HDD Still Top Seller in Storage Industry – Enterprise Storage Forum

Although flash/SSD has been moving up for last several years.

This is a Press Release edited by StorageNewsletter.com on August 24, 2018 at 2:50 pmThis article was posted on August 21, 2018 by Christine Taylor.

Survey Reveals Tech Trends Reshaping storage

The results of the Storage Trends 2018 survey have implications for both IT and business units, as companies of all sizes struggle to strategically plan storage purchases in a fast-changing tech landscape.

Enterprise Storage Forum recently administered a survey of IT and business leaders to gauge their storage plans. The answers have implications for both IT and business units, as companies of all sizes struggle to strategically plan storage purchases in a fast-changing tech landscape.

Entitled storage Trends 2018, the survey provides a portrait of today’s storage landscape, from technology to hiring trends to budget decisions. At the end of this article, we discuss the five key takeaways from the survey.

Challenges: The Rapid Growth of Storage

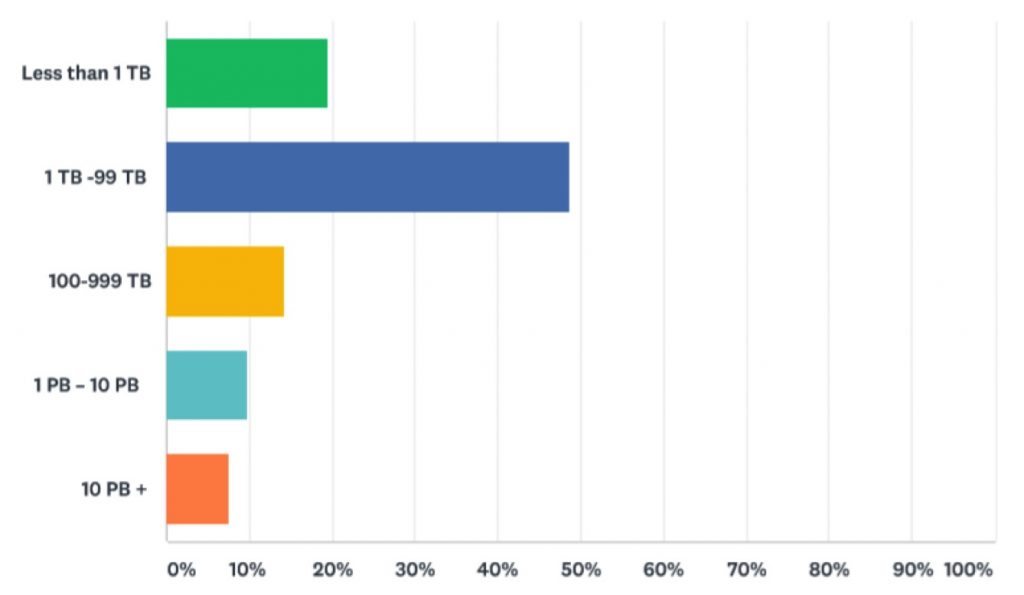

How much has your company’s storage grown in the last 2 years?

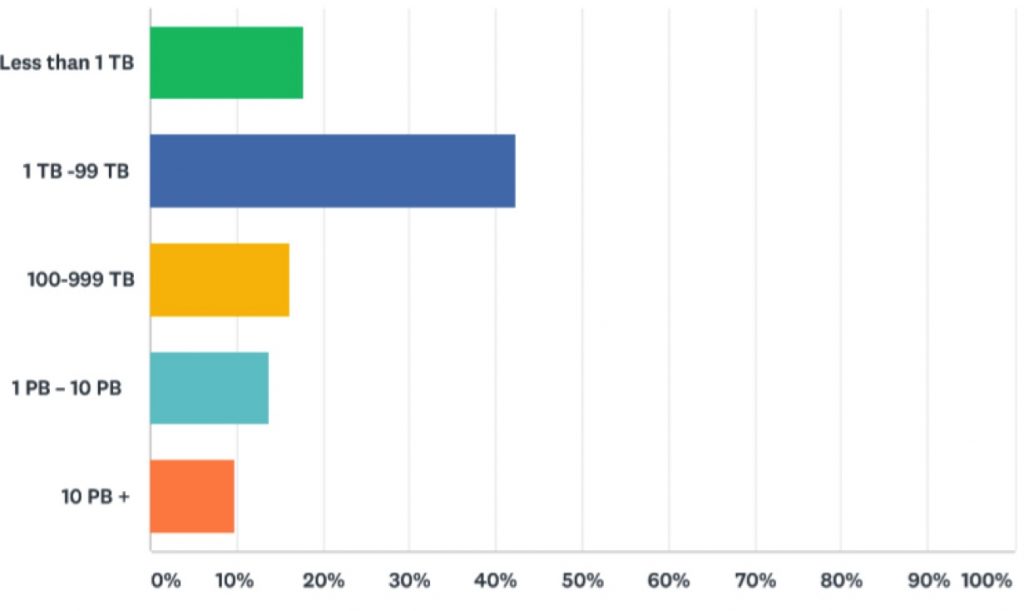

What is your company’s expected storage growth in the next 2 years?

As the responses above reveal, current and projected data growth are large enough to create a true challenge to storage platform, forcing managers to invest in new technology, as noted below. Clearly, part of the rise of cloud storage is a response to the high cost of storage hardware; businesses are hoping to outsource the headaches of in-house storage.

Storage Investment

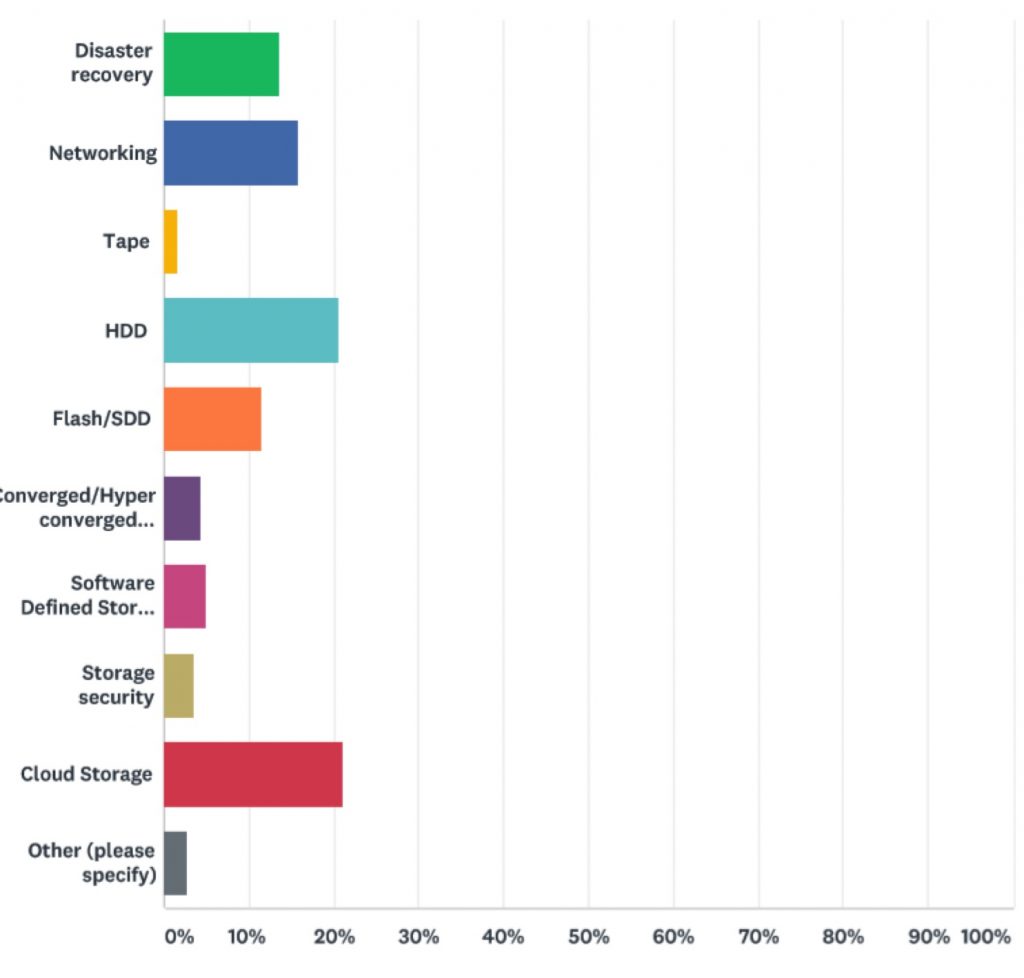

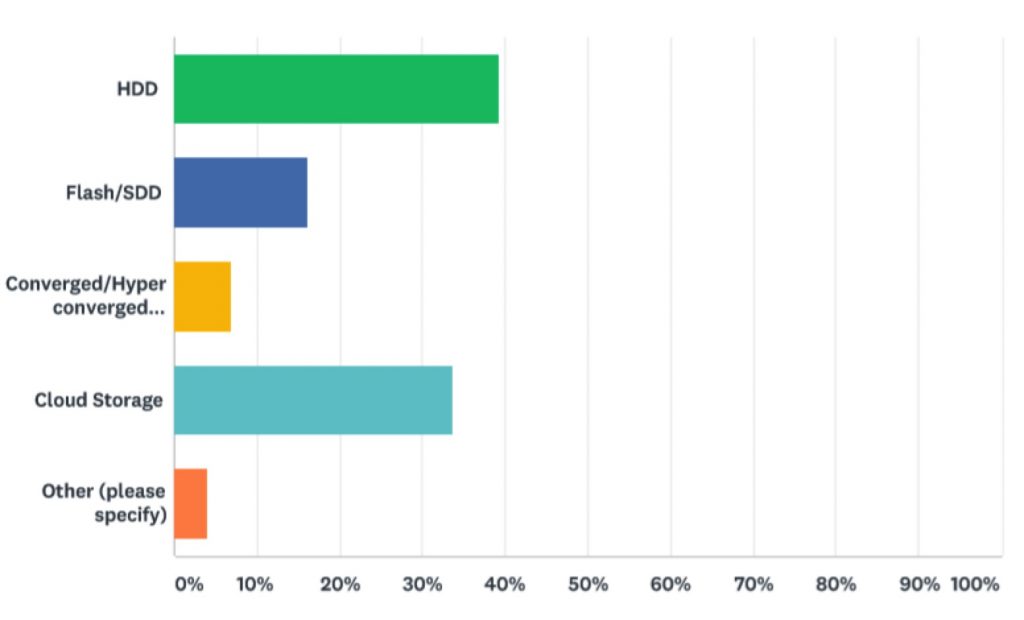

To which storage technology has your company allocated the greatest amount of budget in the last 5 years?

• HDD and cloud storage purchases shared the top slot at 21% each. DR and flash/SSD came in at 14% and 12% respectively.

• HDD media is still a top seller in the storage industry although flash/SSD has been moving up for the last several years. Given fast data growth, large media investments are no surprise in this sector.

Storage Technologies

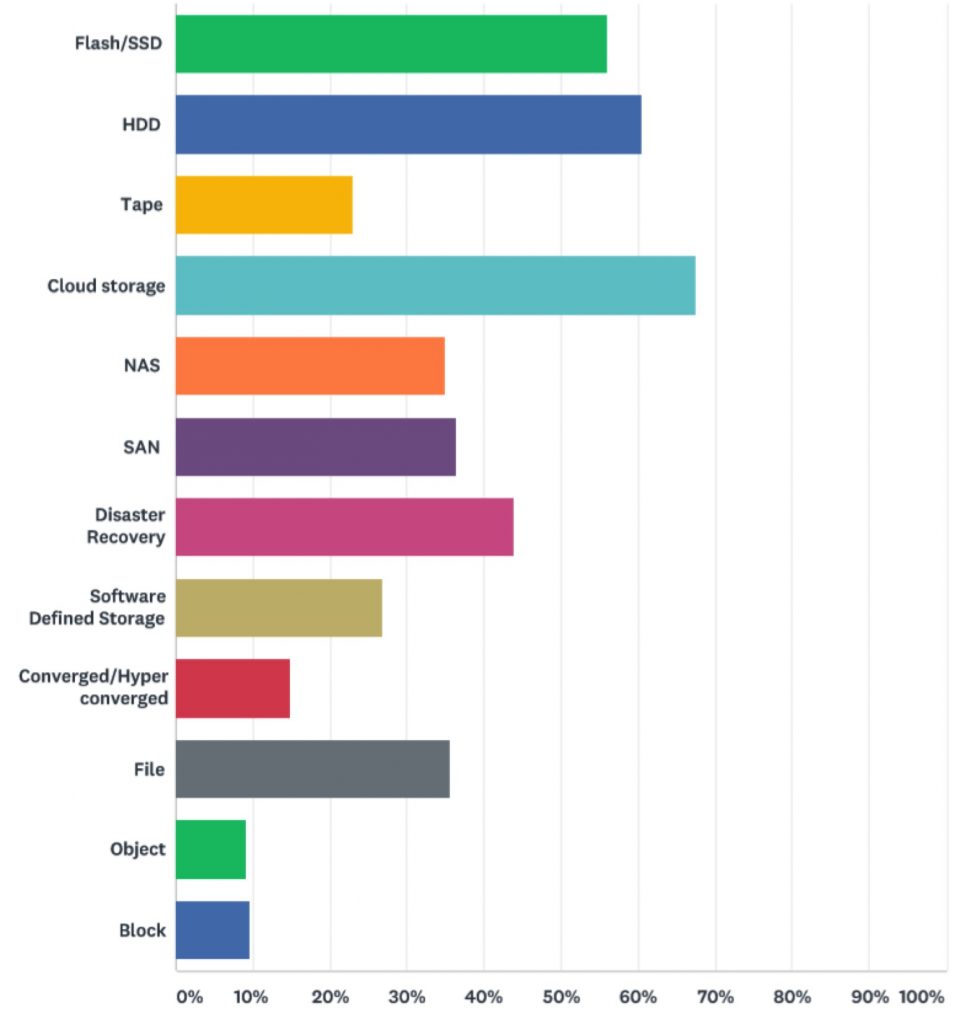

What storage technologies are included

in your company’s current storage infrastructure?

Current storage environments juggle many moving pieces, with a mix of last generation and next generation technologies forming a heterogeneous storage environment. But the respondents certainly say that cloud adoption has become a dominant model.

Notice, too that flash/SSD and HDD are essentially tied. Modern storage platforms are at a transition point where these two storage mediums are nearly even; but it’s safe prediction that flash will pull ahead in the coming years.

What storage technology holds

most of your company’s primary storage data?

• Respondents reported their primary storage media: HDD and flash/SSD, followed next by cloud storage and then tape. Many respondents own NAS and/or SAN.

• Although DR only accounts for 44% of respondents, it’s unlikely that 56% of survey takers are not backing up their data. IT generally distinguishes between backup/recovery and DR functions like hot sites and failover services in the Web.

• Software-defined storage (SDS) and converged/hyperconverged systems displayed smaller percentages. Neither technology is new, but SDS and/or hyperconverged adopters tend to manage highly scaleable, heavily virtualized environments.

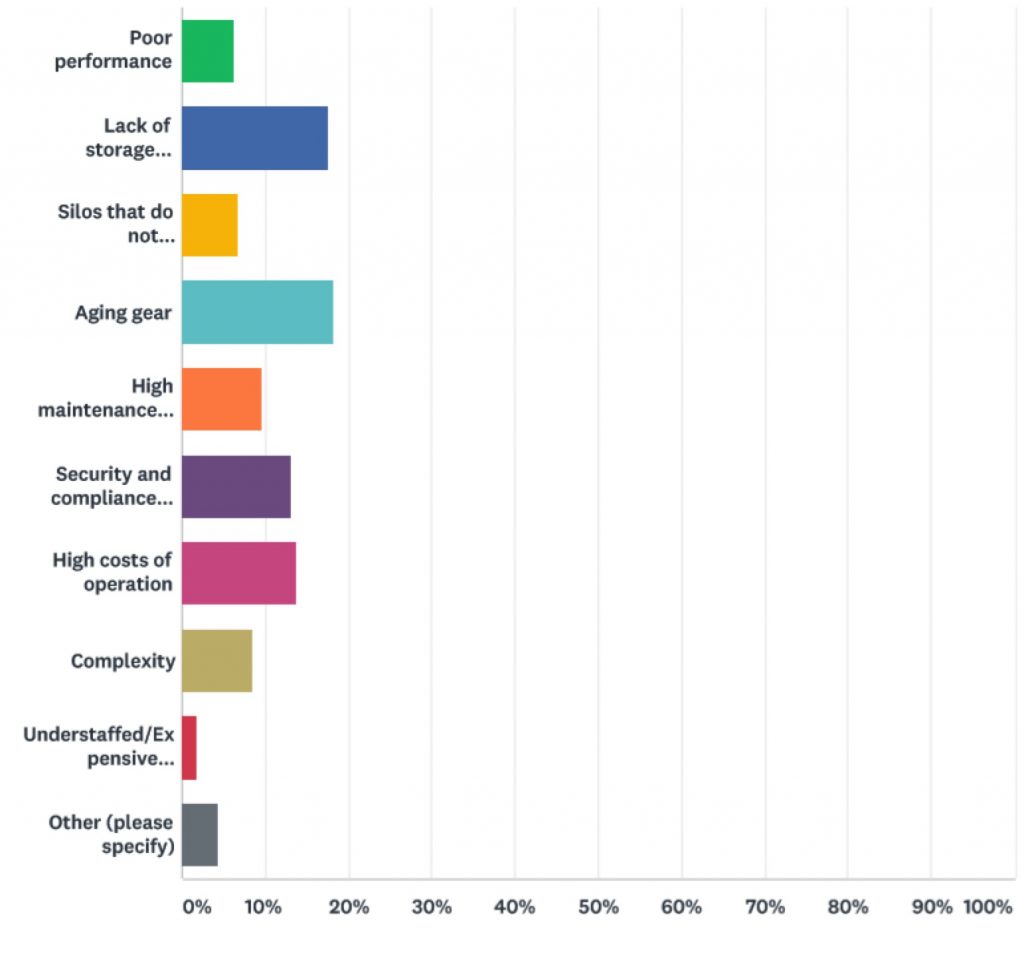

Storage Challenges

What is the biggest challenge involved

with operating your current storage infrastructure?

Survey respondents cited aging equipment and inadequate storage capacity as their major concerns, as both heavily impact business application performance.

• Respondents reported several leading challenges for managing and optimizing their storage environment. At the top was aging gear at 18% followed closely by lack of storage capacity at 17%, and high costs of operation and security/compliance issues at 13%.

• Regular technology refreshes upgrade ageing storage hardware and software but are often are complex and costly. Hidden (dark) data is also at risk in storage moves. Best practices include investing in policy-driven software to locate and move or delete data before retiring old technology for new storage systems.

• Despite temporary pain from refreshes, smart investing in new storage technologies and management automation overcomes obsolete storage infrastructure, insufficient capacity, high OPEX, and data security issues.

Storage Purchasing Decisions

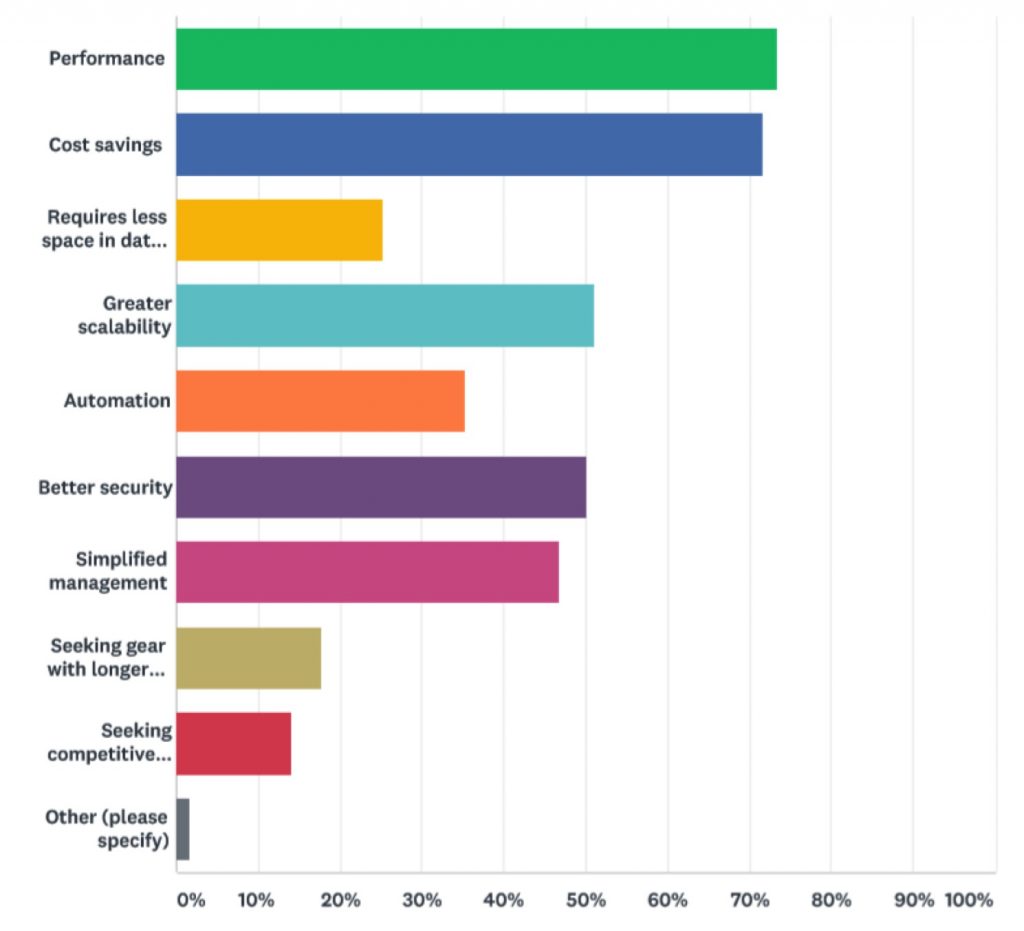

What are the key qualities you look for in new storage technologies?

• Although most respondents did not mention performance as a limiting factor in their current environments, 73% consider it a key qualification for any new storage purchase.

• Cost savings came in just slightly behind performance at 72%. Greater scalability is also important at 51%, better security at 50%, and automation at 35%.

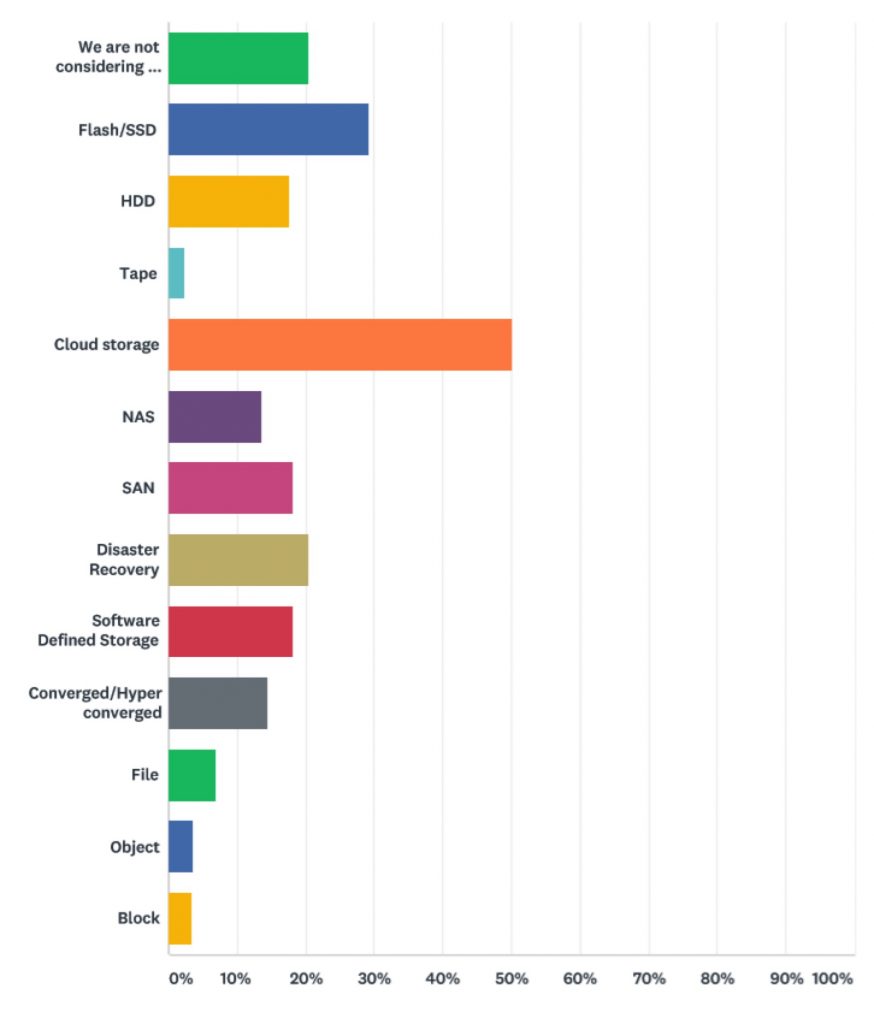

Which storage technologies is your company

seriously considering purchasing in next 2 years?

• At 50%, cloud storage is far and away the major planned purchase. More companies are relatively confident about security in the cloud and tend to trust the major providers. And because most providers offer free ingress and inexpensive per-gigabyte pricing for storage under a certain threshold, entry costs are low.

• At about half that percentage is flash/SSD at 29%, and DR products and services at 20%. We expect both of those segments to grow. Flash is steadily becoming less expensive, and more all-flash-arrays (AFA) with cost-effective storage tiers are entering the market. Cloud-based failover offerings and DR as a Service (DraaS) are also more widely accepted.

Storage Trends 2018: Key Takeaways

While the data above shows the statistical response, the following key takeaways delve into what these numbers mean for businesses and storage administrators:

1. Performance and cost drivers run neck-and-neck. Balancing performance and cost aren’t exactly new to storage administrators. What is new is the extreme storage performance that is now available with flash and flash accelerating technologies like NVMe. They are costlier than hybrid systems or lower cost AFAs, so it’s important for IT to conduct detailed cost analyses for high performance storage purchases.

2. Flat IT headcount meets fast-growing data. Most survey takers do not plan to decrease or increase their IT departments over the next two years. Not decreasing staff is good news in most organizations. But not increasing IT staff presents a challenge during fast-growing data and security challenges like Shadow IT. The key to managing storage with a smaller staff is automation: simplified upgrades, dynamic scalability, automatic monitoring and alerts, and policy-driven storage management.

3. Hyperconvergence is limited. Hyperconvergence is very good at what it does: it delivers performance and scalability for some workloads at a reasonable cost. However, no one type of infrastructure can handle every type of workload, and companies must make choices about where to invest data center dollars.

4. Flash adoption is steady but not roaring ahead of HDD. HDD’s installed base is massive and works well with all but the fastest high-performance applications. It makes no sense for IT to rip and replace disk-based or hybrid systems – and may not for years to come. Flash/SSD is still the high-performance choice: important for transactional systems but not critical for most business applications.

5. Cloud storage takes a big cut of IT’s budget, but IT is buying it anyway. Low monthly storage costs plus CAPEX and OPEX savings are the major drivers for storing data in the cloud. However, as cloud storage grows it takes careful financial management. Watch out for unexpected monthly charges, premium payments as your data grows, the cost of cloud tiering, and egress expenses.

Survey methodology

The total number of respondents was 374. Respondents came from small, mid-sized and large companies. 33% of respondents came from companies with less than 100 employees. 27% were from companies employing 100-999 employees. We broke down larger companies into 2 segments: 24% were from companies employing 1000-9999 people and 15% worked for companies employing 10,000+. (If we treat the enterprise as a single segment, then 39% of respondents work at large companies.)

Most respondents identified themselves as IT staff (37%) or manager/senior manager (34%). Others ranged between owners, directors, VPs, and C-level positions.

The survey crossed vertical industries, with most respondents coming from technology/internet, healthcare, and education. Financial, healthcare, manufacturing, and government also showed up in force with additional respondents from media and entertainment and energy/utilities.

Verticals by company Size

• Enterprise: The largest vertical at 28% was technology/Internet, followed by government at 17% and healthcare at 15%.

• Mid-sized: At 24%, education represented the largest vertical by a wide margin. Technology/Internet came in at 15% and the next closest was manufacturing/consumer goods at 10%.

• SMB: Technology/Internet pulled back into first place with 39%. The next closest at 10% was education. Financial, manufacturing/consumer goods, and retail/wholesale are neck and neck at 6%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter