Status of Flash for Practitioners

CIO and senior IT executives should minimize investments in HDDs for latency storage investments going forward, said Wikibon CTO David Floyer

This is a Press Release edited by StorageNewsletter.com on September 23, 2015 at 2:40 pm This article, published on August 31, 015, has been written by David Floyer, Wikibon’s resident CTO. He spent more than twenty years at IBM holding positions in research, sales, marketing, systems analysis and running IT operations for IBM France. He directly worked with IBM’s largest European customers including BMW, Crédit Suisse, Deutsche Bank and Lloyd’s Bank. He was a research VP at IDC.

This article, published on August 31, 015, has been written by David Floyer, Wikibon’s resident CTO. He spent more than twenty years at IBM holding positions in research, sales, marketing, systems analysis and running IT operations for IBM France. He directly worked with IBM’s largest European customers including BMW, Crédit Suisse, Deutsche Bank and Lloyd’s Bank. He was a research VP at IDC.

The Status of Flash for Practitioners

Premise

CIO and senior IT executives should minimize investments in HDDs for latency storage investments going forward. Any storage that involves assisting end-users and customers should be regarded as latency storage.

Flash Status: HDD Viewpoint

When enterprise flash first came out in 2008, it was earmarked by many as only for the lunatic fringe; crazy financial investment egg-heads manipulating the stock market, or crazy gamers with nothing better to do. Flash on PCs was only for people that could afford an Apple Mac Air. You still hear vendor luddites express this opinion. The executives from the disk-based storage industry still opine that flash cannot be improved any more, that flash wears out in months, that flash is in its last throes, the last generation of flash before it has to be replace with other non-volatile storage. Senior executives of HDD companies show log charts of flash price reduction flattening out, against all evidence to the contrary. CEOs of large companies actually believe(d) that flash could not possibly take over from HDDs, because of the cost of a new fabric to manufacture flash chips is measure in billions, and a HDD factory in Thailand is measured in only millions.

Wikibon and other research shows that HDDs will decline on both PCs (rapidly) and in the data center. End-users spend over 50% of their time with flash-only devices (mobile phone, tablets and SDD PCs) in 2015. Flash-only PCs are expected to account for 50% of PC revenue by 2017.

The place where HDDs will continue to be dominant until the end of this decade is data center capacity storage, housing mobile and PC overspill data in cloud storage, mobile& PC backup, and the Internet of things. It is not a given that all data created will be stored, or stored in data centers;

Flash Status 2015: Storage Practitioner Viewpoint

The flash market has matured in 2015. The reliability issues have be completely solved by PCIe flash and SDD vendors, with sophisticated flash controller software. Vendor 7-year guarantees for flash storage are normal in 2015, and are expected to extend to increase to 10-year guarantees in 2016. 3D flash is now in volume production by Samsung, and Samsung, Toshiba and SanDisk will be aggressively shipping 3D flash in volume in 2016, with the objective of meeting consumer demand (less than 15% if flash storage goes to enterprise deployment) and doing their best to prevent the PCM-based Intel/Micron 3D XP storage from taking hold. Flash prices for consumers and enterprises are expected to drop by greater that 40% per year as 3D flash becomes denser and much much faster than HDDs.

Wikibon regards the disk market is declining, and will be managed long term as a cash cow, with unassertive investment in new technology or manufacturing sites. The PC market is declining, and there is no investment in performance disks. The development of disk drives with caches has had very limited success; for data center disk drives, the cache should be at a higher level. The only disks that have a role to play are high density disks that utilize sequential writing. Companies such as Infinidat have created very large flash and DRAM caches in front of the disk storage.

In 2015, flash is poised to take over latency storage. Wikibon has put out detailed projections of storage revenues and capacity on many dimensions. Two of the interesting recent dimensions for Wikibon projects are latency storage vs. capacity storage, and Flash vs. HDD. The detailed research can be found at Enterprise Flash vs. HDD Forecasts 2012-2026 and Latency vs. Capacity Storage Projections 2012-2026.

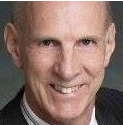

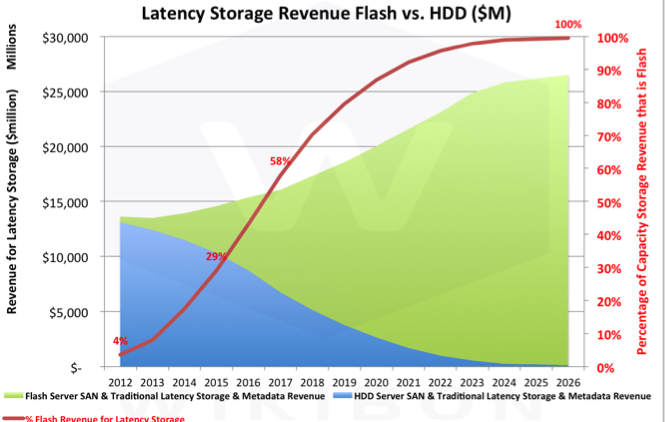

The essence of these research findings for practitioners is shown in Figure 1 and Figure 2 below, which is taken from Latency vs. Capacity Storage Projections 2012-2026.

Figure 1: Wikibon Latency Storage Revenue Projection by HDD and Flash, 2012-2026

(Source: Wikibon Server SAN & Cloud Research Projects 2015)

Figure 2: Wikibon Capacity Storage Revenue Projection by HDD and Flash, 2012-2026

(Source: Wikibon Server SAN & cloud Research Projects 2015)

Latency storage is defined by Wikibon has being storage that enables storage access times of one millisecond or less. Figure 1 shows that the spend on flash storage for latency is projected to be about 29% in 2015, and break the 50% barrier in 2017. Figure 2 shows that the spend on flash for capacity is projected to be 1% in 2015, and break the 50% barrier in 2021. HDDs are projected to be about 2% of total data center storage revenue by the end of the forecast period in 2026.

The storage characteristics of latency and capacity storage will continue to diverge over time. Latency storage is characterized by a higher and higher percentage of reads, and capacity by a higher and higher percentage of writes. HDDs are efficient at writing data, particularly sequential data. Flash in 2015 excels in read efficiency, but flash-based capacity storage will develop strongly in low-cost capacity technology in 2018 and beyond.

Data Sharing of Flash Storage

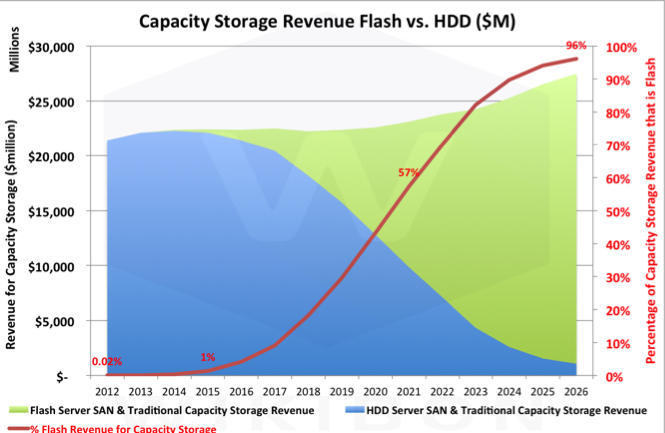

Figure 3: Percentage Growth of Logical Storage Capacity, 2012-2026

(Source: Wikibon Server SAN & cloud Research Projects 2015)

One key difference between flash and HDD storage is the degree to which flash can hold a single physical view of data, and use this hold multiple logical views of the same physical data. Only a small percentage of metadata is required to manage the multiple logical view. Figure 3 shows the projected growth of Physical and logical storage capacity for data center storage. Logical storage is difficult to achieve on HDD storage, because of the mechanical nature of HDDs. Almost all additional logical storage is projected to be on flash storage. Additional logical storage is expected to be equal to physical storage by 2018, and grow to be five time larger by 2026.

Storage executives and practitioners should be looking to maximize the potential of flash for sharing data. Because of the high IO capability of flash, it is possible to organize data workflows in ways that were impossible before. For example, with flash it is possible to take a space efficient snapshot of an active production database, perform any data masking or scrubbing processes required for security and regulatory compliance, publish a full logical copy to each of the developers, and enable them to work and test against the most up-to-date version of the code and data possible. This process would have required a traditional storage system to clone and publish multiple partial copies of the data to the application development team.

Managing Latency and Capacity Storage

Latency flash storage will not be homogeneous. There will be a number of different flash speeds and ecosystems, including very low latency flash storage. One type will be PCIe flash based on PCIe switches and PCIe clusters of servers and storage. EMC’s DSSD is an example of this, allowing 50 microsecond IO access, and the potential to get down to single digit microsecond IO access. There will be even lower IO times potential based on memory bus switches with high nanosecond access times. VMware is working hard on improving application IO times with a new architecture for VSAN, which enables third party flash solution from companies such as SanDisk. Non X86 platforms such as the Open Power Foundation are using technologies such as CAPI to improve IO bandwidth by a factor of 10 or more, and improving big data streaming applications.

Wikibon has written of the importance of catalogs with orchestration and automation to manage the shared storage environmenthttp://wikibon.com/managing-a-virtual-flash-world-where-snapshots-are-king-and-knave/. This should obviously be done across both latency and capacity storage, and across a hybrid cloud. As discussed the the previously linked article, the key to optimizing latency storage is to reduce the number of physical copies of data by pointing logical copies to the physical channel.

One key challenge is the intersection between latency storage and capacity storage. Much of the capacity layer will migrate to cloud storage. If capacity data is store as a logical copy on flash storage, there is no reason to physically move the data to capacity storage. The catalog is a key part of managing data, and ensuring that logical capacity data is migrated to physical capacity data when the original flash storage is deleted. There is an enormous opportunity for vendors to create software solutions for managing the migration down from latency to capacity.

Hybrid vs. All-Flash Arrays

HDDs offer applications the lowest cost/GB and, if used as a sequential device, offer applications good data bandwidth for large data objects. Flash-only together with QoS offers application low latency and low low latency variance (reduce the jitter, at a higher cost/GB. Hybrid storage solutions (both as storage arrays and within the servers) offer applications a flash cache or flash tiering system, and provide solutions that focus on ensuring a high percentage of IO is supplied by the faster flash layer. Applications with small consistent working sets that can tolerate occasional much longer IO times to disk work well in a hybrid environment.

The main challenge for hybrid storage solutions is that management of the environment is more complex. The major challenges are:

Maintaining Small Application Data Working Sets: The size of the application working set increases with the age of the application, especially as historic data increases, and additional functionality from new data sources are added (e.g., adding real-time analytic data to improve operational systems).

- Maintaining Consistent Application Data Working Sets: Application working data sets are prone to sudden changes (e.g., month end/year end processing, special days such as “Black Fridays/Mondays”, special events such as sales, advertising or media exposure, etc.

- Maintaining Low Data Locking rates: All applications need to lock data at some point or another to ensure data consistency and integrity. The database layer usually deals with this problem. With higher transaction rates and more integrated applications can cause higher data locking rates, and the impact of cache misses become amplified.

- Increasing Gap between Flash latency and HDD Latency: The introduction of flash has resulted in significant attention being paid to the IO data paths. For example, the PCIe switching has allowed cluster of servers to access data in 50 microseconds. Other data path reductions can reduce this to under 10 microseconds. New 3D flash innovations are improving the flash layer itself. Wikibon expects that flash access time to flash data will dip into nanosecond range within two years. The opposite is true of HDDs, which are increasing density (e.g., the 8TB helium drive from HGST), but little improvement in IO performance.

All of these trends put pressure on system and storage administrators together with database administrators to manage the data environments for applications. Wikibon observes that data centers with experience of all-flash arrays reduces the administration costs for application data, and improve response times for users.

Hybrid devices are a good strategic fit for current applications which do not need storage/system/DB administration. Over time, the set of applications that can be best supported with hybrid solutions will decrease. All-flash solutions will grow faster that hybrid solutions.

Wikibon strongly recommends that organizations choose hybrid storage solutions that can be upgraded seamlessly to all-flash solutions as the best strategic path for latency storage application support. Companies like Coho Data, Tegile and Tintri offer excellent architectures that can seamlessly accommodate a journey for applications from hybrid to all flash. Coho Data has announced support for 8TB helium drives, which can improve storage costs for applications that fit the hybrid model.

Action Item

Storage practitioners should focus on moving latency storage to flash, implementing a sound catalog strategy for the management of snapshots, and a strategy for linking to on-premise or cloud-based capacity resources. Any storage that involves assisting end-users and customers should be regarded as latency storage. CIO and senior IT executives should minimize investments in HDDs for latency storage investments going forward.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter