Micron: Fiscal 1Q20 Financial Results

Sales down 35% Y/Y, -14% for NAND, poor outlook

This is a Press Release edited by StorageNewsletter.com on December 20, 2019 at 1:10 pm| (in $ million) | 1Q19 | 1Q20 | Growth |

| Revenue |

7,913 | 5,144 | -35% |

| Net income (loss) | 3,293 | 2.6 | 491 |

Micron Technology, Inc. announced results for its first quarter of fiscal 2020, which ended November 28, 2019.

1FQ20 highlights

• Revenues of $5.14 billion vs. $4.87 billion for 4FQ19 and $7.91 billion for 1FQ20

• GAAP net income of $491 million, or $0.43 per diluted share

• Non-GAAP net income of $548 million, or $0.48 per diluted share

• Operating cash flow of $2.01 billion vs. $2.23 billion for 4FQ19 and $4.81 billion for 1FQ19

“Micron posted solid first quarter results, delivering good profitability and positive free cash flow. With our strong execution and improving industry conditions, we are optimistic that Micron’s fiscal second quarter will be the cyclical bottom for our financial performance,” said president and CEO Sanjay Mehrotra. “Our improved competitive position, dramatically stronger product portfolio, structurally higher profitability and investment-grade balance sheet position Micron very well to drive long-term shareholder value.”

Investments in capital expenditures, net of amounts funded by partners, were $1.93 billion for 1FQ20, which resulted in adjusted free cash flow of $79 million. Micron repurchased an aggregate of 1 million shares of its common stock for $50 million during 1FQ20 and ended the quarter with cash, marketable investments, and restricted cash of $8.31 billion, for a net cash position of $2.66 billion.

Acquisition of Intel’s Interests in IMFT

On October 31, 2019, the firm purchased Intel’s non-controlling interests in IMFT and IMFT member debt for $1.25 billion. It recognized a non-operating gain of $72 million for the difference between the $505 million of cash consideration allocated to the extinguishment of IMFT member debt and its $577 million carrying value, and a $160 million adjustment to equity for the difference between the $744 million of cash consideration allocated to the purchase of Intel’s noncontrolling interest and its $904 million carrying value.

Business Outlook for 2FQ20:

Revenue between $4.5 and $4.87 billion

Comments

Global evenue for the quarter was up 6% Q/Q and down 35% Y/Y.

Despite a challenging industry environment, Micron delivered profitability, maintained positive free cash flow, and strengthened its product portfolio.

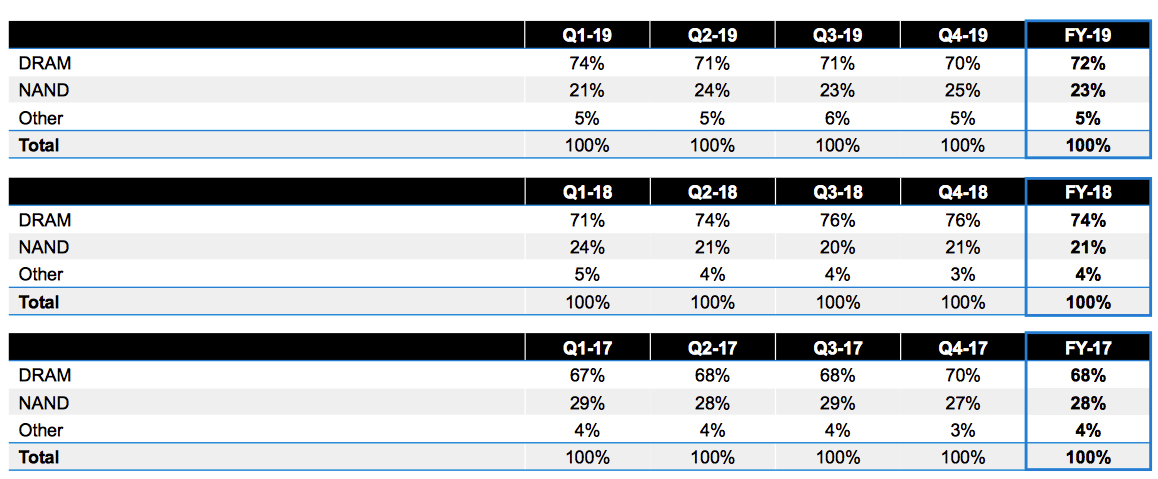

% of revenue:

- DRAM 67%

- NAND 28%

- Other 5%

Historical Revenue % by Technology

Revenue for the Storage Business Unit in 1FQ20 was $968 million, an increase of 14% from 1FQ19 and down 15% Y/Y. Sequential revenue growth was driven by SSD volume growth and ASP increases.

Industry supply-demand balance continues to improve in both DRAM and NAND expected to grow from 50% of NAND bits in FY19 to over 66% in FY20, and up to 80% in FY21

NAND

- Revenue up 18% Q/Q and down 14% Y/Y

- Bit shipments up mid-teen percent range Q/Q

- Bit shipments up mid-30 percent range Y/Y

- ASPs up low-single-digit percent range Q/Q

- Expect to begin production on its 128-layer first-gen RG node in 2HFY20 delivering minimal cost reduction in FY20

- Second-gen RG node with higher layer count in FY21 will provide more robust cost reduction as it ramps

- Second-gen node will leverage firm's leadership in QLC and CMOS under the array

- High-value solutions in FY19 accounted for 50% of NAND bits. This figure is expected to grow to over two-thirds of NAND bits sold for FY20, and the firm remain on track to drive 80% of its NAND bits into high-value solutions in FY21.

In NAND, Micron is continuing to make progress on its replacement gate (RG) transition and expects to begin production of 128-layer, first-gen RG node in 2HFY20. This node will be deployed for a limited set of products, and the company expects minimal NAND cost reduction in FY20. It will be followed by an introduction of a higher-layer-count, second-gen RG node in FY21 targeted for a broader implementation, which will begin to provide more robust cost reduction as it ramps. This second-gen RG node will leverage firm's NAND technology leadership in CMOS under the array, as well as QLC.

SSDs

- Supply shortages across the industry, and pricing trends are improving.

- Demand from data center customers was strong in 1FQ20. Attach rates and capacities for client and consumer SSDs have continued to increase across customers.

NVMe client SSD bit shipments represented almost three-quarters of client SSD bits in 1FQ20, vs. virtually none a year ago. In the data center market, sales of previously announced high- performance NVMe SSD nearly tripled Q/Q, and the firm announced a 96-layer mainstream data center NVMe SSD.

NAND Outlook

Industry

- CY19 industry bit demand growth in the mid-40% range

- CY20 industry bit demand growth of high-20% to low-30% range. Industry bit supply to be lower than industry bit demand

- Long-term industry bit demand growth CAGR of approximately 30%

Micron

- CY19 bit supply growth slightly below industry bit demand growth

- CY20 bit supply growth to be meaningfully below industry bit supply growth; bit shipment growth to be close to industry bit demand growth as the company ships its inventory during first gen of its RG transition

- Long-term Micron supply growth in line with industry demand CAGR of approximately 30%

As previously disclosed, the firm is continuing to ship some products to Huawei that are not subject to Export Administration Regulations and Entity List restrictions.

Next quarter revenue is is expected to be down between -5% and -13%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter