HPE: Fiscal 3Q18 Financial Results

Storage once more decreasing, 3% Q/Q, but up 16% for 9-month period

This is a Press Release edited by StorageNewsletter.com on August 29, 2018 at 2:35 pmHPE revenue for storage only

(in $ million)

| 3FQ17 | 2FQ18 | 3FQ18 | 9 mo. 2017 | 9 mo. 2018 | |

| Storage revenue | 877 | 912 | 887 | 2,375 | 2,747 |

| Q/Q growth | 25% | -4% | -3% | Y/Y growth | 16% |

Hewlett Packard Enterprise LP (HPE) announced financial results for its fiscal 2018 second quarter ended July, 2018.

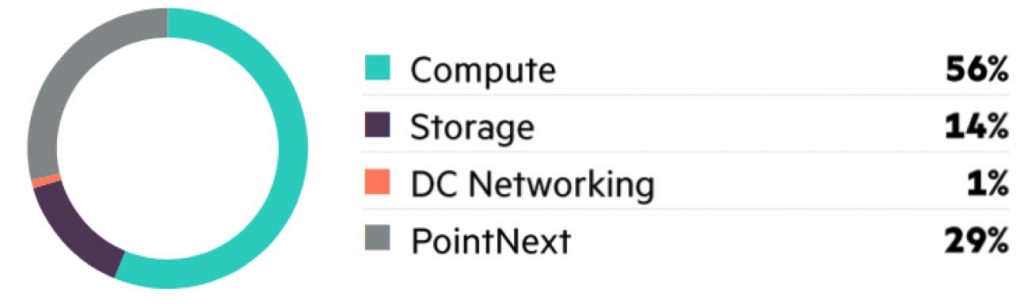

Hybrid IT revenue was $6.2 billion, up 3% year over year and flat when adjusted for currency, with a 10.6% operating margin. Compute revenue was up 5%, up 2% when adjusted for currency, storage revenue was up 1%, down 2% when adjusted for currency even with tough second half compares, DC networking revenue was down 6%, down 10% when adjusted for currency, and HPE Pointnext revenue was down 1%, down 2% when adjusted for currency.

3FQ18 hybrid IT revenue

When you look with the combination of that segment plus the other platforms, including hyperconverged and composable, actually total growth is 12%. And within that also, HPE saw big base of storage growing 70%, because that’s the demand.

At the same time, HPE saw 17% growth in big data storage.

It expects improved organic growth in 4FQ18 as it drives increased sales productivity and as its latest storage offerings gain customer traction.

For example, in July, the company expanded its offering of HPE InfoSight across its 3PAR portfolio, which now enables intelligent all-flash storage for customers.

Quarterly revenue for HP and then HPE for storage only since 1FQ13

(in $ million)

| Fiscal quarter |

Revenue |

Q/Q Growth |

| 1Q13 | 833 | -12% |

| 2Q13 | 857 | 3% |

| 3Q13 | 833 | -3% |

| 4Q13 | 952 | 14% |

| 1Q14 | 834 | -12% |

| 2Q14 | 808 | -3% |

| 3Q14 | 796 | -1% |

| 4Q14 | 878 | 10% |

| 1Q15 | 837 | -5% |

| 2Q15 | 740 | -12% |

| 3Q15 | 784 | 6% |

| 4Q15 | 905 | 3% |

| 1Q16 | 863 | 3% |

| 2Q16 | 752 | -13% |

| 3Q16 | 763 | 1% |

| 4Q16 | 779 | 8% |

| 1Q17 | 730 | -6% |

| 2Q17 | 699 | -4% |

| 3Q17 | 844 | 21% |

| 4Q17 | 871 | 3% |

| FY17 | 3,144 | 3% Y/Y |

| 1Q18 | 948 | 5% |

| 2Q18 | 912 | -4% |

| 3Q18 |

887 |

-3% |

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter