120 Companies in Software-Defined Storage

Very active but fuzzy market segment

By Philippe Nicolas | June 8, 2017 at 2:18 pmCondor Consulting Group has just released a new study about software-defined storage (SDS). Here is an abstract.

As an industry buzzword with a broad coverage, it deserves some clarifications. You find below an extract of the report.

Definition and segmentation

First, it’s important to define the SDS term we use and categories we have established to segment the SDS market offering.

We define SDS as software that transforms commodity servers equipped with local storage into a storage pool and services exposed to applications with industry file sharing protocols, block access methods or object APIs.

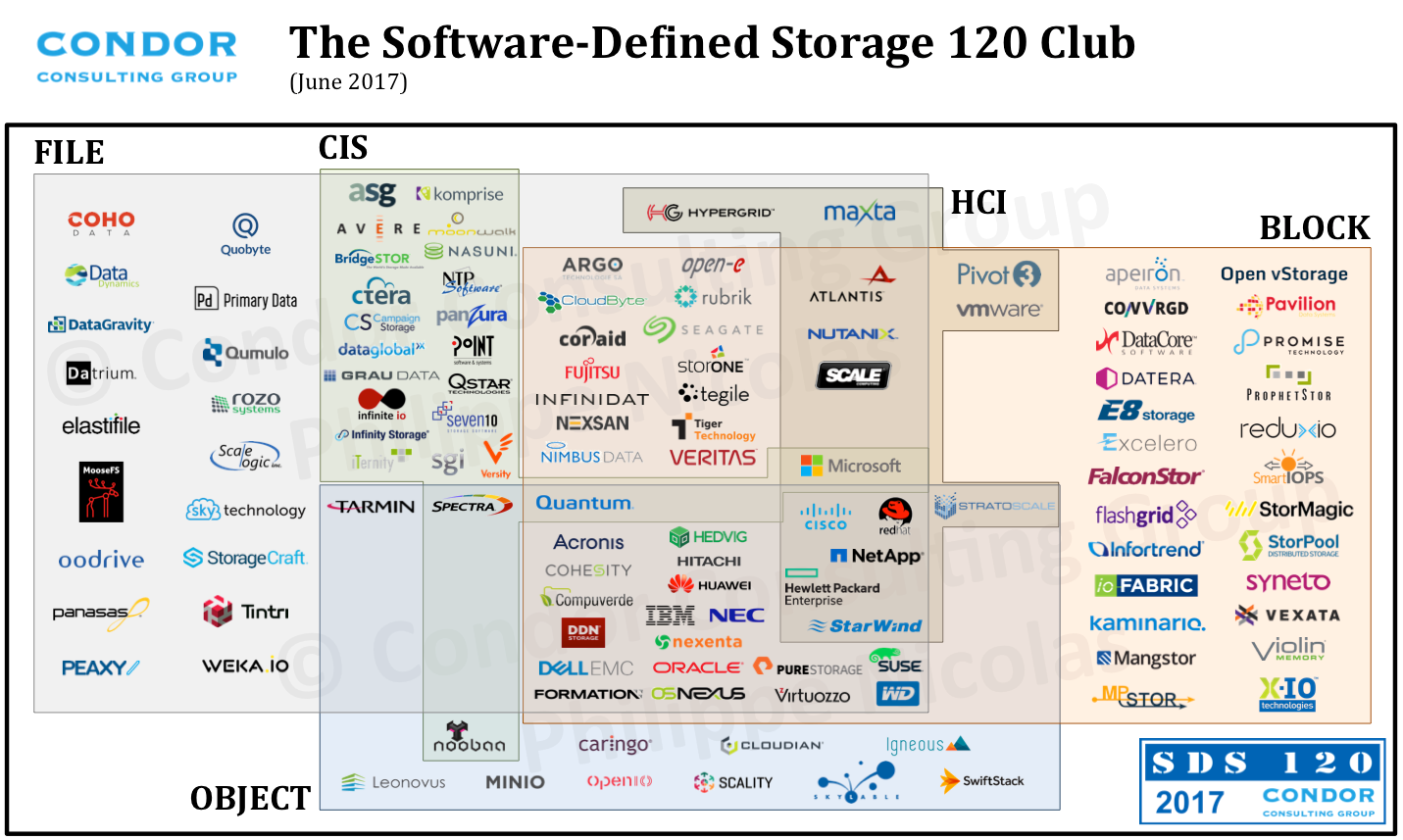

We have identified a little bit more than 120 players segmented in 5 categories:

- File storage aligned with SDS File,

- Block storage i.e SDS Block,

- Object storage i.e SDS Object,

- Cloud integrated storage aka CIS i.e SDS CIS and,

- Hyperconverged infrastructure aka HCI i.e SDS HCI.

As gateways and other close solutions have started to merge a few years ago, we have decided to name a category CIS as indicated previously. We decided to eliminate some adjacent categories such de-dupe, archiving, container, disaster recovery, SaaS/cloud, client related P2P and Hadoop.

According to several analysts (Gartner, IDC, Technavio, MarketandMarkets,etc.) and our estimation, the SDS market globally in 2017 could be as big as $40 billion split in $7 billion for SDS file (NAS, file server, etc.), $18 billion for SDS block (flash, NVMe, etc. included), $1 billion for SDS object and $5 billion for SDS HCI to list a few categories. Secondary storage is estimated at around $8 billion and is aligned with several SDS groups we establish such SDS file, SDS block, SDS object or SDS CIS. With these numbers in mind, it illustrates that software is everywhere obviously with some fuzzy boundaries and sometimes assimilations. Some others studies are very limited and forget to integrate some approaches. These numbers are big but the Club is big representing a real momentum in the industry.

With the commoditization of hardware, SDS has participated to the transformation of the storage industry resulting to a radical change: storage is software. In other words, values and differences come from software. In the industry journey, we have to recognize the impact and contribution of Linux as the enabler of such transformation. But as the storage industry continues maturing powered by software, it has started to be very difficult to make and create differentiators in each SDS segment.

We have named this report the SDS 120 Club.

This report classifies and lists companies. Many of them have multiple products, some of them have even made acquisitions, so at the end these firms belong to multiple categories and it explains the overlap across these categories in the diagram below.

In other words, a company can belong to multiple SDS groups with one or distinct products. Good examples are NetApp who has acquired Spinnaker Networks, Bycast and SolidFire in addition to their own product line such recent HCI announcement meaning they are at the intersection of several groups, same story for HPE who has a strong historic acquisition path with Polyserve, Ibrix, SimpliVity and Nimble Storage or EMC who swallowed ScaleIO, XtremIO, Isilon and got finally acquired itself by Dell. This is the case of several players also based on the data access interface exposed by products.

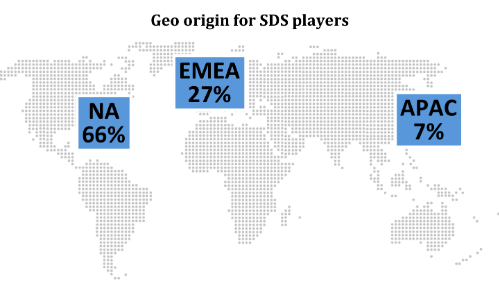

Worldwide origin of SDS players

Two third of the SDS companies come from North America and ten have Israeli roots.

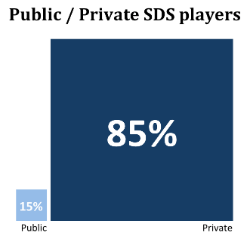

Public and private companies

The vast majority are private companies and the small percentage represents in fact big IT vendors that play in the SDS segment with internal developments or acquired products.

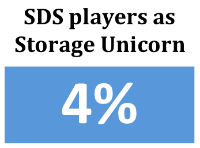

Storage Unicorn

We published recently the June edition of the Storage Unicorn study with 8 companies: Actifio, Datto, Dropbox, DDN, Infinidat, Kaminario, Rubrik and Veritas. We consider here only DDN Storage, Infinidat, Kaminario, Rubrik and Veritas. It means only 4% of the full SDS list belongs to the unicorn club. DDN Storage, Rubrik and Veritas are considered in the SDS block + file sub-groups and Infinidat and Kaminario in the SDS block.

The big picture

The following picture illustrates the full list of SDS players and their belonging category.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter