Western Digital: Fiscal 3Q18 Financial Results

HDD shipments falling 14% but average price up 14% Q/Q

This is a Press Release edited by StorageNewsletter.com on April 27, 2018 at 2:30 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

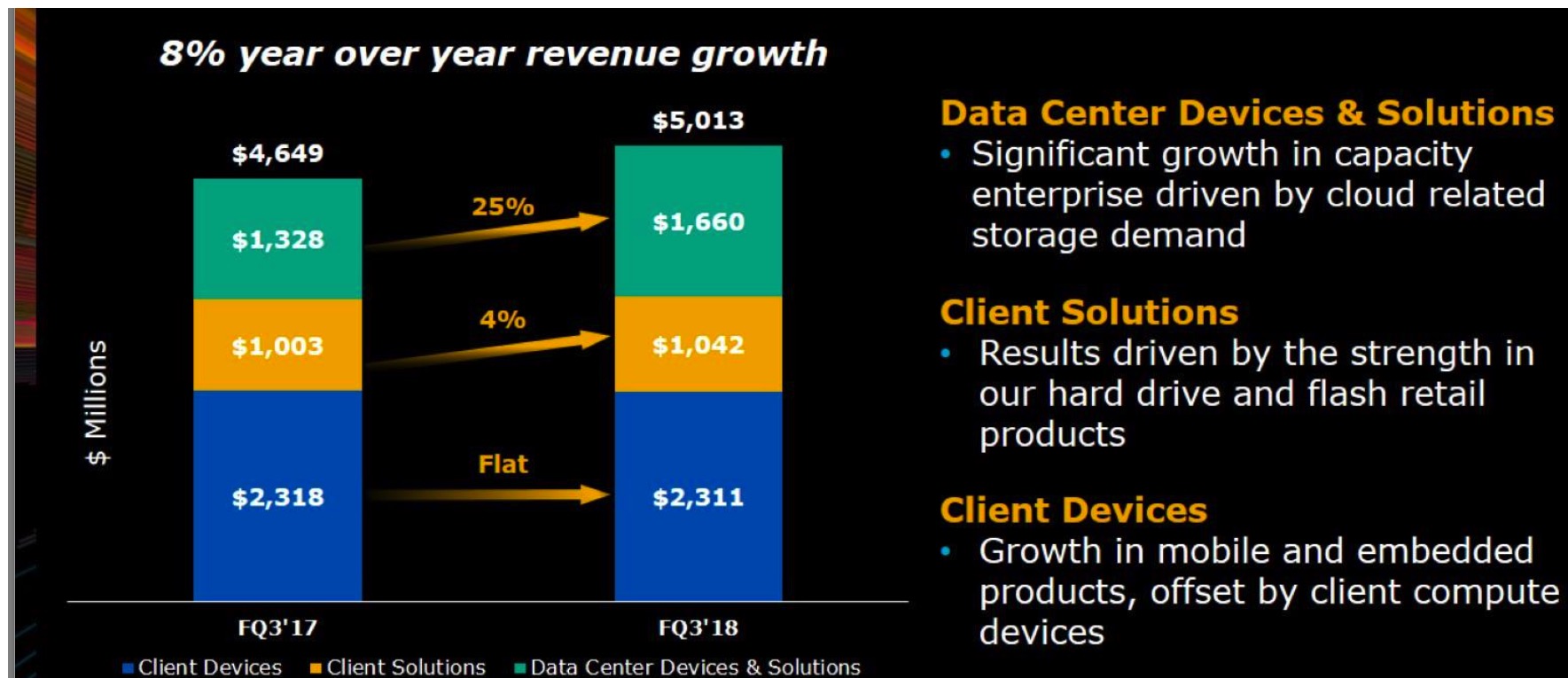

| Revenue | 4,649 | 5,013 | 14,251 | 15,530 |

| Growth | 8% | 9% | ||

| Net income (loss) | 248 | 61 | 137 | (81) |

Western Digital Corp. reported revenue of $5.0 billion for its third fiscal quarter ended March 30, 2018.

Operating income was $914 million with net income of $61 million, or $0.20 per share. The GAAP net income for the period includes debt extinguishment costs related to the company’s debt financing transactions. Excluding these charges and after other non-GAAP adjustments, the company achieved non-GAAP operating income of $1.3 billion and non-GAAP net income of $1.1 billion, or $3.63 per share.

In the year-ago quarter, the company reported revenue of $4.6 billion, operating income of $525 million and net income of $248 million, or $0.83 per share. Non-GAAP operating income in the year-ago quarter was $1.0 billion and non-GAAP net income was $716 million, or $2.39 per share.

The company generated $1.0 billion in cash from operations during the third fiscal quarter of 2018, ending with $5.1 billion of total cash, cash equivalents and available-for-sale securities.

On Jan. 27, 2018, the company declared a cash dividend of $0.50 per share of its common stock, which was paid to shareholders on April 16, 2018.

“The power and agility of our platform and our global team’s sustained focus on operational execution drove another quarter of strong financial performance for Western Digital,” said Steve Milligan, CEO. “We saw particular strength in our high capacity enterprise HDDs, which achieved record quarterly revenue. A compelling portfolio of HDD and NAND flash products coupled with favorable macroeconomic conditions positions the Western Digital platform to drive further value for our customers and other stakeholders.“

Comments

Revenue is down 6% Q/Q and up 8% Y/Y as HDD shipments is falling 14% Q/Q and 7% Y/Y, compensated by average drive price augmenting drastically, 14%, from $63 to $72, a record since many years, reason being huge number of entreprise units sold for the quarter. That's also why exabytes per HDD shipped is up quarterly from 2,253 to 2,755GB, and total exabytes shipped just surpasses a record 100TB.

For all other categories, devices shipped were decreasing, total being at 36.4 million down 14% Q/Q.

WDC now estimate that on a year-over-year basis in the first half of calendar 2018, the capacity enterprise market is expected to grow at least 75%, well above prior estimate of 60%+. It is also increasing previous estimate for exabyte growth for the full calendar 2018 of greater than 50% to more than 65%. Long-term exabyte growth estimate of 40% remains unchanged. Vendor's estimate for industry bit growth in calendar 2018 remains unchanged at the high end of its long-term range of 35% to 45%

For CFO Mark Long, "The March quarter revenue for Datacenter Devices and Solutions was $1.7 billion, an increase of 25% year-over-year. Our Data Center business continues to be driven by growth in cloud-related storage. (...) This was led by strong demand for capacity enterprise hard drives. Client Devices revenue was $2.3 billion, which was essentially flat year-over-year. We had significant growth in Mobile and Embedded products, offset by client compute devices. Client Solutions revenue was $1 billion, an increase of 4% year-over-year, driven by strength in our hard drive and flash retail products."

About flash, CEO Steve Milligan comments: "During the third quarter, we saw the market environment continue to normalize with expected price declines. We continue to deploy our 64-layer 3D NAND technology across our product portfolio and will be ramping our 96-layer technology as planned throughout calendar 2018. We expect the flash market to continue to be constructive with the possibility of a constrained supply environment in the second half of calendar 2018."

Like Cordano, president and COO, stated on technology: "From a hard drive technology standpoint, we are on track to begin sampling our groundbreaking MAMR recording technology in the second half of calendar 2018 with a meaningful production ramp expected in calendar 2019. (...) Fab 6 operations have commenced and we expect initial output in the third calendar quarter of 2018 as indicated. For calendar 2018, we expect BiCS3 to constitute more than 70% of total bit supply and the manufacturing ramp of 96-layer 3D flash has commenced, with meaningful output expected in the third calendar quarter."

Company expects revenue of $5 billion to $5.1 billion for next quarter, about the same figure recorded in 3Q18.

Volume and HDD Share

| WD's HDDs (units in million) |

Enterprise | Desktop | Notebook | CE | Branded | Total HDDs | HDD share | Exabyte Shipped |

Average GB/drive |

ASP |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 61.0 | 43.4% | 66.4 | 1,087 | $60 |

| 3Q15 | 7.5 | 13.5 | 18.8 | 8.6 | 6.1 | 54.5 | 43.6% | 61.3 | 1,123 | $61 |

| 4Q15 | 7.2 | 11.6 | 15.5 | 9.1 | 5.2 | 48.5 | 43.7% | 56.2 | 1,159 | $60 |

| 1Q16 | 7.2 | 11.7 | 15.8 | 11.5 | 5.6 | 51.7 | 43.6% | 63.5 | 1,228 | $60 |

| 2Q16 | 7.0 | 12.5 | 15.3 | 8.5 | 6.4 | 49.7 | 43.2% | 69.1 | 1,390 | $61 |

| 3Q16 | 6.4 | 10.7 | 13.6 | 7.3 | 5.2 | 43.1 | 43.2% | 63.7 | 1,443 | $60 |

| 4Q16 | 6.0 | 7.9 | 11.4 | 10.0 | 4.7 | 40.1 | 40.7% | 66.1 | 1,648 | $63 |

| 1Q17 | 6.5 | 9.0 | 14.6 | 12.3 | 5.2 | 47.5 | 41.9% | 80.0 | 1,684 | $61 |

| 2Q17 | 6.4 | 9.9 | 14.7 | 8.3 | 5.5 | 44.8 | 39.9% | 77.8 | 1,737 | $62 |

| 3Q17 | 5.8 | 9.4 | 11.3 | 7.7 | 4.9 | 39.1 | 39.6% | 74.2 | 1,898 | $63 |

| 4Q17 | 6.2 | 8.9 | 10.3 | 9.6 | 4.3 | 39.3 | 40.8% | 81.2 | 2,066 | $63 |

| 1Q18 | 6.1 | 9.5 | 11.4 | 10.3 | 4.9 | 42.2 | 40.5% | 87.4 | 2,071 | $61 |

| 2Q18 | 6.8 | 10.2 | 10.9 | 8.6 | 5.8 | 42.3 | NA | 95.3 | 2,253 | $63 |

| 3Q18 | 7.6 | 7.9 | 9.7 | 6.1 | 5.1 | 36.4 | NA | 100.3 | 2,755 | $72 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter