 128-layer product mix to increase the sales of enterprise SSDs, and begin mass production of 176-layer products with the accumulated knowhow from the 128-layer technology.

SK hynix expressed a commitment to ESG management. Kevin (Jongwon) Noh, EVP and head of corporate center (CFO), said: “SK hynix has continued ESG management activities since last year by strengthening the responsibility of the board of directors, and participating in the Semiconductor and Display Carbon Neutrality Committee. The company will make its utmost efforts to help the semiconductor industry lead the ESG management while raising the level of RE100* by actively developing eco-friendly technologies.”

*RE100: Declaration to cover 100% of the company’s electricity use with renewable energy by 2050

Comments

We classified SK hynix as the top storage company in the world for public companies revealing their financial results in 2020 for storage only, with annual sales of $28,688 million, up 18% Y/Y.

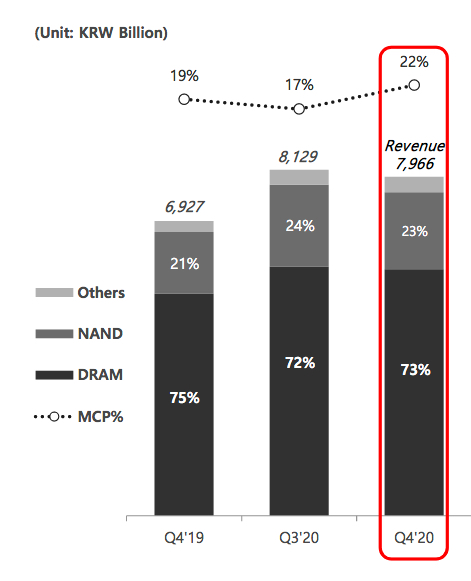

For the former quarter, its revenue was 7,966 billion won (+7% Q/Q) with net income of 1,768 billion won, NAND flash bit shipment up 8% Q/Q.

Consequently, SH hynix saw sales down 2% sequentially from the most recent quarter (and up 15% Y/Y), with profit down 44%, and this time NAND flash bit shipment grew by 21% Q/Q. Sales of 8,494 billion won is not a record as it was 8,607 billion won in 2FQ20.

Revenue by business unit

NAND highlights

Accelerated ramp-up of 3D 128L, which was developed 1st in industry

- 128L reached 30% (20YE) of production, expanding to more than 50% during 1H21

- Time-to-market supply of 128L solution products, plan to expand 128L to eSSDapp

- Start mass production of 176L in 2021, leveraging 128L know-how

Strengthened market addressability with high-density solution products

- Datacenter SSD revenue increased 6x, reaching meaningful threshold

- Diversifying from mobile-focused product portfolio

Achieving growth momentum through inorganic growth

- Instant acquisition of high-talented engineering resources, building cooperative relationship between the two companies

- Leap frog toward next level of growth though enhancement of NAND competitiveness

NAND outlook

| Revenue | Y/Y growth | Net income | |

| 1FQ19 | 6,773 | -22% | 1,102 |

| 2FQ19 | 6,452 | -38% | 537 |

| 3FQ19 | 6,839 | -40% | 495 |

| 4FQ19 | 6,927 | 15% | (126) |

| 1FQ20 | 7,199 | 6% | 649 |

| 2FQ20 | 8,607 | 33% | 1,264 |

| 3FQ20 | 8,129 | -6% | 1,078 |

| 4FQ20 | 7,966 | 15% | 1,768 |

| 1FQ21 | 8,494 | 18% | 993 |

(in KRW or won million)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter