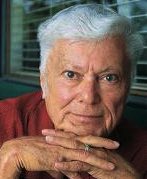

History (1995): Exclusive Interview With Seagate CEO and COB Al Shugart

"The name of Conner will disappear."

By Jean Jacques Maleval | May 6, 2021 at 2:31 pmComputer Data Storage Newsletter: The definitive agreement of the merger between Seagate Technology and Conner Peripherals was announced officially last October 3. It was a surprising event. When, for the first time, were you interested in buying Conner?

Alan Shugart: Finis [Conner] and I have talked for a long time, but never seriously. Last June, our corporate development people were interested in a couple of the businesses of Conner, they were interested in their disk division, they were interested in Arcada, their software division, and I guess the discussions, by the way, I wasn’t in on these discussions, although I knew they were going on, from there the conversation led to ‘Why don’t you just acquire the whole company, or let’s merge together, and not just those one or two divisions. I guess it started last June.

Alan Shugart: Finis [Conner] and I have talked for a long time, but never seriously. Last June, our corporate development people were interested in a couple of the businesses of Conner, they were interested in their disk division, they were interested in Arcada, their software division, and I guess the discussions, by the way, I wasn’t in on these discussions, although I knew they were going on, from there the conversation led to ‘Why don’t you just acquire the whole company, or let’s merge together, and not just those one or two divisions. I guess it started last June.

Korean Samsung was interested in buying Conner. Was it a factor in your decision?

I don’t know that they were. I have no knowledge of that at all. So, no, that was not a factor.

Finis Conner is not your best friend. Was that a factor?

I think the friendly competitiveness between Finis and myself is much overstated by people.

But he’s not your best friend.

I have very few really good friends. No that was not a factor at all.

In your opinion, why did Conner want to sell?

You have to ask them, they’d be a better source of information. They probably believed as I do that in the future, successful technology corporations are going to be large, well-financed, with a lot of global technology, and that they can see themselves being better positioned for their shareholders by becoming part of Seagate, so I think they probably agreed with my thoughts about being a larger. better financed company. Because I really believe that’s the case. Not just in disk drives, but in all the computer industry.

What’s the real synergy between the two companies?

Well, of course, the disk drive business is certainly valuable, but strategically, what I look forward to is their disk division, they make good magnetic disks. In fact, they just bought a substrate company [Stormex] to supply the substrates. They have a magnetic tape drive company, The Archive company, which is of strategic value to us. They have Arcada, which fits very nicely with our software strategy. That’s of great strategic value to us. So those three things, forgetting about the disk drive business, are of great strategic value.

You were never really interested in tape before.

No, we have been looking at tape companies for a long time. We looked at Archive, before Conner bought them. But we never really found anything that we wanted to do. At the right price, with the right products, so maybe we haven’t here, I think we have, but I think this is potentially of great strategic value to us because we are going to be in the tape drive business whether we like it or not, when we close the deal. Then we’ll find out whether we really should be or not. I’m excited about it.

Will you keep Conner as a separate entity?

No, we’re going to integrate the whole thing.

Will you keep the name Conner?

We’re not planning on it. The only name we may keep is Arcada, they have a good trade name, although the Arcada people tell me that maybe that’s not true, so I’m not sure, but the Conner name will disappear. I thought that the Arcada name had pretty high visibility, but their people think that Seagate software has got a better ring to it than Arcada.

What will be the new role of Finis Conner himself and for how long?

Finis will help us in the initial integration, but he has no long-term role in the company, he won’t have a long term role in the company.

Will he report directly to you?

Everybody does. Yeah, he’s going to help us in the transition period, but I’m the boss. He’ll have no long-term role, there will be no Conner board members on our board either. Our board will stay as it is.

Do you know what he wants to do next?

You’ll have to ask him. I don’t know. At one time, he wanted to go on the Senior Tour, be a senior golf professional. Maybe he still does, I don ‘t know.

When did you meet him for the last time, and what did you speak about?

Well, you see, he lives two blocks from my house. He eats in my restaurants. And we talk quite frequently, we talk on the phone, so I have no idea the last time, maybe he was trying to make a reservation for the restaurant, I don’t know.

Arcada is actually an 80% subsidiary of Conner. Will you keep It as a subsidiary?

No we’re going to buy the other 20%. As soon as we do this deal, we buy the minority interest. Arcada will be another software company just like the six that we did buy already. We merge them all together.

The merger with Conner is costly.

What do you mean, costly?

I mean, will you have enough money to continue your acquisitions of software companies to reach your goal to earn $1 billion in software in 1999?

I fully expect the availability of capital will not be a limiting factor in our getting to a billion dollar in software.

How many people from Conner do you intend to keep?

Can’t talk about that, because I don’t really know. We haven’t made public and haven’t completed our study of whether both Seagate and Conner people, there’s bound to be some duplication. Once we do the deal, we’ll have to handle the duplication as it is discovered. I can’t tell you what they’re going to be.

Actually, some OEMs or distributors had two disk drive sources, Seagate and Conner. Because of the merger, some of them are already searching a new second source. Consequently, what will you do to avoid competition with a new second source?

That’s one of the things I’m not going to discuss yet. There are some market overlaps, some market overlaps are good and some are not good, but it should be good for the industry. If Conner and Seagate are the only disk drive manufacturers for the distributor, and the distributor wants to find another one that should provide an opportunity for another disk drive manufacturer. It’s good for the industry.

And with the deal in February, when will you be able to talk about the way you will restructure the company?

Hopefully, very shortly after we close the deal, I’ll be able to tell people what we’re doing.

So your plan is ready?

We have a lot of people working on it. It’s not complete, but a lot of people are working on it. But the day it closes, we will be prepared, and then I can talk about it.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 95, published on December 1995.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter