History (1993): Shipments of HDDs Continue to Climb

But sharply lower prices sqeeze manufacturers.

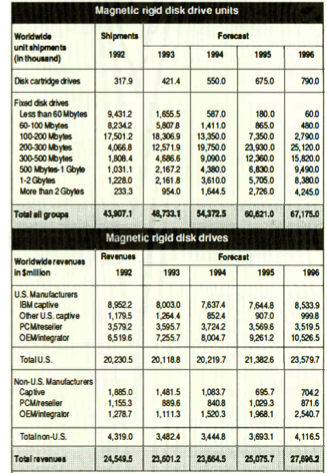

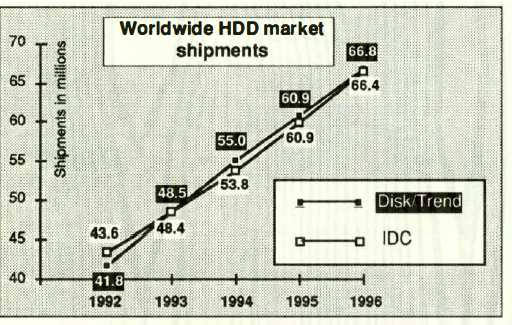

By Jean Jacques Maleval | November 18, 2020 at 2:08 pm1993 WW shipments of 48.7 million rigid disk drives are forecast by the newly released 1993 Disk/Trend Report ($2,125) published by Disk/Trend Inc. (Mountain View, CA), an 11% increase over 1992.

Unfortunately for the drive manufacturers, prices have fallen faster than normal, forcing some of them to take major losses.

Even while the HDD industry continues to ship more drives, changes in product mix are challenging manufacturers to move rapidly to higher capacities. For example, after a 3x increase in 2 years, shipments of 100-200MB drives are expected to peak in 1993 at 18.3 million, then quickly decline as personal computers move to larger disk capacities.

The 200-300MB range is expected to become the product group, with 25.1 million drives in 1996.

Prices falling from 28 to 55%

More than 85% of the HDD industry’s shipments are now “noncaptive” drives, those sold to system manufacturers, distributors and other nonaffiliated customers.

The 1993 disk drive price wars have dropped the industry’s average price levels for noncaptive drives faster than the normal pattern, and the average noncaptive prices for drives in the 100-300MB capacity range are down more than 37% in 1993.

Prices for other volume drive groups are also dropping, with average annual price declines varying from 28% to 55% for various capacity ranges.

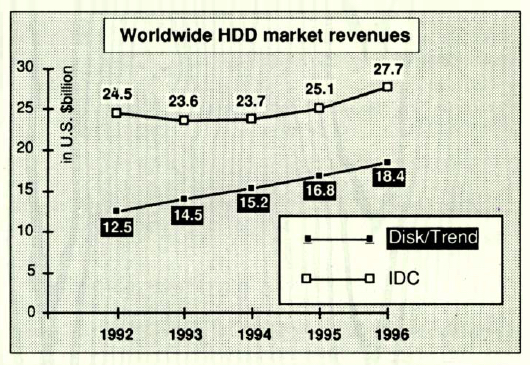

1993 total sales revenues for HDDs are expected to be down 3.9% at $23.6 billion, but starting next year renewed overall sales growth for the industry is forecasted.

The 1996 total is projected at $27.7 billion, with growth built on a continuing trend to higher capacity drives and a slower rate of price declines.

OEM sales by drive manufacturers directly to system manufacturers will continue to be the industry’s marketing channel with the best growth potential, expected to jump from 1992’s 31.8% of total industry revenues to 47.1% in 1996.

In 1992, the industry’s total shipments of rigid disk drives jumped to 11 million units, to 43.9 million drives, the result of expanding PC shipments and extensive upgrading of disk capacity for existing systems.

The 1996 WW total is forecasted to reach 67.2 million drives, with the fastest growth going to drives using small disks.

49.4 million 3.5-inch drives are predicted for 1996, but the average annual growth rate for 3.5-inch drives in the 1994-96 period will be only 6.9%.

2.5-inch drives are projected to increase shipments an average of 27.8% per year in the same period, reaching 13.2 million drives, and 1996’s shipments of 4.4 million.

1.8-inch and smaller drives will represent 181.2% average annual growth.

8,180TB shipped

By combining growth in unit shipments and annual increases in the average capacity of disk drives, the amount of disk recording capacity shipped each year is increasing at breakneck speed. In 1992, the total capacity of all disk drives shipped was 8,180TB. By 1996, the total capacity is expected to be 43,720TB, an annual average increase of 52.6%.

The industry’s extremely competitive nature is forcing more companies with small market shares to drop out of the business. 57 companies manufactured rigid disk drives in 1991, but that total dropped to 47 firms in 1992, with a further reduction to 40 manufacturers in 1993.

Most of the dropouts had small market shares and were not able to compete efficiently as total shipment levels climbed and prices fell. Noncaptive revenues for HDDs rose to $12.5 million in 1992.

Seagate Technology maintained its long-term leadership in noncaptive sales revenues with 23.3% of the WW total. Conner Peripherals’s share of the total was up to 17.8%.

The report contains basic product specs on 614 disk drives and profiles on the 40 existing manufacturers of rigid HDDs, plus start-up firms and recent dropouts.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 70, published on November 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter