Micron: Fiscal 2Q21 Financial Results

Micron: Fiscal 2Q21 Financial Results

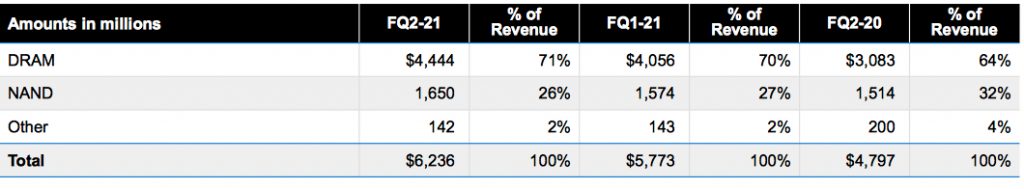

NAND revenue up 5% Q/Q and 9% Y/Y at $1.7 billion, representing 26% of global sales up 30% Y/Y

This is a Press Release edited by StorageNewsletter.com on April 2, 2021 at 2:33 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 4,797 | 6,236 | 9,941 | 12,009 |

| Growth | 30% | 33% | ||

| Net income (loss) | 407 | 603 | 915 | 1,406 |

Micron Technology, Inc. announced results for its second quarter of fiscal 2021, which ended March 4, 2021.

2FQ21 highlights

- Revenue of $6.24 billion versus $5.77 billion for 1FQ21 and $4.80 billion for 2FQ20

- GAAP net income of $603 million, or $0.53 per diluted share

- Non-GAAP net income of $1.13 billion, or $0.98 per diluted share

- Operating cash flow of $3.06 billion versus $1.97 billion for 1FQ21 and $2.00 billion for 2FQ20

The company ended the quarter with total cash of $8.6 billion and total liquidity of approximately $11.1 billion. 2FQ21 ending total debt was $6.6 billion.

“Micron’s strong fiscal second quarter performance reflects rapidly improving market conditions and continued solid execution,” said president and CEO Sanjay Mehrotra. “Our technology leadership in both DRAM and NAND places Micron in an excellent position to capitalize on the secular demand driven by AI and 5G, and to deliver new levels of user experience and innovation across the data center and intelligent edge.“

Outlook for 3FQ21: Revenue of $7.1 billion ± $200 million

Comments

Total 2FQ21 revenue was $6.24 billion, up 8% Q/Q and up 30% Y/Y, above original projections of $5.6 to $6.0 billion, driven by solid execution and higher-than-expected demand across multiple end markets.

Highlights

- DRAM market in severe shortage, and NAND market showing signs of stabilization in near term

- Reached records for mobile MCPs and automotive

- Reached normal levels of inventory ahead of schedule

- Began volume production of 1-alpha DRAM node, solidifying technology leadership in DRAM and NAND

Due to drought in central Taiwan, there has been a reduction in the water supply at one of DRAM fab sites, but the firm secured alternative sources of water to mitigate the water shortage; at this time, it does not see an impact to DRAM production output.

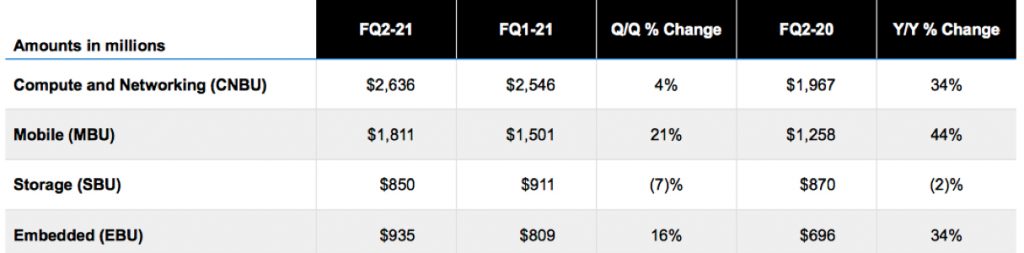

Revenue by business unit

Revenue for the storage business unit was $850 million, down 7% from 1FQ21 and down 2% Y/Y. SSD and component revenue declined Q/Q. But Micron expects storage revenue to increase as it introduce 176-layer client SSDs into volume production.

Revenue by technology

For NAND only:

- Revenue was $1.7 billion in 2FQ21, representing 26% of total revenue.

- Sales were up 5% Q/Q and up 9% Y/Y.

- NAND market was showing signs of stabilization in the near term.

- Bit shipments were up high-single-digit percent range Q/Q and ASPs were down low-single-digit percent range Q/Q, showing an improvement in trajectory in the NAND pricing environment.

- QLC SSD adoption continues to grow, and the company achieved a record high QLC bit mix in 2FQ21.

- The firm expects NAND to be its workhorse for FY22, fueling its bit growth and contributing to long-term cost reduction goals.

It drives an increased mix of QLC NAND and achieved a record-high QLC bit mix in 2FQ21 - It continues to expand its data center NVMe SSD portfolio with internally developed controllers and has new product introductions planned in the coming quarters.

- In client SSDs, it is on track to begin customer qualification of next-gen client SSDs using 176-layer NAND in 2HFY21.

- In data center SSDs, revenue declined sequentially as customers in certain segments reduced their higher-than-average inventory levels.

- Earlier this month, Micron exits 3D XPoint development and manufacturing.

Next quarter, the manufacturer expects revenue of $7.1 billion ± $200 million or up between 11% and 17%.

Data center demand should be strong in calendar 2021, particularly in the second half.

In NAND, Micron expects calendar 2021 bit growth in the low to mid-30% range, above its prior expectation of 30%. While it is seeing stabilization in near-term pricing, the elevated levels of industry Capex are a cause for concern, and more Capex cuts are needed to allow for healthy NAND industry profitability.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter