93% of Organizations Using at Least One Cloud Service – Spiceworks

30% expect more than half of their IT services to be cloud-based in 2 to 3 years.

This is a Press Release edited by StorageNewsletter.com on March 28, 2016 at 3:03 pmSpiceworks, Inc. announced the results of a new survey exploring IT professionals’ usage of cloud services, future investment plans, and perceptions of cloud storage, productivity, and computing providers.

The study Diving into Cloud Services found that while 93% of organizations are currently using at least one cloud service, 30% of organizations expect more than half of their IT services to be cloud-based in two to three years.

In terms of the most commonly used cloud services today, web hosting leads at 76%, followed by email hosting at 56%, and cloud storage and file sharing at 53%. While only 35% of organizations are using online backup and recovery, it’s expected to see the most growth in the next 12 months with an additional 23% of IT professionals considering it for use. Additionally, adoption of infrastructure as a service currently stands at 20%, but an additional 16% of IT professionals are considering it.

“At my bank, we’re currently using web hosting, data hosting, and several other software-as-a-service applications,” said Mark Miller, IT manager, Clayton Bank and Trust. “As Internet connectivity gets faster and cheaper, it makes sense to move more of our IT services to the cloud. They’re not only easier to scale and manage, but they also help strengthen our DR plan.”

Where IT pros are investing and why

When asked to reveal the most important factors to consider when evaluating IT cloud services, 71% of IT professionals said cost, followed by reliability at 58%, data security controls at 41%, and customer support at 32%. IT professionals were also asked to indicate which cloud storage, productivity, and computing providers they’re investing in and which attributes they associate with each provider.

Cloud storage and file sharing:

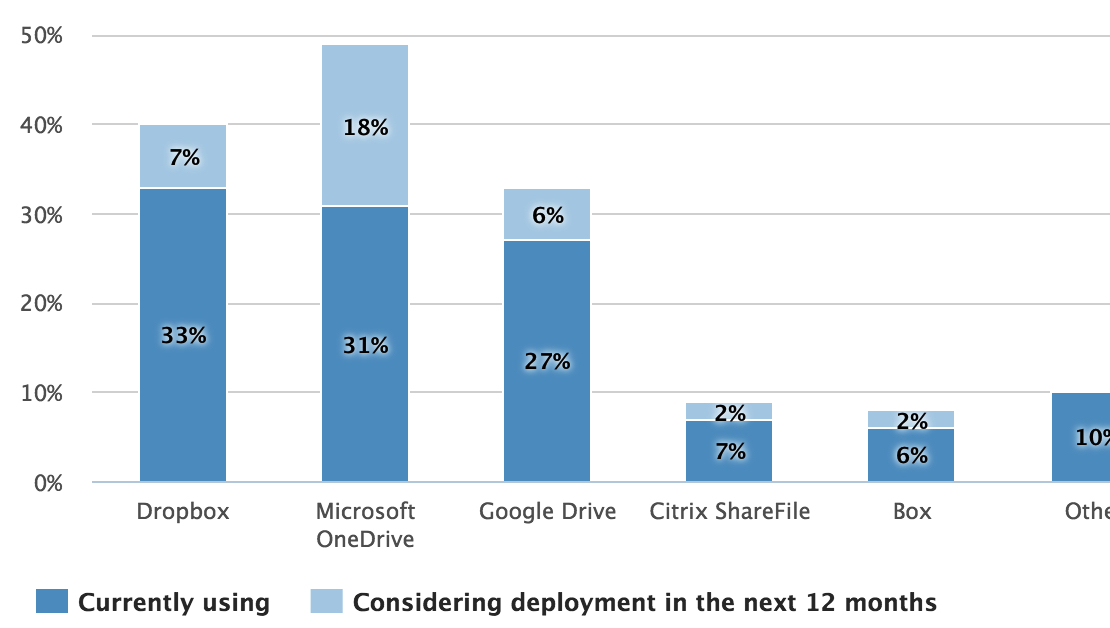

According to respondents, Dropbox has been deployed by 33% of organizations, followed by Microsoft OneDrive at 31% and Google Drive at 27%. However, OneDrive is expected to see the most growth in the next 12 months with an additional 18% of IT professionals considering it for use. When IT professionals were asked to identify which cloud storage and file sharing providers their employees are using without IT approval, 78% said Dropbox, 59% said Google Drive, and 45% said OneDrive.

Cloud Storage/File-Sharing Services Deployed Company Wide

(Data based on all IT pros surveyed)

When IT professionals were asked to detail how they perceive cloud providers, Google Drive was most frequently associated with the top two purchase drivers (cost-effectiveness and reliability), but Microsoft OneDrive and Dropbox followed closely behind. When it comes to security, OneDrive and Google Drive tied for the lead. Notably, a significant number of IT professionals didn’t strongly associate any brand with quality customer support.

Cloud computing/infrastructure as a service (IaaS):

In the public cloud IaaS category, IT professionals surveyed indicated that Microsoft Azure is the most commonly used at 16%, followed closely by Amazon Web Services at 13%. Comparatively, 6% of organizations are currently using Rackspace as their IaaS provider and 1% are using Google Compute Engine. Azure is also expected to see the most growth in the next 12 months with an additional 21% of IT professionals considering it for use.

While the other cloud categories show clear market dominators across the top three purchase drivers (cost-effectiveness, reliability, and security), IaaS has yet to see any single brand emerge as a top performer across brand attributes tested in the survey. Microsoft Azure and Amazon Web Services were most frequently associated with the attributes and tied for first place in almost every instance, excluding security and trust where Microsoft Azure leads. However, the majority of respondents didn’t have strong brand associations with any of the providers.

Cloud-based productivity suites:

When evaluating cloud-based productivity suites, 36% of organizations are using Microsoft Office Online as part of Office 365, 16% are using Google Apps for Work, and 4% are using Apple iWork. Office Online is expected to see the highest growth in the next 12 months with an additional 23% of IT professionals considering it for use.

Although IT professionals most frequently associated Office Online with being cost-effective, followed closely by Google Apps, one in three IT professionals didn’t associate any provider with this critical attribute. Office Online continues to lead across all other brand attributes, including reliability and security, but similar to cloud storage and file sharing, the majority of respondents didn’t strongly associate quality customer support with any provider.

“While we expect to see a major shift in IT services moving to the cloud in the next few years, IT professionals are still being cautious about adopting emerging cloud services like IaaS as they familiarize themselves with the providers,” said Sanjay Castelino, VP marketing, Spiceworks. “The results show that IaaS lacked strong brand associations across the board, but this will most certainly change as adoption of IaaS increases and familiarity with brands grows in the market.”

Methodology

The survey was conducted in January 2016 and included 343 respondents from North America and EMEA. Respondents are among the millions of IT professionals in Spiceworks and represent a variety of company sizes including small-to-medium-sized businesses as well as enterprises. Respondents come from a variety of industries including manufacturing, healthcare, non-profits, education, government, and finance.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter