Western Digital: Fiscal 1Q19 Financial Results

Revenue and net income down due to decline in flash pricing, next quarter to be horrible

This is a Press Release edited by StorageNewsletter.com on October 26, 2018 at 2:16 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

5,181 | 5,028 | -3% |

| Net income (loss) | 681 | 511 |

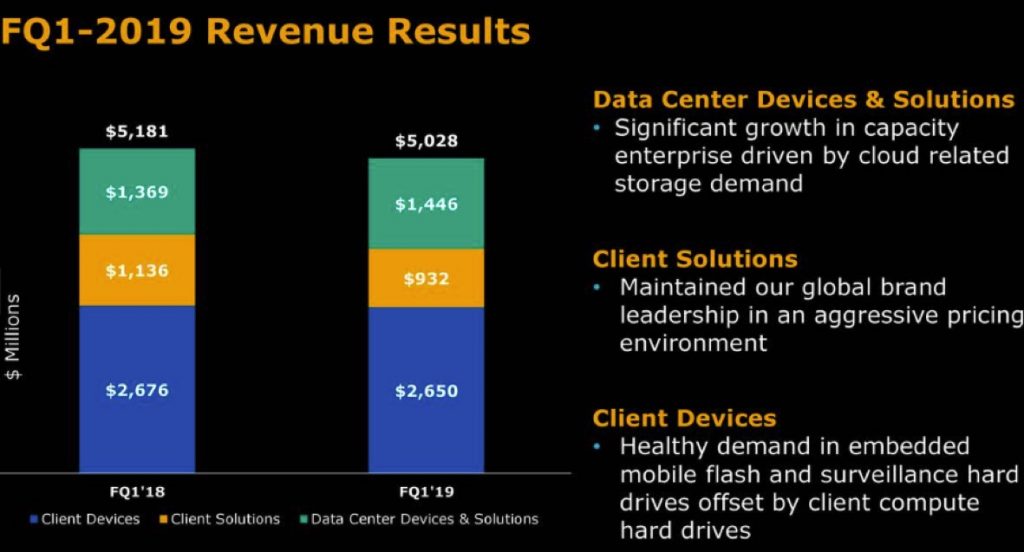

Western Digital Corp. reported revenue of $5.0 billion for its first fiscal quarter ended Sept. 28, 2018.

Operating income was $686 million with net income of $511 million, or $1.71 per share. Excluding certain non-GAAP adjustments, the company achieved non-GAAP operating income of $1.1 billion and non-GAAP net income of $906 million, or $3.04 per share.

In the year-ago quarter, the company reported revenue of $5.2 billion, operating income of $905 million and net income of $681 million, or $2.23 per share. Non-GAAP operating income in the year-ago quarter was $1.4 billion and non-GAAP net income was $1.1 billion, or $3.56 per share.

The company generated $705 million in cash from operations during the first fiscal quarter of 2019, ending with $4.8 billion of total cash, cash equivalents and available-for-sale securities.

The company returned $711 million to shareholders through share repurchases and dividends. On Aug. 1, 2018, the company declared a cash dividend of $0.50 per share of its common stock, which was paid to shareholders on Oct. 15, 2018.

“Our fiscal first quarter results reflected strength in capacity enterprise, surveillance HDDs and embedded flash solutions, with each growing revenue over 30% from the year-ago quarter,” said Steve Milligan, CEO. “However, strength in these end markets was offset by ongoing declines in flash pricing. A more challenging global business environment and the corresponding economic impacts are contributing to a more conservative demand outlook for our products. In response to these conditions, we are taking immediate actions to align our flash output with projected demand. We remain focused on successfully navigating the current market conditions as we continue to build the Western Digital platform for long-term success and industry leadership.”

Comments

The company expected revenue of $5.1 billion to $5.2 billion for this quarter, $50 billion being realized, down 2% Q/Q and 3%Y/Y.

| in $ million | 1Q18 | 1Q19 | % Growth |

| HDD revenue | 2,610 | 2,494 | -4% |

| SSD revenue | 2,571 | 2,534 | -1% |

HDD shipments, at 34.1 million, was down 13% Q/Q and 19% Y/Y, at a record average price of $72 like in 4FQ18.

Global lower results were impacted by declines in flash average selling prices, but the company experienced strong performance in capacity enterprise, surveillance HDDs, and embedded flash solutions, with each growing revenue over 30% on a year-over-year basis.

This softening flash demand, in combination with increased flash supply, has led to a market imbalance resulting in a deteriorating near-term flash pricing environment. In response to these conditions, WD is making an immediate reduction to wafer starts and delaying deployment of capital equipment. These actions will reduce its wafer output beginning in 3FQ19. So the manufacturer expects to reduce planned flash output by 10% to 15% for calendar year 2019.

Flash-based products had revenue bit growth of 28% sequentially, while the average selling price was down 16%.

President and COO Mike Cordano comments:" Our immediate reduction in wafer starts and delayed deployment of capital equipment is a reflection of the adjustment to bit supply growth needed to improve the supply-demand dynamic by mid-year 2019. The magnitude of these actions is a reduction of 10% to 15% of our planned bit output in calendar year 2019. With these adjustments to our supply, we expect our bit growth in calendar year 2019 to be in line with our view of end market demand growth of between 36% to 38%."

The September quarter revenue for data center devices and solutions was $1.4 billion, an increase of 6% Y/Y. Data center revenue growth continues to be driven by cloud-related storage. In this sector, revenue grew year-over-year, driven primarily by continued demand for capacity enterprise HDDs. For the calendar year 2018, the company now projects capacity enterprise exabyte growth of approximately 55%. Based on discussions with its customers, it expects stronger growth to resume in the second half of calendar year 2019.

Client devices revenue was $2.7 billion, flat year-over-year. WD had significant growth in embedded flash and surveillance products, offset by client compute HDDs.

Client solutions revenue was $932 million, a yearly decrease of 18%, driven by the normalization trends in flash market pricing.

Click to enlarge

For next quarter, WD expect much lower revenue, between $4.2 billion to $4.4 billion or between -19% and -12%.

Volume and HDD Share for Fiscal Quarters

(units in million)

| HDDs | Enterprise | Desktop | Notebook | CE | Branded | Total HDDs | HDD share | Exabyte Shipped |

Average GB/drive |

ASP |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 61.0 | 43.4% | 66.4 | 1,087 | $60 |

| 3Q15 | 7.5 | 13.5 | 18.8 | 8.6 | 6.1 | 54.5 | 43.6% | 61.3 | 1,123 | $61 |

| 4Q15 | 7.2 | 11.6 | 15.5 | 9.1 | 5.2 | 48.5 | 43.7% | 56.2 | 1,159 | $60 |

| 1Q16 | 7.2 | 11.7 | 15.8 | 11.5 | 5.6 | 51.7 | 43.6% | 63.5 | 1,228 | $60 |

| 2Q16 | 7.0 | 12.5 | 15.3 | 8.5 | 6.4 | 49.7 | 43.2% | 69.1 | 1,390 | $61 |

| 3Q16 | 6.4 | 10.7 | 13.6 | 7.3 | 5.2 | 43.1 | 43.2% | 63.7 | 1,443 | $60 |

| 4Q16 | 6.0 | 7.9 | 11.4 | 10.0 | 4.7 | 40.1 | 40.7% | 66.1 | 1,648 | $63 |

| 1Q17 | 6.5 | 9.0 | 14.6 | 12.3 | 5.2 | 47.5 | 41.9% | 80.0 | 1,684 | $61 |

| 2Q17 | 6.4 | 9.9 | 14.7 | 8.3 | 5.5 | 44.8 | 39.9% | 77.8 | 1,737 | $62 |

| 3Q17 | 5.8 | 9.4 | 11.3 | 7.7 | 4.9 | 39.1 | 39.6% | 74.2 | 1,898 | $63 |

| 4Q17 | 6.2 | 8.9 | 10.3 | 9.6 | 4.3 | 39.3 | 40.8% | 81.2 | 2,066 | $63 |

| 1Q18 | 6.1 | 9.5 | 11.4 | 10.3 | 4.9 | 42.2 | 40.5% | 87.4 | 2,071 | $61 |

| 2Q18 | 6.8 | 10.2 | 10.9 | 8.6 | 5.8 | 42.3 | 40.4% | 95.3 | 2,253 | $63 |

| 3Q18 | 7.6 | 7.9 | 9.7 | 6.1 | 5.1 | 36.4 | 38.8% | 100.3 | 2,755 | $72 |

| 4Q18 |

7.5 | 8.2 | 9.6 | 8.9 | 4.8 | 39.0 | NA | 106.5 | NA | $70 |

| 1Q19* |

6.6 |

NA | NA |

NA | NA |

34.1 |

NA | 103.3 | NA | $72 |

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter