Prices of NAND Flash Rose by 26% in 1H17 in China – China Flash Market

While prices of 2H17 will depend on output of 3D NAND from flash vendors.

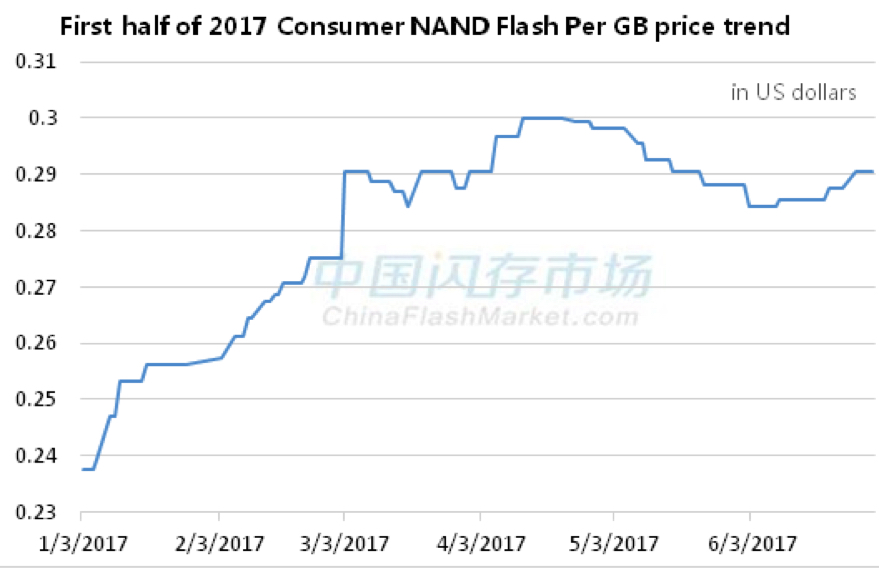

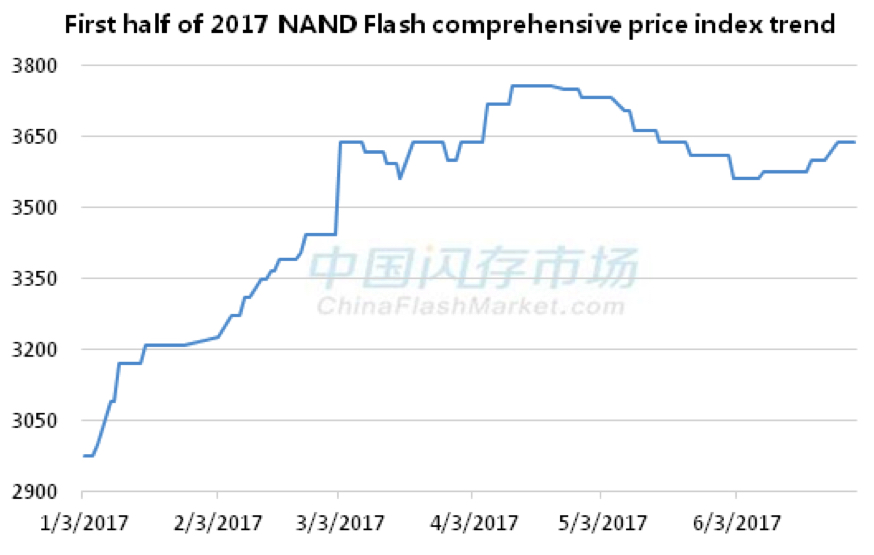

This is a Press Release edited by StorageNewsletter.com on July 25, 2017 at 3:18 pmDue to the circumstance that the constrict market conditions of NAND flash supply were not fully mitigated, as well as strong demand for SSD from data centers, enterprises and other areas, prices of NAND flash continued to soar in 2017 and reached its highest point in April.

According to the China Flash Market comprehensive price index, prices of NAND flash prices had been increasing by 26%, sales price of per gigabyte NAND flash in consumer category exceeded $0.3.

Due to the decline demand of smart phones, flat and other consumer electronics in China coupled with rising prices of NAND flash, the SSD market showed a downturn under the pressure of high costs. The comprehensive price index of NAND flash fell by 3.4%. However, the market demand went up in June, the market purchasing capability also picked up, on the other hand 64/72 layer 3D NAND flash from vendors will not be released until Q3, these factors had driven NAND flash prices pulled up again by 2.2%.

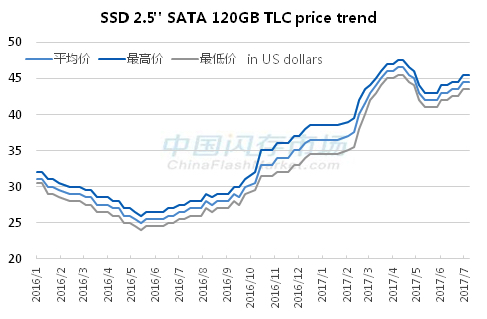

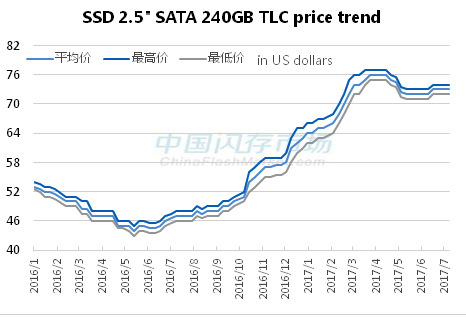

In mainstream SSD application market, the prices of SSD, affected by the short supply of NAND flash, had been increasing until 2Q16. The accumulated increment of the prices of the mainstream 120GB, 240GB TLC SSD was 46%. The prices trend of SSD from January to April in 2017 still showed an increasing. According to the quotes from China Flash Market, prices of mainstream 120GB TLC SSD had risen from $36.5 to $46.5, saw a 27% increasing. Prices of mainstream 240GB TLC SSD had increased by 19%, from $64 to $76.

Nevertheless, SSD marketing saw significant price inversion (purchase price higher than the selling price) due to the high costs of NAND flash. And thanks to downturn of the market in May, SSD faced its first price reduction in the year, the prices of SSD went up again in June since there is a warming up in market demand. According to the latest quote in July 11, price of 120GB TLC SSD maintain at $44.5 and 240GB TLC SSD at $73.

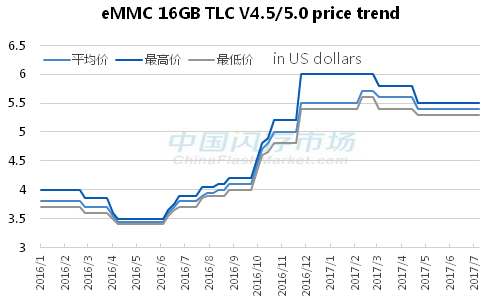

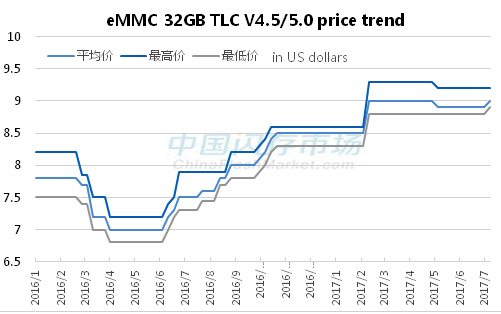

In the embedded products market, due to the short supply of NAND flash, prices of eMMC had been increased from the second half year of 2016, eMMC 16GB TLC eMMC 32GB TLC saw 59% and 21% increasing respectively. In the first half year of 2017, because of the short supply of NAND flash and affected shipment of smart phones manufactures, the rising rate of eMMC prices is limited, no more than 5%.

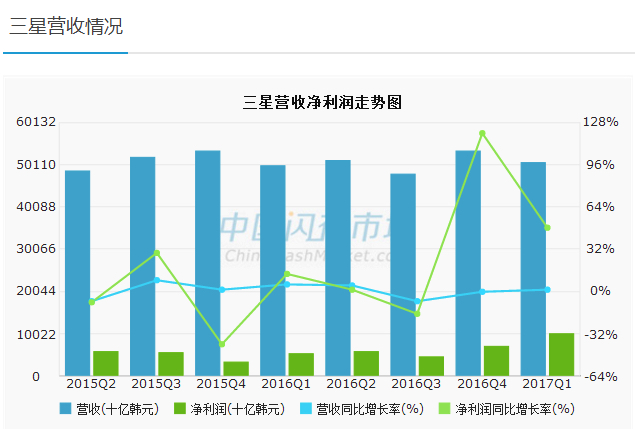

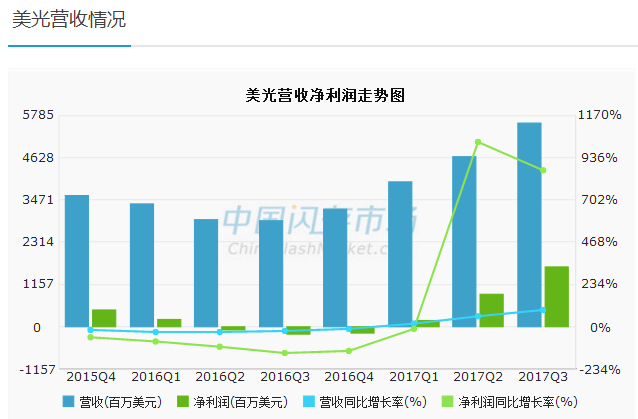

Although the shipments of storage related enterprises had declined due to the short supply of NAND flash, prices of NAND flash rose sharply offset the decline in shipments, coupled with high SSD market demand, profits of flash vendors still hit a historical high.

Flash vendors financial report

Estimated operating profit of Samsung in Q2 will peak a historical high at 14 trillion won, month-on-month increasing is 41% while year-on-year is 72%.

Revenue of Micron Q3 (March – May) month-on-month growth is 20%, and 92% increasing year-on-year. Net profit this year is $1.65 billion, while faced a loss of $215 million over the same period last year.

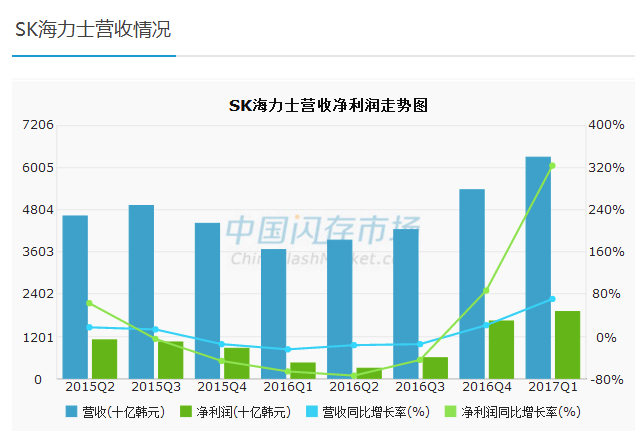

Since the price of NAND flash has increased, the revenue and profits of SK Hynix are gradually getting higher, revenue of 1Q17 was 6.29 trillion won, year-on-year increase was 72%; net profit was 1.9 trillion won, year-on-year increase was 324%, a record high.

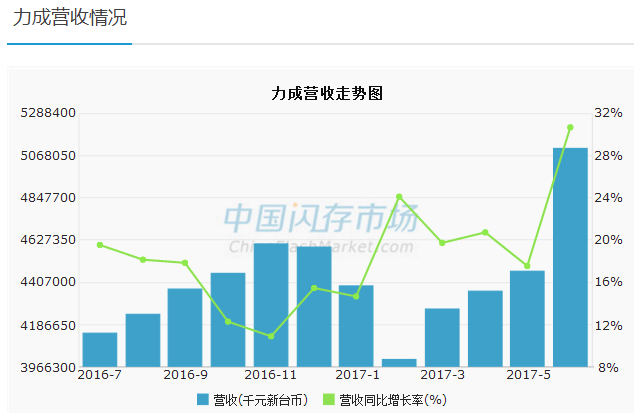

f10

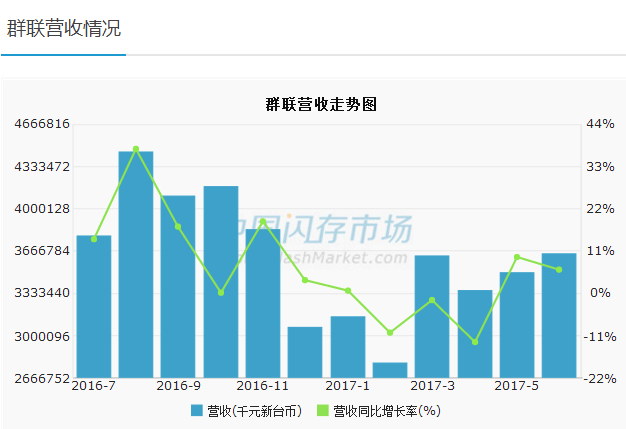

NAND flash controller fabs financial report

Due to NAND flash supply constraints and the impact of the traditional off-season, year on year revenue growth of NAND flash controller fabs Silicon Motion is 13%, net profit grew slightly. Q2 revenue is expected to have a 5%-10% rising month-on-month.

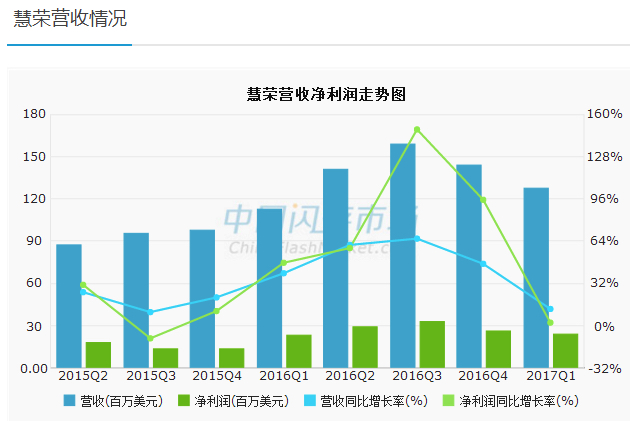

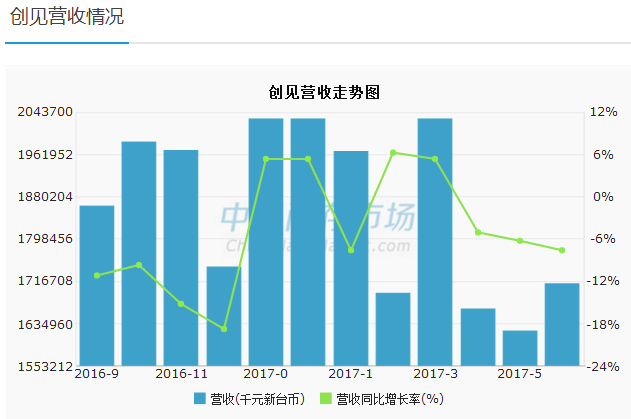

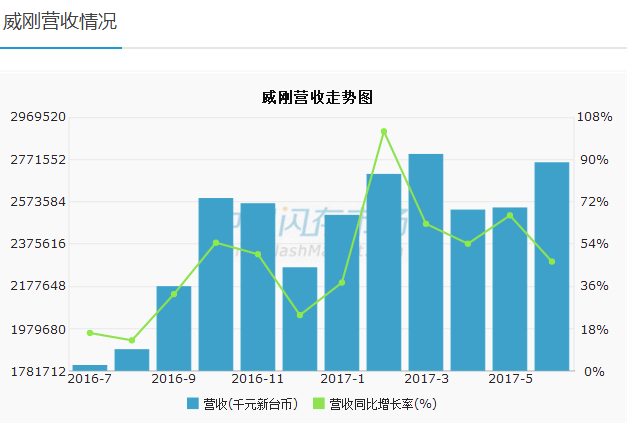

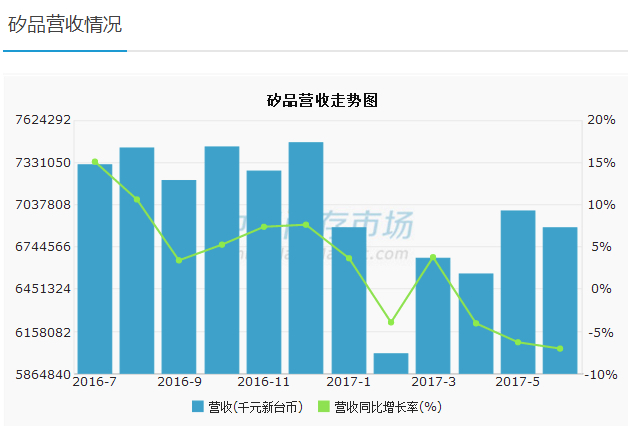

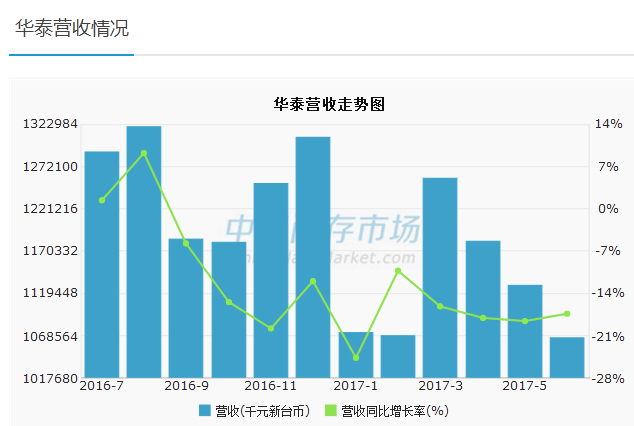

Module factory financial report

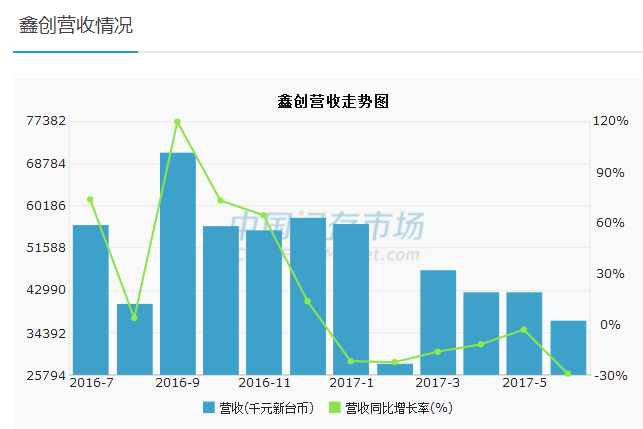

Packaging plant financial report

Taking an outlook beyond the seasonally strong Q3, even though the arrival of off-season in the first half of 2017 had an impact on SSD sales, insiders hold a more optimistic attitude towards the Q3 because of the booming demand of companies including Apple Inc., Huawei Inc., OPPO Inc., VIVO Inc. throughout the second half of 2017. According to the current progress of 3D NAND, each flash vendors would start to increase their output of new capacity in 3D NAND in succession in order to meet the rising demand on smartphones and SSD.

However, as a result of the expansion of production in 3D NAND, a close examination of flash vendors’ shipments as well as the actual market demand should be conducted, especially in Q4, in case that excess capacity of 3D NAND causes a glut on the market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter