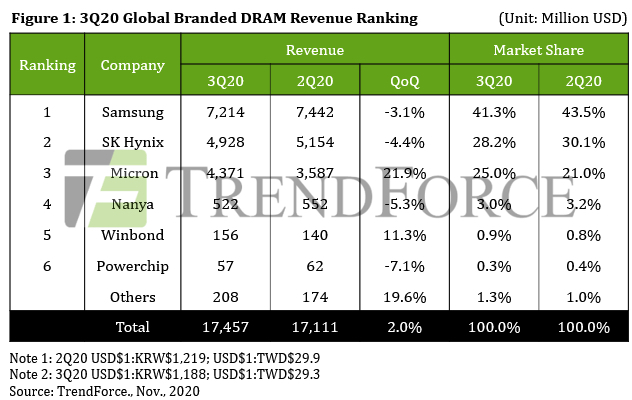

Rising Shipments and Falling Prices Limit DRAM Revenue Growth for 3Q20 at $17.5 Billion

To merely 2% Q/Q

This is a Press Release edited by StorageNewsletter.com on December 14, 2020 at 2:05 pmDRAM suppliers’ bit shipments exceeded expectations due to the demand surge from prior to the September 15 deadline of US sanctions prohibiting the shipment of tech products to Huawei, according to TrendForce, Inc.‘s investigations.

During that period, Huawei was aggressively building up its component inventory in response to the tightening of the export control rules. All suppliers posted a Q/Q growth in their bit shipments.

On the other hand, DRAM prices also made a downward turn in 3Q20. Among the different application segments of the DRAM market, the server DRAM segment exhibited the weakest procurement momentum due to server manufacturers experience excess inventory, leading to a general decline in DRAM prices.

For most suppliers, the growth in bit shipments was not enough to offset the drop in quotes. Their quarterly revenues therefore registered a marginal Q/Q decline.

However, Micron managed to post a significant revenue growth despite headwinds, and its result helped raise the entire industry’s performance.

In sum, the quarterly global DRAM revenue for 3Q20 increased by 2.0% Q/Q to $17.46 billion.

Looking ahead to 4Q20, demand will stay at a healthy level for most application segments including PC DRAM, mobile DRAM, and graphics DRAM. The server DRAM segment will be the exception as customers there will still be focusing on getting rid of excess inventory. The persistent weakness of the server DRAM segment will continue to exert downward pressure on the overall ASP of DRAM products. As such, 4Q20 will again see rising bit shipments and falling prices. As for the quarterly global revenue, it is expected to be relatively on par with 3Q20.

As DRAM prices shifted down in 3Q20, Micron’s 21.9% Q/Q increase in revenue vs. headwinds led industry

The 3 dominant suppliers all posted an increase in bit shipments and a decrease in the ASP. They only diverged with respect to the Q/Q growth rate of bit shipments.

Samsung’s and SK Hynix’s quarterly revenues registered a decline because the increases in their respective shipments were marginal and insufficient to compensate for the declines in their respective ASPs. Samsung’s DRAM revenue for 3Q20 fell by 3.1% Q/Q, while SK Hynix’s DRAM revenue for the same period also dropped by 4.4% Q/Q.

Micron raised its bit shipments by around 25% Q/Q, in turn leading to a 21.9% Q/Q increase in revenue and a 25% market share in 3Q20. The number of weeks in Micron’s fiscal quarter will return to 13, from 14. Moreover, the high base for comparison and the ongoing price decline will adversely affect Micron’s revenue and operating margin. TrendForce currently forecasts that Micron’s market share will fall back to a level of just above 20% in 4Q20.

In terms of profitability, suppliers’ performances for 3Q20 were all impacted by the general price decline. However, there are discrepancies in the calculations of suppliers’ operating margins since suppliers have different product mixes as well as different start and end dates for fiscal quarters.

Samsung’s operating margin was kept at 41% as its cost optimization efforts more or less compensated for the decline in its ASP.

SK Hynix suffered a larger decline in its operating margin, from 35% in 2Q20 to 29% in 3Q20. This was attributed to server DRAM accounting for a substantial share of its product mix.

Compared to the two major Korean suppliers, Micron experienced a smaller drop in the ASP for its latest fiscal quarter. Furthermore, Micron also benefited from the substantial increase in bit shipments and the corresponding reduction in the fixed cost per bit. Its operating margin grew vs. headwinds to 25% from 21% in its previous fiscal quarter.

However, moving to 4Q20, suppliers are expected to be constrained in raising profitability because their ASPs will still be on the downswing.

Among the top 3 suppliers, Micron is projected to experience the largest decline in both bit shipments and operating margin because of the existing downward pressure and the high base for comparison.

Turning to Taiwan-based suppliers, Nanya Tech posted a small dip in both its bit shipments and its ASP for 3Q20 due to the previous quarter being a high base for comparison. Hence, its DRAM revenue for 3Q20 also showed a Q/Q decline of 5.3%. Nanya’s operating margin shrank from 19.6% in 2Q20 to 13.5% in 3Q20 on account of the sliding ASP.

Winbond posted gains in both its DRAM and flash revenues for 3Q20 despite the market downturn.

Huawei’s aggressive inventory building boosted its DRAM sales during the period, while the demand for its flash products has been fairly strong.

Winbond’s revenue increased by 11.3% Q/Q, vs. industry headwinds.

Powerchip’s DRAM revenue for 3Q20 fell by 7.1% Q/Q. Powerchip continues to focus on foundry orders for logic products (e.g., power management ICs, driver ICs, and CMOS image sensors) as the demand for them is still quite strong. Hence, its DRAM production has been constrained as a sizable portion of its wafer processing capacity is assigned elsewhere. It should be noted that the calculation of Powerchip’s DRAM revenue only covers the sales of the company’s branded, in-house manufactured PC DRAM products

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter