Micron: Fiscal 1Q18 Financial Results

SSD revenue to cloud/enterprise customer up 50% Q/Q

This is a Press Release edited by StorageNewsletter.com on December 20, 2017 at 2:31 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

3,970 | 6,803 | 71% |

| Net income (loss) | 180 | 2,678 |

Micron Technology, Inc. announced results of operations for its first quarter of fiscal 2018, which ended November 30, 2017.

Fiscal Q1 2018 Highlights

• Revenues of $6.80 billion, 71% higher compared with the same period last year

• GAAP net income of $2.68 billion, or $2.19 per diluted share

• Non-GAAP net income of $2.99 billion, or $2.45 per diluted share

• Operating cash flow of $3.64 billion, 220% higher compared with the same period last year

“Micron’s strong results were driven by double-digit sequential revenue growth in mobile, server and SSD applications, with expanded gross margins and improved profitability,” said president and CEO Sanjay Mehrotra. “We are making solid progress on our strategic priorities to drive cost competitiveness, deploy high value solutions and strengthen our balance sheet. We believe these actions will position Micron to benefit from the broad demand trends ahead of us.”

Revenues for the first quarter of 2018 were 11% higher compared to the fourth quarter of 2017, reflecting increased demand for our mobile, server, and SSD products. Overall consolidated gross margin of 55.1% for the first quarter of 2018 was higher compared to 50.7% for the fourth quarter of 2017 and reflects margin expansion for both DRAM and trade NAND products supported by ongoing strength in the pricing environment and a favorable product mix.

Investments in capital expenditures, net of amounts funded by partners, were $1.92 billion for the first quarter of 2018. During the quarter, Micron raised $1.36 billion from an equity offering and repurchased or converted $2.36 billion principal amount of our debt, lowering our total face value debt to $9.34 billion exiting the quarter. It ended the first quarter with cash, marketable investments, and restricted cash of $6.61 billion.

Comments

This is an excellent financial quarter (+71% for global revenue and a record at $6.8 billion) compared to one year ago and a good one (+11%) from previous three-month period following favorable NAND, DRAM, and SSD demand

About NAND and SSD only:

- • SSD revenue to cloud/enterprise customer up 50% Q/Q

- • Recovering from the flash component issue discussed in September earnings call that impacted last quarter's SSD sales.

- • Revenue from trade NAND increased by 2% sequentially and represented 27% of overall company revenue in this quarter and was up 47% Y/Y, driven by growth and market share gains in the SSD market and demand from the mobile and embedded markets. On a sequential basis, shipment quantities increased in the mid-single-digit range, while ASPs declined in the low single-digit range. Trade NAND non-GAAP gross margin was 49% in 1FQ18, up 9 percentage points from the prior quarter and up 26 percentage points from the year-ago quarter, reflecting a richer mix of sales into high-value end markets.

- • Shipped initial samples of 64-layer 3D NAND discrete UFS solution

- • Expect to achieve bit output crossover on 64-layer NAND during 2H18

- • 3D NAND development progressing, and Micron remains on track for initial output in the 2CQ18.

- • Introduced fast high-density 32GB NVDIMM-N, which combines DRAM and NAND to deliver a persistent memory solution that addresses intense data analytics workloads

- • Continued to make progress with 3D XPoint technology

- • For FY2019 and beyond, continues to assess scenarios for the fab cleanroom space required to implement technology transitions to future, more advanced 3D NAND nodes.

- • NAND bit output growth will be relatively greater in 2FQ18.

Micron' s industry outlook

- • Increasing SSD adoption across client and datacenter

- • Industry supply bit growth approaching 50% in year 2018

- • FY18 Micron bit to grow above industry

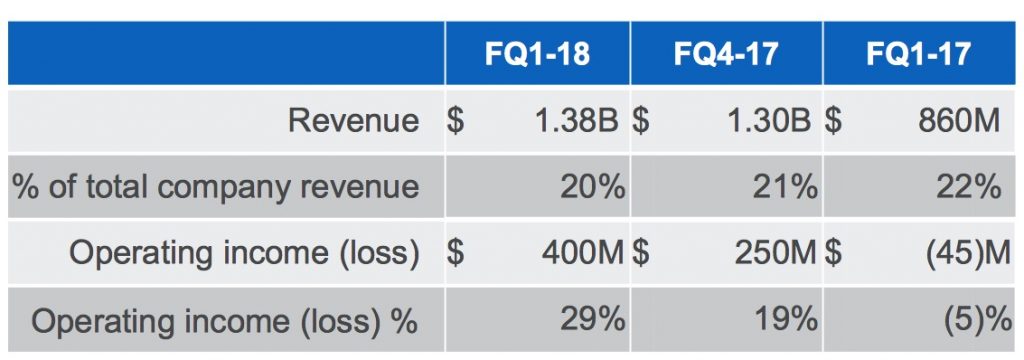

Storage Business Unit (SBU)

- • Revenue increased 61% Y/Y due to increased SSD market share

- • Record quarterly sales of SSDs

- • Revenues increased 7% sequentially to $1.4 billion

- • On a year over year basis, sales were up 61%, driven by increasing market share in SSDs.

- • SBU operating margins increased to 29% from 19% in the prior quarter, and negative 5% in 1FQ17. These results reflect higher value product mix and continued market acceptance of company's TLC 3D NAND based products.

Revenue of $6,800 to $7,200 million is expected next quarter or a small growth, between -0% and 6%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter