NetApp: Fiscal 2Q19 Financial Results

AFA business grew 29% Y/Y to annualized revenue run rate of $2.2 billion.

This is a Press Release edited by StorageNewsletter.com on November 15, 2018 at 2:29 pm| (in $ million) | 2Q18 | 2Q19 | 6 mo. 18 | 6 mo. 19 |

| Revenue | 1,415 | 1,517 | 2,736 | 2,991 |

| Growth | 7% | 9% | ||

| Net income (loss) | 174 | 241 | 305 | 524 |

NetApp, Inc. reported financial results for the second quarter of fiscal year 2019, which ended October 26, 2018.

“Through focus and disciplined execution, NetApp again delivered strong results in the second quarter. We introduced a tremendous amount of innovation across our portfolio that helps us drive share gains, expand our available market, and set the industry agenda,” said George Kurian, CEO. “Our consistent and strong performance reflects the clear differentiation of our technology and the strength of our business model, as well as our customers’ growing commitment to NetApp and value of our Data Fabric strategy.”

2FQ19 Financial Results

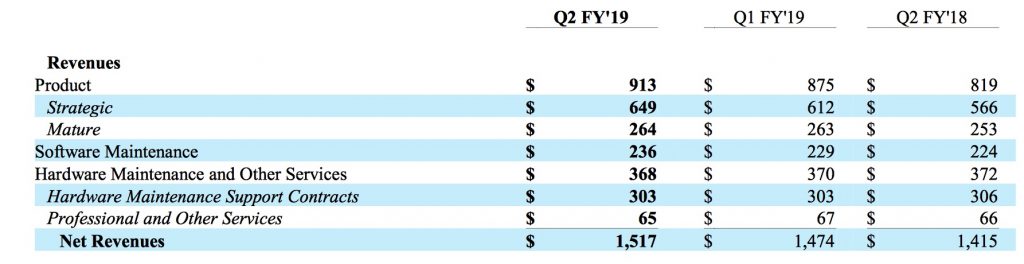

• Net Revenues: $1.52 billion, increased 7% Y/Y from $1.42 billion in 2FQ18

• Net Income: GAAP net income of $241 million, compared to GAAP net income of $174 million* in 2FQ18; non-GAAP net income 1 of $280 million, compared to non-GAAP net income of $221 million in 2FQ18

• Earnings per Share: GAAP earnings per share2 of $0.91 compared to GAAP earnings per share of $0.63 in the second quarter of fiscal 2018; non-GAAP earnings per share of $1.06, compared to non-GAAP earnings per share of $0.80 in 2FQ18

• Cash, Cash Equivalents and Investments: $4.3 billion at the end of 2FQ19

• Cash from Operations: $165 million, compared to $314 million in 2FQ18

• Share Repurchase and Dividend: Returned $663 million to shareholders through share repurchases and cash dividends

3FQ19 Financial Outlook

- Net revenues are expected to be in the range of $1.550 billion to $1.650 billion

- Earnings per share is expected to be in the range of $0.96-$1.02 and $1.12-$1.18

Dividend

Next cash dividend of $0.40 per share to be paid on January 23, 2019, to shareholders of record as of the close of business on January 4, 2019.

2FQ19 Business Highlights

New Products and Solutions Help Data-Driven Organizations Thrive

• Announced new solutions to enable customers to deliver data-driven business outcomes for applications across hybrid cloud and multicloud environments, including NetApp Cloud Insights, Azure NetApp Files, Cloud Volumes Service, Cloud Volumes ONTAP, NetApp HCI, SaaS Backup for Microsoft Office 365, and NetApp Data availability Services.

• Announced expanded availability and features for NetApp Cloud Volumes for Google Cloud Platform (GCP) to help customers deploy workloads such as video rendering, databases, high-performance computing, and continuous integration on GCP.

• Announced ONTAP 9.5, MAX Data, StorageGRID SG6060, NetApp Solution Support for FlexPod, and Flash Performance Guarantee. These new data services and solutions further extend the NetApp Data Fabric across edge, core, and cloud, enabling organizations to realize the promise of AI.

• Introduced ONTAP AI architecture, powered by NVIDIA DGX supercomputers and NetApp AFF A800 cloud-connected all-flash storage, to simplify, accelerate, and scale the data pipeline across edge, core, and cloud for deep learning deployments and to help customers achieve real business impact with AI.

• Announced updates to Trident, its automated provisioner for solving the persistent storage challenge for containers; a new verified architecture for Red Hat OpenShift Container Platform on NetApp HCI; and enhanced flexibility for DevOps on both NetApp Cloud Volumes for Google Cloud Platform and NetApp Cloud Volumes for AWS.

• OnCommand System Manager 9.4 is now bundled with ONTAP 9.4 features improvements that simplify day-to-day operations.

• Announced the acquisition of StackPointCloud, in multicloud Kubernetes as a service and a contributor to the Kubernetes project. The combination of StackPointCloud creates NetApp Kubernetes Service, a complete Kubernetes platform for multicloud deployments and a complete cloud-based stack for Azure, Google Cloud, AWS, and NetApp HCI.

Expands Partnerships

• Has partnered with DreamWorks to develop and oversee the studio’s customized Data Fabric approach, designed to enable expanded capabilities and future growth for the Glendale-based leader in family entertainment.

• Announced a partnership with WuXi NextCODE, a genomic data platform and analysis company, working to improve health for people around the globe. It will use NetApp Cloud Volumes for simplified deployment and optimized management of data-driven applications.

• Lenovo and NetApp announced a global, multifaceted partnership to bring technology and a simplified experience to help customers modernize IT and accelerate their digital transformation.

Comments

NetApp's financial results beat analysts' expectations and revenue that topped forecasts.

Net revenues of $1.52 billion grew 7% Y/Y and 3% Q/Q, driven by product revenue of $913 million which increased yearly 11%.

In the quarter, AFA business inclusive of all-flash FAS, EF and SolidFire products and services grew 29% Y/Y to an annualized net revenue run rate of $2.2 billion.

Based on 2FQ19, annualized monthly recurring cloud data services revenue is $27 million, up 35% from he former quarter.

Software maintenance and hardware maintenance revenue of $539 million increased 2% Y/Y.

Revenue is expected to increase between 2% and 9% next three-month period..

The company remains confident in driving free cash flow of 19% to 21% of revenue for the full current fiscal year.

| Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1FQ18 | 1,325 | -11% | 136 |

| 2FQ18 | 1,422 | 7% | 175 |

| 3FQ18 | 1,523 | 7% | (506) |

| 4FQ18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1FQ19 |

1,474 | 12% |

283 |

| 2FQ19 |

1,517 | 7% |

241 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter