Oversupply of NAND Flash Market in 1Q18 – DRAMeXchange

Contract prices of SSD, NAND flash chips and wafer will finally drop.

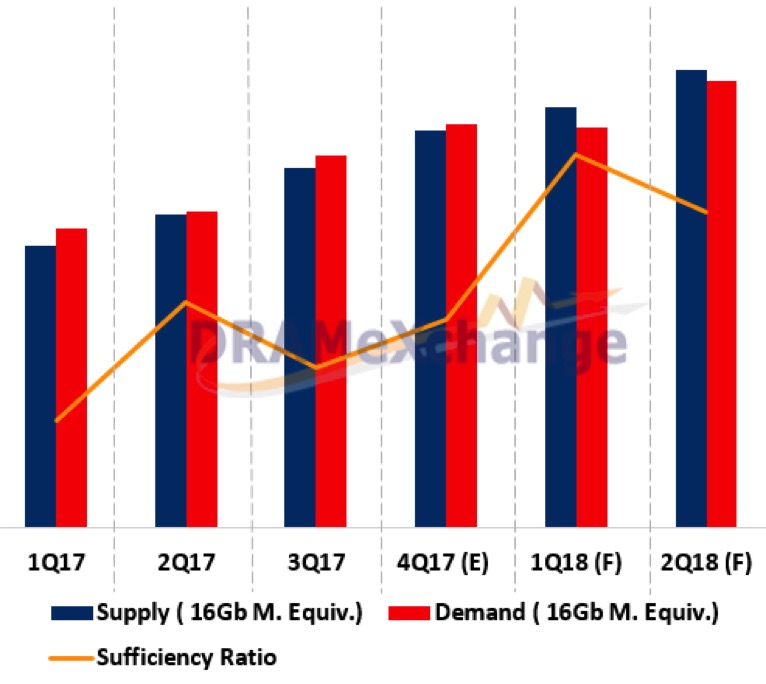

This is a Press Release edited by StorageNewsletter.com on December 12, 2017 at 2:37 pmDRAMeXchange, a division of TrendForce Corp., expects lower demand for NAND Flash in 1Q18 due to the traditional off-peak season.

The demand from notebooks, tablets, and smartphones (mainly Chinese branded smartphones) is estimated to drop by more than 15% compared with 4Q17, and that from server will remain generally the same.

Therefore, the overall bit demand is projected to drop by 0-5% compared with 4Q17.

On the other hand, as suppliers keep improving their production capacity and yield rate of 3D NAND flash, the bit output will grow by more than 5% compared with 4Q17. Consequently, NAND flash market will experience an oversupply in 1Q18 and contract prices of SSD, NAND flash chips and wafer, etc. will drop.

Supply and demand in NAND flash market

In 1Q17, NAND flash undersupply was aggravated as the transition from 2D-NAND to 3D-NAND caused production capacity loss, together with strong demand from Chinese vendors like Huawei, OPPO, and Vivo.

The contract prices of eMMC/UFS, client SSD, and enterprise SSD all recorded a growth of more than 10% in 1Q17 compared with 4Q16.

In 2Q17, the demand for NAND flash from notebooks and tablets increased, but that from Chinese branded smartphones was lower than expectation. Consequently, the price rise slowed down.

In 2H17, the launch of new iPhone and SSD demand from servers raised the demand in NAND flash market, widening the gap between supply and demand. Although there is undersupply, the price increase is limited. This is because the current price is approaching the highest level that OEM factories can afford after a long period of continuous price hike. In 4Q17, the demand growth from server slows down while Apply remains its strong demand.

In addition, Toshiba’s production troubles did not have noticeable effect on the industry as rumors expected.

Together with 3D NAND’s continuous capacity expansion, the supply will eventually meet up to the demand, thus achieving market balance and resulting in stable or slightly higher contract prices.

DRAMeXchange expects the NAND flash to experience another round of oversupply, leading to end-products’ lower prices and OEM’s higher intention to use more advanced products such as UFS and SSD with PCIe interface. They will also race to increase the memory content. As the result, when peak season comes in 2H18, the market situation of NAND flash has chance to reverse, ending up with tight supply again.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter