Nutanix: Fiscal 2Q17 Financial Results

This is a Press Release edited by StorageNewsletter.com on March 6, 2017 at 2:35 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

| Revenue | 102.7 | 182.2 | 190.5 | 349.0 |

| Growth | 77% | 93% | ||

| Net income (loss) | (33.2) | (93.2) | (71.8) | (255.4) |

Nutanix, Inc. announced financial results for its second quarter of fiscal 2017, ended January 31, 2017.

Second Quarter Fiscal Year 2017 Financial Highlights

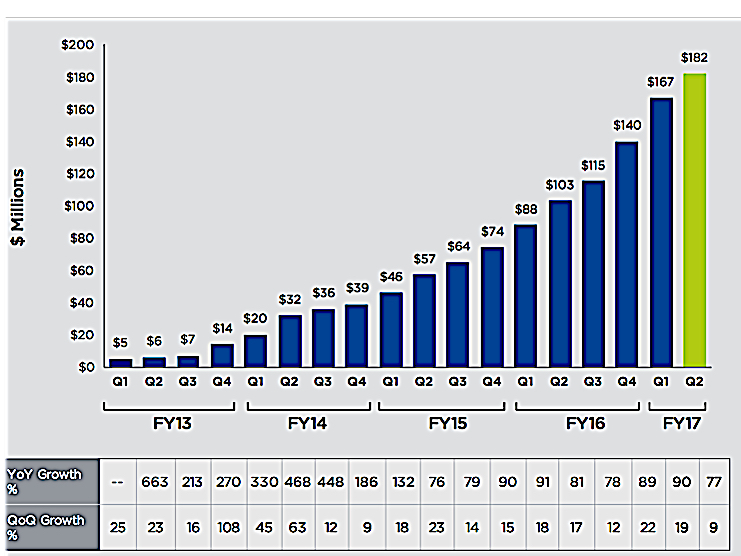

- Revenue: $182.2 million, growing 77% year-over-year from $102.7 million in the second quarter of fiscal 2016

- Billings: $227.4 million, growing 59% year-over-year from $143.4 million in the second quarter of fiscal 2016

- Net Loss: GAAP net loss of $93.2 million, compared to a GAAP net loss of $33.2 million in the second quarter of fiscal 2016; Non-GAAP net loss of $39.9 million, compared to a non-GAAP net loss of $30.9 million in the second quarter of fiscal 2016

- Net Loss Per Share: GAAP net loss per share of $0.66, compared to a pro forma GAAP net loss per share of $0.28 in the second quarter of fiscal 2016; Non-GAAP net loss per share of $0.28, compared to a pro forma non-GAAP net loss per share of $0.26 in the second quarter of fiscal 2016

- Cash and Short-term Investments: $355.2 million, up 175% from the second quarter of fiscal 2016

- Deferred Revenue: $420.6 million, up 128% from the second quarter of fiscal 2016

- Operating Cash Flow: $19.8 million, compared to $4.5 million in the second quarter of fiscal 2016

- Free Cash Flow: $7.1 million, compared to $(5.9) million in the second quarter of fiscal 2016

“Our journey has taken us from an unknown upstart to a well-established enterprise IT brand approaching a $1 billion annualized billings run-rate in just five years of selling. We continue to evolve and refine our strategy, including product expansions, sales focus and alternate consumption models, as we seek to capture a growing share of the highly dynamic $100+ billion enterprise infrastructure market,” said Dheeraj Pandey, CEO.

“Our solid results were driven by notable strength in our international business. Further, I am pleased we were able to hold our non-GAAP gross margins essentially steady despite component price increases impacting our costs,” said Duston Williams, CFO.

Recent Company Highlights

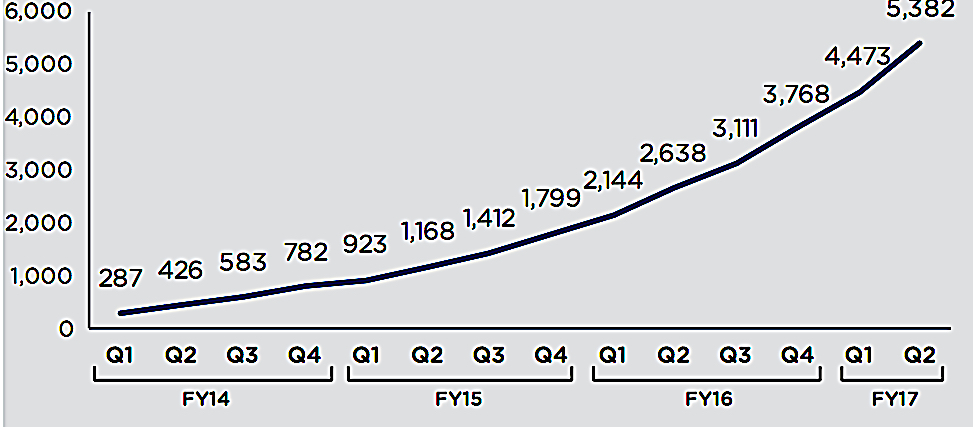

- Continued Customer Growth: The company ended the second quarter of fiscal 2017 with over 5,380 end-customers, adding over 900 new end-customers during the quarter.

- Increasing AHV Adoption: The company continued to see strong adoption for its built-in hypervisor, AHV. Usage rose to 21%, up from 17% in the prior quarter, based on a four-quarter rolling average of nodes using AHV as a percent of total nodes sold.

- AHV Certified on SAP Business Suite Powered by SAP NetWeaver: Customers are now able to simplify their infrastructure and virtualization stack when delivering business-critical SAP applications on the Nutanix Enterprise Cloud Platform.

- Awarded CRN Product of the Year: The Nutanix Enterprise Cloud Platform for Cisco Unified Computing Systems (UCS) was named a winner in the 2016 Product of the Year Awards in the Hyperconverged Infrastructure category taking first place in two subcategories: Technology and Customer Demand.

- Enterprise Cloud Platform Selected to Be a Part of a Large Contract by United States Navy Space and Naval Warfare Systems Command: As a subcontractor to Crown Point Systems, the firm will be part of a five-year, firm-fixed-price Indefinite Delivery/Indefinite Quantity contract with a total overall maximum value of $28.8 million to Crown Point, if all orders are exercised.

- Names New CIO: Wendy M. Pfeiffer, former vice president of IT at GoPro, was appointed CIO in January.

For the third quarter of fiscal 2017, Nutanix expects:

- Revenues between $180 and $190 million;

- Non-GAAP gross margin between 57% and 58%;

- Non-GAAP net loss per share between $0.45 and $0.48, using 144 million weighted shares outstanding.

Comments

Revenue for the quarter was $182 million growing 77% from a year ago and up 9% from the previous quarter, with international bookings representing a record 48% of total bookings in the quarter.

Nutanix added a record number of new customers in the last quarter finishing up with over 900, up from 700 in the former three-month period. Now it has a total of 5,382 customers, up 104% Y/Y.

It saw strong growth in the Global 2000, increasing total Global 2000 penetration to 473 up 68% from 2FQ16.

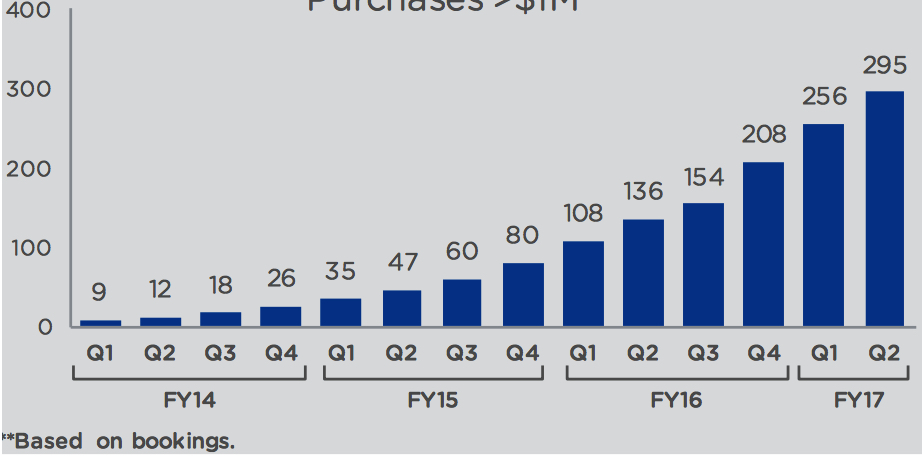

Cumulative end customers lifetime purchase at more than $1 million

295 customers were registered with with more than $1 million in lifetime bookings.

48% of bookings came from international customers.

Founder, CEO and chairman Dheeraj Pandey also remarks: "Lenovo had their best quarter since they started selling Nutanix powered appliances about a year ago and we continue to identify new market opportunities to pursue together. Specifically around in SAP go-to-market where Lenovo's erstwhile IBM servers had a strong foothold traditionally."

Nutanix notes that memory prices have become more volatile. Next quarter, it expects DRAM prices to increase 30% to 40%. In response to this increase, the firm raised product list prices on February 1, 2017.

For next quarter, the firm expects a pause with revenues between $180 million and $190 million only, or a sequential growth between -1% and +4%, the lowest percentages since 1FQ13.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter