Nutanix: Fiscal 1Q20 Financial Results

Approaching $1 billion milestone in deferred revenue, but Y/Y total sales once more flat Y/Y and enormous net losses

This is a Press Release edited by StorageNewsletter.com on November 27, 2019 at 2:14 pm| (in $ million) | 1Q19 | 1Q20 | Growth |

| Revenue |

313.3 | 314.8 | 0% |

| Net income (loss) | (23.7) | (135.3) |

Nutanix, Inc. announced financial results for the first quarter of fiscal 2020 ended October 31, 2019.

1FQ20 Financial Highlights

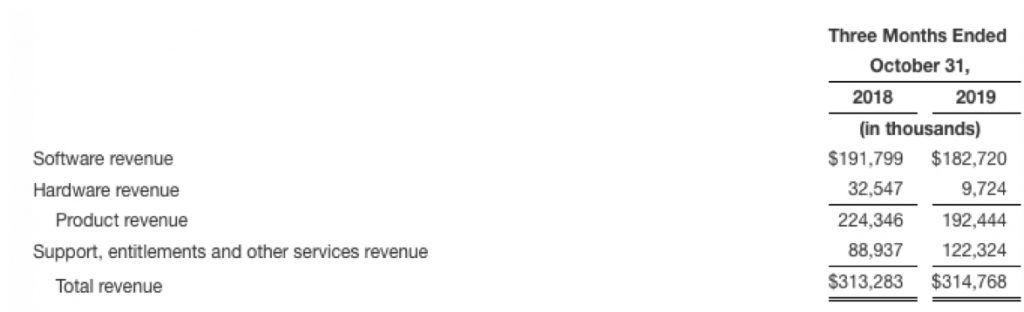

• Revenue: $314.8 million, up from $313.3 million in 1FQ19, reflecting revenue compression from the company’s ongoing transition to subscription and the significant reduction of hardware revenue from the prior year

• Billings: $380.0 million, down from $383.6 million in 1FQ19, reflecting billings compression from the company’s ongoing transition to subscription and the significant reduction of hardware billings from the prior year

• Software and Support (TCV or Total Contract Value) Revenue: $305.0 million, up 9% Y/Y from $280.7 million in 1FQ19, reflecting revenue compression from the company’s ongoing transition to subscription

• Software and Support (TCV) Billings: $370.3 million, up 5% Y/Y from $351.0 million in 1FQ19, reflecting billings compression from the company’s ongoing transition to subscription

• Gross Margin: GAAP gross margin of 77.1%, up from 76.3% in 1FQ19; Non-GAAP gross margin of 80.1%, up from 78.6% in 1FQ19

• Net Loss: GAAP net loss of $229.3 million, compared to a GAAP net loss of $94.3 million in 1FQ19; Non-GAAP net loss of $135.3 million, compared to a non-GAAP net loss of $23.7 million in 1FQ19

• Net Loss Per Share: GAAP net loss per share of $1.21, compared to a GAAP net loss per share of $0.54 in 1FQ19; Non-GAAP net loss per share of $0.71, compared to a non-GAAP net loss per share of $0.13 in 1FQ19

• Cash and Short-term Investments: $889.4 million, compared to $965.0 million in 1FQ19

• Deferred Revenue: $975.3 million, up 39% from 1FQ19

• Operating Cash Flow: Use of $26.2 million, compared to gen of $49.8 million in 1FQ19

• Free Cash Flow: Use of $44.4 million, compared to gen of $20.0 million in 1FQ19

“Our solid 1FQ20 performance, particularly in the Americas, gives us confidence that we have the right formula for global sales leadership as demonstrated by improved productivity and sales hiring over the last 6 months,” said Dheeraj Pandey, chairman, founder and CEO. “We have also seen momentum in key areas of our business, including the transition to subscription and an improved 28% attach rate of new products onto our core HCI platform.“

“We continued to make progress towards our goal of more than 75% of billings coming from subscription by the end of the fiscal year, further demonstrating that customers want the freedom and flexibility that a subscription software model offers,” said Duston Williams, CFO. “Our last 2 quarters of solid execution position us well to deliver on our growth plans for FY20.”

Recent company Highlights

• Continued Shift to Subscription Recurring Revenue Model: 1FQ20 subscription billings grew 41% Y/Y to $276 million, representing 73% of total billings, and subscription revenue increased 72% Y/Y to $218 million, representing 69% of total revenue.

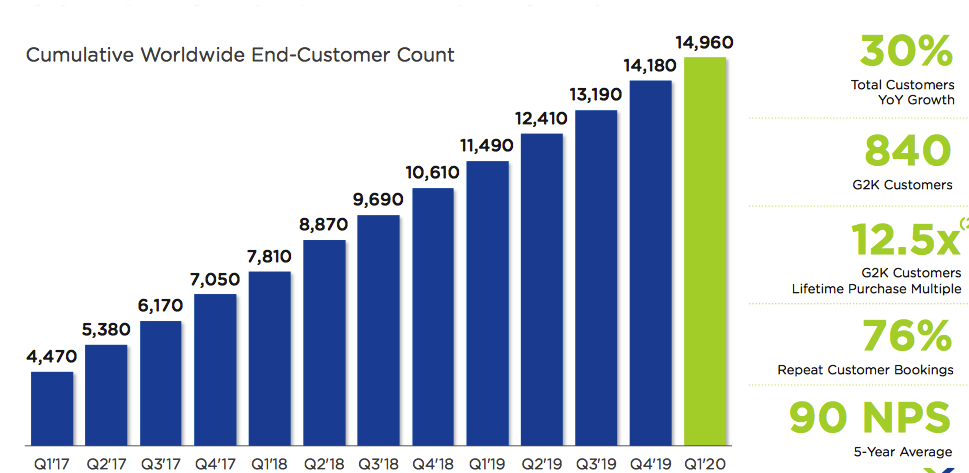

• Expanded Customer Base and Closed Record Number of $1 Million+ Deals: The firm ended 1FQ20 with 14,960 total customers and closed a record high of 66 deals worth more than $1 million. 1FQ20 customer wins included Anheuser-Busch InBev, Akron Children’s Hospital, Banco Patagonia S.A., Huaxia Bank, and The College of Education and Human Ecology at Ohio State University.

• Grew Adoption of New Products: The company saw continued new product traction with 28% of deals including at least one product outside of the company’s core offering.

• Added Two New Executives in Key Functions: Tarkan Maner joined as chief commercial officer and is responsible for global business development strategy, with a focus on partnerships, alliances, system integrators, and service providers. He will lead hybrid cloud-focused product teams including Nutanix clusters, end-user computing, networking and cloud services, and era. In addition, Christian Alvarez joined as VP of Americas channel to oversee building and managing the Americas channel team.

• Hosted Ninth .NEXT User Conference: Nearly 4,500 attendees, including customers, prospects and partners, joined Nutanix in Copenhagen, Denmark, where attendees heard about company’s vision for the hybrid cloud. The venue was also the location for the largest EMEA Partner Xchange to date, with 1,200 Nutanix channel attendees.

• Announced New IT Automation for Private Clouds: With ServiceNow, it announced integration of its HCI platform and ServiceNow’s IT operations management solution to automate critical private cloud workflows. This solution enables IT teams to spend less time servicing incidents and issues and instead focus on offering a public cloud-like experience within the data center, competitive differentiation, and strategic planning in their digital transformation journey.

• Announced availability of HPE GreenLake for Nutanix: The HPE GreenLake solution leverages Nutanix’s Enterprise Cloud OS software, including its built-in AHV hypervisor, to deliver a HPE-managed private cloud. It lowers TCO and accelerates time to value, allowing customers to pay for the service based on actual consumption.

• Launched All Together Now Campaign to Expand Brand Reach Into Market: The company introduced a new global brand campaign that simplifies and amplifies its vision for the hybrid and multi-cloud focusing on the simplicity, choice, and delight it brings to customers.

• Released Results of Second Annual Enterprise Cloud Index: The firm engaged a third-party research firm to conduct a global survey of 2,650 IT leaders in mid-2019. 85% of those respondents reaffirmed that hybrid cloud is the IT model to strive for, and the majority have plans to aggressively shift investment to hybrid cloud architectures over the next three to five years. The research also found that the flexibility afforded by hybrid clouds to match and move applications to the right infrastructure in order to optimize cost, performance, security, and other variables as needed was what respondents value most about the hybrid model.

• Named a Great Company for Millennials in the Bay Area: Nutanix was named one of the 18 great companies for millennials to work for in the San Francisco Bay Area by Comparably, a career data website. The rating was based on what millennials say they find most important in a job, including flexibility, benefits that match their values, social impact, and an opportunity to feel like valued contributors rather than just a number at work.

• Named to the 50 Companies to Watch in 2020 List: This list of 50 companies worth watching was developed by analysts at Bloomberg Intelligence. When curating the list, they considered revenue growth, margins, market share, debt, and other factors such as economic conditions.

For 2FQ20, Nutanix expects:

• Software and support (TCV) billings between $410 million and $420 million;

• Software and support (TCV) revenue between $330 million and $335 million;

• Non-GAAP gross margin of approximately 80%;

• Non-GAAP operating expenses between $400 million and $410 million; and

• Non-GAAP net loss per share of approximately $0.70, using approximately 193 million weighted shares outstanding.

For FY20, it expects:

• Software and support (TCV) billings between $1.65 billion and $1.75 billion;

• Software and support (TCV) revenue between $1.30 billion and $1.40 billion;

• Non-GAAP gross margin of approximately 80%; and

• Non-GAAP operating expenses between $1.65 billion and $1.70 billion.

Comments

Since 3 financial quarters, Y/Y revenue is perfectly flat: +0%, -1% and +0% for the last three-month periods in order respectively, with losses never ending and a historical record of GAAP net loss of $229 million for the most recent quarter.

This pause can be explained by the transformation of firm's business model from appliance to software and now doing sole subscription since fifth quarter.

But financial results were better than expected in progress in subscription, recorded large deals, and continued new product traction. The firm also exceeded guidance for software and support billings, software and support revenue, gross margin, operating expenses and earnings per share.

For its 10th anniversary, Nutanix reached $1 billion in annual revenue, "faster than most software companies had in the past 20 years with deferred revenue at almost $1 billion as well," according to CEO.

The company signed the second highest number of deals greater than $500,000 in a quarter. Subscription grew to 73% of total billings up from 71% last quarter as it moves towards the goal of more than 75%, stated goal by the end of FY20.

One example is US-based Internet service provider (not revealed). The deal which was $750 million comprised Nutanix's core AOS OS, Prism Pro, Bios and native AHV hypervisor to build a scalable private cloud, deleveraging Nutanix to run several of the enterprise apps including their Oracle databases.

Another example is a $1 million plus subscription deal in 1FQ20 with a new customer that is an US-based apparel manufacturer (not revealed).

A leading organ transplant non-profit organizations (not revealed) purchased $2 million of software including AOS OS, comm, flow, files and AHV Hypervisor to run its SQL databases.

One of top subscription deals in the quarter came from a large civilian department of the U.S. government (name not revealed) and worth $5 million. It represents its first private cloud solution with AHV hypervisor to manage and scale mission-critical workloads.

Biggest deal for the most recent quarter was with a repeat marquee client (not revealed) that invested $9 million in subscription licenses to modernize the infrastructure.

These customers were one of 66 the firm signed in the quarter that worth over $1 million record. 13 of those also spend at least $1 million in 4Q19, with 50% of them increasing their engagement to support new workloads in 1Q20. In addition, this quarter, it closed 9 deals worth more than $3 million.

One example of ots new relationship with HPE is ramping faster than any of its past OEM partnerships is a $2 million deal in 1FQ20 with an unknown new customer being a large EMEA-based insurance company.

Americas was firm's best performing region in 1FQ20 on a yearly basis where the enterprise-related business outperformed the commercial business. Federal business performed slightly better than expected. In 1FQ20 TCV bookings were softer, and support bookings from international regions represented 40% of total bookings vs. 40% in 1FQ19.

HCI company's holistic approach of a hybrid cloud stack is a reason of winning deals. In 1FQ20, number of deals that included at least product beyond firm's core HCI offerings increased once again, at 28%, in a rolling 4-quarter basis showing progression from 26% in the previous quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter