North America Disaster Recovery-as-a-Service Provider 2015 Vendor Assessment – IDC

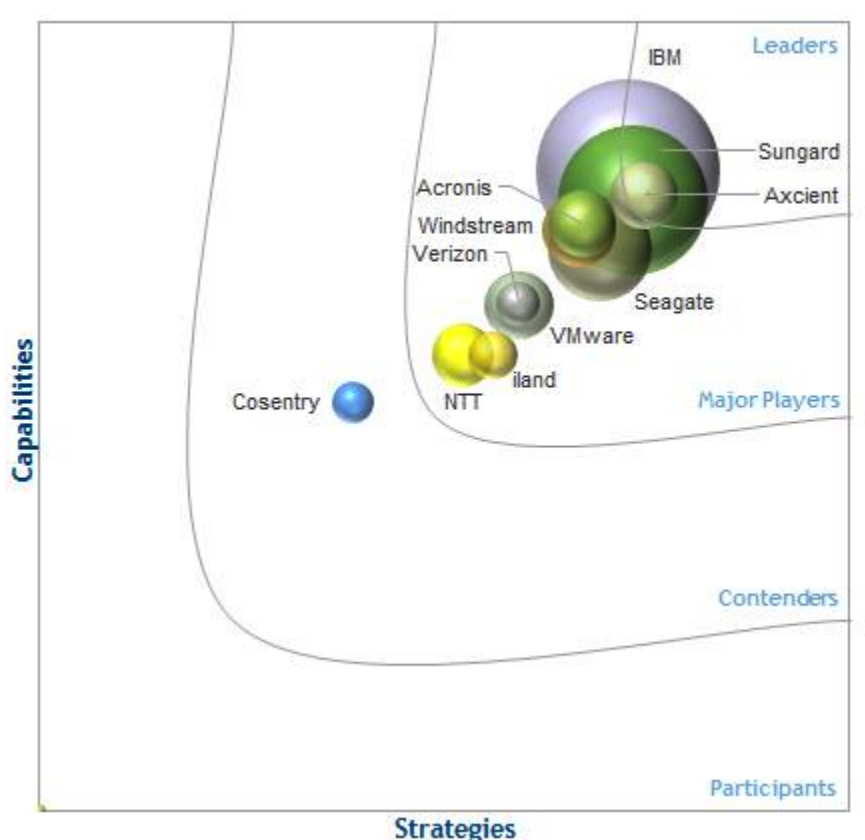

Major players in order: IBM, Sungard, Axcient, Acronis, Windstream, Seagate

This is a Press Release edited by StorageNewsletter.com on December 11, 2015 at 2:54 pmThe content for this excerpt was taken from IDC MarketScape: North America Disaster Recovery-as-a-Service Provider 2015 Vendor Assessment (November 2015, Doc #259816), written by analysts Paul Hughes and Phil Goodwin from IDC Corp.

IDC MarketScape North America Disaster Recovery-as-a-Service Provider Market

Buyer guidance

A dynamic market and diverse providers can make DRaaS evaluation and selection process a daunting task. DRaaS is a discrete solution, however, so taking a ‘best of breed’ approach makes sense – as does taking the time to find the right match because changing providers can be disruptive and expensive. IDC advises buyers to develop a comprehensive checklist with evaluation criteria ranked in order of priority. Important considerations include provider size, provider maturity, growth rate, pricing models, developed versus sourced technology, breadth of offerings, customer service model, and customer satisfaction ratings. These considerations and other business-specific priorities should be taken into account when buyers evaluate both current services and the services road map.

Buyers will want to feel confident that future offerings align with anticipated operating objectives and budget projections.

In addition to fundamental requirements such as recovery time objectives (RTOs), recovery point objectives (RPOs), and related configuration flexibility, IDC urges buyers to pay special attention to the following decision factors:

- Understand each DRaaS provider’s business model and where it fits in the value chain. On one end of the spectrum, providers may set up a facility and simply resell other companies’ software. Alternatively, others are developing their own software and intellectual property along with customized and customizable offerings.

- Avoid putting all eggs in one basket. Choose a disaster recovery vendor that is different from the primary storage vendor.

- Understand the levels of compliance, security, encryption, and data integrity/data resiliency that the providers offer and be sure they meet requirements. For example, buyers will want to be clear about:

- The nuances of encryption for data at rest and data in flight

- Who holds the encryption key and under what circumstances

- Which mechanisms are used to ensure data consistency across all copies

- Road test the DRaaS user interface for look, feel, and usability. Portals and interfaces vary significantly from provider to provider.

- Determine if the onboarding process matches buyer preferences on the spectrum of selfservice to white-glove service. Think through the scenarios in which an in-house IT team will need or want to be able to request assistance. Onboarding with an existing vendor may or may not be easier than it is with a new vendor.

- Understand how customer service is delivered from front end to back end – specifically, note what’s in place to assure consistency and follow-through (e.g., process documentation and a dedicated account manager versus multiple points of contact).

- View testing as a critical success component. Cloud-based disaster recovery testing is less intrusive and painful than traditional disaster recovery testing. The best practice is to conduct at least one physical test per year and four or more simulations. Give the initial test the importance it deserves because failure and/or inability to meet service-level agreements

- (SLAs) or agreed-upon commitments could be an indicator of things to come. Don’t forget to include failback testing as well. It makes sense to identify complementary services, such as networking, infrastructure, platform, backup, and archive that are available in addition to DRaaS, in case a need arises. This helps streamline the service purchasing process and increases the ability for cross-sell discounting.

- Clarify the roles, expertise, and responsibilities of the DRaaS provider and channel partner in situations when a channel partner is involved. As much as DRaaS is an automated cloudcentric service, there will no doubt be times when human interaction will be requested or required.

- Check references. Peer-to-peer conversations can uncover pros and cons that may not come up in conversations with providers. Request references that are matched as closely a possible to the industry, the operating environment, and other key requirements.

Disaster recovery is the classic triumvirate of people, process, and technology. The DRaaS vendo should be able to comprehensively address all three areas.

Profile of leader IBM

IBM is well known and respected in the industry for many things, among them offering disaster recovery services long before DRaaS was even a concept. Its current DRaaSs are offered by its Global Technology Services business unit. The related services that IBM is prepared to offer range from the initial DR assessment all the way through system design and deployment. IBM’s target market is very broad, ranging from SMEs up through large-scale enterprises. DRaaS is a part of IBM’s overall managed services portfolio.

IBM has the size and scale to offer services ranging from SME organizations up through large-scale enterprises. IBM can support organizations that wish to be fully self-managed up through those looking for fully managed DR solutions. The main commercial solution is virtualized server recovery, but customization of ‘cloud rapid recovery’ is also available. Later in 2015, the company plans to offer self service DRaaS through SoftLayer.

IBM offers a ‘silver’ service level, which features on-demand virtual machines, a maximum RTO of 30 minutes and maximum RPO of 1 hour. The “gold” service has dedicated VMs, a maximum RTO of 1 minute and maximum RPO of 1 minute. IBM can write runbooks as necessary and assist in performing DR tests. The company has a ‘go live’ service delivery timeline of as little as 3 days, with a typical implementation taking 6-12 weeks. Pricing plans are available for fully dedicated infrastructure (‘always on’), 20/80 ‘always on’ where 20% of the infrastructure is dedicated and the other 80% is on demand, or 100% on-demand boot from scratch. However, the company does not presently offer software-defined infrastructure for DRaaS. IBM also has various overlapping solutions that are part of a greater continuum of offerings. Customers may need greater clarification to understand and position the correct solution for their needs.

Strengths

- Size and scale with long history of DR services

- Strong consulting services

- Complete solution across all platforms

- Ability to manage entire DR process for the customer if needed

- Strong R&D investment capabilities

Challenges

- Legacy infrastructure approach (i.e., no SDDC available)

- Continuum of solution overlap can create confusion

- Broad DR portfolio needs rationalization to better map to customer needs

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter