Facts and Figures on Nutanix

$2 billion start-up supposed to raise $200 million in IPO

By Jean Jacques Maleval | December 29, 2015 at 2:51 pmCompany

Nutanix, Inc.

Location

HQs in San Jose, CA, offices in Sydney and Melbourne, Australia, Antwerp, Belgium, Sao Paulo, Brazil, Beijing, Guangzhou and Shanghai, China, Neuilly-sur-Seine, France, Frankfurt, Germany, Hong Kong, Bangalore, India, Herzeliya, Israel, Jakarta, Indonesia, Tokyo and Osaka, Japan, Seoul, Korea, Kuala Lumpur, Malaysia, Ciudad de México, Mexico, Dubai, UAE, Hoofddorp, The Netherlands, Drobak, Norway, Singapore, Bangkok, Thailand, Kavacık/Istanbul, Turkey, Theale, UK, Durham and Seattle, USA

Date founded

September 2009

Financial funding

- $13 million in 2010

- $25 million in 2011

- $33 million in 2012

- two rounds in 2014, $101 million and $140 million

Total: $312 million from investors including Fidelity, Wellington Management, Lightspeed Venture Partners, Riverwood Capital and Khosla Ventures

Principal stockholders:

- Lightspeed Venture Partners: 23.0%

- Khosla Ventures: 10.9%

- Mohit Aron*: 8.8%

- Blumberg Capital II: 5.7%

- Fidelity: 6.1%

- Riverwood Capital Partners: 5.1%

* Co-founder and CTO of Nutanix who left the company in January 2013 and then founded Cohesity being its CEO.

Revenue and profitability for FY Ended July 31

(in $ thousand)

| Year | Revenue | Y/Y growth | Net loss |

| 2012 | 6,586 | NA | (13,962) |

| 2013 | 30,533 | 364% | (44,734) |

| 2014 | 127,127 | 316% | (84,003) |

| 2015 | 241,432 | 90% | (126,127) |

Revenue and profitability for the quarter ended October 31

(in $ thousand)

| Quarter | Revenue | Y/Y growth | Net loss |

| 2014 | 46,053 | NA | (28,522) |

| 2015 | 87,756 | 91% | (38,545) |

Support and services is only 20% of total sales compared to 80% for products in the last three-month financial period.

Repartition by region for quarter ended October 31, 2015

| USA | 65% |

| EMEA | 19% |

| AsiaPac | 13% |

| Other Americas | 4% |

| Total | 100% |

Total cash, cash equivalents and short-term investments: $136 million.

Main executives:

Dheeraj Pandey, 40, co-founded the company and served as president, CEO and chairman since its inception. Formerly he was VP engineering at Aster Data Systems (now Teradata) from February 2009 to September 2009 and its director of engineering from September 2007 to February 2009. (Total compensation in FY15: $21,954,200)

Dheeraj Pandey, 40, co-founded the company and served as president, CEO and chairman since its inception. Formerly he was VP engineering at Aster Data Systems (now Teradata) from February 2009 to September 2009 and its director of engineering from September 2007 to February 2009. (Total compensation in FY15: $21,954,200)

Duston M. Williams, 57, served as CFO since June 2014 and was previously CFO of Gigamon from March 2012 until June 2014. From March 2011 to January 2012, he served as CFO for SandForce, acquired by LSI. He is currently on the board of Applied Micro Circuits. (Total compensation in FY15: $1,635,750)

Sunil Potti, 44, has the position of SVP engineering and product management since January 2015. He was formerly at Citrix where he served as VP and GM. (Total compensation in FY15: $9,005,476)

Rajiv Mirani, 47, is SVP engineering since January 2015 and was VP engineering from June 2013 to January 2015. Prior to that, he was with Citrix most recently as VP engineering.

SVP operations since April 2014, David Sangster, 51, was previously company’s VP operations from December 2011 to April 2014. Prior to joining Nutanix, he served as VP manufacturing technology at EMC from July 2009 to December 2011.

Howard Ting, 40, is SVP marketing since April 2014 and was VP marketing and product management from October 2012 to April 2014. Prior to that, he served as a senior director corporate marketing at Palo Alto Networks.

Sudheesh Nair Vadakkedath, 38, is SVP WW sales and business development since April 2014 and was VP of WW sales from October 2013 to April 2014, and director of sales from February 2011 to October 2013. He served previously as a consulting storage architect for IBM.

Note the name of Mark Leslie as company’s special advisor, who was former founder, chairman and CEO of Veritas Software, and currently also senior advisor of Pure Storage and at the board of Stratoscale, Pernixdata and Zerto.

Number of employees

1,368

Technology

Nutanix came out of stealth mode in August 2011 with the Complete Cluster, one of the first hyper-converged storage products rebranded as the Virtual Compute Platform in June 2013.

This platform delivers enterprise data storage as an on-demand service by employing a distributed software architecture eliminating the need for traditional SAN and NAS solutions, and delivers a set of software-defined services that are VM-centric, including snapshots, high availability, disaster recovery, de-dupe.

The hardware NX-3000 Series is comprised of several nodes of commodity x86 servers with dual-core Intel Haswell processor with SSDs and HDDs, and 1GbE or 2GbE connections. Components are generally purchased through Super Micro.

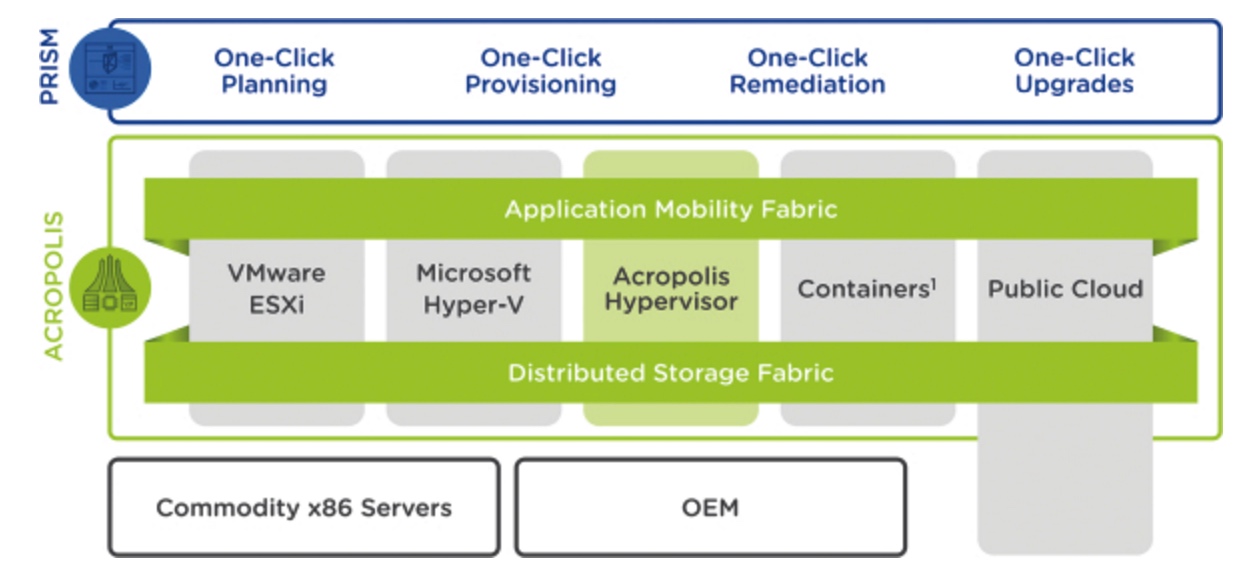

The software that can be sold separately provides an enterprise cloud platform that converges traditional silos of server, virtualization and storage into one integrated solution and can also connect to public cloud services. It is comprised of two product families, Acropolis and Prism. Acropolis delivers high performance distributed storage, application mobility capabilities, which is continuing to expand, and a built-in hypervisor, software that allows multiple OS to share a single hardware host. Prism delivers integrated virtualization and infrastructure management, operational analytics and one-click administration capabilities.

Applications

A range of workloads, including enterprise applications, databases, virtual desktop infrastructure, unified communications and big data analytics.

OEM and distribution

Nutanix primarily sells through indirect sales channels, including channel partners such as distributors, hardware OEM partners, VARs and system integrators like Arrow, Avnet, Carahsoft, Exclusive Networks, Ingram Micro, MTI, Nissho and Promark. Sales through Carahsoft and Promark to end-customers represented 23% and 15%, respectively, of total revenue for FY 2015. In June 2014, it entered in an OEM deal with Dell that allowed Nutanix software to be sold on Dell’s PowerEdge servers. Other OEM is Lenovo PC HK Ltd.

Number of customers

2,100 including 226 global 2000 enterprises among them Activision Blizzard, Inc., ADD, Agilis, Airbus, Anthelio, ASL Airlines, Automotive Data Solutions, Bauer Built, Beedie Development Group, Bentleys, Best Buy Co., Inc., Blue Springs School District, Cal OES, China Merchant Bank, City of Westfield, Claranet, Cleveland State Community College, Cochise County, ConocoPhillips, Covance Inc., Credito Valtellinese, Currie European Trasport, Direct One, DoD Agency, Emperial PFS, Empire Life, Farm Credit, Farmer Insurance Group Federal Credit Union, Guilsborough School, Hallmark Business Connections, Hasting and Prince Edward Countries, Helkama Emotor, Hellmann Australia, Honda, Houston Healthcare, Imperial PFS, InComm, Jabil Circuit, Inc., Joseph Chamberlain College, Kellogg Co., LA Fitness, Langs Building Supply, Language Access Network, LCUB, Lion Group, Luke’s, LWDN, Mason IT, MBB Radiology, Nasdaq, Nashville Hire, Nintendo Co., Ltd., NJVC, Nordstrom, Inc., NTT SmartConnect Corporation, Ohio National Guard, Orrick, PH Tech, PEO Aviations, pi, Prosoco, Protected Trust, Richter, Riverside, San Mateo County, Sanity, Serco, Shenzhen Airlines Cargo, St Luke, Swiss Lottery, Synergics, Total S.A., Toyota Motors of North America, Tri-Country College, U.S. Department of Defense Office of the Secretary of Defense, Universitas Management, University of Waterloo, US Navy, Vitacost, Washington Health Benefit, William Jessup U., and Yahoo! Japan.

Comments

The company files registration statement for a long-awaited IPO at proposed maximum aggregate offering price of $200 million.

It's not a huge sum compared to what was invested into the start-up that could probably get more than that. $241 million Nutanix is growing very fast but never was profitable, accumulating a deficit of $312 million, exactly the total sum invested in the company.

It's always a dilemma for a start-up to choose: to sell the company or being public. In the first case, shareholders can get a huge sum - maybe something like $2 billion for Nutanix - and in the second case owners keep the hand of their firm with the possibility to sell later their shares at a good price.

Hyperconverged systems is one of the most popular trend in the storage industry and Nutanix, with an excellent portfolio, is leading the sector but now with many competitors like EMC, VMware, SimpliVity, Scale Computing, Pivot3, Maxta, etc.

It's not easy for a manufacturer to have big OEMs like Dell or Lenovo competing with its channel. At a time, the name of HP was rumored as another possible OEM.

There were three other IPOs of storage companies this year with Box getting $175 million, Pure Storage $425 million and Mimecast $77.5 million. There was only one last year (Hortonworks).

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter