NAND Market Revenue Grew 28% in 2020

Poised for rebound in 2021

This is a Press Release edited by StorageNewsletter.com on March 30, 2021 at 2:32 pmThis DRAM and NAND Quarterly Market Monitor – 1Q21 was published by Yole Développement.

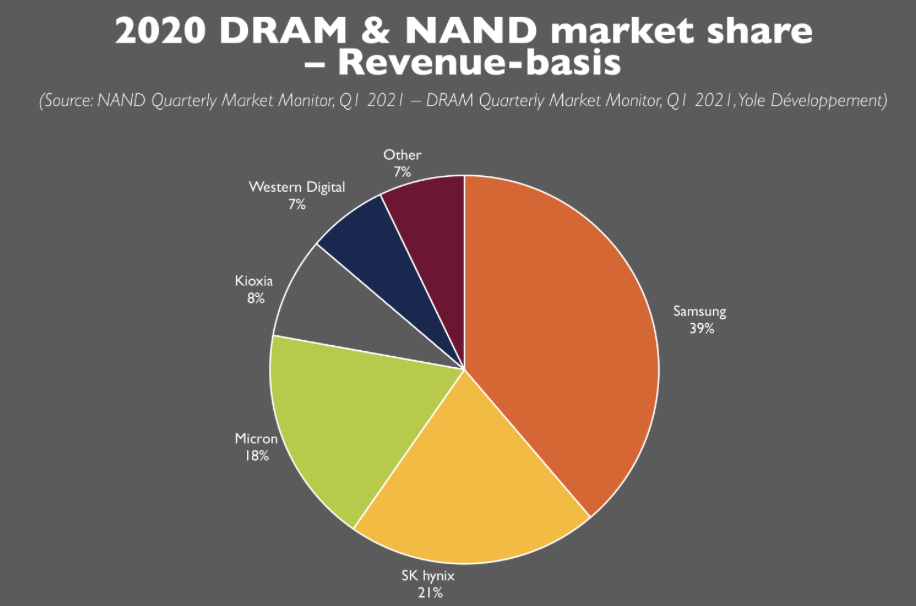

DRAM and NAND: at the forefront of the semiconductor industry

Market dynamics:

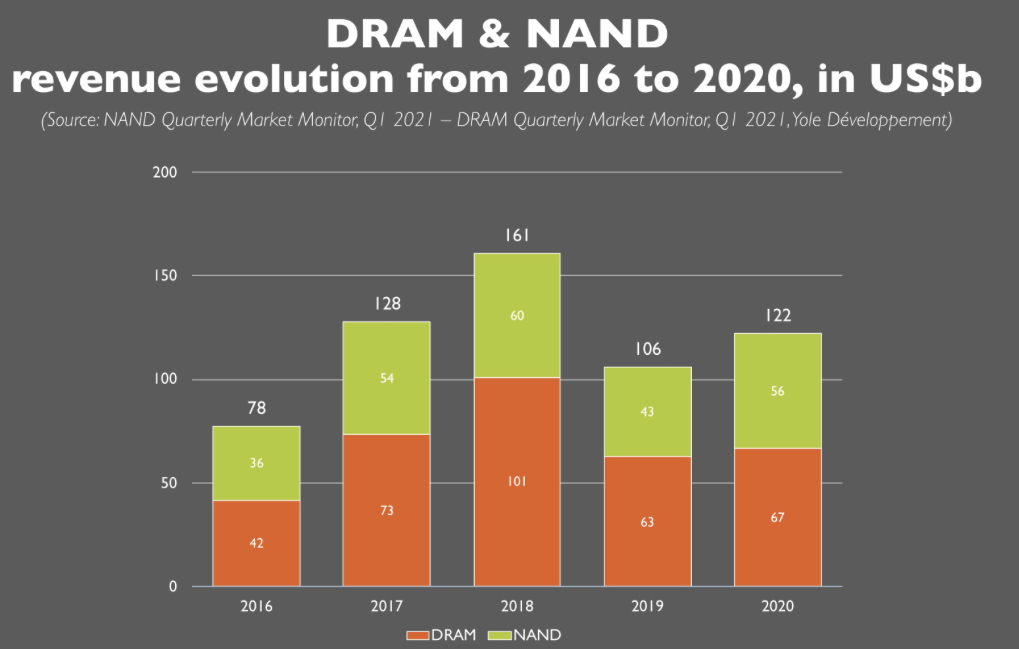

• The memory market grew 15% to reach $122 billion in 2020.

• NAND Q4 2020:

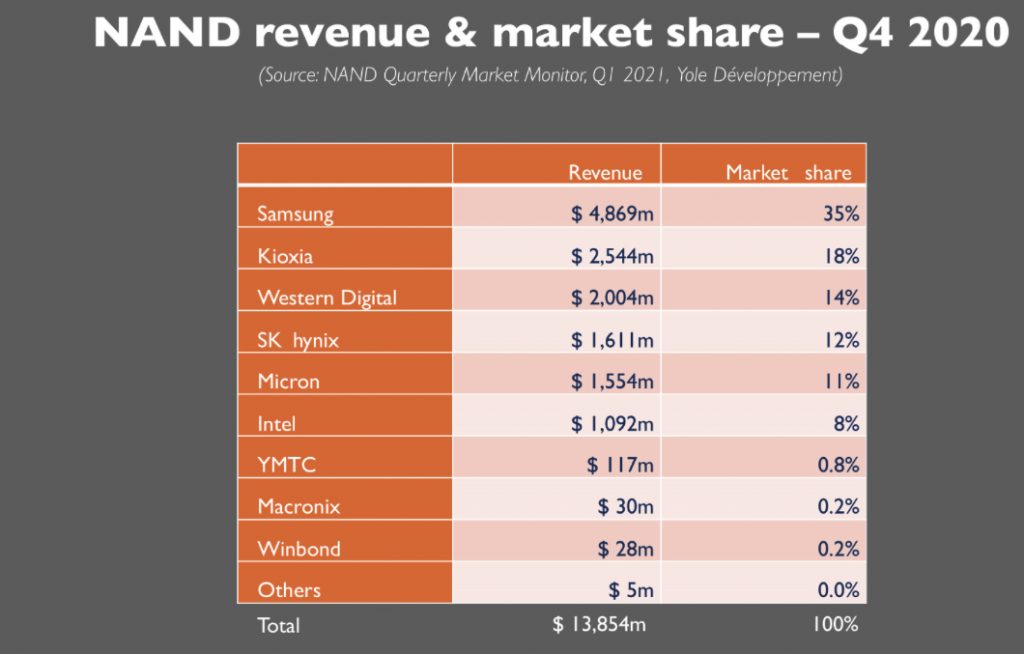

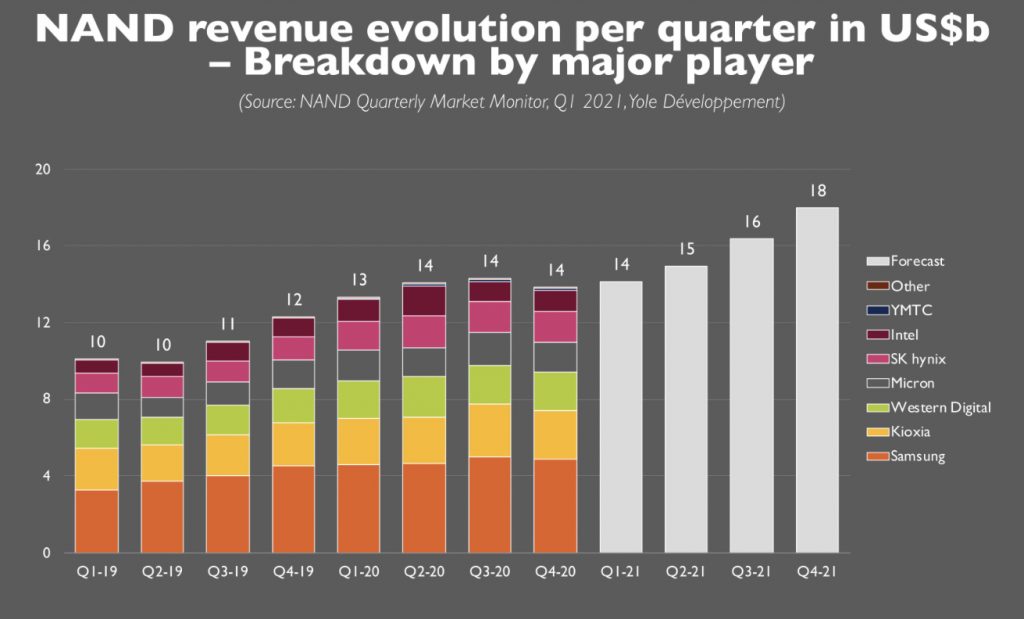

- NAND market revenue grew 28% in 2020.

- NAND’s competitive landscape remains incredibly dynamic.

- As the NAND market evolves, the industry faces many important questions.

• DRAM 4Q20:

- DRAM market revenue grew 6% in 2020.

- The DRAM market is constantly evolving and changing.

- The DRAM market’s future promises to be as dynamic as its past.

When the memory markets surpassed $160 billion in revenue in 2018 it would have been easy to believe that a new era had dawned on the notoriously volatile semiconductor segment. The last 2 years, however, have proven that the only certainty in the memory markets is uncertainty. Revenues collapsed in 2019 by more than 30% as prices fell by nearly 50% for both DRAM and NAND.

As the Covid-19 pandemic gripped the world in 2020 it seemed certain that the memory markets would continue their disastrous declines … yet they did not.

Proving once again that they are volatile and fickle markets, both NAND and DRAM markets grew revenue in 2020, 28% and 6% respectively. Exiting 2020 both the DRAM and NAND markets showed signs that 2021 could be an even stronger year.

Are we entering another memory super cycle similar to 2017? There are still a lot of moving pieces and a lingering pandemic that could change the market’s prospects, but the current outlook is bright.

NAND conroller shortages pull in 2021 recovery

Megatrends and HDD replacement will push NAND to new heights

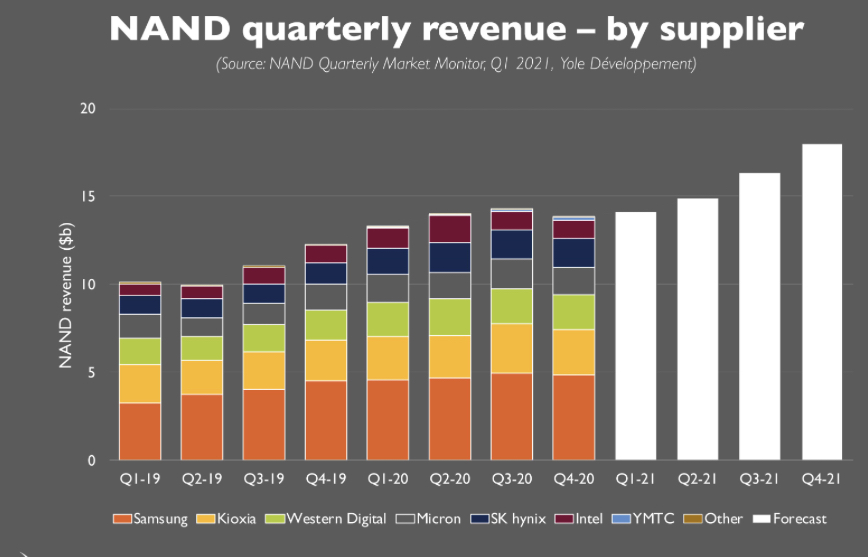

As said in the NAND Quarterly Market Monitor, 1Q21, the long-term outlook for the NAND market is positive, despite the continued presence of seasonality and cyclicality. Imbalances in supply and demand can cause market volatility in the short term, but emerging megatrends driving massive data gen and the ongoing replacement of HDDs with NAND-based SSDs are expected to push NAND to new heights.

According to Walt Coon, VP of NAND and memory research: “Shortages of controllers and other NAND sub-components are causing supply chain uncertainty, putting upwards pressure on ASP3s. The recent shutdown of Samsung’s manufacturing facility in Austin, TX, USA, which manufactures NAND controllers for its SSDs, further amplifies this situation and will likely accelerate the NAND pricing recovery, particularly in the PC SSD and mobile markets, where impacts from the controller shortages are most pronounced.“

NAND’s competitive landscape remains incredibly dynamic. Samsung is utilizing its massive Pyeongtaek site and expanding its facilities in Xi’an, China; Kioxia Corporation and its partner Western Digital continue to expand their footprint in Japan; SK hynix is in the process of acquiring Intel’s NAND/SSD business; and Micron continues to be a 3D technology leader even as it transitions from floating – to replacement-gate technology. Meanwhile, a new entrant looms on the horizon: China’s Yangtze Memory Technologies Co. (YMTC), which threatens to disrupt the status-quo.

The DRAM rocket ship is fueled up and ready fir blast off

Megatrends are pushing more dram into products

The DRAM rocket ship is fueled up and ready for blast off to reach $120 billion by 2022 due to limited supply coupled with resurgent demand.

The long-term megatrends boosting the entire semiconductor industry have a very positive impact on the memory market, especially DRAM. Mobile phone in general and the 5G revolution in particular, along with hyperscale data center, AI and ML, and autonomous driving are all pushing DRAM adoption, with a CAGR of more than 20% for bit demand over the next 5 years.

f2

According to Mike Howard, VP of DRAM and memory research: “The DRAM market is constantly evolving and changing. The recent market volatility is clear evidence of this. New Chinese suppliers threaten to eventually disrupt the market and emerging memory technologies are poised to cannibalize huge chunks of DRAM demand while the demand drivers of the past (PCs and smartphones) lose steam and no longer push industry demand.”

The DRAM market’s future promises to be as dynamic as its past.

DRAM and NAND industries: outlook looks promising, but …

Without a doubt, memory is one of the primary market segments for semiconductor products. However, uncertainties in the NAND and DRAM markets remain, as highlighted by Yole in its latest memory monitors, NAND Quarterly Market Monitor and DRAM Quarterly Market Monitor, 1Q21.

What’s next?

Although the anticipated 2020 NAND recovery failed to materialize as impacts from Covid-19 and worsening trade tensions between the US and China proved too much to overcome, the market appears poised for a rebound in 2021. Post pandemic demand recovery and limited revenue is expected to grow as cost reductions enable further penetration of NAND-based storage solutions into traditional HDD markets. On the technology front, despite layer count growth and the emergence of QLC, technology-driven bit growth will slow as process and manufacturing complexities continue to rise.

With the world slowly emerging from the Covid pandemic and markets returning to normal things are looking very positive for the DRAM market. Underinvestment in new production capability over the last 2 years will result in a tight supply of DRAM which, when coupled with recovering demand, will result in rising prices and rising prospects for the overall DRAM market. We are likely on the cusp of another huge up-cycle for the DRAM market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter