In Cloud IT Environments, Spending on Storage Platforms to Grow 6% in 2018 – IDC

Total spending on IT infrastructure products (server, enterprise storage, and Ethernet switches) in cloud environments expected to total $52.3 billion next year up 11% Y/Y

This is a Press Release edited by StorageNewsletter.com on April 12, 2018 at 2:21 pmAccording to a forecast from the IDC‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, total spending on IT infrastructure products (server, enterprise storage, and Ethernet switches) for deployment in cloud environments is expected to total $52.3 billion in 2018 with Y/Y growth of 10.9%.

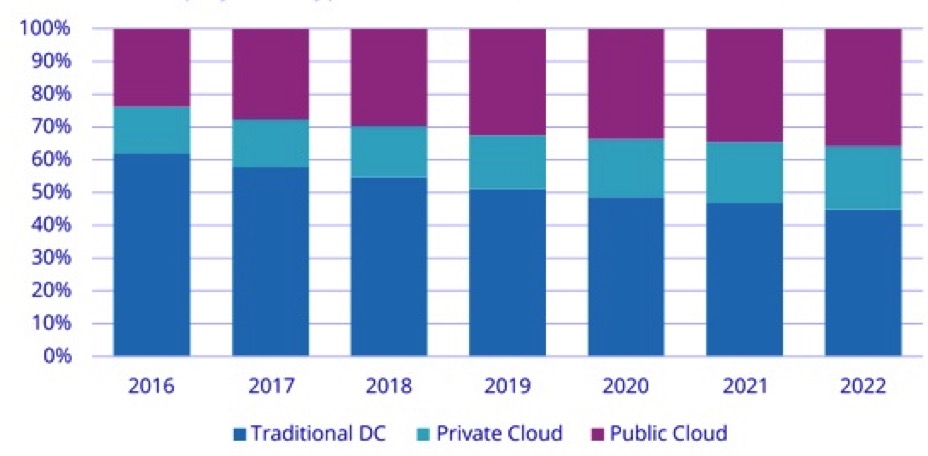

WW Cloud IT Infrastructure Market Forecast by Deployment Type 2016-2022

(shares based on value)

Public cloud datacenters will account for a majority of this spending, 65.9%, growing at the fastest annual rate of 11.3%. Off-premises private cloud environments will represent 13.0% of cloud IT infrastructure spending, growing at 12.0% year over year. On-premises private clouds will account for 61.7% of spending on private cloud IT infrastructure and will grow 9.1% Y/Y in 2018.

WW spending on traditional, non-cloud, IT infrastructure is expected to decline by 2.0% in 2018 but nevertheless will account for the majority, 54.7%, of total end user spending on IT infrastructure products across the three product segments, down from 57.8% in 2017. This represents a faster share loss than in the previous three years. The growing share of cloud environments in overall spending on IT infrastructure is common across all regions.

In cloud IT environments, spending in all technology segments, except for storage platforms, is forecast to grow at double digit rates in 2018. Ethernet switches and compute platforms will be the fastest growing at 20.9% and 12.4%, respectively, while spending on storage platforms will grow 6.0%. Investments in all three technologies will increase across all cloud deployment models – public cloud, private cloud off-premises, and private cloud on-premises.

Long-term, IDC expects spending on off-premises cloud IT infrastructure will grow at a five-year CAGR of 10.8%, reaching $55.7 billion in 2022. Public cloud datacenters will account for 83.6% of this amount growing at a 10.6% CAGR while spending on off-premises private cloud infrastructure will increase at a CAGR of 11.4%. Combined with on-premises private cloud, overall spending on cloud IT infrastructure will grow at an 10.9% CAGR and by 2022 will surpass spending on non-cloud IT infrastructure. Spending on on-premises private cloud IT infrastructure will grow at a 11.5% CAGR, while spending on non-cloud IT (on-premises and off-premises combined) will decline at a 2.7% CAGR during the same period.

“Growing expansion of digital transfomation initiatives enables further adoption of cloud-based solutions around the globe. This will result in a continuous shift in the profile of IT infrastructure buyers. SaaS, PaaS, and IaaS offerings address a broad range of business and IT needs of enterprises from ‘lift-and-shift’ to emerging workloads. As a result, service providers’ demand for IT Infrastructure for delivering these offerings is growing steadily making them as a group a major buyer of compute, storage, and networking products,” said Natalya Yezhkova, research director, enterprise storage, IDC.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

IDC defines compute platforms as compute intensive servers. Storage platforms includes storage intensive servers as well as external storage and storage expansion (JBOD) systems. Storage intensive servers are defined based on high storage media density. Servers with low storage density are defined as compute intensive systems. Storage platforms does not include internal storage media from compute intensive servers. There is no overlap in revenue between compute platforms and storage platforms, in contrast with Server Tracker and Enterprise Storage Systems Tracker, which include overlaps in portions of revenue associated with server-based storage.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter