History (1995): “IBM Storage System Division Is Around $10 Billion,” said Bill Noble

"Largest WW actor in storage industry"

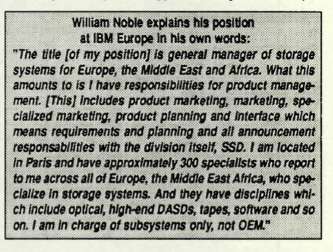

By Jean Jacques Maleval | March 22, 2021 at 2:31 pmUpon an early April announcement of 3590 tape cartridge drives from IBM In Mainz, Germany, we spoke with Bill Noble, GM of Storage Systems for Europe, Africa and the Middle East (EMEA).

Computer Data Storage Newsletter: What were the total sales for IBM’s Storage System Division (SSD) in 1994?

Bill Noble: If you don’t count the stuff that goes outside, which we can’t count, SSD would be around $10 billion. I don’t know the exact number. We’re about a billion and a half in Europe, the US is about $2.3-$2.4 billion, and then the other geographies like Japan, Latin America and Canada would probably be another billion, or close to another billion. And then you’ve got all of your OEM which is probably now running close to $3 billion worldwide. Yes, at $2.7, yeah. And then you’ve got software and software worldwide is probably $600 to $800 million, in Europe it’s about $200 million. So the US is going to be a little bit bigger, probably $250 million. And then the others.

And in comparison with 1993, what was the growth of SSD?

I’ll answer that 2 ways, it was probably higher. The reason I say that is we didn’t have embedded files then, so let me give you an example: in 1993 our embedded files in Europe represented $450 million in EMEA alone. And in 1994, it represented $230 million in EMEA, this is the – I didn’t say that right, I’m sorry, let me rephrase that. The external files, the attachable, the 9335’s, -36’s and – 37’s was $450 billion – million – then it went down to $230 million last year, it’s expected to be around $100 million this year. But the embedded files, of course is going the other way, they’re adding. So it’s kind of a misleading number. My guess would be that it was probably around $1.8 to $2 billion in 1993. It’s a guess… $1.8 is probably closer. So with $10 billion, IBM Is the largest worldwide actor in the storage industry. Much bigger than Seagate, for example. I don’t know this, [but] I think Seagate is a far larger OEM, and we’re probably bigger all together.

Looking ahead into the next century, do you foresee a continuation of centralized storage in big companies?

Well, I think what we’re going to see is a continued reduction in the amount of storage that is installed in the centralized data center and a continued increase in the remote sites, because we’re [already] seeing that across the board and I don’t think that’s going to stop. The saving grace from the revenue perspective, if I can take a parochial viewpoint, is that in the centralized spot, we’ll probably do most, if not all the backup, which is ADSM application. And as ADSM installs for backup and for management of the remotes, it’s going to require greater amounts of capacity in the central sites.

Today what’s the percentage of IBM’s storage growth in the mainframe environment?

What we’ve got is a situation like this over the years, that it cycles: when we first announce a product, like we announced Ramac, we’re supply constrained for about the first 6, 8, 10 months, which is what happened. Then the supply demand gets in balance, then it falls off over the next 3 to 6 months, until we announce the next thing. So what we saw was that throughout the third quarter and the fourth quarter, we were supply constrained – first quarter of 1995 supply constrained, so what you see is an incredible increase in shipments. And our increases year on year went up about 70% in terms of capacity. Then it will fall off, like it always has fallen off, and towards the second half of next year, we hope to announce the next level of Ramac in the middle of this year with availability third/fourth quarter. What we have seen is that the rate of growth of tape has been very small. In most cases it’s been 1% to 2% at best, in many cases it’s less. I think we’re seeing an increase on that now that we’ve a tape that is capable of doing the things that you just saw out there today. So, it will most likely start to grow, probably to the detriment of DASD, it will probably start taking away some of the DASD applications, but at least I can see it doing that, but I can also see this thing going on for years, I don’t know why it would end.

Do you still manufacture any big form-factor drives today?

The 3390s, [but] not the 3380’s. And we’re still shipping [them]. We shipped 370 [units] in Europe in the fourth quarter, along with the Ramac drives. And we’ve got an inventory built up. We can continue manufacturing, but we built an inventory of about 200 that we’re sitting on. What I’m hoping will happen is that when we get the Ramac fully installed from the first quarter 1995, we’ll see a release in the second quarter back to the leasing company of the 3390 model 3’s and we’ll use those to fill the requirements. String fillers and that sort of thing.

You don’t plan to stop making the 3390 right now?

Not yet, no.

In the next century, do you think that mainframes will only use RAID, rather than regular disk drives?

I would guess it would be RAID only, yes. If I could give you some numbers: the 3390 model 3 we had a mean time to failure, don’t hold me to the exact number, but I think it was 1.2 million hours. It was huge. Whereas the Allicat drive that is in the Ramac, it’s less. It’s in the 800,000 range. If you’re going to a less reliable HDA, you’ve got to have something else that keeps the device running, that’s why the fault tolerance. And as we move from 3.5-inch to 2.5-inch, and that sort of thing, it would seem logical to me hat you would want to continue the RAID concept.

What is the competition doing in terms of price?

Oh yeah, yeah. We’ve seen a decline, I think I heard it in the meeting today that it was declining 25% per annum. I’d be surprised if it weren’t more than that. It’s going down dramatically. The price/MB or/GB, or however you measure it.

And today, what is the price/MB or /GB for the Ramac?

I hate to use averages, but I’ll take a stab at it. What we saw with the Ramac device for the fourth quarter of 1994, first of 95 in Europe on average was about $4/MB, so about $4,000/GB.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 87, published on April 1995.

Note: IBM sold its HDD business in 2002 to Hitachi for $2.050 billion. IBM storage is now under $2 billion per year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter