Only 2% Y/Y Growth for EMEA Integrated Systems Market in 2Q15 Reaching $663 Million

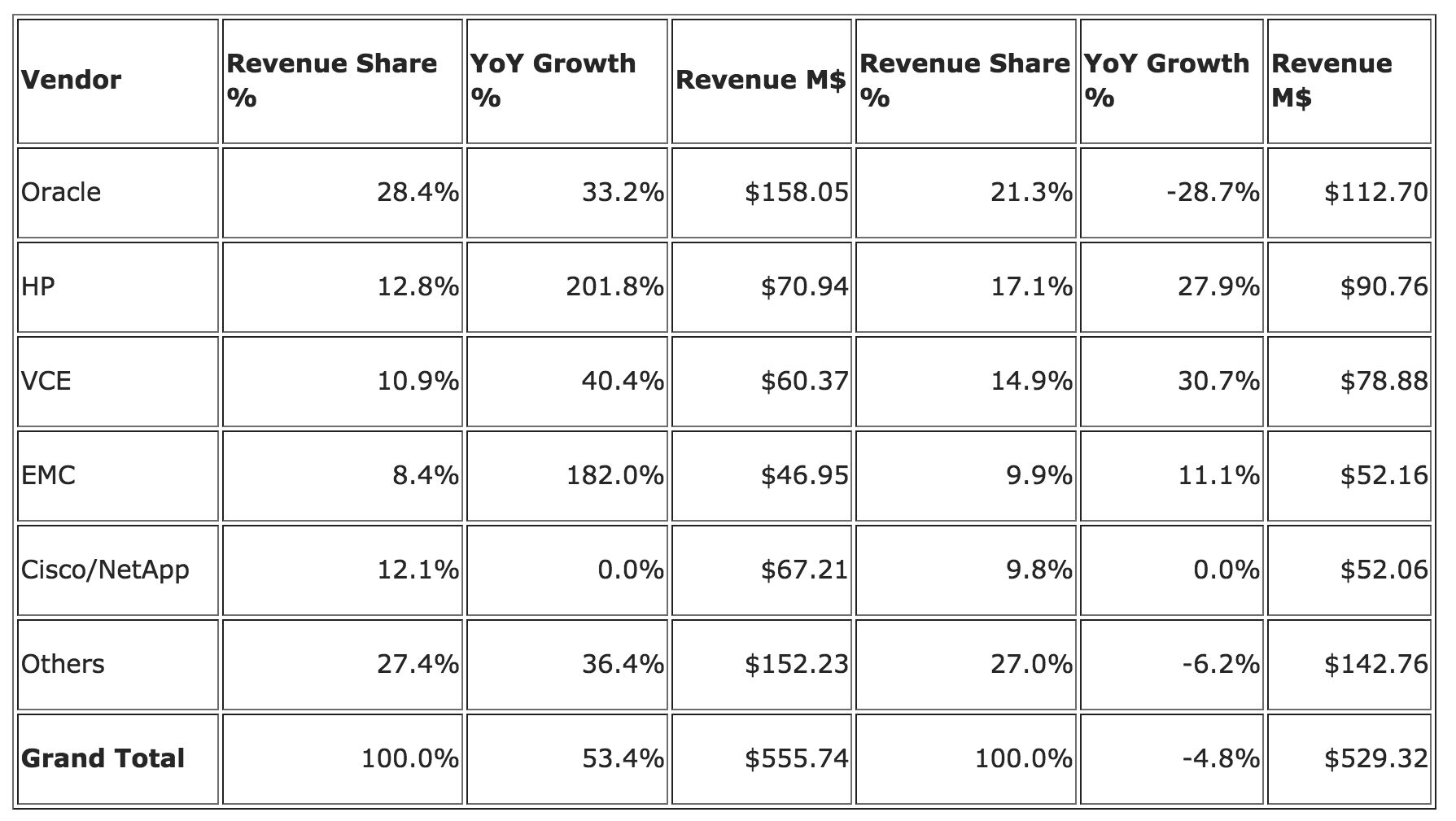

Top 5 ranking: Oracle, HP, VCE, EMC and Cisco/NetApp

This is a Press Release edited by StorageNewsletter.com on October 15, 2015 at 2:55 pmThe integrated systems market in EMEA showed minor growth in 2Q15, reporting $662.91 million in vendor revenue, amounting to year-on-year growth of 1.9%, according to International Data Corporation‘s Quarterly Integrated Infrastructure & Platforms Tracker.

Integrated infrastructure systems – single SKU systems optimized for virtualization (see definitions below) – have continued to show stronger growth levels this quarter, accounting for 65.0% of total sales in EMEA in 2Q15, to show a slight slowdown in its significant growth levels over 2Q14, mainly driven by development in the private cloud industry.

Looking at the market in euros, in 2Q15 EMEA reported a continuation of its strong Y/Y vendor revenue growth (26.4%), as currency fluctuations begin to show an impact on the higher end market. This demonstration of price inelasticity towards higher end appliances is somewhat greater than that seen by its individual components, and although a continued increase in ASPs in local currencies (euro or other) as a means of maintaining dollar profitability could start to affect value proposition and demand for these appliances’ components toward the end of 2015, integrated systems with their additional demonstrations of increased functionality and performance might not see this trend as strongly; a discussion that is covered in more detail in IDC’s Exchange Rate Trends, 1Q15: Server and Storage Systems Tracker – Western European View ($4,500.)

“The broader adoption of integrated systems by hosters and service providers has been a key driver for integrated infrastructures stability,” said Silvia Cosso, senior research analyst, European infrastructure, at IDC. “The added value in terms of simplified management, improved availably, flexibility, and utilization offered by these systems will continue to increase traction seen in the hosting and service provider markets.”

Regional Highlights

In the EMEA region, Western Europe’s revenues account for 79.8% of sales. U.K., French, and German companies represent a little under 58.8% of the market, a significant difference from 2Q14 (67.6%), while a few of the Nordic and Benelux countries have enjoyed stronger quarters, overall the Western European market has performed poorly to report its first negative Y/Y revenue growth ever (-4.8%).

This downturn can be attributed to a slowdown in the integrated platform market that saw a 19.3% decline compared to a historically very large 2Q14. In euro terms, the integrated platform market reported a flat quarter.

“IDC does not see this as an ongoing trend,” said Eckhardt Fischer, research analyst, European infrastructure, at IDC. “As these systems will continue to be driven by predominant workloads such as SAP HANA and Hadoop.”

2Q15 saw integrated infrastructure report a 7.1% growth in sales compared to 2Q14 in Western Europe, historically only the second quarter of growth below double-digits. IDC believes that this slowdown can be attributed to the weakening euro, which has resulted in local component price increases, where the last three quarters have seen an average Y/Y euro ASP increase of 16.9%, a trend that is beginning to take its toll.

2Q15 also saw the Quarterly Integrated Infrastructure & Platforms Tracker report figures on all 16 Western Europe countries; of the eight new broken out countries Italy, Switzerland, and Austria combined contribute 65.5% of these eight countries revenue.

Central and Eastern Europe, the Middle East, and Africa (CEMA) recorded revenue growth of 41% year over year to reach $133.59 million in the second quarter of 2015, accounting for 20% of EMEA market value in the quarter, keeping the share steady over the past quarter. Central and Eastern Europe (CEE) sales increased 61%, making it the fastest-growing region in EMEA for the second consecutive period. CEE region sales were supported by a large public sector deal in Poland. The Middle East and Africa (MEA) continued to record strong growth as well, up 31% year on year, driven by projects in financial and government sectors.

“Integrated systems continue to gain traction, benefitting from growing implementations of private cloud across the CEMA organizations,” said Jiri Helebrand, research manager, servers, systems, and infrastructure solutions, IDC CEMA.

Top 5 EMEA Integrated Systems Value Table

A New Way of Purchasing Infrastructure and Applications

IDC defines integrated infrastructure and platforms as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment and basic element/systems management software at the point of sale. Systems not sold with all four of these components are not counted within this tracker.

IDC segments this market into two categories:

- Integrated platforms are systems sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools.

- Integrated infrastructure systems are designed for general-purpose, distributed workloads that are likely to have differing performance profiles. While integrated infrastructure is similar to integrated platforms in that it will leverage the same infrastructure building blocks, it is not optimized for a specific workload.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter