18.6% Y/Y Growth for EMEA External Storage Market But Down 5.7% Q/Q – IDC

Up 73.4% for AFAs accounting for 35.6% of total market

This is a Press Release edited by StorageNewsletter.com on September 13, 2018 at 2:37 pmThe EMEA external storage systems market recorded another positive quarter in 2Q18, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

Helped by a positive exchange rate (+9.2% in euros), the market grew 18.6% year on year in the quarter.

The all-flash-array (AFA) market recorded high double-digit growth in dollars (73.4%), accounting for over a third (35.6%) of overall external storage sales in the region. Hybrid arrays also recorded double-digit growth (18.5%), and continued to account for the majority of shipments (45.3%).

The EMEA external storage market showed resilient growth on the back of resumed spending driven by digital transformation and infrastructure consolidation. Emerging workloads such as AI and deployments on the edge are proliferating in verticals such as manufacturing, healthcare, and oil and gas, where they bring advantages in terms of increased efficiency and better customer experience.

Western Europe

The Western European market grew 20.4% in dollars and 10.9% in euros. AFAs played a big part in this increase, jumping 37% in total shipments with a year-on-year increase of 80%.

“European companies are increasingly looking at AFAs as a means to consolidate more workloads in fewer systems, with significant gains in TCO and performance. With newer systems featuring NVMe hitting the market, IDC expects the shift to AFA in the region to continue and competition to exacerbate,” said Silvia Cosso, research manager, European storage and datacenter research, IDC.

Central and Eastern Europe, the Middle East, and Africa (CEMA)

For a third quarter in a row, CEMA recorded double-digit growth in external storage spending (12.8% Y/Y).

AFA solutions reconfirmed their growth potential with a 50% Y/Y increase, and hybrid arrays also maintained the positive trend by supporting a sizeable share of capacity-driven workloads.

Almost all Central and Eastern European (CEE) storage markets grew in value, supported by deals in the public sector and the mid-market, supported by the channel. Performance in the Middle East and Africa (MEA) was more varied, but projects related to divergence from an oil-fueled economy supported datacenter infrastructure expansion in various sectors.

“The external storage market in CEMA is strongly supported by large-scale projects to boost economic performance in the region,” said Marina Kostova, research manager, storage systems, IDC CEMA. “Demand is also driven by the continuing transition from HDD-only systems to either AFA or HFA for all types of workloads, taking advantage of new optimized storage technologies and approaches.”

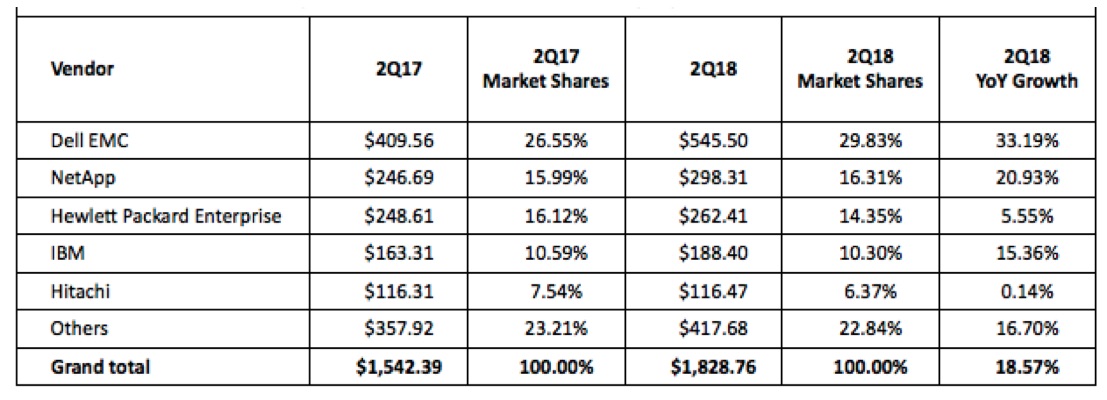

Top 5 Vendors, EMEA External Disk Storage Systems Value

(in $million)

Click to enlarge

Note: Hewlett Packard Enterprise includes the acquisition of Nimble, completed in April 2017.

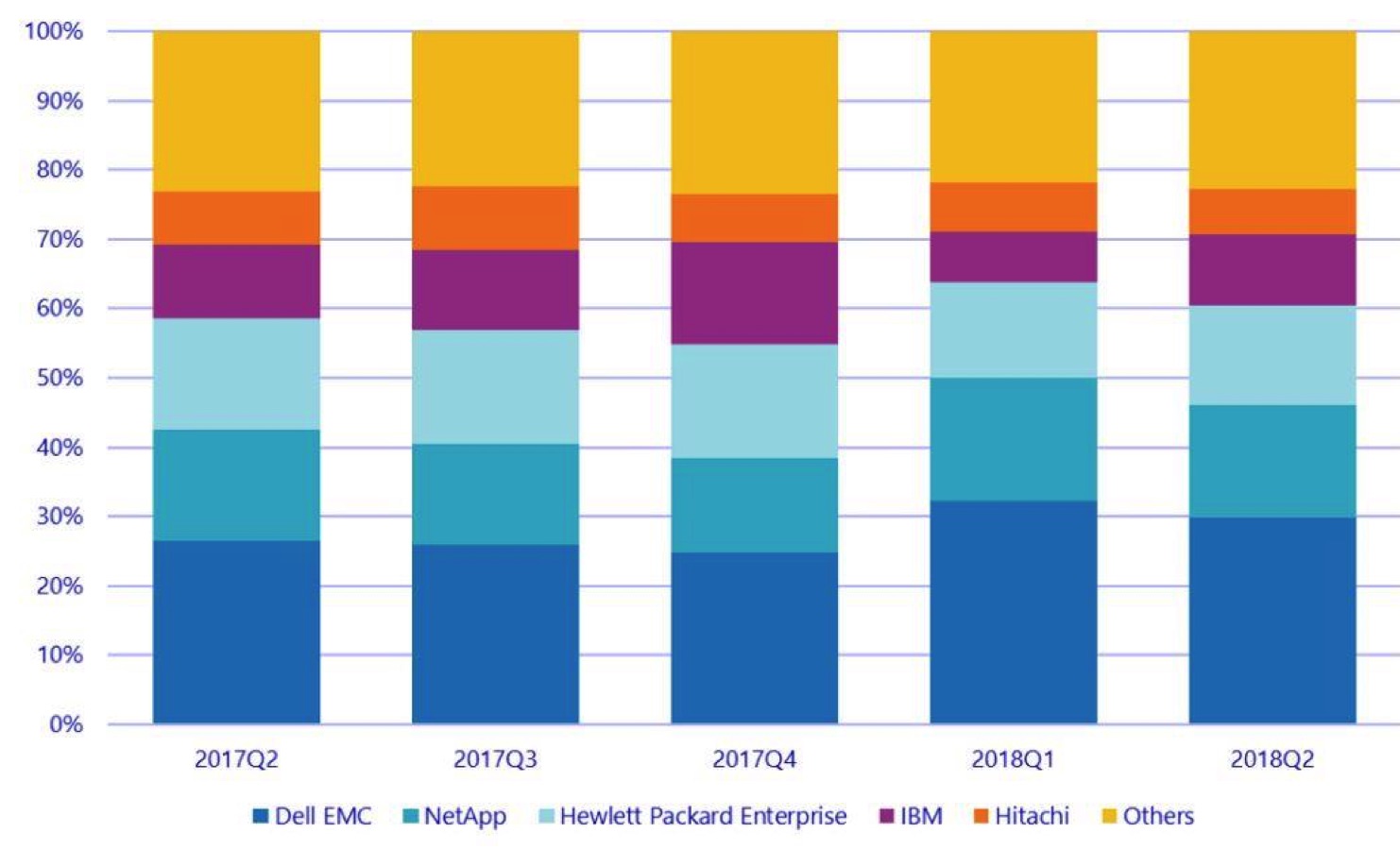

EMEA Top 5 Enterprise Storage Systems Companies,

2Q18 Value Market Share

Click to enlarge

Read also:

Explosive Growth (+24% Y/Y) of EMEA External Storage Market – IDC

Pushed by AFAs (+59%) and Dell (+55%)

2018.06.15 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter