EMEA External Enterprise Storage Down 5.4% Y/Y in 4Q19

Market led by Dell EMC, HPE, NetApp, IBM and Hitachi

This is a Press Release edited by StorageNewsletter.com on April 14, 2020 at 2:28 pmEMEA external storage systems market value in 4Q19 was down 5.4% year on year in dollar and 2.5% in euro, according to IDC Corp.‘s EMEA Quarterly Disk Storage Systems Tracker.

The market closed 2019 down 2% in dollar terms for the full year and up 3.1% in euros. This comes after stellar growth in 2018 – 16% year on year in dollar and 11.5% in euro. But the quarter saw marked differences across subregions, with Western Europe down 8.9% Y/Y and CEMA up 4.2% (both in dollar).

On a bright note, for the first time the AFA segment was the largest array type by spending in 4Q19, taking more than 44% of value shipments, with hybrid flash arrays (HFAs) representing roughly 37% of shipment value.

For the full 2019, AFA represented just over 40% of total value shipped in the region, up from roughly 37% in 2018.

The bright spots in the storage market – AFA and HCI – have been increasingly adopted in the region as a way to modernize the datacenter, enhance its cloud-like capabilities, and guarantee HA and performance for critical workloads.

“As the COVID-19 crisis intensifies in the region, IDC expects investments to concentrate on guaranteeing BC for highly critical workloads in the short term and, in the medium term, in accelerating digital transformation initiatives and the shift toward Opex-based payment methods for hardware infrastructure,” said Silvia Cosso, research manager, storage systems, IDC Western Europe. “In this context, AFA, HCI, and software-defined-storage [SDS] are expected to gain increased traction in the region as a way to modernize the datacenter and enhance its cloud-like capabilities while guaranteeing high performance for critical workloads.”

Western Europe

Western European market value declined again, by almost 9% in dollar (-6% in euro), a decrease that needs to be put into the context of a very positive 2018.

AFAs jumped to more than 46% of total value shipped in the subregion in 4Q19, bringing the 2019 total to over 41%.

Storage spending in the region has been impacted by a further drop in the UK and a negative performance in Germany, where datacenter renovation plans appear to have slowed due to uncertain macroeconomic conditions in 2H19.

Central and Eastern Europe, the Middle East, and Africa

The single-digit growth of the storage market value in CEMA in 4Q19 confirmed the positive trend throughout the year and was triggered by enterprises spending their remaining annual budgets. This contributed to 4.7% Y/Y growth in dollar terms for the full 2019.

Overall growth in CEMA was impacted by the spending of large business in finance and central government in the bigger countries, featuring some $million projects to enhance datacenters.

AFA recorded double-digit growth in both the CEE and MEA subregions and for the first time became the leading market segment in 4Q19.

Penetration in MEA, however, was higher and on a par with Western Europe, surpassing a 40% share of the total market for the quarter and the year.

“The acceleration of digitized economies and the investment in mobility, video surveillance, and smart cities in the Middle East are leading to a proliferation of particularly all-flash HCI solutions to support the respective workloads,” said Marina Kostova, research manager, storage systems, IDC CEMA. “In the context of the world health crisis and the worsening business climate, the trend toward more optimized and cost-effective infrastructure spending in CEMA will speed up and the deployments will shift faster to the cloud, with HCI still expected to record growth relative to the declining total market in 2020.“

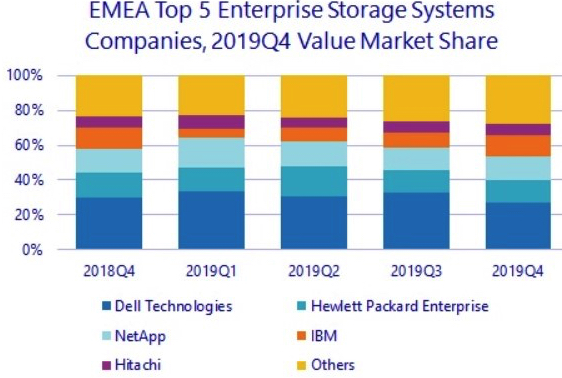

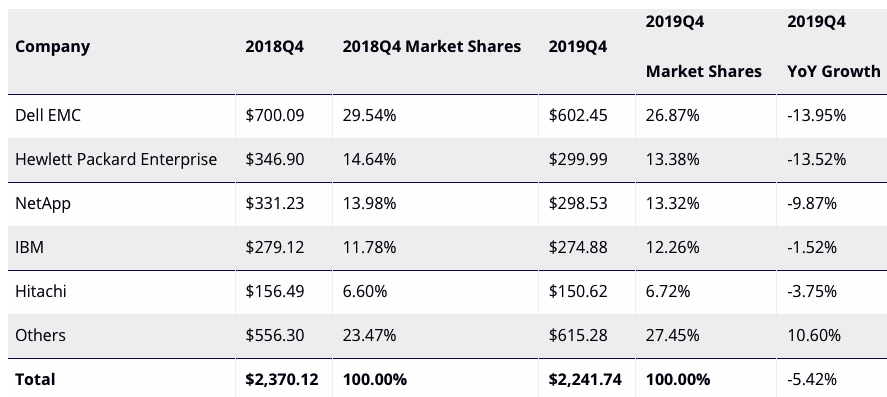

Top 5 Vendors, EMEA External Enterprise Storage Systems Value

(in $million)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter