Gartner Magic Quadrant for Hyperconverged Infrastructure

Notable vendors: Cisco, Dell EMC, HPE, Pivot3, Scale Computing

This is a Press Release edited by StorageNewsletter.com on September 13, 2019 at 2:11 pmThis article is an abstract of a report from Gartner, Inc., Midmarket Context: Magic Quadrant for Hyperconverged Infrastructure, published on April 17, 2019 and written by analysts Mike Cisek and Julia Palmer.

Hyperconverged infrastructure (HCI) is evolving into the de facto standard for on-premises and hybrid cloud integration for many midsize enterprises. MSE I&O leaders should leverage this report to identify the HCI vendors and products best suited to their scale and requirements.

Market Differentiators

Finite staffing levels (typically 10 to 30) and budgets (typically less than $20 million) necessitate that midsize enterprise (MSE) infrastructure and operations (I&O) leaders champion investments that are rightsized, cost-effective and emphasize operational simplicity.

In a majority of cases, HCI will yield better TCO than traditional three-tier approaches within midsize data center environments, due primarily to the operational efficiency resulting in Opex savings and Capex avoidance.

Native capabilities such as centralized management, data protection, DR, replication, deduplication and compression within HCI solutions often meet or exceed MSEs’ functional requirements.

A December 2018 poll at Gartner’s Infrastructure, Operations and Cloud Strategies Conference in Las Vegas, NV, found that of the MSE infrastructure and operations (I&O) leaders surveyed:

• 46% have HCI deployed in production/test/development environment.

• 5% were using HCI exclusively in production.

• 52% have IT organizations of fewer the 50 full-time equivalents (FTEs).

The ‘versatilist’ nature of MSEs’ IT teams dictates that a premium be put on service and support quality, reliability, and ease of administration.

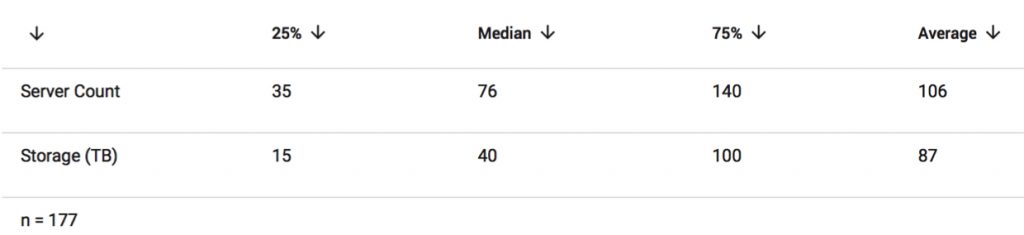

While some attributes are consistent across the spectrum of MSEs, such as high levels of virtualization (80% to 90%) and standardization on a single hypervisor and/or storage array, the infrastructure footprints within these organizations remain diverse (see Table 1).

Table 1: MSE Server and Storage Footprints

MSEs require the ability to run mixed application workloads with guaranteed performance per cluster, which has resulted in MSEs opting for all-flash HCI deployments. With NVMe storage going mainstream, along with increased drive capacity, HCI has the capacity and performance capabilities to effectively run all the virtual workloads within a typical MSE environment.

Although the ‘system hardware requirement’ has been dropped from the Magic Quadrant criteria, MSE I&O leaders continue to disproportionally favor single-vendor HCI appliance products with robust native capabilities. This results in simpler, less expensive vendor management and maintenance, and relinquishing the need to integrate disparate products.

Considerations for Technology and Service Selection

The HCI market is experiencing 45% annual growth, offering MSE I&O leaders mature products from major server OEMs/ODMs and software companies. While entry-level pricing options differ, MSE I&O leaders must judge candidate HCI solutions in the context of solution requirements and operational preferences.

MSE I&O leaders should seek an HCI vendor that can deliver:

- Simplified pricing, maintenance, contracts and licensing, with an all-inclusive pricing scheme.

- High-quality and responsive pre- and post-sales support. Ideally, the price should not drastically affect the quality of support, including SLAs for rapid hardware replacement.

- Preferred hypervisor support and native integration to cloud providers – that is, hybrid cloud integration, and management capabilities that align with your organization’s hybrid cloud vision.

- A focus on the MSE sector – that is, a vendor that delivers a full-featured product within a sc–aled-down footprint with a unified and intuitive management interface.

- Integration with preferred/incumbent:

- Infrastructure management tools (such as VMware vCenter and Microsoft System Center Configuration Manager [SCCM]).

- Legacy storage products and archival data platforms, which can ease the transition to software-defined solutions.

- Robust native, backup, data protection and DR capabilities, including orchestration.

- Appliance-to-appliance, DR as a service service, or partnerships with proven data protection vendors.

- Overall reduced risk solution, including more-secure hybrid environments.

MSE I&O leaders who prefer specific hardware platforms or who wish to maintain relationships with resellers offering HCI software preinstalled on hardware platforms within their portfolio should use Gartner’s HCI Magic Quadrant and Critical Capabilities to guide decision making.

MSE I&O leaders should not assume the best choice is one that is in the leaders quadrant, but should give preference to cultural fit and vendors specializing in midsize enterprise deployments, specific geographies or verticals, and should not discount vendors in the Niche Players or Challengers quadrants.

Notable vendors of HCIs: Cisco, Dell EMC, HPE, Pivot3, Scale Computing

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter