164 Million SSD Units Shipped in 2017, Up 11% From 2016 – Trendfocus

Annual exabyte growth was 21%.

This is a Press Release edited by StorageNewsletter.com on March 9, 2018 at 2:31 pmThis is an abstract of NAND/SSD Information Service CQ4 ’17 Quarterly Update – February 20, 2018 Executive Summary, by Trendfocus, Inc.

CQ4 ’17 SSD Shipments Rise 6% to 42.485 Million Units

Client SSDs and Enterprise PCIe Post Healthy Growth

Total SSD capacity shipped increased 7.7% sequentially to 16.7EB;

enterprise PCIe outpaced other categories,

jumping 48.3% Q/Q to more than 1.4 million units

• Multiple client SSD vendors had solid unit growth in both modules and DFF, with DFF shipments climbing nearly 13% to 14.56 million units.

• Client module SSDs still dominate over DFF with 22 million units and 5.641EB shipped – 46% higher capacity shipped than DFF.

• Although enterprise SATA SSDs posted the largest percentage drop of all SSD segments, it maintained the highest unit and capacity shipments of all enterprise segments at 3.780 million units and 3.274EB.

• SAS SSDs stalled for the second quarter in a row, falling 1.6% Q/Q to 0.710 million units, but capacity shipments grew slightly to 1.546EB.

• Enterprise PCIe shipments of 1.433 million units and 2.361EB maintains a solid second position of the three enterprise interfaces – the transition from SATA to PCIe continues in some segments.

• NAND bits shipped rose 7.8% sequentially to 49.66EB in CQ4 ’17 – for the year, NAND bits shipments grew nearly 39% to 175.51EB.

• 3D NAND accounted for 63% or 31.5EB in CQ4 ’17; NAND bits for phones and SSDs equaled 42% and 38%, respectively.

• For calendar year 2017, the industry shipped over 164 million SSD units, an 11.3% Y/Y increase, while annual exabyte growth was 20.8%, despite tight supply and pricing challenges seen throughout the year.

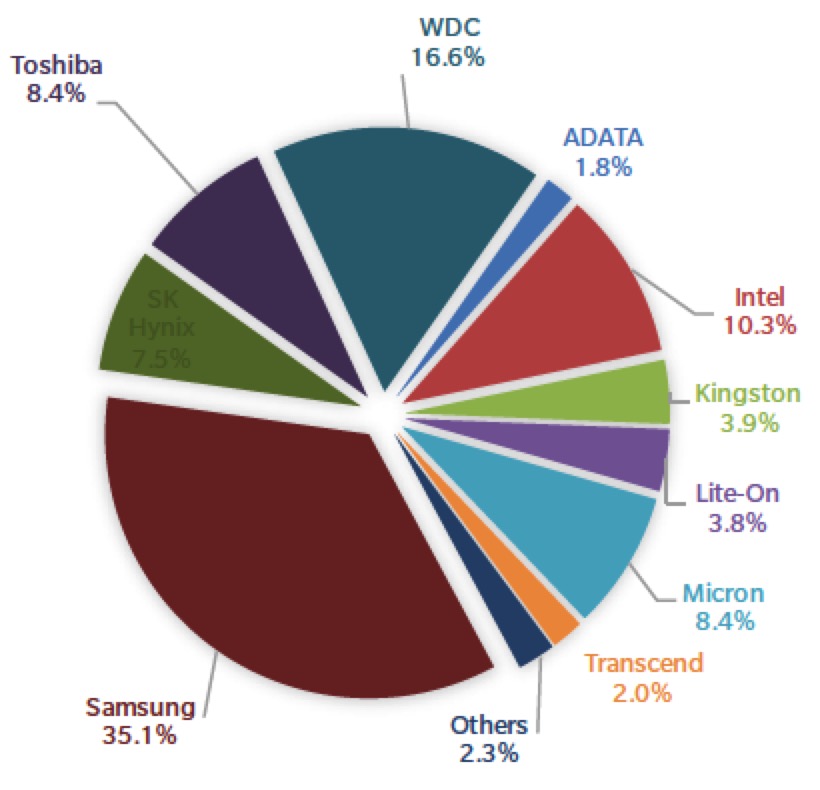

CQ4 ’17 Total SSD Market: 42.485 Million Units

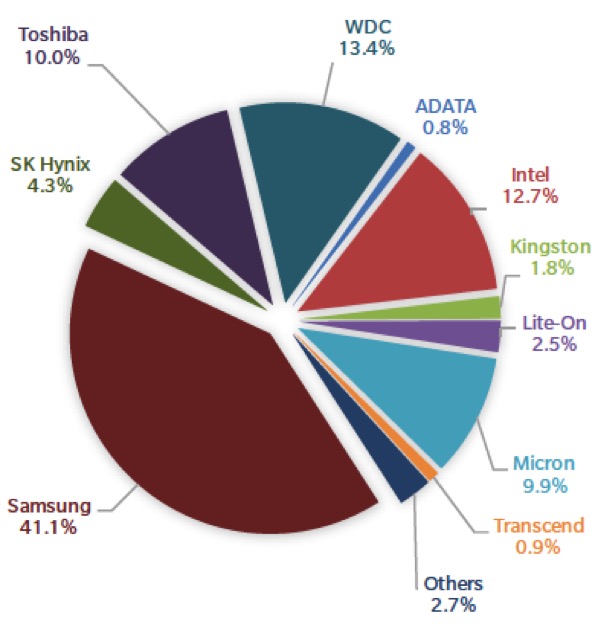

CQ4 ’17 Total SSD Market: 16.680EB

*Exabytes shipped for raw NAND reflect physical capacity. Exabytes shipped for SSDs reflect user capacity.

Comments

404 million HDDs were shipped in 2017 (down 5% Y/Y), 2.5X more compared to 164 million SSDs (up 11% Y/Y), according to figures from Trendfocus.

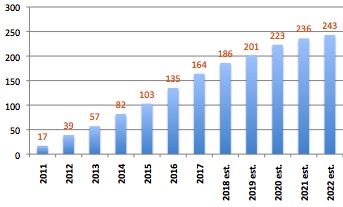

597 million SSDs were shipped from 2011 to 2017.

The growth trend in favor of flash units will continue but the global number HDDs shipped will be in front of SSDs at least until 2022.

SSDs shipped from 2011 to 2022

Units in million, 25% CAGR

(Source: IHS Supply, IHS Technology, Trendfocus, compiled by StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter