EMEA Purpose-Built Backup Appliances Market Value Back to Growth, Up 3% Y/Y in 3Q19

Reaching $325.5 million

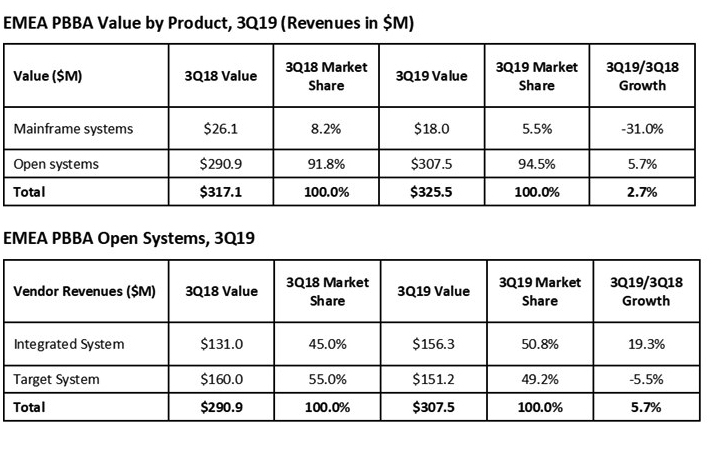

This is a Press Release edited by StorageNewsletter.com on December 18, 2019 at 2:26 pmThe EMEA purpose-built backup appliance (PBBA) market rose in value 2.7% Y/Y to reach $325.5 million in 3Q19, according to International Data Corporation‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

This follows the 6.3% Y/Y decline seen in 2Q19, bringing the market back to growth.

Total EMEA PBBA open systems shipments were valued at $307.5 million, which represented an increase of 5.7% Y/Y. Conversely, mainframe system sales decreased 31% Y/Y in 3Q19.

Regional Highlights

Western Europe

The PBBA tracker for Western Europe indicates a nearly flat performance of this region in terms of value, with 0.9% Y/Y growth, reaching $262.9 million in 3Q19.

The DACH market became the largest in Western Europe in 3Q19, responsible for 36.2% of the market’s value and growth of 33.3% Y/Y.

The United Kingdom lost 6.3% of market value, gaining second place in the Western European PBBA market, suffering a contraction of 19% Y/Y in value.

The French PBBA market ranked third 39.3% growth Y/Y in value, giving it a 14.2% market share.

“The United Kingdom and Germany are the main drivers in the development of data protection technology in Europe,” said Jimena Sisa, senior research analyst, EMEA storage systems, IDC. “Organizations are becoming increasingly disposed to update their legacy or third-platform technologies with tools that provide more functionality in terms of automation, better monitoring deployment, data management, analytics and orchestration. This is creating more desire to engage in cloud-based data protection-related projects that would help companies to grow their business in a digital transformation era.”

CEMA

The PBBA market in Central and Eastern Europe, Middle East and Africa (CEMA) again recorded growth in value (12.2% Y/Y) in 3Q19, reaching $58.38 million.

The Middle East and Africa (MEA) market was the subregion that prevented the EMEA backup appliances market recording a decline. The major vendors in the open systems space recorded significant growth. The Central and Eastern European (CEE) region had more subdued performance, but nevertheless most companies closed a successful quarter.

“In countries like Saudi Arabia, Egypt, and Israel, there was a demand for larger-drive systems with increased data reduction, backup, and restore rates,” said Marina Kostova, research manager, EMEA storage systems, IDC. “In CEE, the large countries of Poland and Russia saw increased shipments for both incumbents and data protection companies, while smaller countries experienced and overall slowdown in infrastructure spending, affecting PBBA as well.“

Major companies covered in this tracker include Dell, Veritas, HPE, IBM, Quantum, Barracuda, Oracle, Fujitsu, Exagrid, HDS, Unitrends, and Falconstor Software.

Taxonomy Notes

IDC defines a PPBA as a standalone disk-based solution that utilizes software, disk arrays, server engines, or nodes that are used for backup data and specifically for data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. PBBAs are deployed in standalone configurations or as gateways. Solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device serves as the component that is purpose built solely for backup and not to support any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. They can also provide and receive replication to or from remote sites and a secondary PBBA for disaster recovery.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter