NetApp: Fiscal 1Q20 Financial Results

Clearly disappointing, with sales down 16% Y/Y and 22% Y/Y, but supposed to rebound next quarter

This is a Press Release edited by StorageNewsletter.com on August 16, 2019 at 2:52 pm| (in $ million) | 1Q19 | 1Q20 | Growth |

| Revenue |

1,474 | 1,236 | -16% |

| Net income (loss) | 283 | 103 |

NetApp Inc. reported financial results for the first quarter of fiscal year 2020, which ended on July 26, 2019.

“I am clearly disappointed with our Q1 top line results but remain confident in our strategy and the fundamentals of our business model. The gross margin and cost structure improvements we’ve made provide support for our free cash flow generation and enable us to navigate the ongoing macroeconomic headwinds while making the strategic moves that position us well to return to growth,” said George Kurian, CEO. “We consistently receive positive feedback from our customers and partners on the value of our Data Fabric strategy and the strong performance of our best teams demonstrates our ability to capitalize on this strength.”

1FQ20 Financial Results

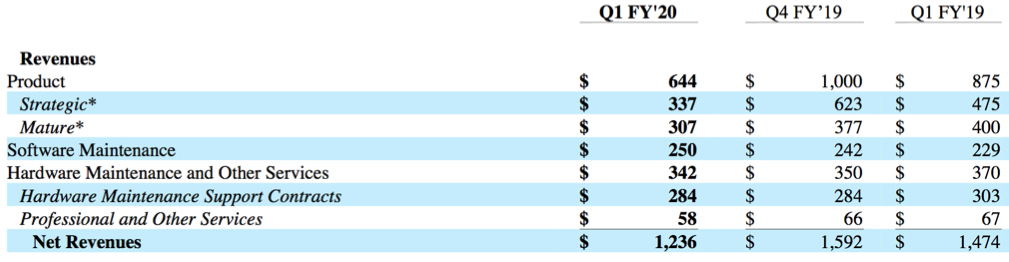

• Net Revenues*: $1.24 billion, compared to $1.47 billion in 1FQ19

• Net Income: GAAP net income of $103 million, compared to GAAP net income of $283 million in 1FQ19; non-GAAP net income1 of $157 million, compared to non-GAAP net income of $281 million in 1FQ19

• Earnings per Share: GAAP net income per share of $0.42 compared to GAAP net income per share of $1.05 in 1FQ19; non-GAAP net income per share of $0.65, compared to non-GAAP net income per share of $1.04 in 1FQ19

• Cash, Cash Equivalents and Investments: $3.5 billion at the end of the first quarter of fiscal 2020

• Cash from Operations: $310 million, compared to $326 million in 1FQ19

• Share Repurchase and Dividend: Returned $365 million to shareholders through share repurchases and cash dividends

*Net revenues in the first quarter of fiscal year 2019 included $90 million from enterprise software license agreements which did not repeat in the first quarter of fiscal year 2020.

2FQ20 outlook:

- Net revenues in the range of $1.325 billion to $1.475 billion

FY20 outlook

- Net revenues decline 5%-10% Y/Y

Comments

According NetApp's expectations announced at the end of 4FQ19, the storage company was supposed to record revenue between $1.315 billion and $1.465 billion for the current quarter. Final result is $1,236 million down 16% Y/Y and 22% Y/Y.

But this figure is expected to rebound next quarter with now projections being $1.325 billion to $1.475 billion or between +7% and +19% for next three-month period.

* In 1FY20 the firm made changes to the products and solutions contained in each of the strategic and mature product groupings. Mature now includes OEM and all products related to disk and hybrid arrays. Strategic now includes add-on software, private cloud solutions, and all products related to AFAs. Revenues for previous quarters have been recast in accordance with the revised product grouping methodology for comparability

During the more recent quarter, product revenue of $644 million decreased 26% Y/Y. AFA business inclusive of all-flash FAS, EF and SolidFire products and services declined yearly 24% to an annualized net revenue run-rate of $1.7 billion. This comparison includes a significant amount of ELA revenue related to all-flash in 1FQ19, that did not repeat in 1FQ20 this year.

Software maintenance and hardware maintenance revenue of $523 million decreased 1% Y/Y.

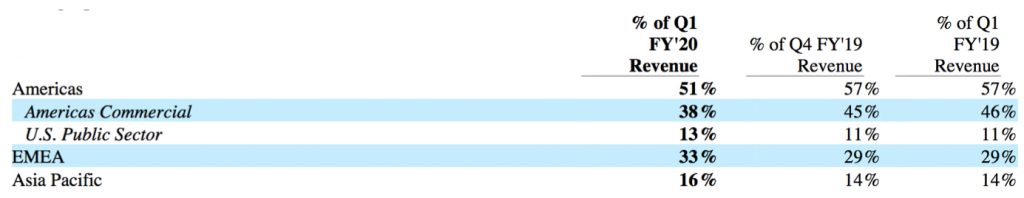

Geographic mix

Abstract of the earnings call transcript:

George Kurian, CEO:

"We have further analyzed the dynamics of what happened in the first quarter and they confirm that we are seeing a combination of slow down related to overall macro conditions and company specific go-to-market execution issues. We continue to see pressure on deal sizes, longer sales cycles and deferral of transaction. But as I noted on our earlier call, our under-performance is not across the board. Our APAC, Europe and U.S. public sector geographies were mostly on track.

"I will now provide more detail on the specific steps we are taking.

"First, we plan to add approximately 200 primary sales resources in the next 12 months with a focus in the Americas. We will do this without increasing the total operating expenses for the company. The new sales headcount will focus on acquiring new account, as well as engaging new buyers and finding new opportunities in existing accounts.

"Second, we will sharpen the focus of our all-flash go-to-market, including marketing sales and services to emphasize our strong value proposition in mission critical environments where customers continue to prioritize spending. We expect that this, combined with additional sales capacity will return us to a position of growth in the all-flash market.

"Third, now that our services are generally available in Azure and will soon be in Google, we expect to see an acceleration of cloud data services revenue as their sales teams' ramp in selling our service. We continue to focus on expanding the range of used cases and deployment scenarios and enabling the various pathways to market to sell these services.

"And finally, we will scale our growth in the private cloud market through focused marketing and sales efforts."

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1Q18 | 1,325 | -11% | 136 |

| 2Q18 | 1,422 | 7% | 175 |

| 3Q18 | 1,523 | 7% | (506) |

| 4Q18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1Q19 |

1,474 | 12% |

283 |

| 2Q19 |

1,517 | 7% |

241 |

| 3Q19 |

1,563 | 2% |

319 |

| 4Q19 |

1,592 | -3% |

296 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 |

-16% |

103 |

To read the earnings call transcript

Read also:

NetApp 1FQ20 Revenue to Be Down 17% From 1FQ19

For FY20, sales will decrease between 5% and 10% Y/Y.

06 Aug 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter