NetApp: Fiscal 4Q17 Financial Results

All-flash array annualized net revenue run rate of $1.70 billion, up 140% Y/Y

This is a Press Release edited by StorageNewsletter.com on May 26, 2017 at 2:23 pm| (in $ million) | 4Q16 | 4Q17 | FY16 | FY17 |

| Revenue | 1,380 | 1,481 | 5,546 | 5,519 |

| Growth | 7% | -0% | ||

| Net income (loss) | (8) | 190 | 229 | 509 |

- Net revenues for Q4 up 5% quarter-over-quarter and 7% Y/Y.

- Q4 all-flash array annualized net revenue run rate of $1.70 billion, up almo st 140% Y/Y.

- Over an exabyte of flash shipped in fiscal year 2017.

- $913 million returned to shareholders in share repurchases and cash dividends in fiscal year 2017.

- First quarter fiscal year 2018 dividend to increase by 5% to $0.20 per share.

NetApp, Inc. reported financial results for the fourth quarter and fiscal year 2017, ended April 28, 2017.

Fourth Quarter Financial Results

Net revenues for the fourth quarter of fiscal year 2017 were $1.48 billion. GAAP net income for the fourth quarter of fiscal year 2017 was $190 million, or $0.68 per share, compared to GAAP net loss of $8 million, or $0.03 loss per share, for the comparable period of the prior year. Non-GAAP net income for the fourth quarter of fiscal year 2017 was $239 million, or $0.86 per share, compared to non-GAAP net income of $157 million, or $0.55 per share, for the comparable period of the prior year.

Fiscal Year 2017 Financial Results

Net revenues for fiscal year 2017 were $5.52 billion. GAAP net income for fiscal year 2017 was $509 million, or $1.81 per share, compared to GAAP net income of $229 million, or $0.77 per share, for the comparable period of the prior year. Non-GAAP net income for fiscal year 2017 was $768 million, or $2.73 per share, compared to non-GAAP net income of $633 million, or $2.13 per share, for the comparable period of the prior year.

Cash, Cash Equivalents and Investments

The company ended the fourth quarter of fiscal year 2017 with $4.9 billion in total cash, cash equivalents and investments. During the fourth quarter of fiscal year 2017, the company generated $365 million in cash from operations and returned $180 million to shareholders through share repurchases and a cash dividend.

The company will increase the first quarter fiscal year 2018 dividend by 5% to $0.20 per share. The quarterly dividend will be paid on July 26, 2017, to shareholders of record as of the close of business on July 7, 2017.

“Our continued focus and disciplined execution yielded yet another quarter of solid results. We have regained momentum, returning the company to revenue growth and delivering against all of our fiscal year 2017 commitments,” said George Kurian, CEO. “By innovating to redefine traditional markets and to bring enterprise-grade technology to emerging areas of the market, we are gaining market share, expanding our addressable market, and creating new opportunities for NetApp.”

Q1 Fiscal Year 2018 Outlook

• Net revenues are expected to be in the range of $1.24 billion to $1.39 billion

• Earnings per share is expected to be in the range of $0.30 – $0.38 (GAAP) and $0.49 – $0.57 Non-GAAP

Full Fiscal Year 2018 Outlook

• Consolidated gross margin is expected to be in the range of 61% – 62% (GAAP) and 62% – 63% (Non-GAAP)

• Operating margin is expected to be in the range of 14% – 16% (GAAP) and 18% – 20% (Non-GAAP)

• Effective tax rate is expected to be in the range of 23% – 24% (GAAP)and 19% – 20% (Non-GAAP)

Business Highlights

NetApp Expands Impact in Flash, Cloud, and Next-Generation Data Center

- New NetApp All-Flash Innovations Improve Data Center Economics. New all-flash FAS A700s array delivers performance in a compact form factor to modernize IT for demanding enterprise applications, analytic workloads and cloud integration.

- NetApp Names Anthony Lye to Lead Cloud Business Unit. Cloud champion joins the company to accelerate hyperscaler and hybrid cloud progress. Lye, who reports to CEO George Kurian, drives the strategy and execution necessary to create a profitable cloud business for NetApp and establish the company as the undisputed leader in managing data in a cloud-integrated world.

- One-Year Anniversary: NetApp SolidFire Redefines Data Center Infrastructure. NetApp celebrated the one-year anniversary of its acquisition of SolidFire, fueling the advance of the next-generation data center that is transforming IT for enterprises and service providers.

Customers Team with NetApp to Drive Transformation and Improve Performance with Their Choice of Hybrid Cloud Deployment

- NetApp Supports Vital Energi in Transforming Data into Energy Savings Throughout the UK. Sustainable energy company, Vital Energi, deployed a NetApp all-flash array to speed performance and NetApp AltaVault cloud-integrated storage to help the company meet mandatory backup requirements.

- DARZ Drives DevOps Success with NetApp. German IT services leader fuels customers’ digital transformation by enabling agile software development through its Docker & Container as a Service offering.

- neteffect Offers Hybrid Cloud DR Solutions with NetApp. Converged infrastructure gives neteffect technologies the flexibility to blend on-premises and cloud services for customers.

- NetApp Helps Kaufman Hall Transform Businesses with Data-Driven Insight. Kaufman Hall takes critical first step toward a hybrid cloud future by consolidating on FlexPod to speed innovation as well as maximize performance and growth.

- Contegix Accelerates Private Cloud Deployment and Cuts Service Costs in Half with SolidFire. The cloud host provider prepares for coming data deluge with high-performing, scalable SolidFire all-flash storage to meet customers’ demands for scalability and guaranteed performance to accelerate their private cloud deployments.

Comments

For the second time since 12 consecutive quarters in a row, revenue is finally growing Y/Y for this second quarter, by only 7% (and 5%Q/Q) at $1.48 billion, at the high end of guidance. Net income is at $190 million, a record since 4FQ14, with annual sales are decreasing since FY14!

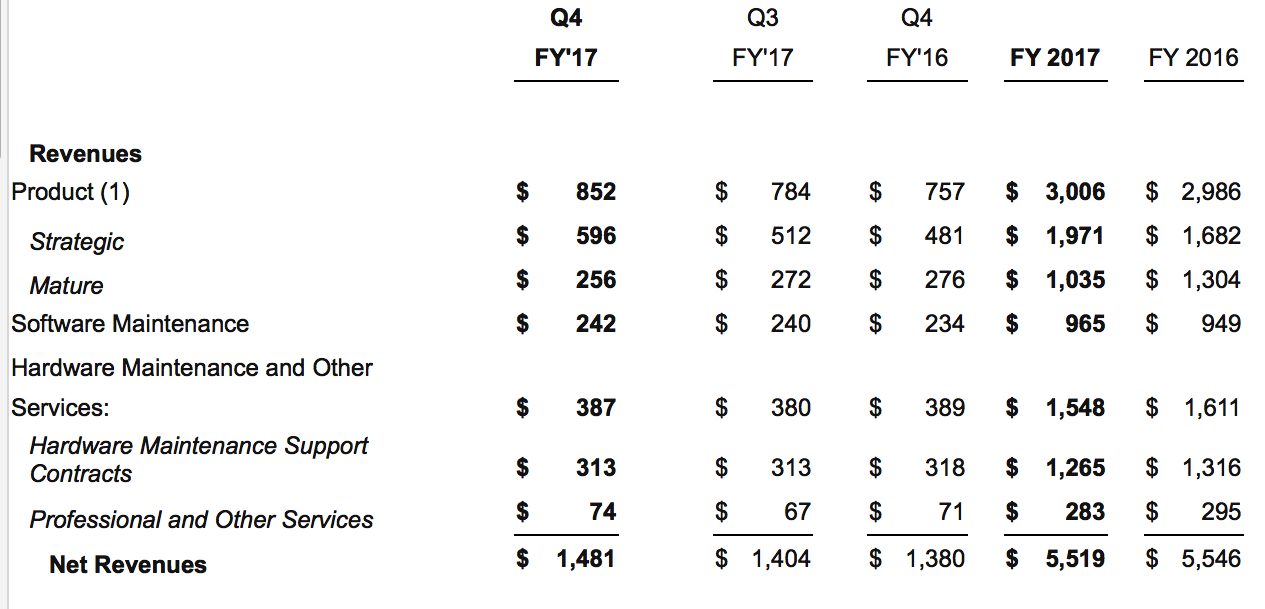

Revenue by business in $ million

The growth of strategic solutions more than offset the declines in mature solutions and started driving net revenue growth in the second half of 2017.

Product revenue of $852 million grew over 12% Y/Y, led by flash and the continued strength of strategic solutions.

Consistent with the firm's plan, the headwinds from mature solutions, add-on hardware, OEM and ONTAP 7-Mode are lessening. In Q4, product revenue from mature solutions declined 7% Y/Y. Going into FY18, the transition from 7-Mode to clustered ONTAP is behind the company having a renewed focus on hardware and software OEM opportunities. These both will further moderate the decline in mature solutions. Strategic solutions was 70% of net product revenue, up 24% Y/Y.

NetApp migrated over 50% of the capacity and almost 50% of the FAS systems in its large installed base to clustered ONTAP. In Q4, clustered ONTAP was deployed on 95% of FAS systems shipped.

In Q4, all-flash array business grew almost 140% Y/Y to an annualized net revenue run rate of $1.7 billion, inclusive of all-flash FAS, EF and SolidFire products and services.

The combination of software maintenance and hardware maintenance and other services revenues increased 1% Y/Y.

The company expects moderated revenue growth to ramp throughout the year, consistent with normal seasonal trends. For 1FQ18 it is forecasting a revenue range of $1.24 billion to $1.39 billion or -16% to -6% Q/Q respectively. At the midpoint, this implies yearly revenue growth of approximately 2%.

| Period | Revenue | Y/Y Growth | Net income (loss) |

| 1FQ14 | 1,516 | 5% | 82 |

| 2FQ14 | 1,550 | 1% | 167 |

| 3FQ14 | 1,610 | -1% | 192 |

| 4FQ14 | 1,649 | -4% | 197 |

| FY14 | 6,325 | -0% | 638 |

| 1FQ15 | 1,489 | -2% | 88 |

| 2FQ15 | 1,542 | -0% | 160 |

| 3FQ15 | 1,551 | -4% | 177 |

| 4FQ15 | 1,540 | -2% | 135 |

| FY15 | 6,123 | -3% | 560 |

| 1FQ16 | 1,335 | -10% | (30) |

| 2FQ16 | 1,445 | -9% | 114 |

| 3FQ16 | 1,386 | -11% | 153 |

| 4FQ16 | 1,380 | -10% | (8) |

| FY16 | 5,546 | -9% | 229 |

| 1FQ17 | 1,294 | -3% | 64 |

| 2FQ17 | 1,340 | -7% | 109 |

| 3FQ17 | 1,404 | 1% | 146 |

| 4FQ17 | 1,481 | 7% | 190 |

| FY17 | 5,519 | -0% | 509 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter