Why FalconStor Never Was and Will Become FalconStar ?

Quarterly sales of only $6.7 million after 17 years of business

By Jean Jacques Maleval | August 21, 2017 at 2:44 pmFalconStor Software was born in 2000 and got $33 million in financial funding. After seventeen years of business it remains a tiny storage company with revenue of only $6.7 million in most recent second financial quarter ended June 30, 2017, down 17% Y/Y, and $12.8 million for the first six months of fiscal year down 18% Y/Y. Net loss is $0.6 million and $0.8 million respectively for these two periods. Per comparison, seven years ago, for the six months ended in June 30, sales were $37.4 million, around three times more than today.

The company acquired only one small firm in 2002, IP Metrics Software, in high availability software and services for mission-critical networks, for $2.5 million. It also bought in 2015 source code distribution license on cloud-based predictive analytics monitoring system from stealthy start-up Cumulus Logic.

Why FalconStor never exploded and will never become FalconStar?

The problems concern essentially products and management.

Management

The company was founded by former Cheyenne Software executives and got $33 million in financial funding. It became public (IPO) via Network Peripherals in 2001.

Founder ReiJane Huai served as president and CEO since December 2000 and chairman since August 2001. In September 2010, he made improper payments to a customer, J.P. Morgan Chase Bank, was amid allegations of insider trading, and consequently fired. He shot himself in September 2011.

Later, in 2014, FalconStor was obliged to pay $5 million to settle class action lawsuit following government investigations concerning Huai.

Jim McNiel succeeds Huai and “voluntarily” resigned in 2013, replaced by Gary Quinn and then in 2017 by Todd Oseth remaining CEO for only six weeks.

It was just announced that new CEO of the company is Todd Brooks with no background in storage. He is an operating partner with Razorhorse Capital, leading the firm’s value creation practice for software portfolio companies. Previously, he was COO for Aurea Software and CEO for Update Software, a publicly traded company in Europe.

It was just announced that new CEO of the company is Todd Brooks with no background in storage. He is an operating partner with Razorhorse Capital, leading the firm’s value creation practice for software portfolio companies. Previously, he was COO for Aurea Software and CEO for Update Software, a publicly traded company in Europe.

“FalconStor’s long-term position as a leader in data storage management software, and extensive enterprise customer base are tremendous assets for the company,” said Brooks following his nomination. “To maximize these assets, the company’s commercial and operational fundamentals must be refocused. I am excited to lead these efforts and position FalconStor for long-term success delivering differentiated value to our customers and shareholders.”

Wait and see.

Products

FalconStor began into software only virtual tape library.

During an interview in 2010, McNiel at this time president and CEO, said:” I think the reason the company did not achieve the trajectory of some of its peers, there’s a number of opinions. One is that since the company is delivering software support in multiple platforms and multiple environments, we invested a lot of time and money in compatibility and interoperability, while our competitors were taking their software and putting it on a single hardware platform and doing a much smaller amount of work and delivering exactly what the customers needed at the time. So you had NetApp which was very focused and delivered its software in a hundred pound box. That’s one view. The second view of it is that our company was focused on supporting the OEMs, and today, EMC has to make 10 VTLs to make up for us selling one VTL with Hitachi Data Systems. So the discounts to the OEMs were significant. So the company didn’t get to recognize as much value as it was bringing to market.”

The firm was obliged to react vigorously and designed a new product, FreeStor, an innovative single, converged, hardware-agnostic data services software platform that works horizontally across all heterogeneous storage hardware, including all-flash arrays, hybrid flash, and HDD arrays. The platform is available since May 2015 and was released three months before.

The latest enhancements were delivered in May 2017, including QoS capability, chargeback support, improved levels of robustness and performance in I/O cluster and I/O multi-cluster failover, additional client agent management and monitoring, and the integration of optimized backup and de-dupe capability, allowing more efficient use of storage.

The software was successful but never compensate revenue in legacy products declining at a fast rate.

2FQ17 FreeStor Vs. Legacy Products

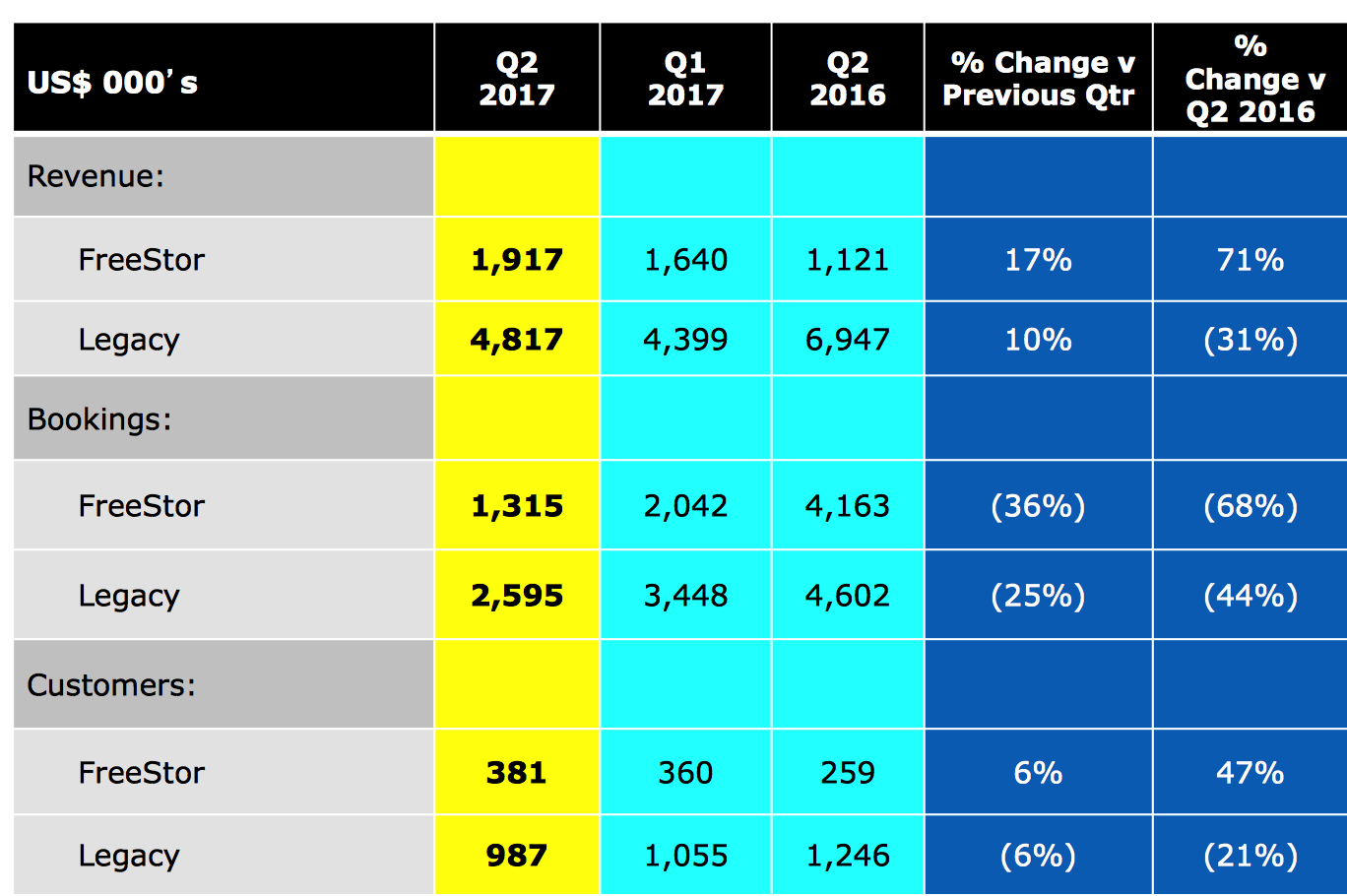

Now FreeStor has just 381 end users (compared to existing customer base of 1,368), not including the customers of MSP and OEM partners, representing an increase of 6% sequentially and 47% compared to the prior year for the quarter ended June 30, 2017. Revenue from the new platform increased 71% to $1.9 million for the second quarter of 2017, compared with 2FQ16.

Commenting on the last three-month period, CFO Dan Murale said: “Our bookings totaled 3.9 million (in 2FQ17) compared with 5.5 million in the previous quarter and 8.8 million in the second quarter of 2016. (…) Our total FreeStor revenue for the second quarter was 1.9 million compared with 1.6 million in the previous quarter and 1.1 million in the prior year, a 17% and 71% increase respectively. Total FreeStor bookings for the second quarter was 1.3 million compared with 2 million in the previous quarter and 4.2 million in the prior year.”

Restructuration

Current CEO Oseth stated during a conference call: “During 2FQ17, the company has taken steps to realign our cost structure with our revenue outlook. In doing so, we have reduced our annualized costs by over $10 million on a proforma basis which helps us in our pursuit of profitability while simultaneously increasing our revenue sequentially. The company has also taken key steps to focus on its existing customers and ensure they are receiving all of the benefits available with the FreeStor application.”

In June 2017, the board approved a plan to increase operating performance, resulting in a realignment and reduction in workforce and the change of CEO by Oseth. The plan was substantially completed as of June 30, 2017 and the 17-year company ended the quarter with 97 employees worldwide.

Cash balance at June 30, 2017 was $1.6 million, compared with $3.4 million at December 31, 2016.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter