Toshiba Finally Completes $18 Billion Sale of NAND Chip Unit to Bain

Expected to occur on June 1, 2018

This is a Press Release edited by StorageNewsletter.com on June 4, 2018 at 2:13 pmRegarding consummation of the transaction for the sale of Toshiba Memory Corporation (TMC), Toshiba Corporation announced that all conditions necessary to close the sale of all shares of Toshiba Memory Corporation (TMC), a wholly-owned subsidiary of Toshiba, to K.K. Pangea (hereinafter Pangea), a special purpose company formed and controlled by a consortium led by Bain Capital Private Equity, LP, had been met, and that the closing of the transaction was expected to occur on June 1, 2018.

Toshiba hereby gives notice that the closing of the sale has been completed as scheduled. As a result of the closing, TMC, which had been deemed a specified subsidiary company under applicable regulations, has been deconsolidated from Toshiba Group, and going forward is expected to be treated as an affiliate accounted for by the equity method.

1. Overview of the Sale

The purchase price is approximately ¥2 trillion, 300 million. Toshiba received a special dividend from TMC of approximately ¥118.0 billion funded from TMC’s other capital surplus on March 29, 2018, in accordance with the share purchase agreement. The purchase price was calculated by adjusting the difference between estimates of TMC’s net debt, working capital and accumulated capital expenditure as of the last day of last month that Toshiba provided to Pangea in accordance with the share purchase agreement, and target amounts for each, as mutually agreed by the parties. Post-closing, the parties will further confirm the difference between the estimated amounts and the actual amounts and will make any required adjustments to the purchase price.

Shares or equity interests (mochibun) in Flash Partners, Ltd., Flash Alliance, Ltd., and Flash Forward LLC, the three manufacturing joint venture companies established by Toshiba Group and Western Digital Corp.‘s SanDisk unit, were previously transferred to TMC in January, 2018.

2. Toshiba’s Re-investment in Pangea

Toshiba has re-invested a total of ¥350.5 billion in Pangea: approximately ¥109.6 billion in common stock with voting rights (approximately 40.2% of the issued common June 1, 2018 Toshiba Corporation stock); and approximately ¥240.9 billion in convertible preferred stock (approximately 40.8% of the issued convertible preferred stock). As a result, Toshiba has acquired approximately 40.2% of the voting rights in Pangea. It has granted each of Innovation Network Corporation of Japan and Development Bank of Japan, Inc. both of which have expressed interest in investing in Pangea, instruction rights* for 16.7% of its voting rights.

The closing of the sale and the re-investment deconsolidates TMC from Toshiba Group, and going forward TMC will be treated as an affiliate accounted for by the equity method.

Note: Instruction rights give a third party the right to instruct the owner of shares in respect of its exercise of its voting rights, though in certain circumstances Toshiba retains the right to exercise its voting rights at its own discretion.

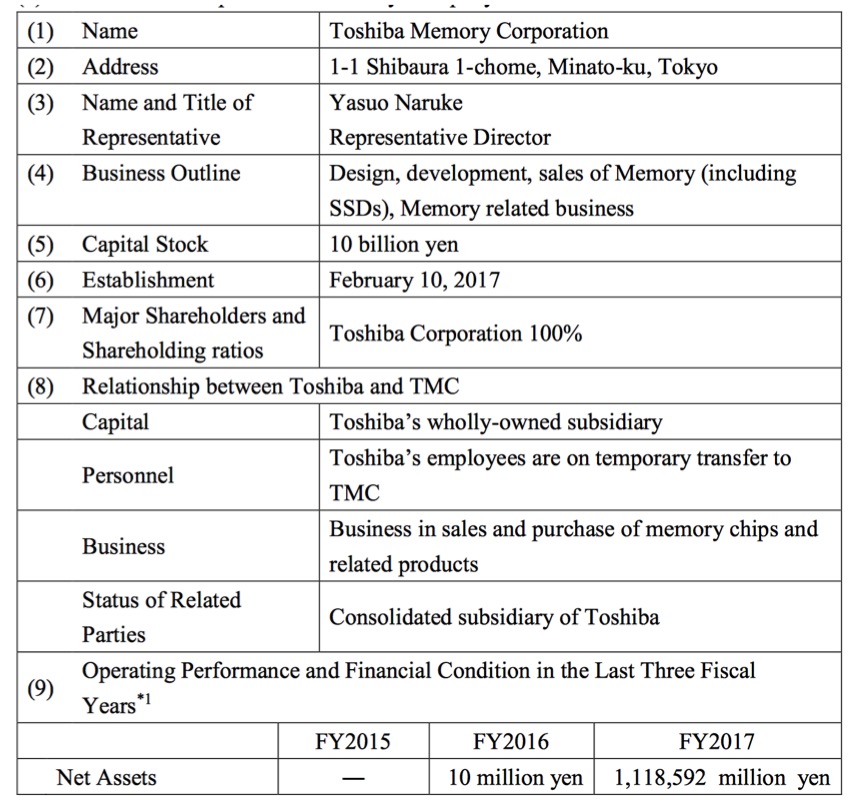

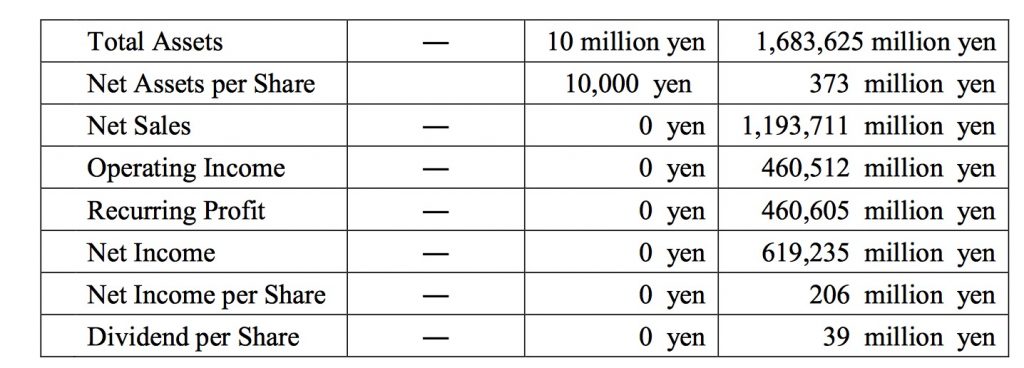

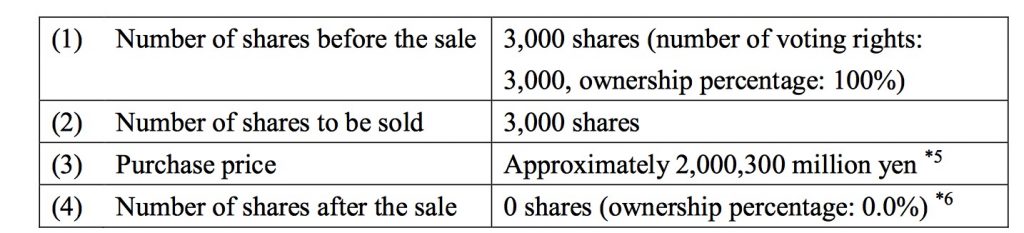

3. Overview of the Change to a Specified Subsidiary Company (1)

Overview of the Specified Subsidiary Company

*1: TMC was established on February 10, 2017, and took over operation of the memory business on April 1, 2017. Accordingly, its FY2016 figures include only its financial status for the non-operational period.

*2: In addition to TMC, 14 other companies will be deconsolidated from Toshiba Group and become Pangea’s subsidiaries or affiliates as a result of the sale.

(2) Overview of Purchaser*3

*3: After Toshiba’s re-investment

*4: Based on ownership of voting rights

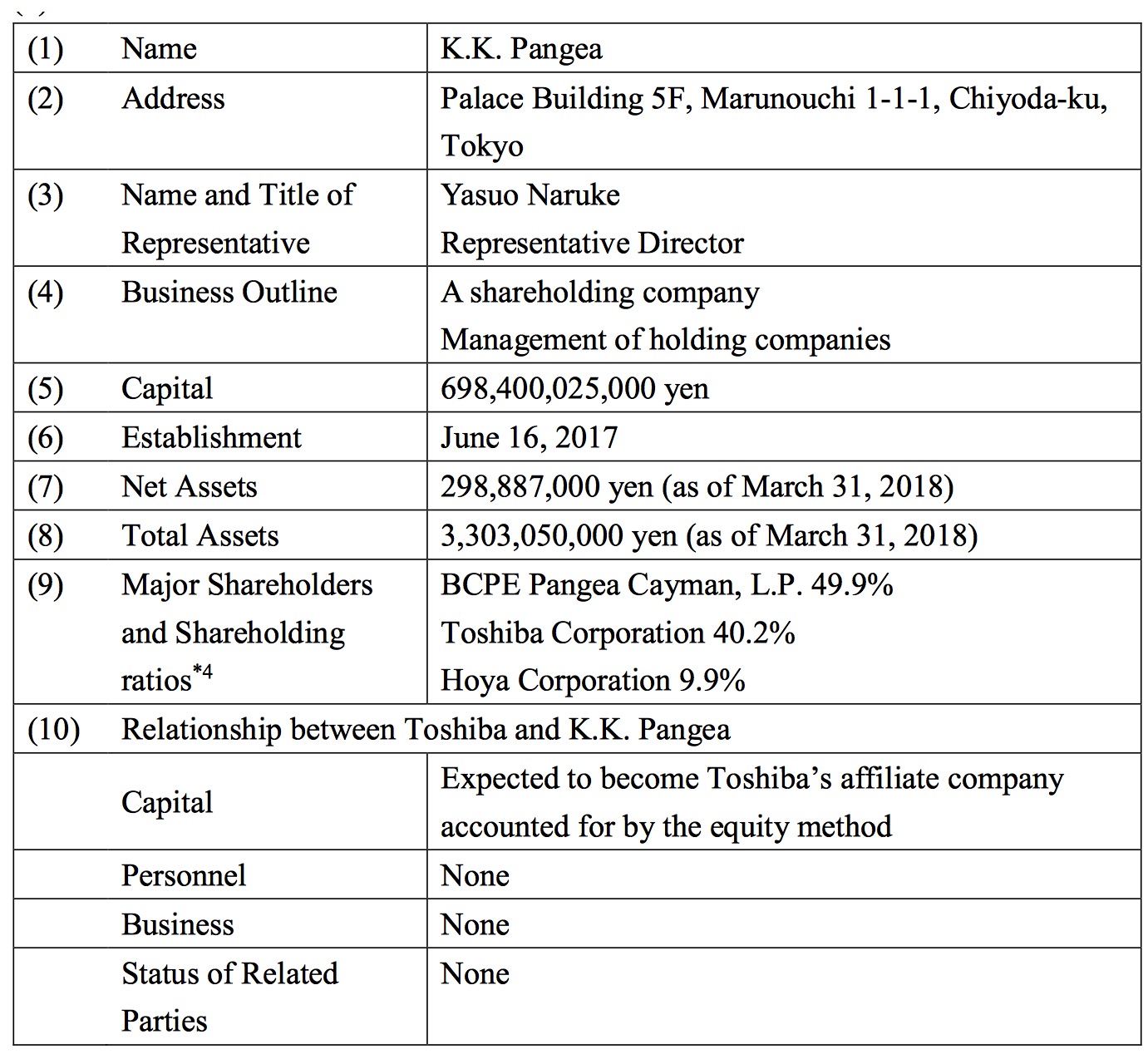

(3) Number of shares to be sold, purchase price and number of shares held by Toshiba before and after the sale

*5: The purchase price was calculated by adjusting the difference between estimates of TMC’s net debt, working capital and accumulated capital expenditure as of the last day of last month that Toshiba provided to Pangea in accordance with the share purchase agreement. The parties will further confirm the difference between the estimated amounts and the actual amounts and will make any required adjustments to the purchase price.

*6: Due to Toshiba’s re-investment in Pangea, TMC is expected to become an affiliate of Toshiba accounted for by the equity method.

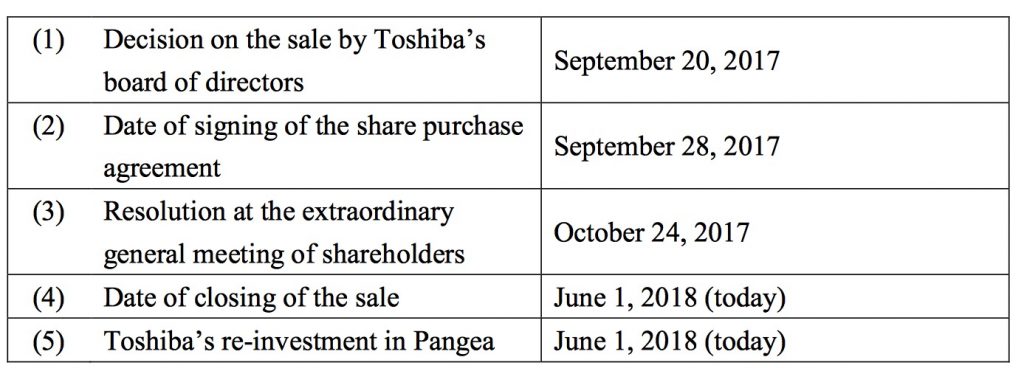

(4) Schedule

4. Future Outlook

As a result of the sale and re-investment, Toshiba will record a profit from the sale of approximately ¥970.0 billion (before tax) in its FY2018 consolidated business results. The FY2018 consolidated business results forecast announced on May 15, 2018 made allowance for the closing of the sale and the re-investment by FY2018 1Q and is unchanged. The impact on Toshiba’s non-consolidated business results is still under review, and figures may be revised to reflect a ¥1.2 trillion improvement in net income. The book value of TMC’s shares in Toshiba’s non-consolidated accounts, the basis in calculating the profit from the sale, is different from that in Toshiba’ consolidated accounts, causing a difference between Toshiba’s consolidated and non-consolidated business results.

On May 15, 2018, in ‘Development of the Toshiba Next Plan, ’ Toshiba announced that it would create the ‘Toshiba Next Plan, ’ a five-year transformation plan, and announce the details of the plan within this year. In creating the plan, Toshiba will consider and determine allocations of resources, including investments in growth, structural reform, financial solidity, impact on credit ratings, and shareholder returns, such as share buybacks, from the perspective of maximizing the company’s enterprise value. With regards to financial solidity and the impact on credit ratings, Toshiba will take into account evaluations by rating agencies, as well as the medium- and long-term shareholders’ equity ratios of competitors. Also, Toshiba will consider implementing early shareholder returns through measures that include closing its accounts to prepare temporary financial statements (non- consolidated) after FY2018 2Q to incorporate the profit from the sale into the non- consolidated distributable amount. Toshiba also intends to implement early shareholder returns proactively after disclosure of the Toshiba Next Plan, and will decide the actual measures and timing taking into account legal and other restrictions, such as insider trading regulations under the Financial Instruments and Exchange Act and the Companies Act.

Toshiba will promptly announce any matters that require further disclosure.

Comments

$18 billion is one of the the highest amount never spent for a merger and acquisition in the history the worldwide storage industry after Dell by EMC for $63 billion in 2015. Next one is $16 billion for the acquisition of SanDisk by Western Digital the same year.

Toshiba has no choice that selling lucrative and growing business TMC after the disastrous acquisition of US nuclear energy firm Westinghouse to avoid to be delisted from the stock exchange and risking bankruptcy.

This deal took a long time, as the purchase was revealed on September 28, 2017, because WDC was contesting the operation and many required anti-trust approvals have been granted, especially from Chinese authorities finally approving the transaction last May, and relatively rapidly if you remember what they did to accept the acquisition of HGST by WDC and Samsung HDD business by Seagate and adding a lot of conditions.

The real buyer of TMC is K. K. Pangea, a Japanese company formed for purposes of the acquisition, representing essentially Bain Capital Private Equity, led by Korean chip maker SK Hynix and also Apple, Dell, Kingston Technology and Seagate, firms who need crucially NAND chips and will get them at more favorable conditions. Apple include them in all its portable phones, smartphones and computers integrating only SSDs. Seagate is not a big actor in SSDs but used these chips being placed into all its HDD controllers.

Hoya Corporation, especially in glass disks for HDDs, announces its intention to invest ¥27 billion in Pangea, subject to some closing conditions.

Pangea will inherit the assets of TMC, the joint venture between Toshiba, the majority owner of the entity, and SanDisk, a wholly-owned division of Western Digital, that has a lot of IPs on NAND and invests in several manufacturing plants with TMC.

Toshiba and Western Digital-owned SanDisk share stakes in three joint manufacturing joint-venture companies, and equity stakes in Flash Partners, Ltd., Flash Alliance, Ltd., and Flash Forward LLC.

Under the terms of the deal, Toshiba repurchases 40% of common stock, which gives him voting rights in Pangea.

As we commented formerly, Toshiba revealed nothing about the future of its HDD business with poor value.

Read also:

Toshiba Said to Have Received All Required Anti-Trust Approvals

Including China, for sale of Toshiba Memory Corporation

2018.05.18 | Press Release

Statement by Bain Capital on Antitrust Approval in China

Toshiba Pessimistic for Likelihood of $18 Billion Flash Chip Deal

Near-term Chinese antitrust approval unlikely

2018.05.10 | In Brief

Toshiba Memory Corporation Answers to Press Reports

On China's anti-monopoly regulator

2018.04.23 | Press Release

Update on Signing of Share Purchase Agreement for Sale of Toshiba Memory Corporation

Closing of transaction now anticipated in April 2018 or thereafter

2018.04.02 | Press Release

Sale of Toshiba Memory Uncertain

Failing to gain approval from Chinese anti-trust authorities

2018.03.28 | In Brief

Toshiba Entered Into Share Purchase Agreement for Sale of All Shares of Toshiba Memory Corporation

Intends to close transaction by end of March, 2018.

2018.03.27 | Press Release

Western Digital to Invest $4.68 Billion in Joint Venture With Toshiba

Over next three years in NAND memory chip plants

2018.03.14 | In Brief

Toshiba Expects to Complete NAND Chip Unit Sale by June

Awaiting antitrust regulatory approval from China

2018.03.09 | In Brief

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter