Facts and Figures on Tintri, Start-Up in Hybrid and All-Flash Platform

Just filing for IPO

By Jean Jacques Maleval | June 5, 2017 at 2:23 pmA company trying to be public is obliged to reveal about all its facts and figures by publishing Form S-1. As usual in this case, We have condensed here the main ones for Tintri from a massive document to help our loyal StorageNewsletter.com‘s visitors.

Company

Tintri, Inc.

Locations

Incorporated in Delaware, HQ in Mountain View, CA, offices in McLean, VA, Chicago, IL, Australia, London (UK), Munich (Germany), Ireland, Tokyo (Japan) and Singapore.

Date founded

June 2008

Financial funding

Total of $260 million including:

- 2011: $17 million (series A, B) and $18 million (C)

- 2012: $25 million (D)

- 2014: $75 million (E)

- 2015: $125 million (F)

Its valuation at the last funding round was supposed to be $785 million.

| Investors (VCs) |

Aggregate prior IPO |

Shares |

| Entities affiliated with New Enterprise Associates |

$31,788,952 | 22.7% |

| Entities affiliated with Silver Lake Kraftwerk | $27,384,198 | 20.4% |

| Entities affiliated with Insight Venture Partners | $27,022,863 | 20.2% |

| Lightspeed Venture Partners VIII, L.P. | $19,814,986 | 14.5% |

IPO

$100 million expected, and listing on the Nasdaq under the ticket TNTR probably in June or July.

Yearly revenue, profitability and total customers

(for fiscal year ended January 31, in $ million)

| FY | Revenue | Y/Y growth | Net loss | Number of customers | Y/Y growth |

| 2015 | 49.8 | NA | 69.7 | 573 | NA |

| 2016 | 86.0 | 73% | 101.0 | 928 | 62% |

| 2017 | 125.1 | 45% | 105.8 | 1,273 | 37% |

Quarterly revenue and profitability

(in $ million)

| Quarter | Revenue | Q/Q growth | Loss |

| 1FQ16 | 15.6 | NA | 23.6 |

| 2FQ16 | 19.8 | 27% | 24.1 |

| 3FQ16 | 24.4 | 23% | 25.8 |

| 4FQ16 | 26.2 | 7% | 27.4 |

| 1FQ17 | 22.9 | -13% | 30.8 |

| 2FQ17 | 27.6 | 21% | 25.7 |

| 3FQ17 | 33.9 | 23% | 23.8 |

| 4FQ17 | 40.8 | 20% | 25.5 |

The company has a history of losses with an accumulated deficit of $338.7 million. As of January 31, 2017, it had cash and cash equivalents of $48 million.

Support and maintenance revenue was 20.2% and 22.2% in FY16 and fiscal FY17, respectively.

Stand-alone software product attach rate, which is stand-alone software license revenue as a percentage of product revenue, increased from 7.7% in FY15 to 9.9% in FY16 to 14.7% in FY17.

Revenue generated from customers outside of the United States was 29.9% and 30.0% of total revenue for FY6 and FY17, respectively.

The number of orders valued at greater than $1 million increased from three in FY15 to five in FY16 and to 13 in FY17. Average order size has grown from $111,000 for the year ended January 31, 2015 to $160,000 for the year ended January 31, 2017.

No customer represented more than 5% of revenue, and no distributor represented more than 10% of our revenue, in each case for fiscal 2017.

Sales of our VMstore systems represented over half of revenue for FY17.

Founders and main executives with their background

Ken Klein, 57, chairman and CEO (total compensation in 2017: $725,073) since October 2013, and director since January 2012, previously served as president at Wind River Systems, Inc., a software company, from January 2004 to October 2013. He has served on the board of directors of MobileIron, Inc., a mobile enterprise management company, since February 2016.

Ken Klein, 57, chairman and CEO (total compensation in 2017: $725,073) since October 2013, and director since January 2012, previously served as president at Wind River Systems, Inc., a software company, from January 2004 to October 2013. He has served on the board of directors of MobileIron, Inc., a mobile enterprise management company, since February 2016.

Ian Halifax, 56, CFO ($417,798), was CFO of Host Analytics, Inc., Grass Valley USA, LLC, Wind River Systems, Inc., Macrovision, Inc., and Micromuse, Inc.

Kieran Harty, 54, CTO since October 2013 and director since August 2008. From June 2008 to October 2013, he served as CEO and chairman. Before founding Tintri, he served as EVP of R&D at VMware, Inc. from June 1999 to February 2006.

Michael McGuire, 52, chief sales officer ($683,097) since March 2015. Prior to that, he served in various senior roles at Dell, including VP of North America enterprise solutions group and channel sales and VP of global storage sales from July 2012 to February 2015. Prior to Dell, he served as chief commercial officer at Nexsan from November 2008 to July 2012.

Number of employees

527

Technology

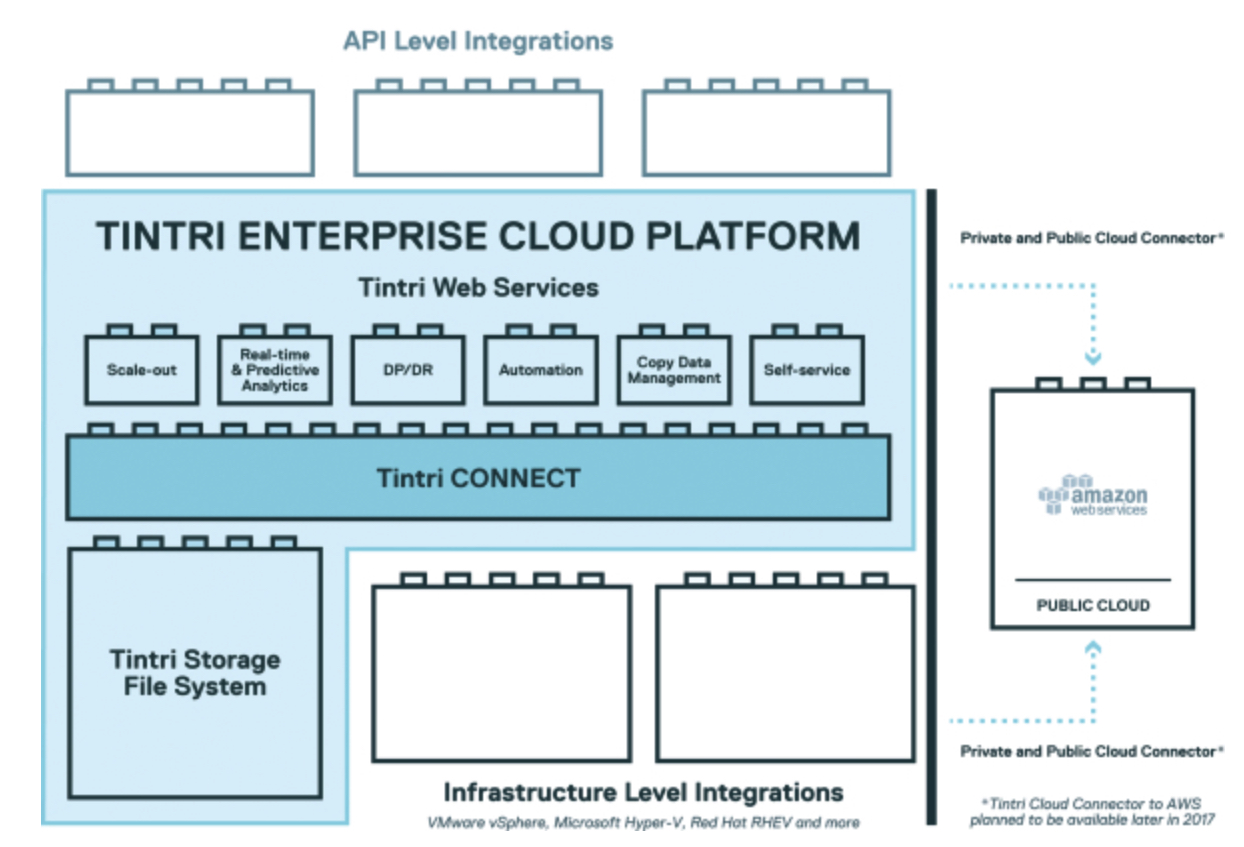

All-flash storage with scale-out and automation as a foundation for company’s own clouds to build agile development environments for cloud native applications and to run mission critical enterprise applications. Extensible enterprise cloud platform combines cloud management software, web services and a range of all-flash storage systems. Tintri had seven issued patents and 34 pending patent applications in the United States and internationally.

Products description

The enterprise cloud platform is based on the Tintri CONNECT web services architecture, which has similar design characteristics as public cloud architecture – using web services that are easy to assemble, integrate, tear down, reconfigure, and connect to other services. This architecture uses a building-block approach that is predicated on REST application programming interfaces, or APIs, and virtual machine, or VM, and container level abstraction. REST APIs are needed to write automation scripts and connect to other elements of infrastructure, and make it possible for web services to be combined and to communicate with other services effectively. Through a set of proprietary software tool kits and plug-ins, it enables users to develop customized workflows and to automate their operations. The CONNECT architecture is based on firm’s virtualization-aware file system that allows an organization to view, manage and analyze application performance and QoS. CONNECT integrates with all major virtualization architectures, including those offered by VMware, Microsoft, Citrix, Red Hat and OpenStack, and can connect with public cloud service providers.

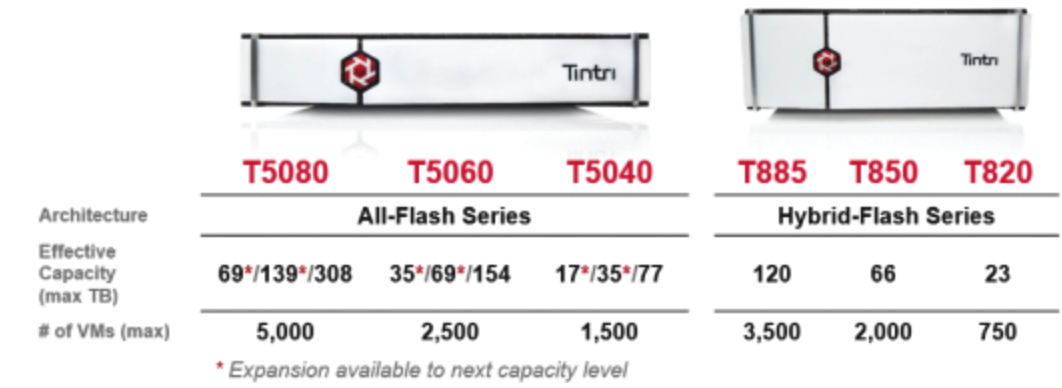

Tintri offers hybrid and all-flash storage subsystems.

The 4U hybrid VMstorage T800 with dual controller packed up to 120TB of effective capacity.

There are two bundles of all-flash systems for cloud use cases. The Cloud Foundation combines four VMstore T5080 with maximum capacity plus the firm’s Software Suite to deliver up to 1.2PB of effective capacity in 8U for cloud applications. Cloud Ultimate combines 32 VMstore T5080 with Software Suite delivers up to 10PB of effective capacity in 64U.

Tintri contracts with an offshore subsidiary of Flex to manufacture all products.

Released date

First products in March 2011

Technology partners

Arista, Brocade, Cisco, Citrix, Commvault, HOE, Intel, Juniper, Mellanox,Mirantis, Openstack, Oracle, turbonomic, unidesk, Veeam

Distribution

283 channel partners including Promark, Arrow, SHI, CDW, CarahSoft, Zycko, Ahead, Champion, Fujitsu and Avnet. 89% and 85% of revenue in FY16 and FY17 respectively derived from sales to channel partners, and no one represented more than 10%.

Number of customers

1,250, 70% enterprises and CSPs

Main customers

Comcast, Chevron, Mentor Graphics (a Siemens Business), NASA, Oakland Raiders, Shire, Toyota, United Healthcare, etc., including 21 of Fortune 100 and 7 of top 5 Fortune 100 and 20% of the Fortune 100. Top 25 customers have ordered 19x the amount ordered in their first quarter as customers.

Target market

Education, financial services and insurance, healthcare, manufacturing and technology

Applications

Server virtualization, VDI, disaster recovery and data protection, and DevOps

Competitors

Intense competition from numerous established companies and new entrants like Dell EMC, IBM, Kaminario, NetApp, HPE, Nutanix and Pure Storage

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter