India External Storage Market Revenue Decreased 6% Y/Y at $64 Million in 2Q16 – IDC

Expected to pick up in 2H16

This is a Press Release edited by StorageNewsletter.com on October 26, 2016 at 2:47 pmAccording to International Data Corporation‘s Asia/Pacific Quarterly Enterprise Storage Tracker, India external storage market witnessed a de-growth of 5.9% year on year (in vendor revenue) and stood at $64.4 million in 2Q16.

Mid-range storage segment continued with the trend of year-on-year growth while entry level and high-end storage systems declined year on year in Q2 2016.

Availability of enterprise class features in mid-range storage systems is propelling the growth for mid-range storage arrays.

Also due to increased cloud adoption, the entry level storage market from SMB units is getting shifted to third party datacenters.

However, third party datacenters are preferring mid-range storage over entry level systems to serve the SMB customers as well due to increased capacities and features.

Storage market was driven by banking and professional services in 2Q16 while telecommunication vertical witnessed a sharp decline but this market is expected to grow in 2017 due to expansion projects pertaining to 4G rollouts.

Large banking refresh deals drove the market in 2Q16 and expecting the same to continue in 2H16.

The adoption of cloud storage/cloud back-up/DR as a service, etc. are adversely impacting the traditional storage business. This trend has created a new buyer segment – third party datacenters that is expected to grow. Third party datacenter organizations have a better negotiation power than SMB units and hence a significant price based competition is due in future.

Across verticals, organizations witnessed an uptake of all-flash arrays and hybrid flash arrays. All flash arrays have gained momentum for workloads like OLTP, business intelligence, billing, virtual desktop infrastructure, data base etc. The demand for both capacity and performance with a single box is addressed by hybrid flash arrays.

Increased demand for optimization technologies like virtualization, de-duplication, automatic tiering, compression and thin provisioning across organizations is being seen. There are several Proof of Concepts running around software defined storage and hyper converged infrastructure as well. This clearly indicates the demand for new optimization technologies in the market

According to Dileep Nadimpalli, senior market analyst, storage, “Increased acceptance of hyper converged infrastructure was witnessed among IT/ITeS organizations. This trend might have a marginal negative impact in the growth of all-flash storage market specially in VDI environments.”

Gaurav Sharma, research manager, enterprise and IPDS, says: “Storage will become the next strategic asset towards achieving the new age digital initiatives. However, the approach to conquer storage performance is expected to remain hybrid (flash and other alternatives) with a combination of cloud based and datacentre options.”

Major Vendors Analysis:

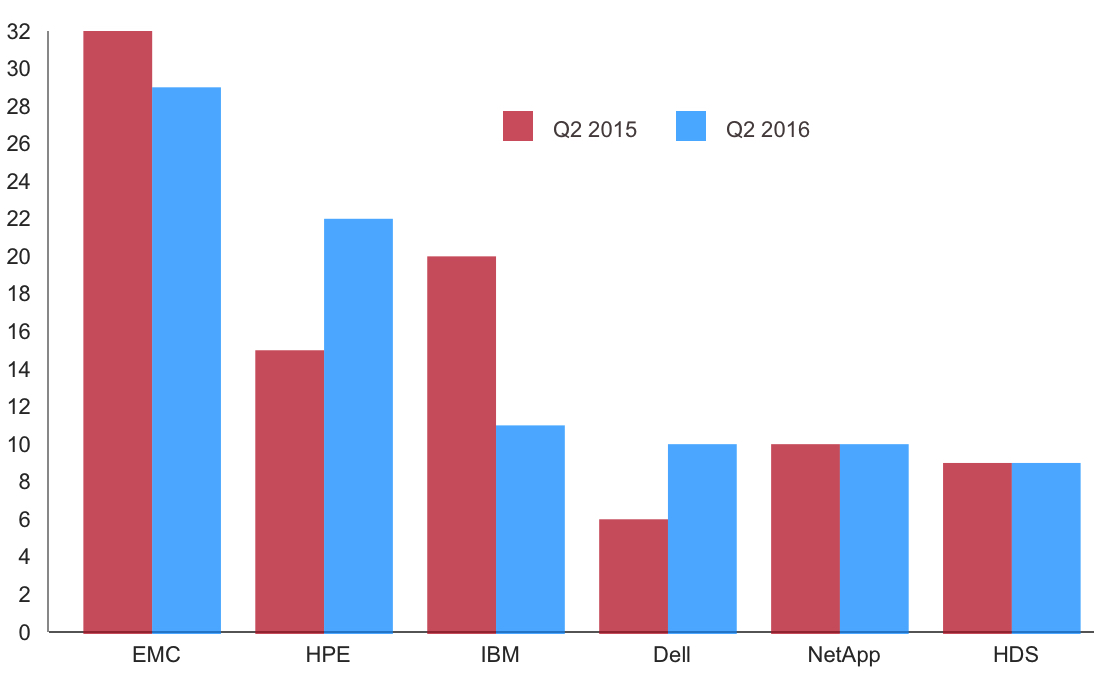

EMC continued to lead the market but witnessed a drop in its market share from 32.1% to 28.7% in 2Q16 year-on-year. HPE achieved an all-time high revenue in 2Q16 due to an increased uptake from banking vertical. Dell also witnessed a significant growth due to uptake from professional services and government segment in 2Q16. IBM, Netapp and HDS saw a year-on-year decline in storage revenues in 2Q16.

India External Storage Market – Vendor Share (%)

The external enterprise storage systems market is expected to grow in single digit in terms of CAGR for 2015-2020 time-period. Banking and government sectors are expected to drive huge storage demand in the coming quarters. Government initiatives around digitalization, smart cities, make in India, e-governance projects are expected to drive the storage demand in the near future.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter