Only 1.6% Growth in 1Q19 From 1Q18 for EMEA Purpose-Built Backup Appliances – IDC

-2% for open systems, +102% for mainframes

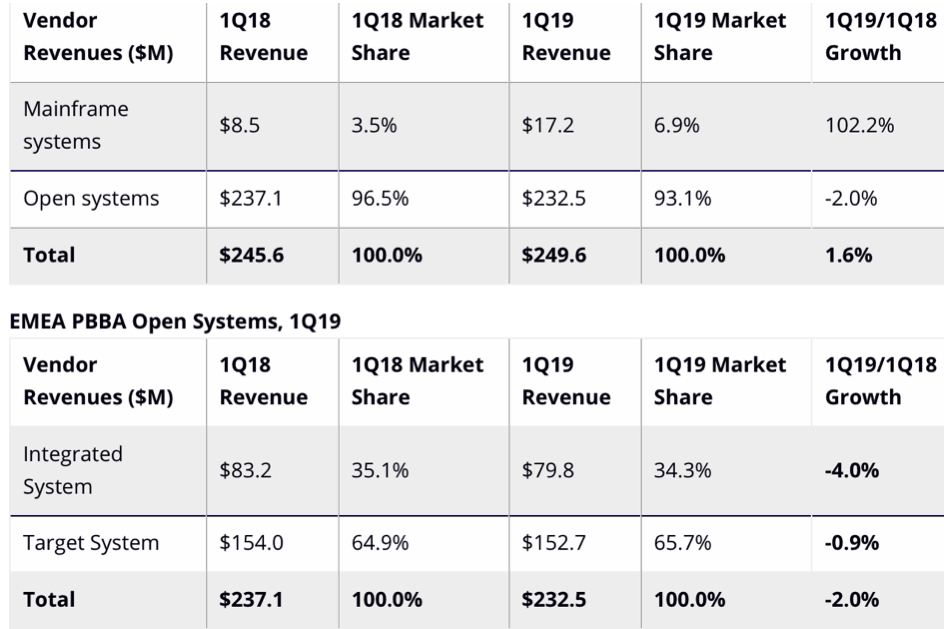

This is a Press Release edited by StorageNewsletter.com on June 24, 2019 at 2:13 pmEMEA purpose-built backup appliance (PBBA) vendor revenues increased 1.6% Y/Y to reach $249.6 million in 1Q19, according to International Data Corporation‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

Total EMEA PBBA open systems vendor revenue decreased 2% Y/Y, with revenues of $232.5 million and continues to be the prime mover for the EMEA PBBA market.

Mainframe system sales increased 102.2% Y/Y in 1Q19.

“Despite the accelerated growth of on-demand cloud infrastructures for backup and DR activities, some EMEA organizations still perceive Backup aaS and DRaaS as risky over data loss due to malware or cyberattacks, which has resulted in sustained investment in PBBA systems, not just for backup, but also as repositories for their critical data,” said Jimena Sisa, senior research analyst, EMEA storage systems, IDC.

EMEA PBBA Vendor Revenue by Product, 1Q19

(in $million)

Regional Highlights

Western Europe

PBBA vendor revenue in Western Europe picked up in 2019 where it left off in 2018, posting a moderate Y/Y growth of 2.5% in 1Q19 to reach $194.1 million.

There was robust PBBA spending in Benelux and the Italian market, with Y/Y growth of 127.0% and 24.8% respectively.

“As many European enterprises execute on their digital transformation strategies, data is becoming their most strategic asset for competitive differentiation,” said Sisa. “Organizations will need to find a way to deal with growing data effectively and cost efficiently to make information available to the relevant teams much faster. Therefore, when investing in specific infrastructure systems, enterprises prefer those technologies that can evolve with their evolving data requirements such as capturing, protecting, recovering, and safely sharing it among different environments while providing a low RTO/RPO.“

CEMA

The robust growth seen in 2018 in the PBBA market in Central and Eastern Europe, Middle East, and Africa (CEMA) could not be sustained in 1Q19, leaving the market flat at -1.1% Y/Y or $55.56 million in vendor revenue.

The Middle East and Africa (MEA) market recorded a single digit decline while demand for backup appliances in Central and Eastern Europe (CEE) continued the growth trajectory.

Open systems continued to dominate the market no matter the slight drop explained by the skyrocketing results in 1Q18.

Mainframe systems managed to generate growth and keep their niche position.

“The PBBA market still shows strong potential for development, which is supported not only by vendors’ geographical expansion and M&A activity but also by the seamless integration of products and support across cloud and non-cloud environments,” said Marina Kostova, research manager, EMEA storage systems, IDC.

Major companies covered in this tracker include Dell Inc., Veritas, HPE, IBM, Quantum, Barracuda, Oracle, Fujitsu, Exagrid, HDS, Unitrends, and Falconstor Software

Taxonomy Notes

IDC defines a PBBA as a standalone disk-based solution that utilizes software, disk arrays, server engines, or nodes that are used for backup data and specifically for data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. PBBAs are deployed in standalone configurations or as gateways. PBBA solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device serves as the component that is purpose built solely for backup and not to support any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. They can also provide and receive replication to or from remote sites and a secondary PBBA for DR.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter