Total Spending on IT Infrastructure Products for Deployment in Clouds Up 16% in 2016 to $37 Billion – IDC

It includes server, enterprise storage, and Ethernet switches.

This is a Press Release edited by StorageNewsletter.com on October 7, 2016 at 2:35 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Forecast, total spending on IT infrastructure products (server, enterprise storage, and Ethernet switches) for deployment in cloud environments will increase by 16.2% in 2016 to $37.4 billion.

Public cloud datacenters, at 18.6% annual growth, will account for the majority (62.5%) of this spending.

Overall spending on IT infrastructure deployed in off-premises cloud environments (public and private) will reach $28.4 billion in 2016.

In comparison, spending on enterprise IT infrastructure deployed in traditional, non-cloud, environments will decline 1.8% in 2016, but it will still account for the largest share (63.1%) of end user spending.

All figures exclude double counting between server and storage.

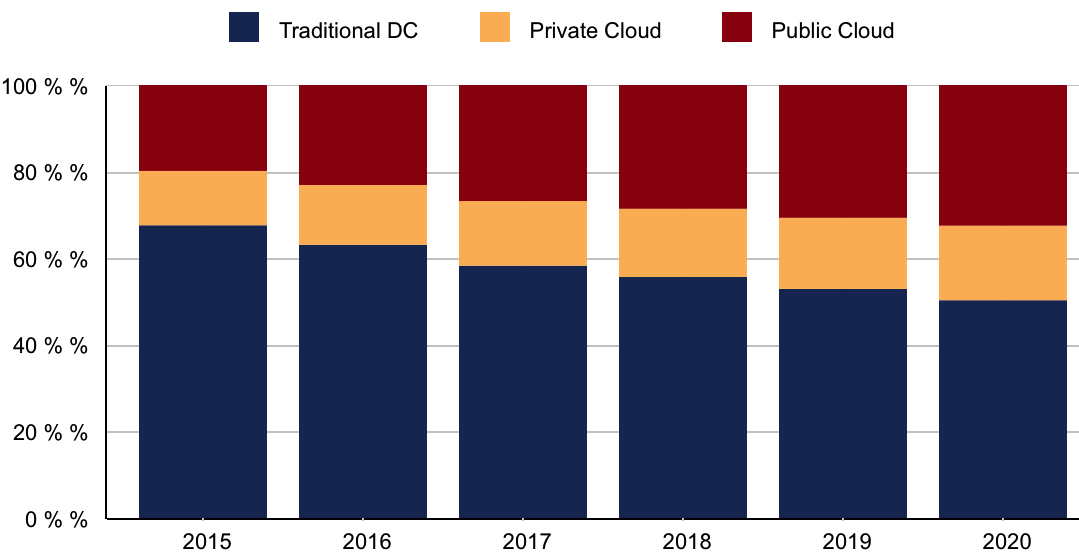

WW Quarterly Cloud IT Infrastructure Market Forecast by Deployment Type 2015-2020

(shares based on value)

In 2016, spending on IT infrastructure for off-premises cloud deployments is expected to see double-digit growth across all regions, indicating strong movement toward off-premises IT resources around the world. Similarly, in on-premises settings, spending on IT infrastructure for private clouds will increase in all regions while spending on non-cloud IT will decline in all but one region. Of the overall spending on IT infrastructure for cloud environments (on- and off-premises combined), spending on Ethernet switches will grow at the highest rate, 41.2%, while spending on server and storage will grow 16.3% and 4.1%, respectively.

For the long-term forecast, IDC expects that spending on IT infrastructure for cloud environments will grow at a five-year CAGR of 13.6% to $60.8 billion in 2020, or 49.7% of the total spending on enterprise IT infrastructure. Off-premises cloud environments (public and private) will account for 77.6% of this amount. Spending on public cloud IT infrastructure will grow at the fastest rate, 15% CAGR, while spending on non-cloud IT will decline at 1.8% CAGR during the same period.

“Cloud is one of the major options considered by end users as they think about optimization of their IT operations and utilization of on-site and off-site resources,” said Natalya Yezhkova, research director, storage systems. “This demand for cloud services will continue to drive the underlying shift in IT infrastructure spending from on-premises to off-premises deployments. As public cloud datacenters represent the major segment of off-premises IT infrastructure deployments, overall spending done by this segment is closely tied to spending by public cloud service providers, in particular, hyperscale SPs.“

Taxonomy notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter