History (1989): Seagate to Buy Imprimis From Control Data

For approximately $450 million in cash and securities

By Jean Jacques Maleval | August 9, 2019 at 2:22 pmThe number one independent HDD manufacturer buys the number two.

This puts the number three way behind this new powerful $2.42 billion group.

This acquisition is one of the last year’s most important event in the storage industry.

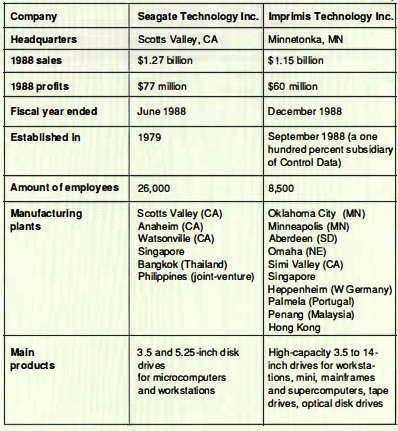

After an 18-month hermetic discussion, Seagate Technology Inc. (Scotts Valley, CA) and Imprimis Technology Inc. (Minnetonka, MN) jointly announced on June 12 that they had signed a letter of intent for Seagate to purchase Imprimis, the 100% storage subsidiary of Control Data Corporation for approximately $450 million in cash and securities.

Payment will be in the form of $250 million in cash, 10.7 million shares of Seagate common stock and a $50 million promissory note. Seagate will finance the transaction with the proceeds of a new $300 million credit agreement.

The companies expect to reach a definitive agreement over the next several weeks, which will be subject to further approval by the boards of both companies, and appropriate government review.

Under terms of the proposed agreement, Seagate would continue to provide to Control Data storage devices for use with the Control Data Cyber line of computers and for militarized use by its government systems division.

In announcing the letter of intent, Robert M. Price, Control Data’s chairman and CEO, stated: “The OEM disk drive market demands continuous focus on low-cost production and considerable investment in new technologies to remain competitive. The combined resources of the two companies will provide the capability for that ongoing competitive focus. At the same time, the transaction will permit Control Data to focus its own efforts on the growing services and systems integration business. Additionally, we can participate in the success of Imprimis through a sizeable investment in Seagate.”

Proceeds from the sale, when completed, will be used for repayment of debt and to provide additional working capital for Control Data.

This one will have one seat on the Seagate board of directors to be filled by Lawrence Perlman, president and COO, Control Data.

The stock of Seagate, equal to about 10 million shares at the current price, will give Control Data an 18% stake in Seagate.

Shugart’s success

This makes Alan F. Shugart a successful man, turning Seagate, now associated to Imprimis, into a business that reached over $2 billion sales in just ten years.

Already the world’s number one independent HDD manufacturer, Seagate is now reinforcing its position by purchasing the number two, Imprimis, a leading WW supplier of high-performing HDDs.

The new group is getting closer to IBM, without exceeding Big Blue who probably weighs four times more in this field, and is now way ahead of American (Maxtor, Micropolis, Miniscribe, etc.) or Japanese competitors that won’t be able to catch up before several years.

The new company should represent 13% of the worldwide HOD market, and even almost one quarter if you don’t count IBM.

Several American competitors have already shown their intentions of fighting this new Seagate Imprimis association by using U.S. antitrust laws.

Concerned by Japanese ambition in this field, the Americans now have a large company, strong enough to compete with firms like Sony, for low-range products and Fujitsu, Hitachi or NEC for high range ones. Before, the market was shared between a herd of small companies with unsafe future.

The actual reorganization proves that the HDD market is growing more mature, too many actors were and still are involved in this too competitive market.

Complementary ranges of products

At a close look, Seagate and Imprimis are almost perfect complements. The first one for low-priced low-range products, the second for high-range ones with a small overlapping on 50 and 100MB products. Seagate (see chart) offers entry level 26 to 192MB 3.5 and 5.25-inch disks, when Imprimis handles 51 to 1,236MB 3.5 to 1 4-inch disks.

The Californian company always preferred mass production and low-cost HDDs with average performance for PCs and now Apple.

The Swift family of 3.5-inch disk drives from Imprimis ranges in capacity from 100 to 200MB, has average seek time of 15ms, 10ms less than Seagate’s 3.5- inch series. WREN line of 5.25-inch drives in full-height or half-height models range in capacity from 51 to 1,200MB and has average seek time as low as 1 4.5ms. Imprimis was the first in the industry to break into the 10ms seek range with its 5.25-inch WREN Runner disk drive and introduced the highest capacity (1.2GB unformatted) 5.25-inch HOD.

Today the two merging companies offer a complete range of HDDs except small capacity drives for laptop computers.

The complementary of the two firms is also obvious for the distribution. The acquisition means access to Imprimis OEM distributors for Seagate oriented on reseller channels.

A few more questions

We don’t know yet if Imprimis will remain an entity, subsidiary of Seagate, or if it will merge with the main company. In any case a reorganization is expected. Imprimis is comprised of four business units: Large Disk, Peripheral Components International, Small Disk, and Rigidyne.

This latter, a wholly-owned subsidiary in Simi Valley (CA), designs and develops drives oriented to high-performance PCs in 3.5-inch format, and it could easily merge with Seagate, just like the Small Disk Division, concentrated on high volume workstations and mid-range applications using 5.25 inch disk drives.

Nothing surprising if some plants are grouped, specially the two Asian ones. The Heppenheim (West Germany) plant owned by Imprimis could also be useful to Seagate who would then own a manufacturing plant in Europe where unification is planned for 1993.

Another question: is Seagate going to use its manufacturing methods, mass-production and low prices, for Imprimis’s high capacity more profitable range, which could upset the market as it would mean a lowering of prices?

Other questions are: how will a $2.42 million entity be flexible enough to quickly react in the HDD market, with a very short life cycle products? How will Seagate’s ambitious management adapt to Imprimis’ slower methods?

Financial risks

Seagate encountered its hardest moments these last few months. It lost $23.7 million in the first nine months of its FY89.

And now the question is how can it keep up its recent recovery to finance the debt it contracted to acquire Imprimis.

Imprimis became a subsidiary to be sold better

The acquisition of Imprimis or a part of it was some how expected. The surprise comes from the buyer, a company that’s no larger than its acquisition. When Control Data Corporation announced that it was establishing its storage products (DSP) group as a separate subsidiary, our article was entitled “Control Data establishes Imprimis: for better sales or for sale?” It was to sell it better, even if the head executives tried to deny it, even if the selling price seems a bit low.

Control Data, who needs fresh money, is slowly getting rid of its vital components. Imprimis counted for one third of Control Data’s sales who has just closed ETA Systems Inc, its subsidiary specialized in supercalculators, and sold its European maintenance activity to Thomainfor, a subsidiary of Thomson. CDC also sold another subsidiary, Credit commercial Corp.

The toughest for Control Data is that Imprimis, who reported sales of $1.15 billion in 1988 compared with $975 million in 1987 of the DSP division, counted for more than 50% of its profit.

We don’t actually know what is going to happen to LMSI, a Control Data 49%-owned partnership with Philips that produces storage units on magnetic tapes, cartridges and optical disks. The LMSI division tape drive product line represents a $120 million per year business.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠17, published on June 1989.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter