Nutanix: Fiscal 1Q19 Financial Results

$3 billion in revenue expected by 2021

This is a Press Release edited by StorageNewsletter.com on November 29, 2018 at 2:20 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

275.6 | 313.3 | 14% |

| Net income (loss) | (61.5) | (94.3) |

Nutanix, Inc. announced financial results for its first quarter of fiscal 2019, ended October 31, 2018.

1FQ19 Financial Highlights

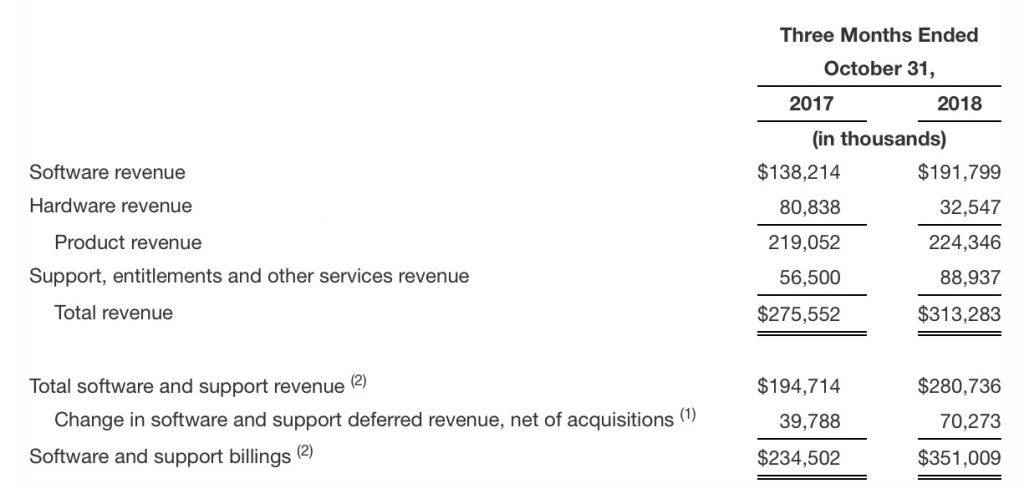

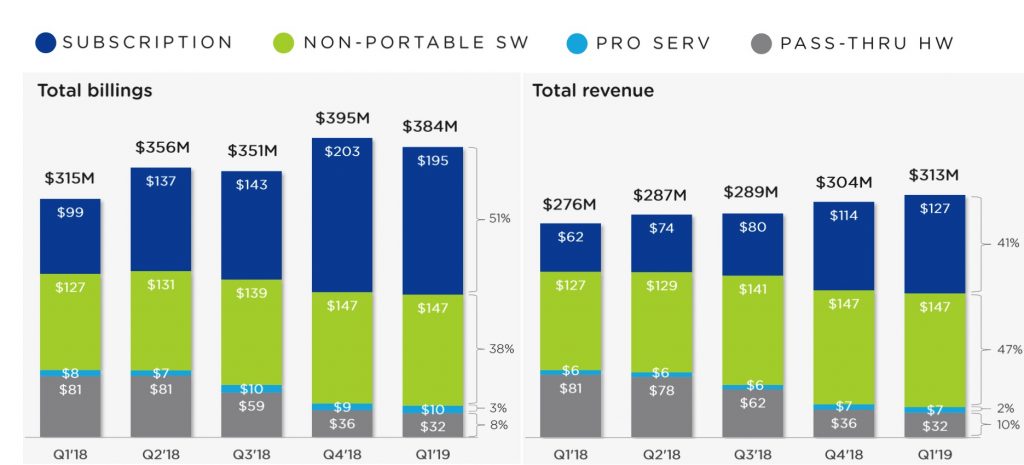

• Revenue: $313.3 million (at 78.6% non-GAAP gross margin), up from $275.6 million (at 61.9% non-GAAP gross margin) in the first quarter of fiscal 2018. This reflects the elimination of approximately $104 million in pass-through hardware revenue in the first quarter of fiscal 2019, up from $8 million in 1FQ18, as the company nears the completion of its shift toward increasing software revenue (1)

• Billings: $383.6 million, up from $315.3 million in 1FQ18. This reflects the elimination of approximately $104 million in pass-through hardware revenue in 1FQ19, up from $8 million in 1FQ18, as the company nears the completion of its shift toward increasing software revenue1

• Software and Support Revenue: $280.7 million, growing 44% Y/Y from $194.7 million in 1FQ18

• Software and Support Billings: $351.0 million, growing 50% Y/Y from $234.5 million in 1FQ18

• Gross Margin: GAAP gross margin of 76.3%, up from 60.6% in 1FQ18; Non-GAAP gross margin of 78.6%, up from 61.9% in 1FQ18

• Net Loss: GAAP net loss of $94.3 million, compared to a GAAP net loss of $61.5 million in 1FQ18; Non-GAAP net loss of $23.7 million, compared to a non-GAAP net loss of $24.7 million in 1FQ18

• Net Loss Per Share: GAAP net loss per share of $0.54, compared to a GAAP net loss per share of $0.39 in 1FQ18; Non-GAAP net loss per share of $0.13, compared to a non-GAAP net loss per share of $0.16 in 1FQ18

• Cash and Short-term Investments: $965.0 million, up 164% from 1FQ18

• Deferred Revenue: $701.8 million, up 72% from 1FQ18

• Operating Cash Flow: $49.8 million, compared to $10.1 million in 1FQ18

• Free Cash Flow: $20.0 million, compared to negative free cash flow of $7.9 million in 1FQ18

“Our results this quarter prove that our core business continues to grow strongly and put us on a solid path to meet our goal of at least $3 billion in software and support billings by 2021,” said Dheeraj Pandey, chairman, founder and CEO. “51% of our billings in our first quarter were derived from subscriptions, up from 31% in the same quarter last year, and our subscription revenue grew 104% year-over-year. As we look ahead, we expect to continue this shift towards subscription, driving a cloud-like, pay-as-you-grow business model.“

Recent company Highlights

• Announces availability for Xi Leap DR Service: After completing its evaluation period with early access customers, the firm has made its Xi Leap DR service available to all customers, signing several customers in the first few weeks of introduction.

• Expanded Customer Base: Ended the 1FQ19 with 11,490 end-customers. First quarter results included deals with ABN AMRO Clearing Bank, AccorHotels, Airbus, Inchcape plc, JSE Limited, Shinsei Bank, Limited, Wintrust Financial Corporation.

• Named a Leader in The Forrester Wave: Hyperconverged Infrastructure, Q3 2018

• Released Results of Enterprise Cloud Index, Validating Hybrid Cloud Strategy: Conducted a global IT research survey of 2,300 IT buyers that shows that public cloud only is not the preferred state for IT, with 91% of respondents claiming that hybrid cloud is the ideal IT model. This research found that cloud interoperability and app mobility were of higher concern to IT professionals when considering hybrid cloud benefits than cost and security.

• Introduces the Nutanix Customer Journey: Outlined new stages of the customer journey to help customers determine what products and solutions are best suited for their needs: beginning with Nutanix Coreto modernize and deliver a cloud-like experience within the walls of their datacenters; Nutanix Essentials builds on the company’s Core HCI offering to deliver more automation and IT efficiency; and culminating in Nutanix Enterprise to enable customers to advance into hybrid and multicloud deployments with offerings including Xi Cloud Services.

• Launched New Beam Functionality Extending its Capabilities to the Private Cloud: Newly introduced Beam features extend its cost visibility and optimization capabilities into Nutanix on-prem deployments. With this new update, Beam customers get visibility and insight into the entirety of their infrastructure environment, including public and private clouds, so they can choose the right cloud for every application.

• Achieved FedRAMP Ready Designation for Nutanix Frame: Frame was granted Federal Risk and Authorization Management Program (FedRAMP) Ready designation for the Frame for Government platform to deliver secure application workspaces on U.S. government approved clouds.

• Announces New Xi Cloud Services for the Modern Multicloud Era at .NEXT London Conference: Introduces the availability of Xi Cloud Services, a suite of offerings designed to create a more unified fabric across different cloud environments, giving IT teams the freedom to run their applications on the optimal platform. Xi Cloud Services is comprised of five distinct offerings at launch, including Xi Leap, a native extension of the Nutanix Enterprise Cloud Platform providing DR as a service, and Xi IoT, an intelligent edge computing platform.

2FQ18 Outlook

• Revenue between $325 and $335 million;

• Billings between $410 and $420 million;

• Non-GAAP gross margin between 78% and 79%;

• Non-GAAP operating expenses between $300 and $310 million; and

• Non-GAAP loss per share of approximately $0.25, using approximately 180 million weighted shares outstanding

(1)The elimination of hardware revenue is based on the estimated cost of hardware in transactions where our customers purchase such hardware directly from our contract manufacturers.

Comments

The song is always the same for Nutanix, now with 4,380 employees: revenue is growing (higher than guidance of $295-$310 million), 14% Y/Y and 3% Q/Q, and huge net loss continuing and increasing, representing last quarter as much as 30% of global sales.

In less than 10 years, the company has done $4 billion in lifetime sales.

CEO stated that "$1 billion in annual revenue [is] faster than any other software company founded in the past 20 years. Salesforce, Palo Alto, Workday included."

It made a successful transition to software over the past year. Recently, business model was evolving toward an increasingly subscription model designed to deliver more recurring and predictable revenue. This quarter it saw 51% of billings from subscriptions, up 20 points from 31% a year ago.

In FY17, subscription business accounted for 31% of billings, in FY 2018 it accounted for 41% of billings and in 1FQ19, it represented 51% of billings. In this quarter, new term-based licensing accounted for over $20 million in bookings. In the next four to six quarters, the firm expects that recurring subscription business will reach 70% to 75% of total billings. And by FY21, it hopes that a large majority of the business should be recurring in nature, either on-prem or cloud-based.

Number of customers increased by 3,670 customers Y/Y in this quarter, the company closing 63 deals worth more than $1 million and three deals worth more than $5 million, and now has 15 customers who have lifetime spend of more than $15 million and more than 700 customers with a lifetime spend of more than $1 million. The firm has seen 83% Y/Y growth in customers with a lifetime spend of $3 million to $5 million and 111% Y/Y growth in customers with a lifetime spend of more than $5 million.

In this 1FQ19, AHV hypervior virtualization solution adoption increased 38% on a rolling four-quarter basis.

For this period, software and support bookings from international regions were 40% of the company's total software and support bookings, up from 36% in 1FQ8.

Software and support billings by quarter

Click to enlarge

Quarterly Revenues

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter