Pure Storage: Fiscal 1Q19 Financial Results

Sales up 40% but huge loss growing Y/Y

This is a Press Release edited by StorageNewsletter.com on May 23, 2018 at 2:16 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

182.6 | 255.9 | 40% |

| Net income (loss) | (57.2) | (64.3) |

Pure Storage, Inc. announced financial results for its first quarter ended April 30, 2018.

Key quarterly financial highlights:

• Revenue: $255.9 million, up 40% Y/Y, exceeding the high end of guidance;

• Operating margin: -24.2% GAAP; -6.0% non-GAAP, up 7.7 ppts and 7.9 ppts Y/Y, respectively;

• Operating cash flow: $18.6 million, free cash flow without ESPP impact: $8.6 million.

“Pure has delivered another strong quarter as we lead the industry in delivering new data-centric architectures that enable enterprises to succeed both today and tomorrow,” said CEO Charles Giancarlo. “The combination of our innovative business model, first-to-market technology innovations, and focus on customer success drove continued momentum in Q1.”

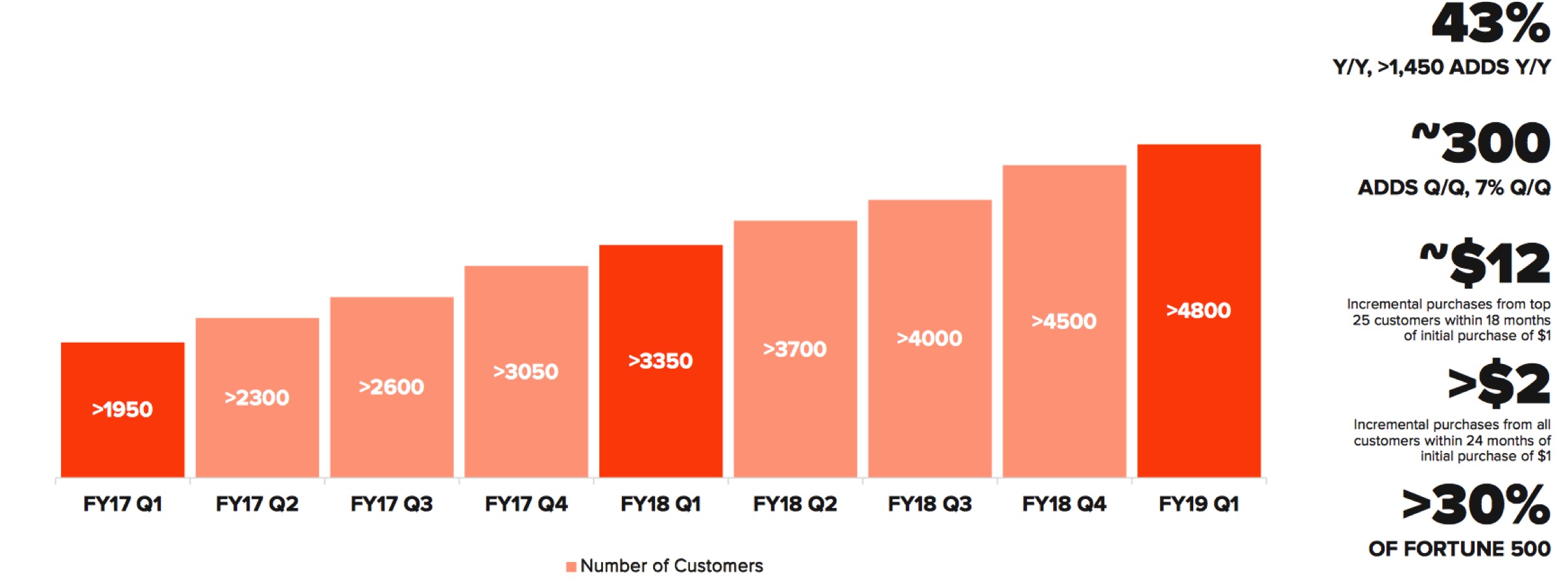

Approximately 300 new customers joined Pure Storage in the quarter, increasing the total to more than 4,800 organizations. New customer wins in the quarter include ALDI International, Barnes & Noble Education, Inc., U.S. Department of Energy, Paige.AI, and Panasonic Taiwan.

“Q1 marked a great start to fiscal 2019, growing 40% year-over-year in revenue and exceeding our operating margin goal,” said Tim Riitters, CFO. “We are focused on driving industry-leading growth and profitability in our business.”

2Q19 guidance:

• Revenue in the range of $296 million to $304 million

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of -7.0% to -3.0%

FY19 guidance:

• Revenue in the range of $1.320 billion to $1.370 billion

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of 0% to 4%

Comments

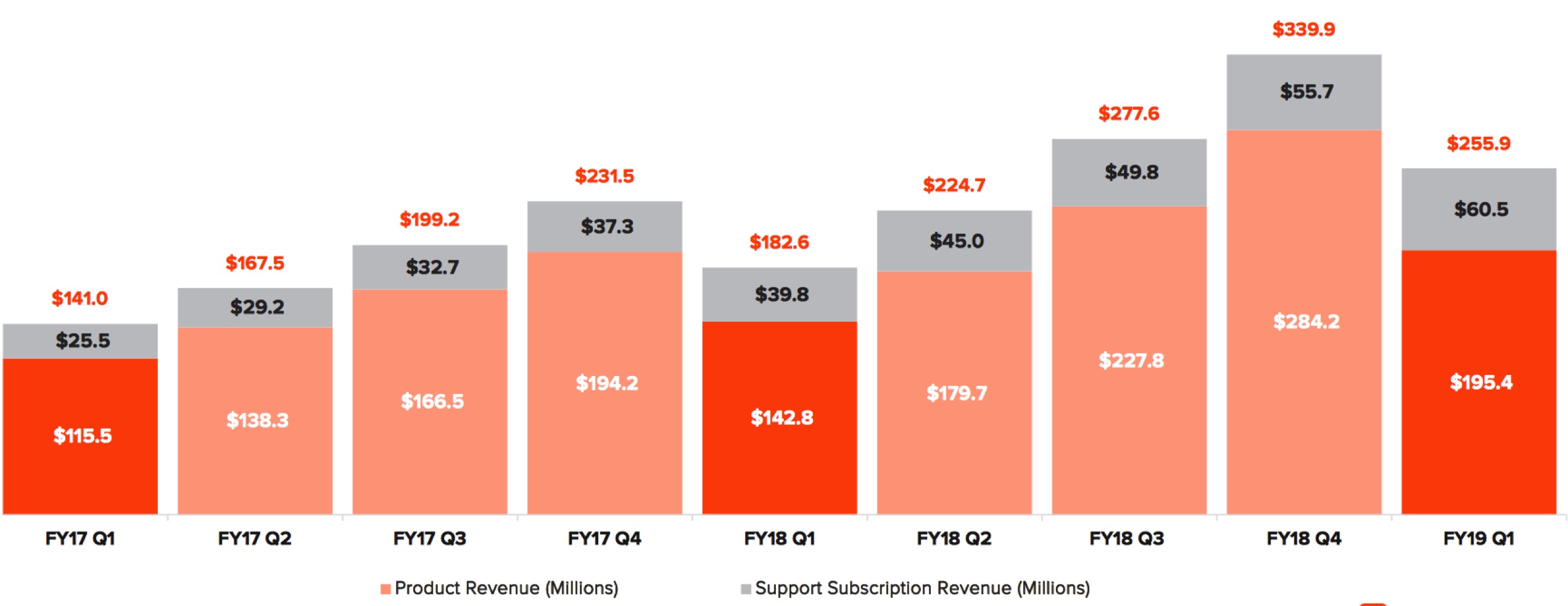

Quarterly revenue

Click to enlarge

Customers

Click to enlarge

Pure is continuing to grow very fast but here with a pause, as revenue decreased 24% sequentially - but up 40% Y/Y, even if it exceeded revenue and operating margin guidance.

Furthermore the company never was able to be profitable. And it's going worst. Net loss was $11.9 million last quarter and it increased to $64.3 million for the most recent three-month period after a figure of $57.2 million in 4FQ18.

Product revenue grew 37% to $195.4 million and support subscription revenue grew 52% Y/Y to $60.5 million.

Repurchase rates remain steady with 70% of the business coming from existing customers.

72% of sales came from the United States and 28% came from international markets from 21% in the year ago quarter.

Total headcount at the end of the period was 2,300 employees compared to 2,100 for prior quarter end and 500 over the same time a year ago.

For next quarter the AFA vendor expects revenue at a $300 million midpoint, up 17% from 1FQ19.

For the full year revenue is expected in the range of $1.320 billion and $1.370 billion or $1.345 billion at the midpoint - up 31% Y/Y - representing a $10 million raise at the midpoint from the guide provided during company's last earnings call.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter