Nimble Storage: Fiscal 3Q16 Financial Results

Revenue growing less than 1% quarterly

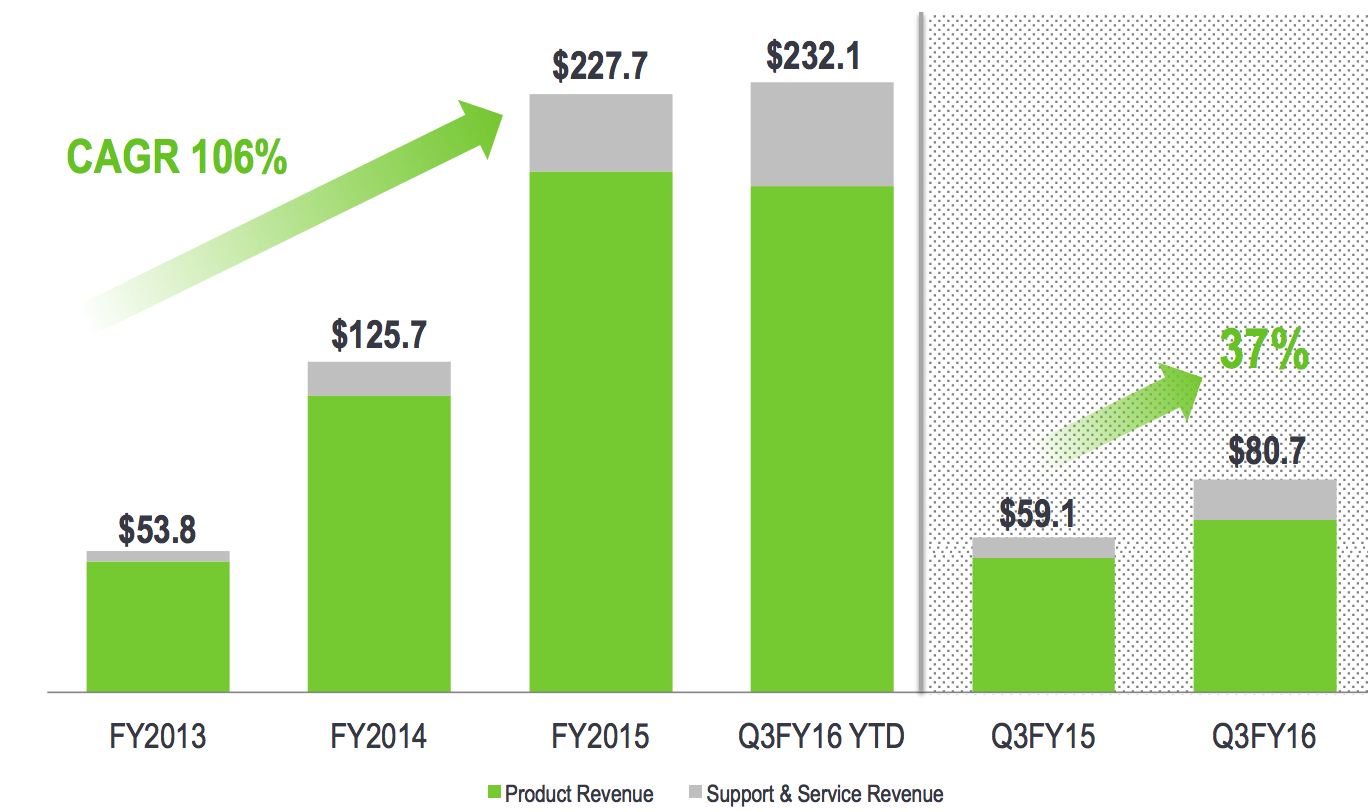

This is a Press Release edited by StorageNewsletter.com on November 23, 2015 at 2:08 pm| (in $ million) | 3Q15 | 3Q16 | 9 mo. 16 | 9 mo. 16 |

| Revenues | 59.1 | 80.7 | 159.4 | 232.1 |

| Growth | 37% | 46% | ||

| Net income (loss) | (28.4) | (28.6) | (74.1) | (87.7) |

Nimble Storage, Inc., the flash storage solutions company, reported financial results for the fiscal third quarter 2016.

Financial Highlights:

- Total revenue increased 37% to $80.7 million, up from $59.1 million in the third quarter of fiscal 2015. Excluding fluctuations in foreign currency, revenue would have been $83.5 million representing a 41% increase over the third quarter of fiscal 2015.

- Non-GAAP gross margin for the third quarter of fiscal 2016 was 66.9% compared to 67.1% in the third quarter of fiscal 2015.

- Non-GAAP operating loss was $10.8 million or negative 13% of revenue for the third quarter of fiscal 2016, compared to a loss of $9.7 million or negative 16% of revenue in the third quarter of fiscal 2015.

- GAAP net loss for the third quarter of fiscal 2016 was $28.6 million, or $0.36 per basic and diluted share, compared with a net loss of $28.4 million, or $0.39 per basic and diluted share in the third quarter of fiscal 2015.

- Non-GAAP net loss for the third quarter of fiscal 2016 was $11.0 million, or $0.14 per basic and diluted share, compared with a net loss of $11.0 million, or $0.15 per basic and diluted share in the third quarter of fiscal 2015.

- Cash flow from operations was negative $3.1 million or 4% of revenue for the third quarter of fiscal 2016, compared to negative $6.5 million or 11% of revenue in the third quarter of fiscal 2015. Free cash flow was negative $12.2 million or 15% of revenue for the third quarter of fiscal 2016, compared to negative $11.5 million or negative 19% of revenue in the third quarter of fiscal 2015.

“We have been executing a strategy of augmenting our customer base of mid-sized enterprises by focusing on expanding our presence in the large enterprise segment, while simultaneously aiming to achieve non-GAAP breakeven operating income in Q4FY16. Our Q3FY16 results fell short of our expectations for two reasons. First, we believe while we are acquiring large enterprise customers at a strong pace, our enterprise investments are taking longer to become fully productive. Second, we believe the shift in investment from commercial to enterprise business impacted our commercial revenue growth more than we anticipated,” said Suresh Vasudevan, CEO, Nimble Storage. “We continue to strongly believe that the market opportunity associated with the shift from disk-centric architectures to flash-centric architectures is significant, and that our Adaptive Flash platform offers the broadest and most differentiated approach to leveraging flash storage in the modern data center.”

“We plan to make some key investments to drive growth that will constrain short-term profitability. We believe our planned investments will improve revenue growth as well as operating leverage over time. We expect that it will take several quarters to realize the impact of these investments and have factored that into our guidance for Q4FY16,” said Anup Singh, CFO.

For the fourth quarter of fiscal 2016, Nimble Storage expects:

- Total revenue in the range of $87.0 to $90.0 million

- Non-GAAP operating loss in the range of $8.0 to $10.0 million

- Non-GAAP net loss per basic and diluted share in the range of $0.11 to $0.13 based on weighted average shares outstanding of approximately 81.0 million

Business Highlights

- Nimble Storage Named a Leader in the Gartner Magic Quadrant for General-Purpose Disk Arrays. This marks the initial entrance of Nimble Storage into the Leaders Quadrant since the company’s founding in 2008; making it the youngest vendor to be named a Leader among well-established storage vendors. The report analyzes providers of mi-range, high-end, and network-attached storage systems and hybrid arrays, and positions vendors into one of four quadrants: Leaders, Challengers, Visionaries, and Niche Players. [1]

- Nimble Storage Ranked Top 10 Fastest Growing company in North America on Deloitte’s Technology Fast 500 Awards. Nimble Storage placed first overall in the electronic devices/hardware industry category, with 7,380% growth. The 2015 Technology Fast 500 award substantiates Nimble’s strong advancement in the flash storage industry as winners are recognized based on%age fiscal year revenue growth during the period from 2011 to 2014.

- CMO Appointment Strengthens Executive Leadership Bench. Nimble Storage named Janet Matsuda as VP and CMO, fortifying the company’s executive bench. Dan Leary, who previously led worldwide marketing, was named to lead product management, technical marketing, solutions and alliances.

- Global Technology Distribution Council (GTDC) Named Nimble Storage as a Recipient of the Prestigious Rising Star Award. This industry award recognizes technology companies for exceptional regional sales growth through distribution partners over the past year. Nimble Storage received the organization’s U.S. Gold Rising Star in the Hardware category.

- Avnet and Nimble Expand Distribution Partnership to Address Growing Demand for SmartStack Across EMEA. Our pan-EMEA expansion with Avnet, a leading global technology distributor, is based on the success of the Nimble partnership in North America. Avnet will now offer the Nimble Adaptive Flash platform along with SmartStack integrated infrastructure solutions to partners across Austria, Belgium, France, Germany, Ireland, Luxembourg, Netherlands, Switzerland, Turkey, and the UK.

- Nimble Storage Senior Executives Lead Industry Dialogue at VMworld and Oracle Open World 2015. At these conferences, Nimble executives shared their insights on the storage industry’s technology directions and trends, and Nimble’s growth in the market. Underscored was the importance of storage consolidation in virtualized environments – helping enterprise customers and prospects to optimize application workloads, lower costs, and increase IT productivity that ultimately enable seamless scale and growth.

[1] Gartner Magic Quadrant for General-Purpose Disk Arrays, written by Stanley Zaffos, Roger W. Cox, Valdis Filks, and Santhosh Rao October 21, 2015.

Comments

In a market with a lot of competitors including big storage companies, Nimble Storage wants absolutely to be a strong force in hybrid and all-flash storage subsystems as soon as possible.

That's why it invested huge sums in quota carrying enterprise sales teams, marketing programs, channel incentives and programs. Consequently revenue is growing fast but with substantial losses in parallel. In fact, the company never was profitable since its inception in 2007 and $168 million IPO in 2013. And this trend is going to continue in the future. Long-term target for sales and marketing is 28% to 31% of total revenue to try to record finally positive net income.

Revenue in $ million

(Fiscal year ended on January, 31)

Quarterly revenue grew 37% Y/Y at $81 million but less than 1% Q/Q and was below expectations ($86 to $88 million) resulting in non-GAAP operating loss of $11 million greater than guidance of $5 to $6 million.

After the publication of financial results, the stock plunged 47% at $10.78 (it was $58.00 in February 2014), and at this price, some acquirers could be interested for a deal. And it's taking competitors Pure Storage down 15% and Violin Memory 6%.

The company was impacted during the quarter by:

- 1. Enterprise investments are taking longer to achieve productivity because of the competition in the market.

- 2. The shift in investment from commercial business to enterprise business impacted the company's growth and this led to lower growth in commercial business.

CFO Anup Singh confirms: "Our slower than expected growth in revenue was due to the investments in our enterprise segment taking longer to pay off."

And consequently CEO Suresh Vasudevan now said: "Our first priority is to increase the investment in our core commercial business."

But there were some positive signs in the high-end, a key enabler being the growth in the mix of FC bookings (as a percentage of FC + iSCSI), which grew to 23.5% from 17.4% during 2FQ16.

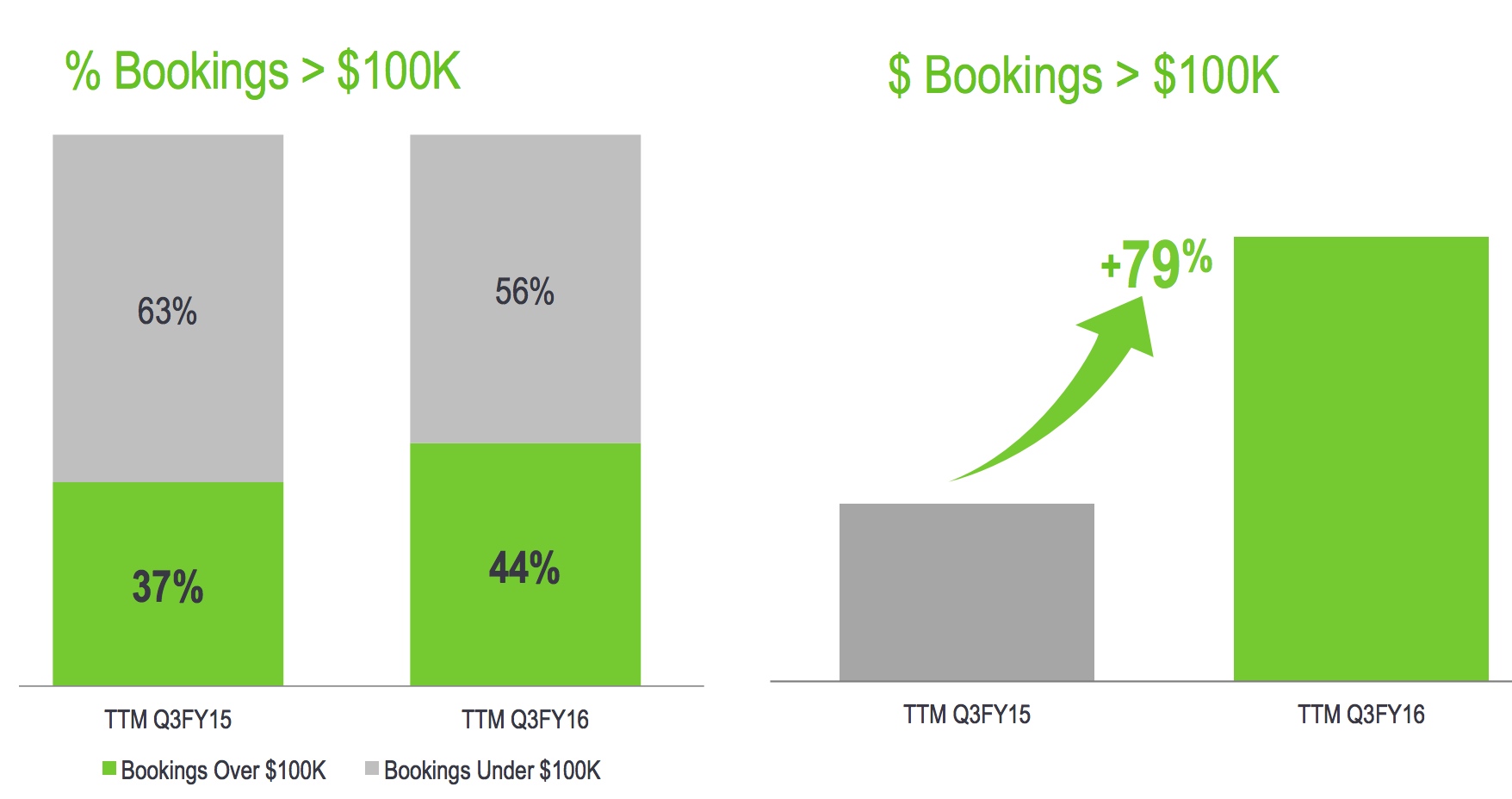

Nimble had record level of bookings from deals over $250,000 during the quarter.

On a trailing 12-month basis, repeat bookings accounted for 46% of total bookings.

The firm now has over 400 customers being big enterprises including 78 of the Global 500.

Cumulative customer base increased from 2,117 in 3FQ14 to 4,319 in 3FQ15 and 6,828 in 3FQ16. For the last quarter, 53% (or 617) were new customers.

International revenue growth was 29% for the last three-month period.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter