Seagate: Fiscal 2Q17 Financial Results

Company more profitable with lower sales

This is a Press Release edited by StorageNewsletter.com on January 26, 2017 at 2:55 pm| (in $ million) | 2Q16 | 2Q17 | 6 mo. 16 | 6 mo. 17 |

| Revenue | 2,986 | 2,894 | 5,911 | 5,691 |

| Growth | -3% | -4% | ||

| Net income (loss) | 165 | 297 | 198 | 464 |

Seagate Technology plc reported financial results for the second quarter of fiscal year 2017 ended December 30, 2016.

For this period, the company reported revenue of $2.9 billion, gross margin of 30.8%, net income of $297 million and diluted earnings per share of $1.00. On a non-GAAP basis, which excludes the net impact of certain items, it reported gross margin of 31.8%, net income of $412 million and diluted earnings per share of $1.38.

During the second quarter, the company generated $656 million in cash flow from operations, paid cash dividends of $188 million, and repurchased 4.1 million ordinary shares for $147 million. Cash, cash equivalents, and short-term investments totaled approximately $1.7 billion at the end of the quarter. There were 295 million ordinary shares issued and outstanding as of the end of the quarter.

“The company’s product execution, operational performance, and financial results improved every quarter throughout 2016. In the December quarter we achieved near record results in gross margin, cash flow, and profitability. Seagate’s employees are to be congratulated for their incredible effort,” said Steve Luczo, chairman and CEO. “Looking ahead, we are optimistic about the long-term opportunities for Seagate’s business as enterprises and consumers embrace and benefit from the shift of storage to cloud and mobile applications. Seagate is well positioned to work with the leaders in this digital transformation with a broad market-leading storage solution portfolio.”

The board of directors approved a quarterly cash dividend of $0.63 per share, which will be payable on April 5, 2017 to shareholders of record as of the close of business on March 22, 2017.

Comments

Revenue fell 3% Y/Y, was up 3% Q/Q at $2.9 billion and beats the average estimate of $2.8 billion.

The company forecast about $2.7 billion for next three-month period, above estimates of $2.6 billion, down 7% Q/Q, representing a slightly less seasonal decline in revenue than the last two years. It expects to achieve revenue growth for fiscal year or more than $11.2 billion..

Net income increases 80% Y/Y and 78% Q/Q with a gross margin expansion 600 basis points Y/Y. Cash flow from operations reaches $656 million, up 72% from one year ago. For the year, a profit of at least $4.50 per share is expected.

Trendfocus' analysts commented: "With unit shipments rising by 1 million HDDs to 39.9 million units, the company is likely the only HDD manufacturer in the industry to post higher sequential units in the quarter - an achievement that should be confirmed following the WDC's earnings announcement scheduled for January 25, 2017." But it also records the highest decreasing percentage of units shipped from one year ago compared to competitors WD and Toshiba.

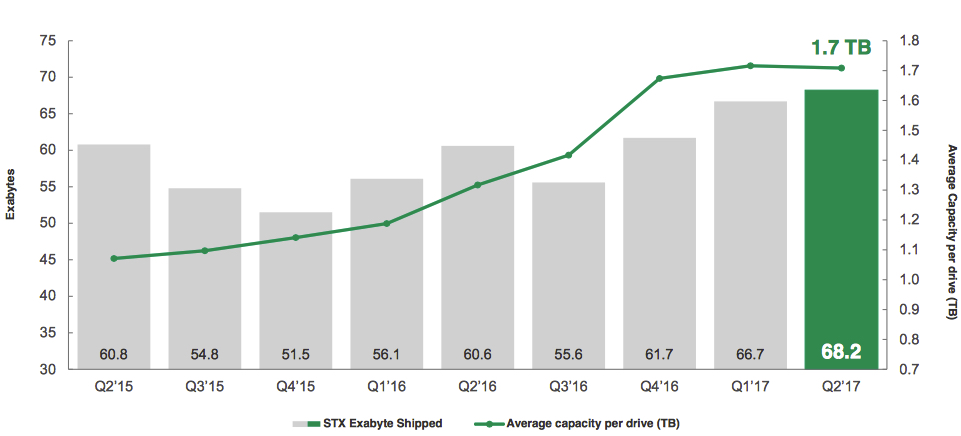

Average capacity per drive (1.709TB) decreased sequentially for the first time since three years even if total exabytes shipped increased from 66.7EB to 68.2EB, and also the first time since 1FQ16 that average HDD ASP, $66, is down from former quarter.

Exabytes shipped and average capacity per drive

The firm expects overall exabyte demand to grow double digits in calendar 2017 over 2016. For the March quarter, it anticipates the unit and exabyte demand environment to decline relatively seasonally.

Chairman and CEO Steve Luczo comments on HDD capacity: "For the last few quarters, our 12TB product has been with customers for evaluation and the feedback has been positive. (...) During the next 12 to 18 months, we expect the nearline market to be diversified in capacity points for different application workloads, with use cases from 2TB to 4TB products for certain applications up to 16TB for other use cases."

We are waiting for Seagate to transform its business model, like did WD, to compensate the long-term decline of the HDD market against solid-state technology. Storage systems and SSDs represent only 8% of total sales in spite of several investments in these fields. A joint venture between the HDD manufacturer and flash maker SK Hynix to develop enterprise SSDs could be a first step.

Revenue by products in $ million

| 2FQ16 | 2FQ17 | Growth | % of total revenue | |

| HDDs | 2,589 | 2,652 | 2% | 92% |

| Enterprise systems, flash and others | 208 | 242 | 16% | 8% |

Seagate's HDDs from 2FQ14 to 2FQ17

(units in million)

| Fiscal period | Enterprise | Desktop | Notebook | CE | Branded | Total |

HDD ASP |

Exabytes | Average |

| HDDs | shipped | GB/drive | |||||||

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

| 3Q14 | 7.7 | 19.8 | 16.4 | 5.4 | 5.9 | 56.2 | $61 | 50.8 | 920 |

| 4Q14 | 7.4 | 18.4 | 16.8 | 5.1 | 4.8 | 52.5 | $60 | 49.6 | 945 |

| 1Q15 | 8.8 | 18.7 | 20.2 | 6.0 | 5.7 | 59.5 | $60 | 59.9 | 1,007 |

| 2Q15 | 9.1 | 16.0 | 19.7 | 6.1 | 6.0 | 56.9 | $61 | 61.3 | 1,077 |

| 3Q15 | 9.1 | 14.3 | 16.8 | 4.8 | 5.1 | 50.1 | $62 | 55.2 | 1,102 |

| 4Q15 | 8.2 | 11.9 | 14.6 | 5.8 | 4.7 | 45.3 | $60 | 52.0 | 1,148 |

| 1Q16 | 7.8 | 12.4 | 16.4 | 5.5 | 5.2 | 47.2 | $58 | 55.6 | 1,176 |

| 2Q16 | 8.1 | 11.7 | 13.6 | 6.2 | 6.4 | 45.9 | $59 | 60.6 | 1,320 |

| 3Q16 | 7.7 | 10.8 | 10.6 | 5.0 | 5.2 | 39.2 | $60 | 55.6 | 1,417 |

| 4Q16 | 8.5 | 8.6 | 8.5 | 6.5 | 4.7 | 36.8 | $67 | 61.7 | 1,674 |

| 1Q17 | 8.7 | 9.1 | 6.8 | 9.6 | 4.7 | 38.9 | $67 | 66.7 | 1,716 |

| 2Q17 | 8.1 | 8.9 | 8.6 | 8.1 | 6.3 | 39.9 | $66 | 68.2 | 1,709 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter