Brocade: Fiscal 4Q16 Financial Results

Probably last (good) figures before acquisition by Broadcom

This is a Press Release edited by StorageNewsletter.com on November 23, 2016 at 2:10 pm| (in $ million) | 4Q15 | 4Q16 | FY15 | FY16 |

| Revenue | 588.8 | 657.3 | 2,263 | 2,346 |

| Growth | 12% | 4% | ||

| Net income (loss) | 84.3 | 66.7 | 340.4 | 213.9 |

Brocade Communications Systems, Inc. reported financial results for its fourth quarter and full fiscal year 2016 ended October 29, 2016.

The firm reported fourth quarter revenue of $657 million, an increase of 12% year-over-year and 11% quarter-over-quarter.

Revenue for fiscal year 2016 was $2,346 million, up 4% year-over-year. GAAP diluted earnings per share (EPS) was $0.16 for the fourth quarter and $0.51 for fiscal year 2016, down 19% and down 35% year-over-year, respectively. Non-GAAP diluted EPS was $0.33 for the fourth quarter and $1.04 for fiscal year 2016, up 27% and up 3% year-over-year, respectively.

“Fiscal 2016 was a year of significant accomplishment,” said Lloyd Carney, CEO. “We delivered record revenue and expanded our market reach to address critical requirements at the network edge through our acquisition of Ruckus Wireless. In addition, we provided our customers with significant innovations across our product portfolio, including Gen 6 FC, data center automation, Ruckus Cloud Wi-Fi, and next-generation data center routing. With a range of new IP networking solutions expected to launch in the first quarter of fiscal 2017, we continue to advance our roadmap and help our customers transform their networks for digital business.”

Highlights:

• Revenue for both the fourth quarter and the full fiscal year was positively impacted by $14.4 million, or 2.2% and 0.6%, respectively, due to a change in channel revenue recognition methodology implemented in the fourth quarter.

• Q4 2016 SAN product revenue was $303 million, down 7% year-over-year and up 8% quarter-over-quarter. The Q4 year-over-year revenue decline was due to an 18% decrease in director sales and a 13% decrease in embedded switch sales, partially offset by a 7% increase in fixed-configuration switch sales. For fiscal year 2016, SAN product revenue was $1,229 million, down 6% year-over-year, primarily due to certain partner business transitions and a challenging storage spending environment, leading to lower director and embedded switch sales.

• Q4 2016 IP Networking product revenue was $256 million, up 51% year-over-year and up 22% quarter-over-quarter. The Q4 year-over-year increase was primarily driven by the inclusion of $96 million of Ruckus Wireless product revenue, following the acquisition in fiscal Q3 2016. This was partially offset by lower service provider sales and lower sales into the education market. For fiscal year 2016, IP Networking product revenue was $730 million, up 21% year-over-year, primarily due to the inclusion of five months of revenue from Ruckus Wireless, partially offset by lower service provider and U.S. federal sales.

• In fiscal year 2016, Brocade’s full-year GAAP gross margin was 64.6%, down 290 basis points from fiscal year 2015. The gross margin decline was primarily due to a shift in product mix primarily from SAN to IP Networking, and the purchase accounting adjustment to inventory related to the Ruckus Wireless acquisition. Fiscal 2016 full-year GAAP operating margin was 13.1%, down 870 basis points, primarily due to lower gross margins, higher acquisition-related costs, and higher operating expenses primarily associated with Ruckus Wireless. GAAP diluted EPS in fiscal year 2016 was $0.51, down 35% from the prior year, due primarily to acquisition-related costs and higher operating expenses associated with Ruckus Wireless, partially offset by a favorable jurisdictional mix of earnings resulting in a lower effective tax rate.

• In fiscal year 2016, Brocade’s full-year non-GAAP gross margin was 67.9%, down 50 basis points from fiscal year 2015. The non-GAAP gross margin decline was primarily due to a shift in product mix primarily from SAN to IP Networking. Fiscal 2016 full-year non-GAAP operating margin was 23.1%, down 320 basis points, primarily due to lower gross margin and higher operating expenses resulting from the acquisition of Ruckus Wireless. Non-GAAP diluted EPS in fiscal year 2016 was $1.04, up 3% from the prior year, due primarily to higher revenue and a favorable jurisdictional mix of earnings resulting in a lower effective tax rate, partially offset by higher operating expenses.

• The board of directors has declared a quarterly cash dividend of $0.055 per share of the company’s common stock. The dividend payment will be made on January 4, 2017 to shareholders of record at the close of market on December 12, 2016.

On November 2, 2016, Brocade announced that it had entered into a definitive agreement under which Brocade would be acquired by Broadcom Limited. In light of the pending acquisition, Brocade will not provide fiscal Q1 2017 guidance and will not hold a conference call to discuss these financial results.

Comments

Broadcom is going to acquire a healthy company but for a price as high as $5.9 billion or more than twice its annual revenue even if several US law firms estimate it could be more than that. LSI costs even more, $6.6 billion in 2013, but Emulex much less, $606 million.

At $657 million, Brocade's quarterly sales are up 11% Q/Q and 12% Y/Y. Annual sales grew 4% at $2.346 billion. Profits are consistent but decreased 21% Q/Q and 37% for fiscal year.

If Broadcom is acquiring the entire connectivity company, it has decided that it will only retaining its FC SAN switching business and will sell the IP networking activity to concentrate on chip manufacturing. As we already remarked, the second one is expanding much more than the bigger first one. Broadcom could get a high price for this IP networking sector allowing the Singapore-based firm to repay a good part of its acquisition.

SAN sales for the quarter, at $303 million, are down 7% Y/Y and up 8% Q/Q due to decline of 18% in directors and 13% in embedded switches. In parallel, SAN revenue decreased 6% during the year at $1,229 million.

For IP networking (Ethernet and Ruckus Wireless), quarterly revenue, at $256 million, is up 22% Q/Q and 51% Y/Y (including the sales of acquired firm Ruckus Wireless during the former quarter). Also consequently, global IP networking business increases 21% for the year to reach $730 million.

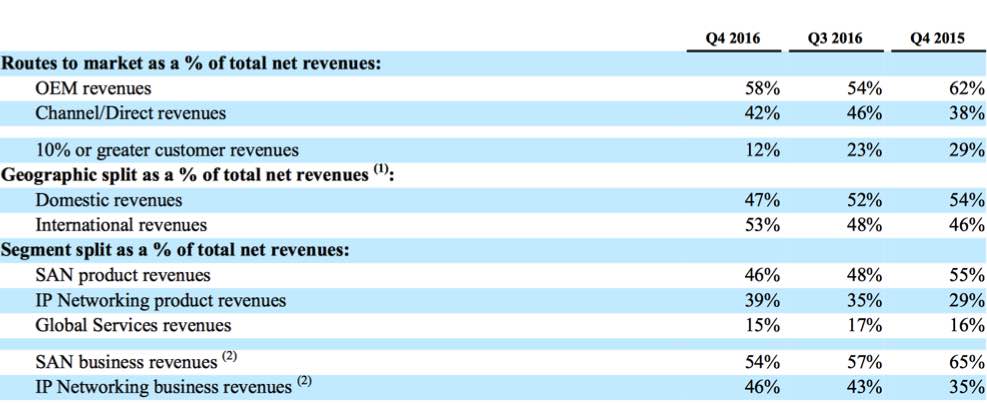

Note that the percentages of revenue of customers above 10% - mainly big OEMs - diminished drastically during the quarter, - 11% Q/Q and -17% Y/Y.

Following the announcement of its acquisition, Brocade didn't stage conference call.

Goodbye Brocade !

(1) Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end users, the percentage of international revenues based on end-user location would likely be higher.

(1) Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end users, the percentage of international revenues based on end-user location would likely be higher.

(2) SAN and IP Networking business revenues include hardware and software product, support, and services revenues.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter